peepo/iStock via Getty Images

To all our shareholders

In 2021 the net asset value per share increased by 37,8 %.

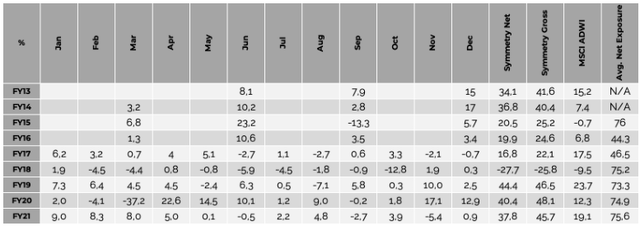

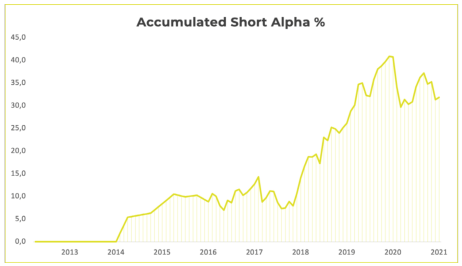

Historicalperformanceandnetexposuresinceinception

We are quite happy with our overall return for 2021. We again delivered a return that was about double of the overall market. And we did so while keeping our net exposure around 75 % throughout the year. Our goal is as always to deliver the best risk-adjusted returns over time. Here we are also pleased to report a net 23 % yearly CAGR over our 9 years since inception. On a gross level our CAGR has been around 30 % per year.

Zooming in and out

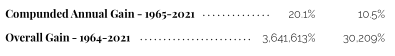

Most of our “followers” is probably well known about the world’s best investor Warren Buffett. Especially his impressive track record:

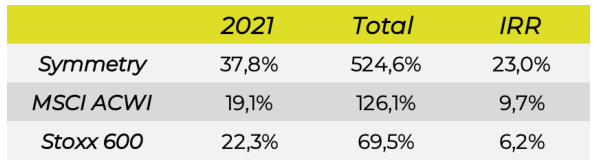

A yearly return of 20.1 % per year compared to 10,5 % for the overall market maybe doesn’t sound of much. But over enough years it compounds and the difference is huge. 3,641.613 % (it’s not a typo) compared to 30.209 %.

What most people often forget when they look at this amazing track record is that they are sitting with the final scorecard. It’s much more complicated to estimate the end result when you are in the middle of the game. Especially in the periods when things have not been going Warrens way. On the next page you can see some of the drawdowns one had to live through to participate in the long-term compounding of Berkshire. It is worth remembering that this is measured on a yearly basis. Looking at “intra-year-drawdowns” as well they would have been even larger.

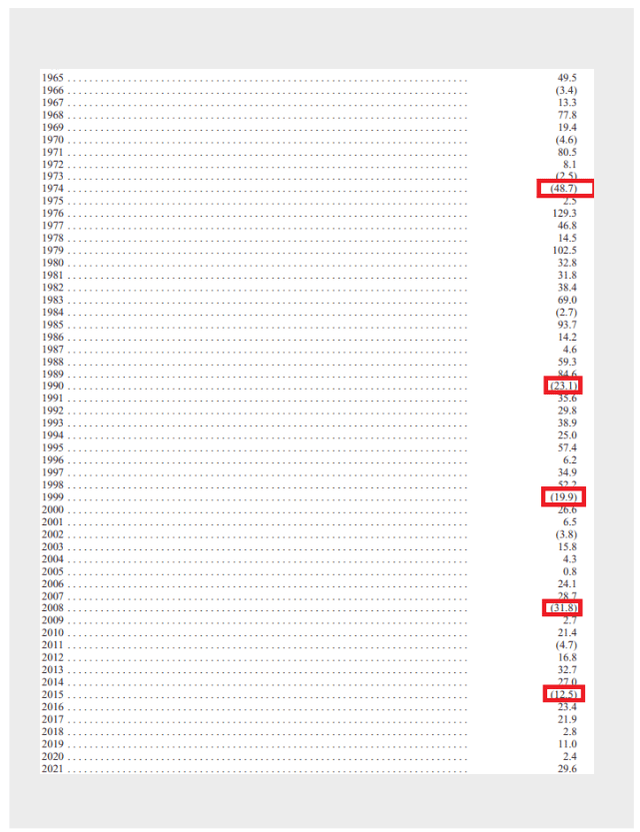

Performance against MSCI ACWI

Longtermandshort–termperformanceagainstMSCIACWIandStoxx600

Why is this relevant?

Because it illustrates what most people already know. The road to success is not linear. It’s easy to remember when you are standing on the top andlooking down, but easy to forget when you are standing in “shit to your knees”.

