Darren415

Here’s my understanding of the current collective wisdom of the market:

- Both inflation and the US economy are “running hot.”

- The Fed needs to boost rates dramatically to slow the economy and bring down inflation.

- The US economy is very likely to suffer another recession as a result.

- The outlook is not so terrible, however, since once it is clear that inflation is under control, the Fed will be able to lower rates.

- The Fed will hike the funds rate to a peak of 4.5% over the next 6-7 months, then cut rates to 3.75% by mid-2024.

- Inflation, currently running about 8%, will fall back to 2% or so by the end of next year

As I’ve pointed out in previous posts, however, the Fed and the market are ignoring some very obvious signs which strongly suggest that the Fed’s best course of action is to not follow this script:

1) the dollar is extremely strong, 2) commodity prices are falling, 3) the M2 money supply has not grown at all for the past 6 months because the federal government is no longer sending Covid stimulus checks to the public, 4) measured inflation is already declining, and 5) inflation expectations have declined significantly, down 120 bps since early March (inflation expectations peaked at 3.69% and are now 2.49%).

Moreover, yesterday FedEx (FDX) shocked the market by suggesting that demand has all but collapsed. All of this suggests money is already tight enough to impact the economy, and more could be destructive.

The market is telegraphing that what the Fed is planning to do is potentially destructive to the economy. Why does the Fed still think the only way to lower inflation is to undermine the economy? That’s Phillips Curve thinking, and it has been debunked countless times.

Growth doesn’t cause inflation. Too much money is the culprit (i.e., money that exceeds the demand for it). What the Fed needs to do in cases like today’s is to 1) bolster the demand for money by raising interest rates (they have accomplished that goal already!), and 2) reduce the unwanted supply of money (something that is well underway since the M2 money supply stopped growing long ago).

If the Fed were to follow the market’s script, we could see real problems develop. The US economy could weaken dramatically, creating a double whammy for the working class: rising unemployment on top of already-declining real wages. This is totally unnecessary.

I have to believe they won’t follow through on their hiking hysteria. And that should prove very positive for the economy and the market.

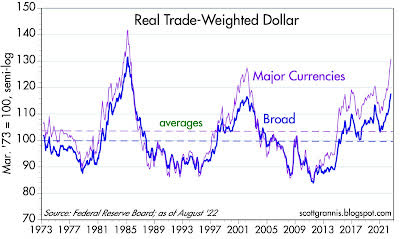

A few charts to illustrate the situation with the dollar:

Chart #1

Chart #1 shows two measures of the trade-weighted, inflation-adjusted value of the dollar. Each uses a different basket of currencies: major currencies vs. most currencies. The dollar today is within inches of its all-time highs according to these measures.

It’s not healthy for the dollar to be this strong, because it is symptomatic of very restrictive monetary policy. Sure, European currencies are weak because their economies are at risk with the Ukraine-Russia conflict.

It’s logical that Europeans would rather hold dollars, and the Japanese too (the yen is plunging). That’s fine, but the Fed should figure this into its calculations: increased demand for dollars with the dollar at all-time highs calls for looser, not more restrictive Fed policy.

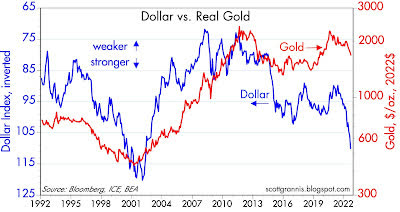

Chart #2

Chart #2 compares the price of gold with the real yield on 5-yr TIPS. Real yields are a direct measure of the relative tightness or easiness of Fed policy. The Fed tightens by causing real yields to rise (shown here by a drop in the blue line), and tight monetary policy from the Fed makes gold less attractive since it yields nothing in comparison. Tight money has always caused gold prices to decline, while easy policy feeds into rising gold prices.

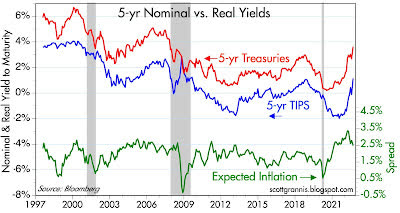

Chart #3

Chart #3 compares real and nominal yields on 5-yr Treasuries, with the difference being the market’s expectation for what CPI inflation will average over the next 5 years.

Inflation expectations have averaged a very modest 2.5% for more than a year, despite the big increase in inflation we’ve lived through. This can only mean that the market realizes that the current inflation is a one-off phenomenon that is very likely to reverse in the near future.

Note also that the last time TIPS yields were as high as they are today was in late 2018. Check out my posts from back then here. This episode was reminiscent of today, in that both times the Fed was hell-bent on tightening policy at a time when the market was warning that a tightening was not needed – and stocks crashed both times. The Fed finally reversed course in early 2019, that unleashed the economy. We can only hope they will do this again!

Chart #4

Chart #4 compares the price of gold to the value of the dollar (inverted on the chart). A strong dollar has always been bad for gold, and a weak dollar good for gold. If the Fed hikes rates aggressively from here the outlook for gold and many other commodities looks quite bleak.

Chairman Powell, you need to take a chill pill, and the sooner the better. Please don’t give us aggressive tightening rhetoric at next week’s FOMC meeting.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment