NicolasMcComber

Home Depot (NYSE:HD) reported better than expected results earlier in August, beating analyst estimates on both top- and bottom-line.

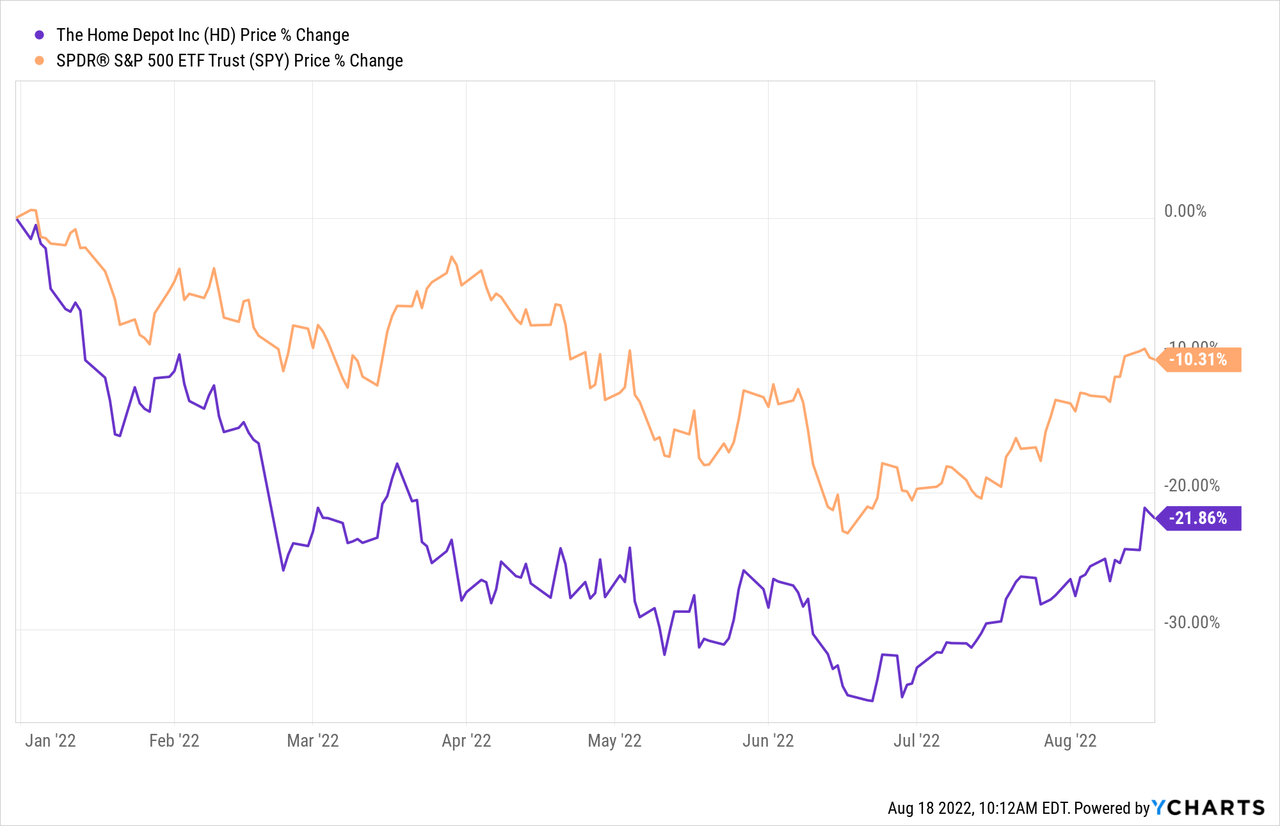

While the HD’s stock has lost more than 20% of its market value year to date, it has recovered substantially from its lows in late June. The optimistic tone of the earnings results further extended the stock’s rally.

While we believe that the sales and net earnings growth is impressive, especially in the current market environment, in this article we would like to highlight a few line items and macroeconomic factors that need to be taken into consideration before investing in HD.

