Andrii Shablovskyi/iStock via Getty Images

Introduction

We review Imperial Brands PLC (OTCQX:IMBBY) (referred here as “IMB”) two weeks ahead of its FY22 pre-close update (on October 6) and after IMB shares have stagnated in USD terms for the past 3 months.

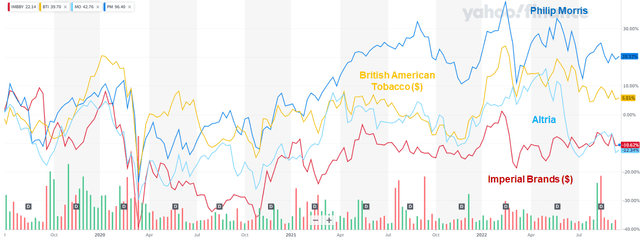

We initiated our Hold rating on Imperial Brands in July 2019. IMB has significantly underperformed its peers since then, and its share price remains lower (even in depreciated GBP) than at our initiation after more than three years:

|

IMB Share Price vs. Peers (Since July 3, 2019)  Source: Yahoo Finance (20-Sep-22). NB. Graph is based on USD share prices for ADR of U.K. companies. |

Year-to-date, in USD, Imperial Brands shares have gained 3.9% (including dividends), 7 ppt behind British American Tobacco (BTI) and roughly in line with Philip Morris (PM), though 10 ppt ahead of Altria (MO):

|

IMB Total Gain vs. Tobacco Peers in USD (2022 YTD)  Source: Refinitiv (20-Sep-22). |

The upcoming pre-close update (for FY22 ending September 30) will likely present mostly positive headlines. We expect IMB to meet its undemanding guidance of flattish revenues and EBIT (at constant currency); the update may also indicate that a higher dividend and a resumption of buybacks will be announced on November 15. IMB shares look superficially cheap with a 7.7x P/E and a 7.3% Dividend Yield. However, we remain cautious because IMB still lacks a long-term answer in Next Generation Products (“NGPs”). We believe investors should focus on specifics in FY23 expectations around NGP profits and cigarette volumes, and expect these to be disappointing. Avoid.

Imperial Brands Hold Rating Recap

We have been cautious on IMB due to its fundamental business problems:

- IMB is mostly in markets with unfavorable demographics or regulations; profit growth was weak, even before the threat from NGPs

- IMB has under-invested, including in NGPs, instead prioritizing an unsustainable dividend growth, until a dividend reset in May 2020

- IMB’s NGPs are far behind peers and have little hope of catching up

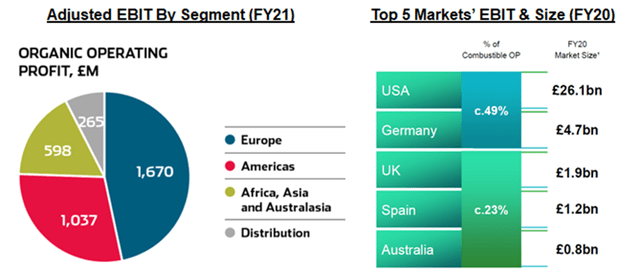

IMB’s largest region is Europe (47% of EBIT), followed by the U.S. (approx. 30%). The U.S. and Germany together were 49% of its Combustible EBIT; the U.K., Spain and Australia together were another 23%. Other top-10 markets were France, Italy, Japan, Russia and Saudi Arabia:

