honglouwawa

Investment Thesis

Newtek Business Services Corp. (NASDAQ:NEWT) is a business development company that provides financial and business services to small and medium-sized businesses in the United States. However, the company is in the advanced stages of converting to a bank holding through the acquisition of the National Bank of New York [NBNYC].

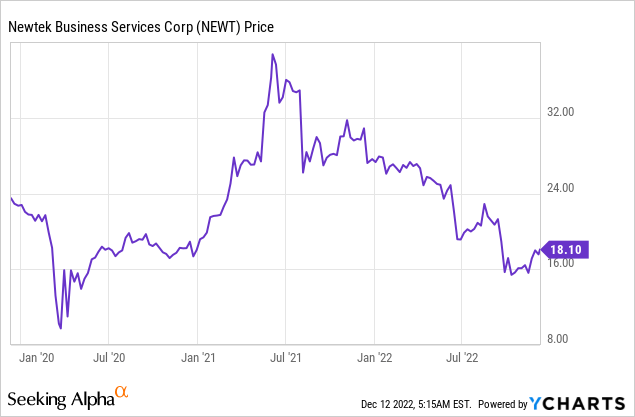

At its current status, it has been on a downward trajectory since June last year until November this year, when it has shown signs of a rebound. Currently, the stock is trading at $18.10, just $3.35 above its 52-week low. The current price is about 41% loss over the last year and lags the market by about 25%.

I believe that the near completion of the company’s procedure to acquire NBNYC is to blame for the poor performance. Management acknowledged on the Q3 ’22 earnings call that acquisition-related costs have weighed on performance, but they remain pretty enthusiastic about the benefits of the purchase.

The acquisition has been completed in all but the final paperwork. The company is exhibiting signs of recovery that I expect to quicken once the deal is finalized and all regulatory approvals are obtained. The company is being molded by capable leaders, optimizing it for maximum benefit from the acquisition. NEWT is spending extensively on technology to strengthen its position as a market leader further. I have a lot of hope because of all these measures, but from an investing standpoint, I would put the bank on hold until the transaction is finalized.

Potential Acquisition

NEWT’s leadership has been working on a deal to convert to a bank holding for the past year, and they expect it to be finalized soon. On the Q3 conference call transcript, management stated that the bank’s acquisition is contingent upon the Federal Reserve approving the bank holding company and the OCC supporting the Acquisition of NBNYC.

NEWT announced in August 2021 that it had signed a deal to acquire the National Bank of New York City for $20 million in cash. The National Bank of New York City is a nationally chartered bank with roughly $204 million in total assets and $36.5 million in tier 1 capital. The agreement stipulates that NBNYC must have $20 million in tangible common equity as of the acquisition’s completion date.

With the approval of federal banking regulators, the U.S. Small Business Administration (SBA), and Newtek shareholders, the acquisition will be the first step in Newtek’s intention to reinvent itself as a bank holding company. Newtek will convert to an FHC bank holding company subject to the approval of shareholders and regulators and the satisfaction of customary closing conditions. According to Newtek, the acquisition should wrap up before the end of this year.

According to the company’s proxy statement, the acquisition will benefit them in the following ways:

- Enhance the company’s ability to raise cash while simultaneously reducing its cost of capital.

- To lessen the need for the firm to raise cash through ordinary shares, which carry a higher cost of capital, allowing it to focus on funding its expansion using cheaper sources.

- Lessen the need for costly commercial finance sources while originating loans.

- Do away with the requirement that bank holding companies and banks maintain a 150% asset coverage ratio [i.e., a 2-to-1 leverage limit].