Let’s start with the second quarter results.

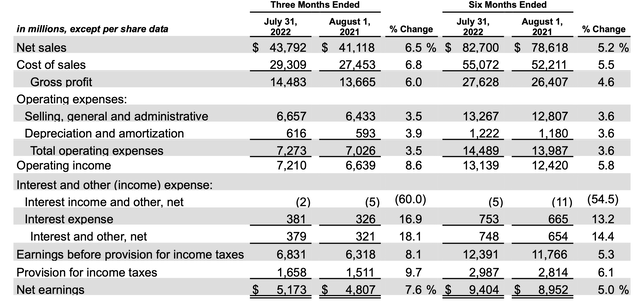

Q2 2022 financial results

In the second quarter of 2022, net sales have increased by 6.5%, while cost of sales grew by 6.8% resulting in a contraction of the gross margin. On the other hand, operating expenses have increased at a slower pace, resulting in a favorable impact on the operating margin. Net earnings also increased by 7.6% year over year, accompanied by an improving profit margin.

Jeff Kinnaird shared details on the earnings call, which type of products were the primary ones, fueling the growth:

All of our merchandising apartments posted positive comps. Building materials, plumbing, millwork, paint and hardware were all above the company average. Electrical, decor and storage, kitchen and bath, outdoor garden tools, appliances, indoor garden, lumber and flooring were positive, but below the company average.

While these results appear impressive, we would like point out two items that are concerning us:

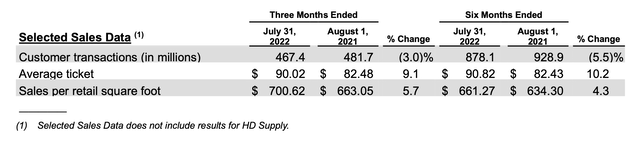

1.) Declining number of customer transactions

Customer transaction (Home Depot)

While analysts have largely downplayed the declining number of transactions, we believe it is crucial to monitor this figure, in order to understand how demand is likely to evolve in the near term. The number of customer transactions is influenced by several macroeconomic factors, which we will discuss later on in this article.

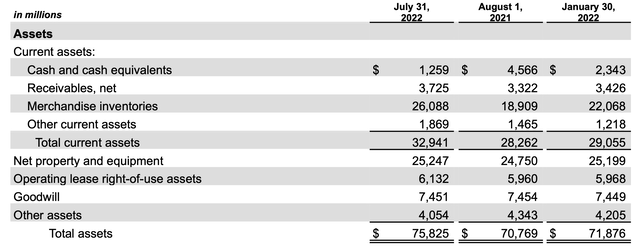

2.) Increasing inventory

Once again, analysts have downplayed the importance of increasing inventory after the earnings call. For example, Morgan Stanley analyst Simeon Gutman said:

Compared to 2019, Q2 inventory increased 77% while sales increased 42%, which implies the spread of inventory to sales has widened to 35% in Q2,” he noted. “All of that being said, we don’t see these heightened inventory levels as problematic, as we believe HD is buying inventory forward more so than in the past, and there continues to be little risk of markdowns of Home Improvement product.

On the other hand, we believe that the sharp increase in inventory might turn out be a real problem in the near term. Other retailers like Walmart (WMT) and (TGT) have experienced significant inventory management issues in the first half of the year, which they are still trying to solve. Although HD has executed well in the first half of the year, it is important to keep inventory management in mind, before investing in the company.

During the earnings call, CEO Ted Decker has also pointed out the uniqueness of the current macroeconomic environment.

While the business performed very well and our consumer remained resilient through the first half of the year, we are navigating a unique environment. We can’t predict how the evolving macroeconomic backdrop will impact our customer going forward. However, we continue to closely monitor elasticities and trends across our respective categories and believe we have the tools, team and the experience to effectively manage in any environment.

So let us take a look now a set of economic indicators that can potentially help us to form expectations about how the demand for HD’s products is likely to develop in the near term.

Macroeconomic environment

In this section we will discuss a number of economic indicators that could be used to gauge the health the housing market.

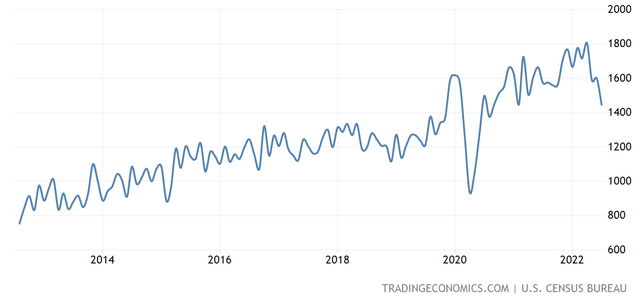

United States housing starts

Housing starts have fallen as much as 9.6 percent on a month-over-month basis to an annualized rate of 1.446 million units in July of 2022, the lowest since February of 2021 and far below the number expected by the market, 1.54 million.

Housing starts (tradingeconomics.com)

In our opinion, the falling number of new housing starts may be an indication that the demand for HD’s products, and also for the products of other home improvement retailers, is likely to decline in the near future.

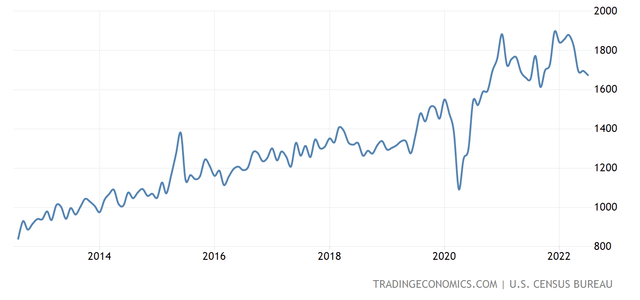

United States building permits

Building permits, a proxy for future construction, is often used as a leading economic indicator to gauge the demand for future housing units. The number of permits have decreased 1.3% to an annualized rate of 1.674 million in July of 2022, the lowest level since September last year.

Building permits (tradingeconomics.com)

Just like a lower number of housing starts, a lower number of business permits may also indicate a potential decline in demand for home improvement related goods.

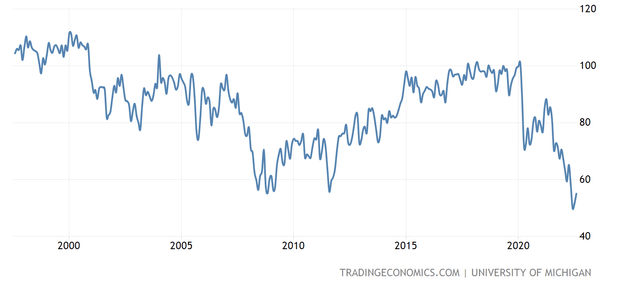

Consumer sentiment

Consumer confidence is also often treated as leading economic indicator, used to forecast potential changes in the consumer spending trends in the near term.

Consumer confidence (tradingeconomics.com)

Consumer confidence in the United States has been rapidly declining in the first half of 2022. While it has slightly rebounded recently, the reading still remains below levels that were observed during the financial crisis in 2008-2009.

A low consumer confidence normally indicates that people are becoming less certain about their financial outlook, which results in increased saving and decreased spending. In such periods, the demand for durable, discretionary, non-essential goods is likely to decline, potentially hurting the financial performance of firms that are selling such products. We believe that the low consumer confidence may also have a negative impact on the demand for HD’s products in the near term.

Conclusions

All three of these indicators are signaling a slowing housing market, which could lead to a declining demand for HD’s products. In our opinion, the declining number of transactions might already be early signs of this. If it turns out to be true, the rapidly increasing inventory is likely to lead to further challenges, just like it did in the case of Walmart and Target.

For these reasons, we remain cautious and rate HD’s stock as “hold” despite the strong top- and bottom-line results.

Be the first to comment