|

IMB EBIT By Segment & Top 5 Markets  Source: IMB company filings. |

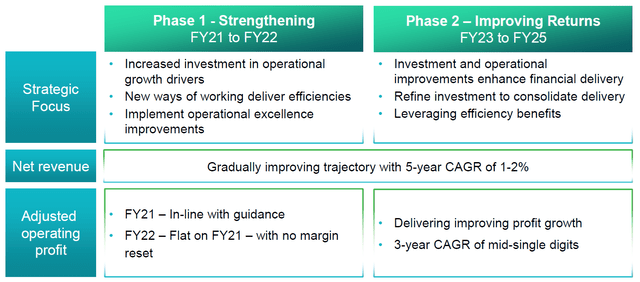

Since 2021 IMB has been executing a 5-year strategic plan, which specifies an Adjusted EBIT trajectory that is relatively flat in FY21-22 but accelerates to a mid-single-digit 3-year CAGR in FY23-25; management have recently clarified that “mid-single-digit” means 3.5-6.5% in this case:

|

IMB FY21-25 Outlook  Source: IMB investor day presentation (Jan-21). |

Given the low expectations set for FY22, we believe IMB should be able to meet these easily.

Likely to Meet FY22 Guidance

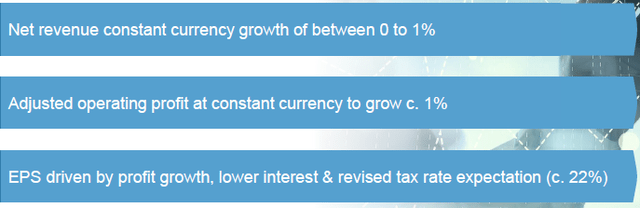

IMB’s FY22 outlook, reiterated at H1 results in May, include Net Revenue growth of 0-1% and Adjusted EBIT growth of approx. 1% (both at constant currency):

|

IMB FY22 Outlook  Source: IMB results presentation (H1 FY22). |

We believe IMB will achieve or even exceed this outlook. It had already achieved Net Revenue growth of 0.3%, Adjusted EBIT growth of 2.9% and Adjusted EPS growth of 7.7% (all at constant currency) in H1, with EPS growth helped by debt paydowns and a lower tax rate. (Translation FX was a 2 ppt headwind to EPS.) H2 is expected to be helped by a stronger tobacco price/mix, after price increases in Q2.

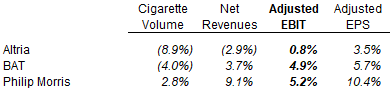

Results reported by other Tobacco companies for H1 CY22 were overall benign, with Altria, British American Tobacco (referred here as “BAT”) and Philip Morris all reporting positive Adjusted EBIT growth:

|

Tobacco Companies Recent Growth Rates (H1 2022)  Source: Company filings. NB. All figures at local currencies. Net revenues are after excise. PM figures exclude Russia but include acquisitions. |

Altria’s growth in H1 was the weakest of the three, due to the significant decline in U.S. cigarette volumes (down 8.9% at Altria and 13.4% at BAT). BAT’s combustibles revenue growth was just 0.6% (excluding currency) in H1, dragged down by a 3.4% decline in the U.S.; Philip Morris combustible revenues, unaffected by the U.S., grew 4.8% organically in H1, though only flattish for European Union and Eastern Europe combined. Both Philip Morris and BAT saw a significant contribution to revenue growth from their NGPs.

Compared to these H1 CY22 results, IMB’s large U.S. and European exposure and much weaker NGP businesses mean that it will likely see its revenue growth worse than both Philip Morris and BAT, but better than Altria’s.

While the results above only overlapped with half of IMB’s H2 FY22 (April to June), we do not believe the market has changed much since then. Despite rising energy costs and inflation (especially in Europe), comments by tobacco executives in early September indicated that these macro headwinds have not impacted their businesses so far:

Nobody’s immune to the inflation that is out there … So far in 2022, we see little coming through that in our business, but it is inevitable to see that the consumer will have to make choices going forward and there will be some elements of downtrading.”

Lukas Paravicini, IMB CFO (Barclays conference, September 6)

“When it comes to the macro-economic pressure, I mean, not specific to Europe, but one has to assume that, at a certain point in time, the degradation of the economic environment will have some impact on the consumption or on down-trading. I’m not sure that we see it for the time being.”

