onurdongel

(Note: This article was in the newsletter on July 30, 2022, and was updated as needed.)

Hess Midstream (NYSE:HESM) has made some very astute financial moves since going public. The result is that the backers of the midstream company are raking in a lot of proceeds while the public benefits as well. Having been through more than a few “take-unders” in the midstream sector, this has been an unexpected very pleasant surprise. Since going public, these common units have appreciated in a very un-midstream-like manner. That is likely to continue because debt levels are still conservative for a midstream company.

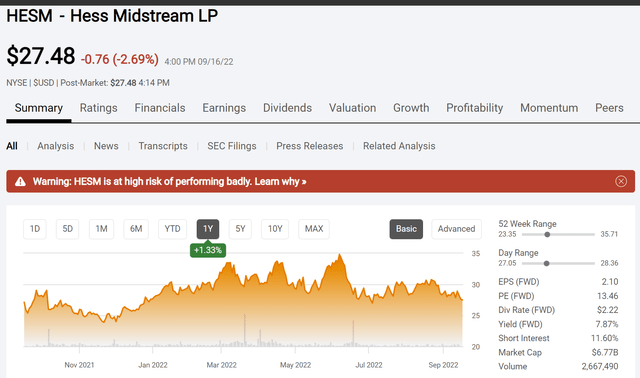

Hess Midstream Common Price History And Key Valuation Measures (Seeking Alpha Website September 16, 2022.)

HESM stock originally began trading in the middle $20s in late 2015. Since then, the common units have appreciated to the current price. That makes this one of very few issues selling at a higher price than was the case back in the 2016 to 2018 period. Given the share repurchases that have been announced from time to time, these common units are unlikely to retreat to previous levels unless there is a major long-term depression. That is highly unlikely.

The distribution has now roughly doubled since the midstream units went public. That distribution has been raised every single quarter since going public. The trend appears likely to continue. Hess Corporation (HES) has long had ambitious plans for the Bakken where this midstream company is located. The currently strong commodity price environment only encourages more ambitious plans which is good news for potential continuing distribution increases.

The way that the finances are being handled has allowed the sponsors to “cash out” holdings at ever higher prices while the public shareholders benefit from the price appreciation. In the meantime, the debt ratio remains in very conservative territory.

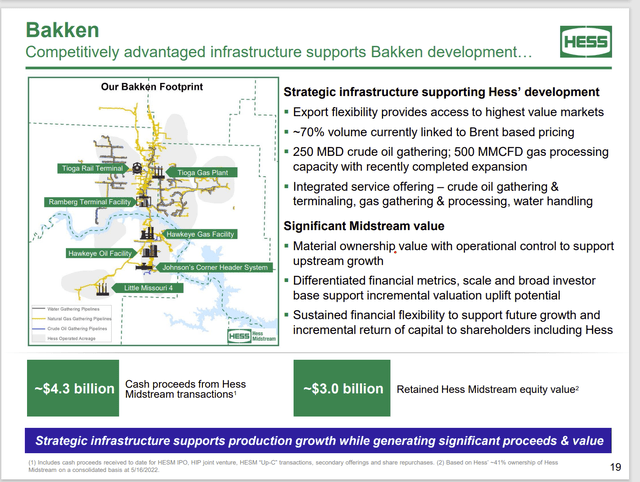

Hess Presentation Of Midstream Benefits To Hess Corporation (Hess Corporation Presentation At J.P. Morgan Energy Power and Renewables Conference June 23, 2022.)

As shown above, Hess Corporation has generated a fair amount of cash that was used to finance the Guyana Partnership that Exxon Mobil (XOM) operates. The currently strong commodity price environment mitigates the need for cash to finance the partnership (as does the ramp-up of the second FPSO). But proper management of the midstream will allow for more cash to be generated in the future should the need arise.

Apparently, the founders of the partnership are well aware of the situation. The ability to increase the distribution every single quarter is something Mr. Market has come to love enough to keep the yield lower than is the case for some of the larger conservative partnerships like Enterprise Products Partners (EPD). In effect, these founders have found a way to cash out at decent prices while much of the industry is still in the market doghouse.

Most of us have been through more than a few “take-unders” to be wary of a situation where the parent company needs cash from time to time. But the difference here is this parent company has a decent debt rating with a need to finance a very profitable production expansion partnership. Most of the past (other investment) unfavorable results came from companies facing a “cash-crunch” in a fairly hostile industry environment where the parent company badly needed the midstream cash flow.

Some other unfavorable outcomes happened when perfectly good midstream company units fell to the point that made going private became a viable option. Then the value of the midstream units went straight to the private company owner(s) instead of the public participation that is expected elsewhere in the marketplace. The generous and relatively predictable midstream cash flows are what made this outcome possible. Investors learned that they could not count on a midstream recovery to recoup investment losses in a cyclical downturn because going private at market bottoms became an option.

Hess midstream, in contrast has been a very pleasant investment experience so far. It also appears a fair amount of good news is on the horizon because Hess has consistently backed growth plans for its Bakken holdings.

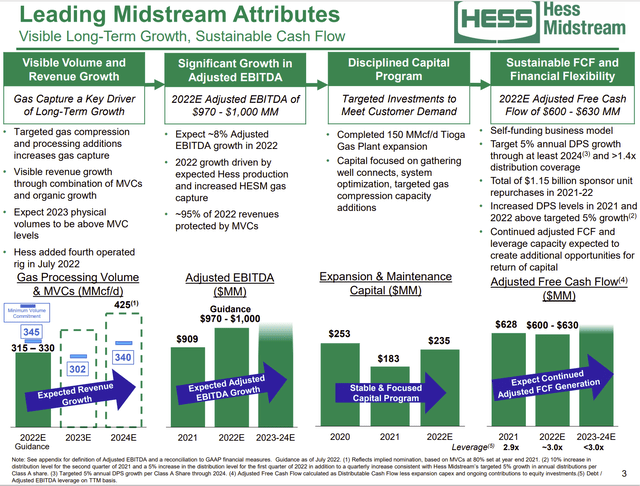

Hess Midstream Operational And Financial Summary And Guidance (Hess Midstream August 2022, Investor Presentation)

The weather has had a big impact upon Hess production so far (and that impact is way less than positive). Anything approaching a normal situation is likely to see a material production jump from a lack of shut-ins and other weather-related issues. Now the midstream company is protected with minimum payment commitments. So, the weather effect was limited to reporting volumes affected.

That means that the EBITDA growth shown above will likely be represented by volume in the future rather than minimum commitments under the contract. Another consideration is the fairly low expansion and maintenance budget when compared to guided adjusted EBITDA.

That amount of available EBITDA backs-up the excellent distribution coverage to allow for distribution growth in the future while long-term debt gets paid down to lower levels. The low leverage shown above means that the midstream has room to finance more common unit buybacks in the future.

Those of us who have experienced secondary offerings know that the result is a period of pricing weakness that often occurs after the secondary offering. Here, there is an attempt to offset that announcement by repurchasing (and retiring) units at the same time as the secondary offering. So far that strategy appears to be successful.

In the future EBITDA appears to be positioned through the common unit repurchases to grow faster on a per share basis than is the case for the announced partnership-wide increases. Similarly, the repurchases allow for great coverage on the distribution which means there is an occasional increase greater than the announced target of 5% per year.

Clearly the founders know what they are doing. The main risk is that Hess could become a takeover candidate because of the company involvement in the Guyana project. Should that risk materialize, then investors would have to evaluate the owner for the safety of distribution maintenance as well as the suitability of maintaining a position in Hess Midstream.

In the meantime, this is one of the top-performing midstream companies controlled by a parent company with an excellent outlook. The combination of distribution growth and common unit appreciation (along with periodic stock repurchases) makes these units attractive to a wide variety of investors. Midstream has far less risk than is the case with upstream and that distribution alone is only slightly less than what many investors report as an annual long-term return on stocks. This is a good core position consideration for many as a result.

Be the first to comment