PM Images

It is not exactly a secret that one of the biggest challenges facing Americans today is the rapidly rising cost of living that has resulted from the current high inflation rate. This high rate of inflation has been a problem for most of this year and has forced many people to take on second jobs or perform other random tasks to get the money they need to feed themselves and their families. Fortunately, as investors, we have other methods that we can use to obtain extra income. One of the best methods is to purchase shares of a closed-end fund that specializes in income. These funds are nice because they provide easy access to a professionally-managed diversified portfolio of assets that can oftentimes deliver a higher yield than any of the underlying assets possesses. In this article, we will discuss the BlackRock Multi-Sector Income Trust (NYSE:BIT), which currently boasts an attractive 10.25% yield. The fund has more than just a high yield going for it, including a reasonably attractive valuation. Therefore, let us investigate further and see if this fund could be a good addition to a portfolio today.

About The Fund

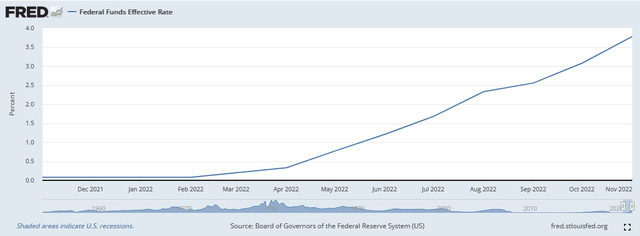

According to the fund’s webpage, the BlackRock Multi-Sector Income Trust has the stated objective of providing investors with a high level of current income. The fund also has a secondary objective of capital appreciation but it is going to struggle to achieve this secondary objective in today’s environment. This is because this is a fixed-income fund and fixed-income securities only have a limited ability to generate income when interest rates are rising. These securities have no link to the actual growth and prosperity of the issuing company. After all, a company will not pay its creditors a higher interest rate just because its profits increase. Rather, the prices of these securities tend to vary with interest rates. This is because newly issued fixed-income securities will have an interest rate that is linked to the market rate so existing securities are repriced so that they deliver a yield to maturity that is similar to existing securities. This means that when interest rates are rising, fixed-income security prices decline and vice versa. As we can see here, the Federal Reserve has been raising the benchmark federal funds rate since March:

Federal Reserve Bank of St. Louis

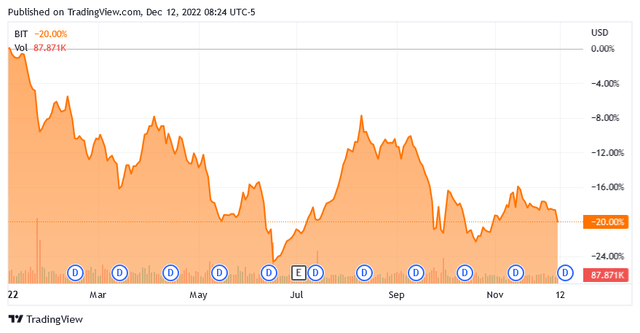

This is an attempt to tighten monetary policy in order to fight the high rate of inflation that is ravaging the economy. The Federal Reserve has given no indication that it will reduce rates anytime soon. In fact, the current consensus among economists is that the central bank will raise the federal funds rate to 5% to 5.25% by early 2023 and then keep it there while it evaluates the inflation situation in the nation. This will almost certainly cause the price of the bonds held by this fund to decline over the next several months. We have already seen this as the fund is down 20.00% year-to-date:

As interest rates are unlikely to decline for quite a while, it seems likely that bond prices will not rise. Thus, the fund will struggle to generate capital gains. With that said, it will do fine at generating income. After all, bonds continue to generate income regardless of what happens to their prices. In addition, a bond will always pay its face value at maturity. So, all the fund really needs to do is hold its current bonds until they mature and then use the money to purchase new bonds. Unfortunately, bond funds rarely do that, which is one reason why mutual funds are not usually the best way to hold bonds if you are concerned about principal preservation. This fund is perhaps worse than most because it has an annual turnover of 75.00%, which is very high for a bond fund. It also likely means that the fund is realizing capital losses on its bond portfolio, which is disappointing. We will discuss that in more detail later in this article.

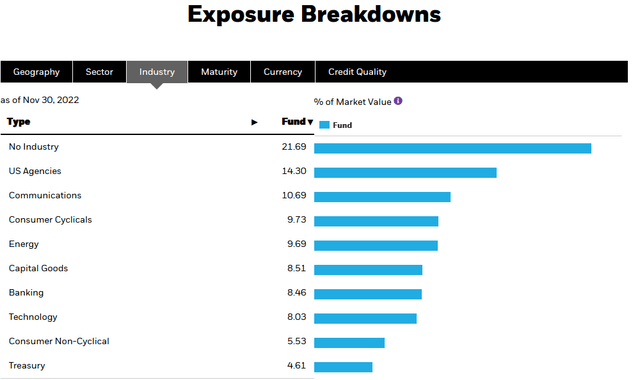

The name of the BlackRock Multi-Sector Income Fund implies that it will invest in bonds from a variety of different industries. This is certainly true as we can see here:

As we can clearly see, the fund invests in a variety of different industries, with no individual industry accounting for an outsized proportion of the portfolio. The confusing thing is the “No Industry” category as we do not know what exactly that is. At first, one might assume that it refers to government securities, but both Agency and Treasury securities are broken down into their own categories. It seems most likely that these are securitized pools of bank loans and similar assets that are made to companies in a variety of industries. Thus, rather than being “No Industry,” these bonds are actually multi-industry. Overall, the general diversity across sectors that we see here is quite nice. As we saw back in 2020, it is not unusual for one sector to encounter financial problems when other sectors do not. The fact that the fund is invested in many different sectors without having too much exposure to any individual one should help limit any losses from defaults in such a scenario. Unfortunately, this diversification does not protect us against interest rate risk because all bonds will decline when interest rates rise.

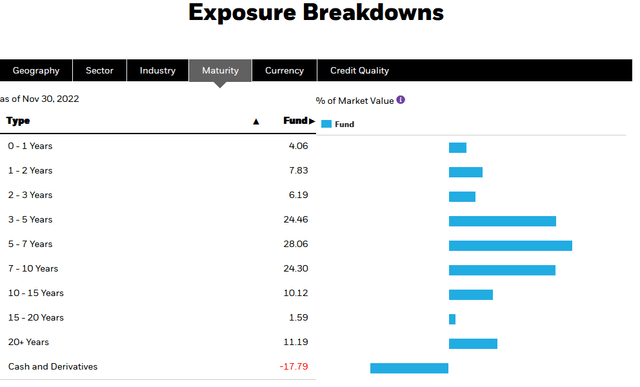

One of the characteristics of bonds is that longer-duration bonds are riskier than shorter-duration bonds. This is because of the fact that bonds return their face value at maturity so the further into the future the maturity date is, the longer we have to wait until we get our money back. This reflects itself in two ways. The first is that long-term bonds typically have a higher yield than short-term bonds. In addition, the further into the future the maturity date is, the more the price of the bond will move when interest rates change. Here is how the BlackRock Multi-Sector Income Trust’s portfolio is structured in terms of maturity dates:

As we can see, the majority of the portfolio consists of bonds that mature in three to ten years. This is a fairly reasonable balance between higher yields and limited interest rate risk. The fact that the fund has relatively few short-term bonds does contribute to some of the price declines that we saw earlier though. This is because it is mostly bonds that mature very rapidly that will tend to hold up best in the current monetary environment. The fact that this fund is mostly medium to long-term bonds reiterates the earlier point that someone buying today should expect to see the share price decrease. It may still be possible to get a positive total return though considering the fund’s incredibly high yield.

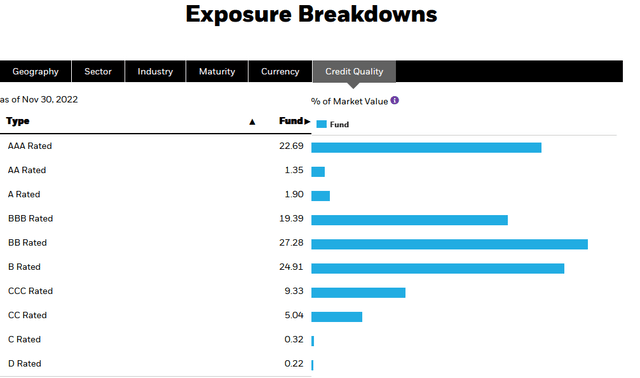

Another thing that we like to take a look at when evaluating a bond fund is the credit quality of the portfolio. This is particularly important for those investors that are concerned about the potential loss of principal due to defaults. Fortunately, the three major credit rating agencies (S&P, Moody’s, and Fitch) assign letter-grade ratings to most bond issues that theoretically tell us the risk that a given issuer will default on the bond. Here is how the fund’s portfolio breaks down:

Anything rated BBB or above is considered to be investment grade. As we can see, that is 45.33% of the portfolio. The remainder is what are colloquially called “junk bonds.” This is something that may concern those investors worried about principal protection. This is because junk bonds are frequently believed to be at high risk of default. However, as we can clearly see, nearly all of these bonds are either BB or B-rated securities. These are the two highest ratings possible for speculative-grade bonds. According to the official bond rating scale, companies with these two ratings are generally financially sound enough to afford their debt payments even through a short-term economic shock. It is possible that they will be vulnerable to a prolonged economic downturn, however. We have not had such a downturn since the Great Depression so such events are exceedingly rare. That certainly does not mean that there is no risk here, but any risk is likely to be fairly minimal. It does not appear too likely that we have to worry about much principal loss due to defaults here.

Another thing that will reduce the risk of loss due to a potential default is the sheer number of securities in the portfolio. The BlackRock Multi-Sector Income Trust has 1,580 total positions so each individual company whose securities are represented in the portfolio only accounts for a very small position. Thus, any single company defaulting on the security will have next to no impact on investors in the portfolio itself since it represents such a small percentage of the investment. The only thing that could really cause problems would be widespread defaults across the economy as a whole and if that happened, we would all have much bigger problems than losing some of our investment capital. Overall, the portfolio appears to be diversified sufficiently to keep losses due to defaults at a minimal level. Our big risk here is interest rates, which we already discussed.

Leverage

As mentioned in the introduction, the BlackRock Multi-Sector Income Trust is able to use certain strategies that allow it to boost the portfolio yield above that of any of the underlying assets. One of these strategies is the use of leverage. Basically, the fund is borrowing money and using that borrowed money to purchase bonds. As long as the fund receives a higher interest rate from the purchased bonds than it pays for the borrowed money, the strategy works pretty well to boost the overall portfolio yield. As the fund is able to borrow at institutional rates, which are higher than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage because this will expose us to too much risk. I do not generally like to see a fund’s leverage above a third as a percentage of assets for this reason. The BlackRock Multi-Sector Income Trust is unfortunately a bit above this level, with its leveraged securities accounting for 38.75% of the fund’s total assets. While this is higher than the level that we really like to see, the fact that the fund’s portfolio is quite well diversified provides some margin of safety. However, we will see this fund decline a bit more than an unlevered fund as interest rates continue to rise.

We have already begun to see the impact of the amplified losses brought on by leverage. As stated earlier, the BlackRock Multi-Sector Income Trust has declined 20.00% year-to-date. However, the iShares Core U.S. Aggregate Bond ETF (AGG) is only down 12.80% over the same time period. The high leverage employed by the closed-end fund will likely cause it to continue to underperform in the near term.

Distribution Analysis

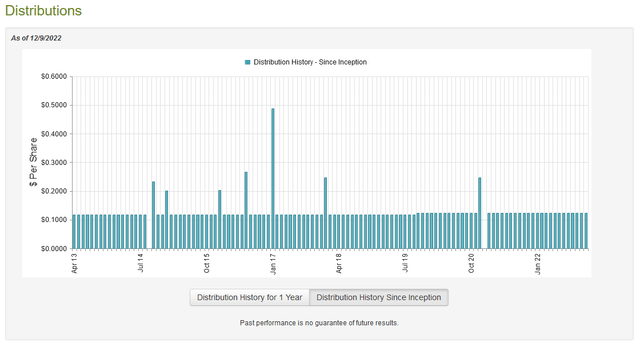

The primary objective of the BlackRock Multi-Sector Income Trust is to provide its investors with a high level of current income. In order to achieve that, the fund invests in a leveraged portfolio of investment-grade and junk bonds, which deliver most of their investment return as direct payments to investors. As such, we might assume that the fund would have a reasonably high distribution yield. This is certainly the case as the BlackRock Multi-Sector Income Trust currently pays out a monthly distribution of $0.1237 per share ($1.4844 per share annually), which gives it a 10.25% yield at the current price. The fund has been remarkably consistent about this payout over its history:

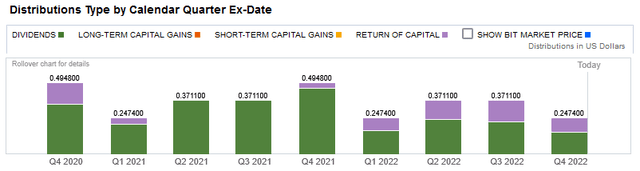

This is one of the most consistent distribution histories of any bond fund, which will likely appeal to those investors that are looking for a steady source of income to use to pay their bills or finance other expenses. This is the very basis of our investment thesis for this fund. However, some of these same investors may be concerned that some of the fund’s recent distributions have consisted of a return of capital:

The reason that this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. There are, however, other things that can cause a distribution to be classified as a return of capital. One of these things is the distribution of unrealized capital gains. It is hard to believe that the fund is actually doing this today as capital gains (realized or unrealized) are going to be quite difficult to come by. Thus, we should investigate exactly how the fund is financing these distributions so that we can figure out how sustainable they are likely to be.

Unfortunately, we do not have any particularly recent documents that we can consult for that task. The fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, this document will not give us very much insight into how well the fund performed in the past eight months or so, which has been a very challenging time for bond funds. However, the Federal Reserve started to raise rates in March, so we should be able to see the initial stages of that on the fund’s portfolio as reflected in this document. During the six-month period, the BlackRock Multi-Sector Income Trust received $1,048,874 in dividends and $24,598,050 in interest from the assets in its portfolio. When combined with a small amount of income from other sources, the fund brought in a total of $25,687,473 during the six-month period. It paid its expenses out of this amount, leaving it with $20,680,304 available for investors. This was, unfortunately, not quite enough to cover the $27,933,070 that it actually paid out in distributions during the period. This is something that will undoubtedly be rather concerning at first glance.

However, the fund does have other methods via which it can obtain the money that it needs to pay the distributions. The primary method is capital gains but as we likely expect, it generally failed at this. The fund did manage to realize a $13,824,483 net gain but this was more than offset by $73,778,389 in net unrealized losses. Overall, the fund’s assets declined by $66,575,305 during the period after accounting for all inflows and outflows. This is certainly disappointing but it is important to note that it did manage to have sufficient net realized capital gains to cover its distribution when combined with net investment income. The distribution is therefore probably safe for now, but the fund will need to continue to generate sufficient capital gains in order to maintain it and that may be quite difficult given today’s market conditions.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for an asset is a surefire way to generate suboptimal returns on that asset. In the case of a closed-end fund like the BlackRock Multi-Sector Income Trust, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. This is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to acquire shares of a fund when we can purchase them at a price that is less than net asset value. This is because such a scenario implies that we are getting the assets for less than they are actually worth. That is fortunately the case with this fund today. As of December 9, 2022 (the most recent date for which data is available as of the time of writing), the BlackRock Multi-Sector Income Trust has a net asset value of $14.87 per share but the shares trade for $14.55 per share. This gives the shares a 2.15% discount to net asset value at the current price. This is a reasonable price and it is much more attractive than the 0.61% premium that the shares have averaged over the past month. Overall, the price seems quite reasonable here.

Conclusion

In conclusion, the BlackRock Multi-Sector Income Trust looks like a decent bond fund that investors can use to boost their incomes to offset the loss of purchasing power that we have been suffering from in today’s inflationary climate. It could also be a way to generate a positive return in a bear market, which is looking likely to continue for a while. Unfortunately, the fund’s shares will likely decline as the Federal Reserve continues its string of interest rate hikes, although that decline will likely moderate once interest rates finally peak. The fund’s distribution also might not be sustainable long-term as it is currently depending on capital gains to maintain it and these may be hard to come by in the current environment. The price certainly looks reasonable though so the fund might be worth thinking about adding to a portfolio, particularly after the Federal Reserve’s next rate hike.

Be the first to comment