Emmanuel Babeau, PM CFO (Barclays conference, September 6)

We therefore see IMB’s FY22 revenue outlook of flat to 1% growth as achievable. Similarly, we see IMB’s FY22 Adjusted EBIT outlook of approximately 1% growth as achievable, especially because a large part of each tobacco company’s OpEx is discretionary marketing expenses and can be reduced significantly for the short term.

Dividend Increase & Buybacks Resumption

We believe IMB’s pre-close update may indicate both an increase in the dividend and the resumption of buybacks will be announced at the full results release on November 15.

Both will be enabled by IMB hitting the low-end of its 2.0-2.5x Net Debt / EBITDA target range, having already reached 2.2x at H2 FY22. Net Debt was £9.76bn at H1 2022, and repaying another £887m on its own would be sufficient to reduce Net Debt / EBITDA by another 0.2x (even with no EBITDA growth). This is likely to have happened during H2 FY22, as IMB has £2.4bn of Free Cash Flow (“FCF”) (in the last 12 months to March 31), FCF is usually H2-weighted (only £336m in H1 FY22), and the dividend only requires about half (£1.32bn) of it.

Speaking at a Barclays conference in early September, IMB CFO Lukas Paravicini strongly indicated that buybacks will be resumed soon and that dividends and buybacks may come to exceed FCF:

At the time when we get to the lower end of 2 to 2.5 times the leverage, we will hopefully be announcing a significant and constant share buyback, and we are very close … we will, if the EBITDA continues to accelerate, continue to return capital, which most likely will be in excess of Free Cash Flow at some stage.”

IMB’s dividend policy is “progressive” and targets “growth reflecting underlying performance”. The dividend was raised by 1% in H1, though less than the 7.7% growth in Adjusted EPS (helped by lower interest expense and a lower tax rates so not necessarily “underlying”). A low-to-mid single-digits dividend increase may be announced in November.

Buybacks can reduce the share count by more than 5% each year, if IMB were to spend 40% of its £2.4bn FCF on buybacks, given the market capitalization is currently £18.2bn.

Valuation: Is Imperial Brands Stock Cheap?

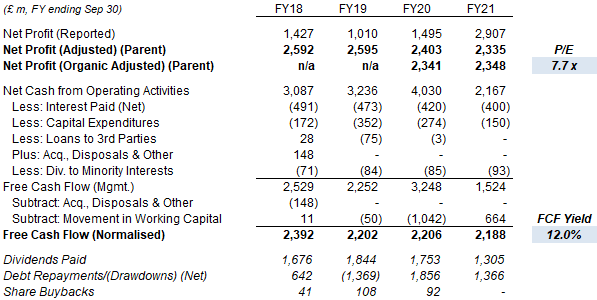

At 1,914p, IMB shares look superficially cheap, with a 7.7x P/E and a 12.0% FCF Yield relative to FY21 financials:

|

IMB Net Income, Cashflow & Valuation (FY18-21)  Source: IMB company filings. NB. Cashflows not adjusted for sale of Premium Cigars. |

The most recent dividend is 139.1p, consisting of a 42.54p interim dividend in H1 FY22 and a final dividend of 93.96p in H2 FY22, implying a Dividend Yield of 7.3%.

Still Lacking Next Generation Products

Given all the positives we have listed so far, why are we still cautious on IMB stock? The reason is that we believe NGPs represent a long-term risk and IMB still lacks an answer there.

IMB’s NGP strategy, under current CEO Stefan Bomhard, is to enter local NGP markets only once they have reached a significant size after efforts made by others. As he said in the past, “our role as the number four is not to build the category, but to offer consumers and customers an alternative choice” (H1 FY22 earnings call), and ”our ambition is not to be the market leader in NGP. And our strategy now really focuses on NGP countries where there is a sizeable NGP segment” (H1 FY21 earnings call).