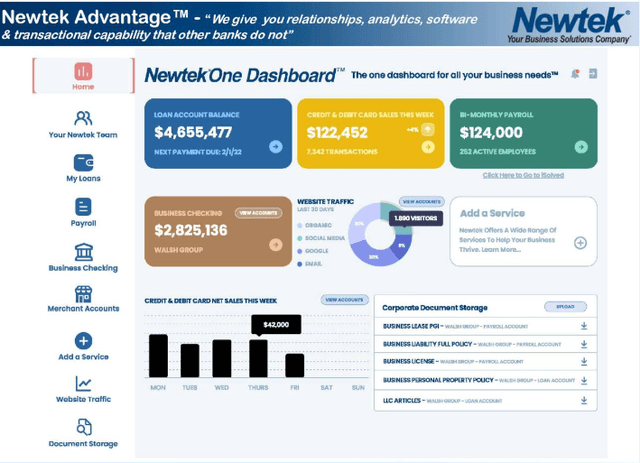

- The possibility of implementing patented technology, such as the company’s new tracker and the NewtekOne Dashboard.

Looking at the acquisition and all of the perks that come with it, I can see that it is a game changer because of all of the synergies it provides to NEWT. I predict this firm will rank among the best financial institutions in the United States. To ensure a smooth integration of the acquisition, the company has increased headcount in critical positions, including hiring John McCaffery as the bank’s new chief financial officer. I am confident that the organization can function successfully as a bank and enjoy the advantages. I mean, it’s a new dawn for NEWT.

Cherishing Technology

The business relies on technological advancements to oust competition as part of an ongoing transformation. The NewtekOne Dashboard and the new tracker are two examples of the technological progress made by this system. The bank’s leadership believes that it can better serve its clients in the future by investing in cutting-edge innovation.

We will be positioned as a bank of the future, a technology enabled bank, and a bank that offers real value to its clients which you’ll see through our discussion of our technology The Newtek Advantage, and many of the assets that we talked about in this particular presentation.

Instead of relying on brick-and-mortar locations for client acquisition, including stores and brokers, the NewTracker allows the organization to establish strategic alliance agreements to reach customers remotely. The NewtekOne dashboard, promoted as the Newtek Advantage, was developed to provide customers with a dependable management solution that helps them run their operations more efficiently.

NEWT Q3 Presentation

The company believes it can increase shareholder value by forming joint ventures with other market participants and financial institutions, like community banks, regional banks, and credit unions, or licensing its technology to them. They think this will put them in a position to make money off their technological assets and processes, which I believe is very feasible and can be a steady source of revenue.

The management also expects that the Newtek advantage will let them offer their future customers personal banking relationship analytics, software, and transactional capabilities that other banks don’t have.

Pre-acquisition recovery signs

Despite the company’s poor performance over the past year, mainly attributable to the financial ramifications of the impending acquisition, there are hints of a turnaround as the acquisition nears its conclusion. All indications are that this is the case, as the acquisition is nearing completion and substantial financial resources are no longer being expended to close the transaction.

The company’s revenue growth rate improved from -24% YoY in Q2 2022 to -10.67% in Q3 2022, representing an improvement of around 13%. Also, the company’s EBIT growth has improved, going from -70% YoY in Q2 2022 to -46.11% in Q3, a 24% increase.

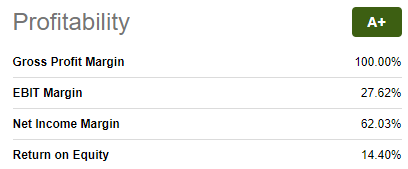

With these notable changes, the company has reported very pleasing bottom lines. It has very healthy margins. Its gross profit margin is 100%, EBIT margin is 27.62%, net income margin is 62.03%, and return on equity is 14.40%

Seeking Alpha

With the impending acquisition and technologies serving as significant tailwinds to the company’s future growth, I expect the company to do even better than this.

Conclusion

NEWT has been on a downward trajectory over the past year, primarily due to the monetary implications of the upcoming acquisition. The corporation’s share price dropped by about 40% over that time. Now that the acquisition is nearly finished, the company is exhibiting signs of a resurgence, with significant increases in both revenue and EBIT.

Due to the many synergies resulting from the acquisition, I believe the company will maintain a significant upside after it is finalized. New specialists have been brought on board to help maximize the acquisition and ensure smooth operations. This decision and NEWT’s technological advancements constitute a tremendous tailwind for the company’s future development. These factors give me hope for the company’s future. My rating is a hold pending the acquisition with solid growth potential.

Be the first to comment