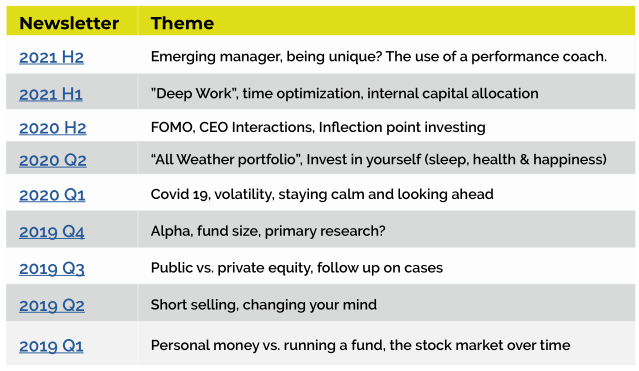

Symmetry letters

As most of you know Symmetry is issuing half-yearly newsletters where we dig into themes and topics that directly or indirectly are relevant for investments. In our newsletters we only briefly discuss individual stocks and our portfolio. Instead, we focus on themes that we think are relevant for our readers. In these yearly investor-letters it’s the opposite. Here we only spend a little time on “investment philosophy” etc. – instead, we spend the time walking you through our returns and our portfolio. For those of you that wanted to catch up with our newsletters, below is a link to them and a short headline around the theme we discuss.

One of the things we have discussed from time to time in our newsletters is the “all-weather” portfolio. This is more relevant today than ever before. The last 3 years have seen most stocks getting into groups/categories like technology vs. commodity, value vs. growth, covid-winner vs. covid-looser etc. Today it seems like all investors want to put a label on a stock and place it in a category so that it can fit an investment theme. In Symmetry we try to not be “all-in” in specific categories but to make smart investments throughout the universe. We definitely like growth stocks and technology stocks, but we are not willing to pay 15-20x revenue for them. We also like traditional value stocks but we would not pay 2-3x earnings for a levered company on the top of a cycle.

This also means that Symmetry will never be the best fund in a single year.

- We were not all-in on technology stocks in 2020

- We were not all-in on reopening/stimulis stocks in 2021

- We are not all-in on commodity related names in 2022

But we have also avoided the big losses “deep-value” investors had from 2017-2020 and the big losses “tech-investors” have had from end of 2021 and until now in 2022. Our goal is to deliver great results throughout the cycle by having a portfolio that can deliver results under most environments but that would never be the best in a single year.

A bigger and stronger business

Besides delivering great returns for Symmetry investors in 2021 we also continued our great development as a business.

Our assets under management have grown from 220 million DKK (30 EUR) at the end of 2020 to around 490 million DKK (around 66 EUR) at the end of 2021. This has not been the result of some extraordinary focus on “sales and marketing”. On the contrary, most investors have found us. We are looking to do what matters by delivering good results to existing investors and telling our story, strategy and process through these letters. When we do that, we think we should attract enough like-minded investors over time. And most important: Investors then choose us; we don’t sell to them. There is a huge difference if an investor has been “sold” a fund in comparison to one that has actively chosen us.

Fortunately for us, Symmetry investors are among the best. We have only had small outflows throughout our 9 years and most-y it has not been related to performance or strategy. At the same time, we see that existing investors are increasingly investing more money with us. When we can deliver a product that people are satisfied with it’s only natural that they choose to allocate a bigger portion of their wealth with us.

Getting more AUM in has allowed us to reinvest the additional fees in the product and the business. In 2020 I hired Henrik as my second employee and we increased our budget for IT, data and subscriptions a lot.

In 2021 we took the step even further and doubled our employee base again. First in the summer with hiring Casper as our CFO and later in the end of the year by hiring Jon as our CTO.

Casper has quickly taken over most of the administrative stuff I was doing before and optimized our internal processes a lot. Besides having improved our external and internal reporting it has also released a lot of my time that I can now redeploy into working in investments.

To get a full time CTO had always been a high priority on my list. Symmetry has no desire to be a quant-based firm, but even when running a fundamental strategy, you just can’t get around using a lot of technology. Both for sourcing, structuring and analyzing data but also for different risk management tasks. Henrik and I was using different word and spreadsheet models for different tasks. Jon has step by step started to migrate these into an internally developed cloud-based ERP system. At the same time, we have started to migrate and consolidate different external data suppliers to our system through an open API. Jon is only a few months into the job but we have big hopes on what we can achieve. We can automate a lot of the manual tasks Henrik and I was doing then freeing up our time for more productive investment work. We can collect, structure and analyze datasets better, create smart dashboards with KPI’s and optimize portfolio and risk management better.

We do expect to hire more people to Symmetry in 2021 but do not think we will double the employee count once again. We intend to stay as a small, nimble and flexible firm.

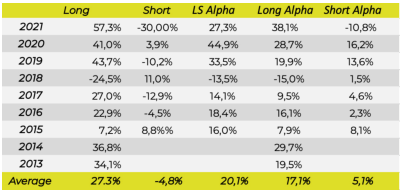

Alpha

One thing is to deliver great returns, the other is to see how these returns have been delivered. We have no desire to create high returns by just taking higher beta. Below is shown our returns from both long and shorts since inception (gross returns).

We once again had an amazing year with a 27 % alpha. But it wasn’t an easy year at all. While we had our best year since inception on the long side with close to a 60 % return it was worse with shorting. We did not have GameStop or AMC shorts. But anyways 2021 was a year when private investors marked up terrible story stocks etc. and we did see some negative developments here.

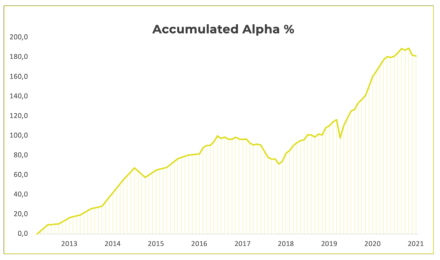

As we can see from the chart above, we have managed to deliver quite consistent alpha since inception. This is how we like to make our money. Not by running extreme leverage or risk on each side but to slowly outperform on each side. If we can do so, over time it will deliver high risk adjusted returns.

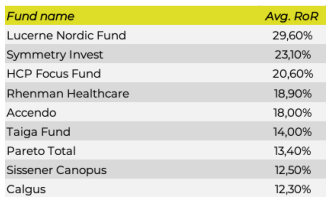

Short alpha

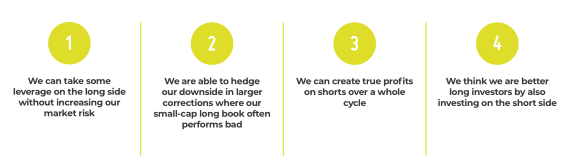

A question we often get is why at all do short-selling?

As we have explained a few times we have several reasons for that:

Below is our accumulated alpha on the short side:

Overall, we cannot be dissatisfied with our performance on the short side since inception. Most people that have tried this know how difficult it is to create alpha over time. We have achieved this in Symmetry. And we have done so without having longer periods with significant underperformance. But 2021 was not a good year for us. We were short some shitty companies that the market for some reason chose to mark up a lot. At the same time, we were too early in shorting the “stimulis-winners”. Timing is difficult, especially on the short side.

But with that said we are off to an amazing start in 2022 so far. In the first 2.5 months alone, we have earned back all the negative alpha from 2021 and more to it – thereby getting to a new ATH in accumulated short alpha.

At the same time, we have now managed to actually turn a profit on our shorts since inception. This over a 9-year bull market. Really few funds have done so. This is measured in total DKK. Measured in percentage returns we are still slightly negative but up for the challenge.

Like on our long side (commented under “all-weather”) we also try to be diversified on our shorts. We avoid “story stocks”, “meme-stocks” etc. We have also avoided all kinds of shorts that had a high short interest and been diligent on position sizing. Our shorts are mostly boring mid-caps with fundamentally bad business models that have for some reason gotten a temporary boost that will not last. Just because you put lipstick on a pig it’s still a pig.

Long alpha

Our alpha on the long side is more volatile. This is because we are more concentrated on the long side, we often invest in smaller companies that is less liquid etc. Stock prices then fluctuate more. At the same time, it’s only a few of our longs that’s included in some type of “index/ ETF” while it’s a bigger percentage of our shorts.

Overall, we are still pleased with our return on our long portfolio. While we have had periods where things were not going our way, we have managed to deliver great returns and alpha over time.

In 2021 we had our best year ever on the long side. Both absolutely and relative with a 57 % gross return or a 38 % alpha to the market. The contribution came from different stocks that outperformed the market and not from a few winners. Our 3 biggest positions in FranklinCovey, Protector Forsikring and JDC Group was among the best delivering close to 100 % each. What I am most proud about is that we kept our discipline throughout the year.

Especially in the first half of the year we managed to sell down some of our high growth stocks as they were close to fair value. Stocks like Kambi, Naked Wines and PAR Technology was names where we locked in some profits around their all-time highs. We then reinvested these proceeds into cheaper companies like JDC, Relesys and Epsilon. This not only helped us get good returns in 2021. That discipline also helped us avoid the huge drawdown most tech/growth investors have had in Q4 2021 and Q1 2022.

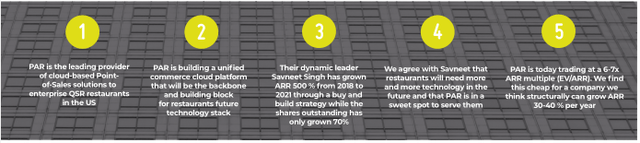

The market is often busy putting labels on investors. Are we a value investor, a growth investor, a tech investor etc.? At Symmetry, we prefer to not label our fund. We want to be flexible in our approach to the market. We liked to buy PAR Technology at $10-15 in March 2020 when most people thought restaurants would never open again. We sold most of our PAR in early 2021 at $70-90 as we thought 15-20x ARR was too expensive to achieve a satisfactory return from there. And we have been buying a lot again in early 2022 at 5x ARR. