coldsnowstorm

Investment thesis

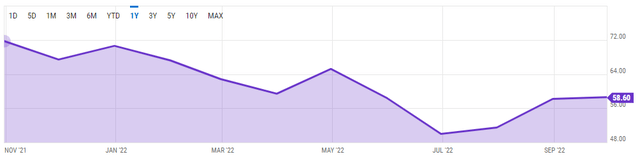

A strong showing in H1 FY12/2022 results appears to be an unsustainable trend, given the backdrop of falling consumer sentiment and increasing price inflation for travel and tourism services. We believe consensus forecasts are too high, and with market expectations about to be corrected down, we rate the shares as a sell.

Quick primer

Tripadvisor (NASDAQ:TRIP) manages a portfolio of travel guidance brands and businesses, connecting travelers to destinations, accommodations, travel activities, and experiences such as eating out. The core platform is the Tripadvisor website, which drives the majority of income through click-based advertising of hotels. The company runs Viator, an online marketplace for travelers to research and book tours, activities, and attractions. There is also TheFork, an online restaurant reservations platform. Peers include Booking.com (BKNG) and Expedia Group (EXPE).

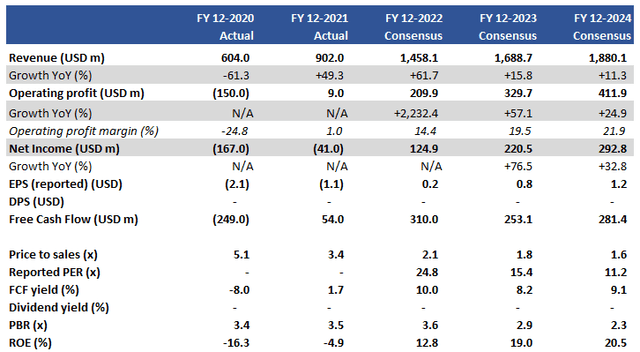

Key financials with consensus forecasts

Key financials with consensus forecasts (Company)

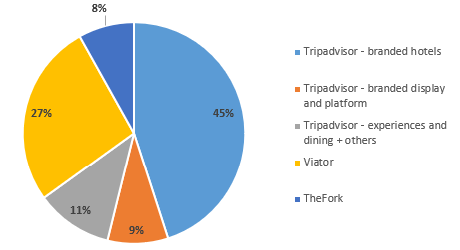

Revenue split by segment – H1 FY12/2022

Revenue split by segment – H1 FY12/2022 (Company)

Our objectives

Tripadvisor is experiencing a major resurgence in customer traffic as demand for tourism returns. In October 2022 it was disclosed that short-term rental accommodation booked online in the European Union increased above 2019 levels from February 2022 onward. However, there were some signs of activity softening in the US market with total travel spending 3% below 2019 levels in August 2022, after four straight months of exceeding pre-pandemic levels.

We want to assess the outlook for Tripadvisor into FY12/2023 given rising concerns over inflation, the cost-of-living crisis, and data from the travel industry. H1 FY12/2022 results were strong, with sales growing 90% YoY (page 37).

The impact from the economic cycle

Although not a hard and fast rule, demand for travel and tourism services generally coincides with economic cycles albeit with a lag. During periods of economic growth, consumer confidence is high and travel activity ramps up, resulting in the airlines, hotels, and related tourism businesses prospering. In a downturn, as consumer confidence declines so does the demand profile.

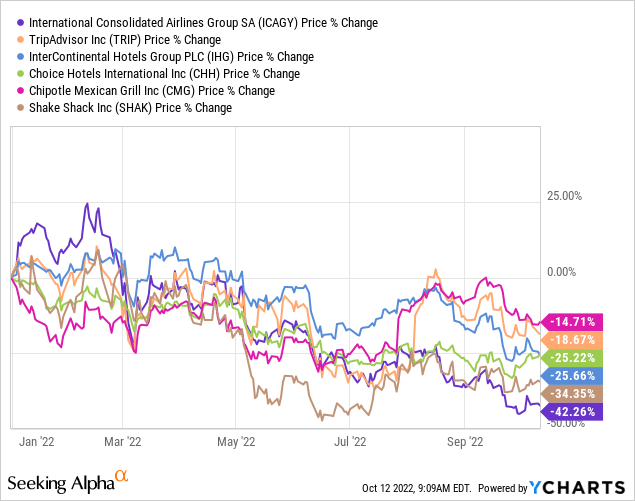

When we look at the relative performance of travel and tourism names versus Tripadvisor’s shares YTD, the simple observations are that 1) price inflation is impacting airlines significantly as per International Consolidated Airlines Group (OTCPK:ICAGY), 2) restaurants such as Chipotle (CMG) and Shake Shack (SHAK) appear to be holding up as discretionary spending amounts are relatively small versus travel, and 3) the hotel chains such as InterContinental (IHG) and Choice Hotels (CHH) saw a spike in demand in early summer, but momentum seems to have been waning more than anticipated as we approach the calendar year-end.

YTD share price performance of sample travel and restaurant names

We believe Tripadvisor’s H1 FY12/2022 results were driven primarily by pent-up demand. The critical issue now is whether growth is sustainable, as indicated by consensus forecasts (Key financials table above) with high double-digit profit growth for the next two prospective years.

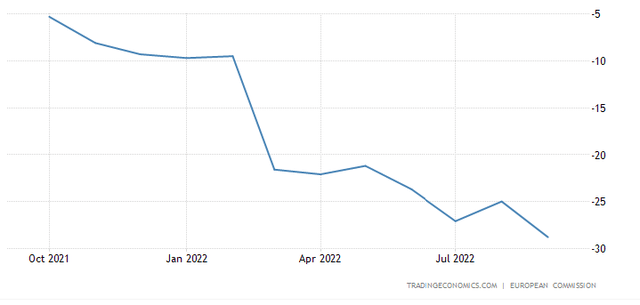

Recent trends in consumer sentiment are a concern, particularly for Europe, where the index has continued to decline since the beginning of the year.

Euro Area Consumer Confidence

Euro Area Consumer Confidence (Trading Economics)

US consumer sentiment is relatively firm, but not exactly on a major upward trajectory.

US Index of Consumer Sentiment

US Index of Consumer Sentiment (University of Michigan Surveys of Consumers)

We conclude that with consumer sentiment still weak, the outlook for FY12/2023 will be challenging given high hurdles YoY, diminishing pent-up demand, and uncertain macro conditions.

Cost increases outpace wage growth

The pace at which inflation is rising is impacting costs, with household income not being able to catch up. When looking at the price increases for airfares and hotels, we can only conclude that unless salaries rise dramatically, spending for travel and tourism will be pushed down the priority list.

According to the U.S. Bureau of Labor Statistics, seasonally unadjusted airfares inflation reached 33.4% in August 2022. Data from OTA Insight showed that in June 2022, hotel room prices for key European city destinations were up high double-digits compared to pre-pandemic levels in June 2019, with Rome up 51.4%, Berlin 50.2%, and Dublin 44.5%. The US saw wages increase by over 8% in August 2022, but the gap with an escalation in travel-related prices remains very wide. Europe saw a wage increase of only 4.4% for the June 2022 quarter, highlighting a bigger divide.

The conclusion here is that with unprecedented levels of price increases being experienced in the travel industry since the early 1980s, we do not think the consumer is in a position to repeatedly soak in price hikes of this magnitude. As a result, the travel industry will see a major downturn YoY into FY12/2023.

Valuation

Consensus forecasts for FY12/2023 look bullish, given expected revenue growth YoY in the high teens, and operating margins near 20% which will be the highest recorded since FY12/2014. The resultant valuations look relatively cheap, with the reported PER multiple of 15.4x and a free cash flow yield of 8.2%. However, these metrics look misleading to us.

Risks

Upside risk comes from pent-up demand for tourism to continue strongly into FY12/2023, despite macro uncertainties and price increases. Macro uncertainties may begin to stabilize in the shorter term, resulting in normalizing pricing.

Downside risk comes from market expectations being too high for Tripadvisor. Despite deteriorating market conditions particularly in Europe, consensus forecasts remain very positive into FY12/2023. Management commentary over a decline in booking growth or cancellation rates rising will be negative catalysts.

Conclusion

Unfortunately, the positive results seen in H1 FY12/2022 look like an unsustainable trend for Tripadvisor. The continued upward movement in travel and tourism costs will trim demand due to price sensitivity. We expect to see management begin to comment about softening demand, and with consensus forecasts set to be revised down, we are sellers of the shares.

Be the first to comment