CFO Lukas Paravicini even indicated more recently that he regarded success in NGPs by competitors as positive:

Things like Zyn (in Modern Oral Tobacco), or Velo (in Vapour), the more successful they are, the better for us, because we will come in as a challenger to carve out some of that market.”

What this approach means in practice is that IMB’s NGP efforts are limited. In Heated Tobacco, for example, IMB is in only three countries – Greece, the Czech Republic and, currently being launched, Italy. IMB’s NGP losses were £140m in FY21 and expected to be approximately £100m in FY22, with a target breakeven in FY25.

We believe this approach will not be enough to protect IMB’s earnings, should the market shift to NGPs decisively.

Heated Tobacco and Modern Oral Tobacco have so far turned out to be mostly “winner takes all” markets, with Philip Morris having a volume share of more than two thirds in most Heated Tobacco markets, Swedish Match (OTCPK:SWMAY) having a 65% volume share of the U.S. Modern Oral market, and BAT similarly having a 69% volume share of the European Modern Oral market. These market share figures are all far in excess of the companies’ share of the cigarette market, which implies that other tobacco companies will be losing much of their profits in the shift to NGPs.

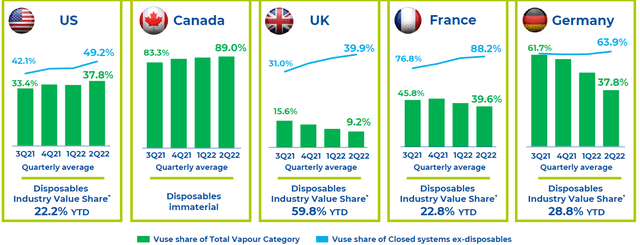

In Vapour, BAT also holds a dominant share in the closed systems category in key markets, and dominates the U.S. closed systems category together with Juul, but the situation is complicated by the presence of a large open systems category as well as the rapid growth a disposable category, both populated largely by independents:

|

BAT Vapour Market Share in Key Markets  Source: BAT results presentation (H1 2022). |

BAT’s market share in Vapour is actually falling in the U.K. and France, the two largest Vapour markets after the U.S. once disposables are included. (Both BAT and Philip Morris have only launched their own disposable products in one market each in Q2.) The danger for IMB is that, outside the U.S where there is strong FDA regulation, Vapour may have intrinsically low barriers to entry and therefore be structurally far less profitable than cigarettes.

Another risk in Vapour is that IMB’s myblu received a Marketing Denial Order (“MDO”) from the FDA in April, though IMB is appealing and management note in September that “there has not been any enforcement order against our brand and our product from the FDA”. Juul has also received a MDO and BAT has only received Marketing Granted Orders for a small portion of its products, so is possible that many Vapour products will end up being banned – which would be a positive for IMB. However, there is also the risk that IMB is banned while key competitors are not.

Focus on FY23 Targets & Specifics

We believe investors should focus on specifics in FY23 expectations around NGP profits and cigarette volumes, though much of the details around these may only be available at the full results release in November.

This is because FY22 guidance is undemanding and, given the extraordinary impact from COVID-19 in prior years, FY22 only offers limited insights on the future of IMB’s businesses, especially on NGPs.

FY23 is more relevant because IMB is guiding to a mid-single-digit EPS CAGR in FY23-25. In addition, IMB’s competitors are accelerating their NGP efforts, especially in the case of Philip Morris with regards to both Europe and the U.S. What IMB expects to achieve in FY23, especially around NGP profitability and cigarette volumes, will offer the most direct measurable datapoints on whether IMB businesses have a long-term future.

We expect these to be disappointing.

Is Imperial Brands A Buy? Conclusion

The nightmare scenario for IMB investors continues to be one of rapid cannibalization of cigarette profits by NGPs, which will see IMB profits being impacted disproportionately given its lack of competitive NGP products. The likelihood of this happening, based on current evidence, remains to too high for comfort.

We reiterate our Hold rating on Imperial Brands stock, and believe the stock should be avoided.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment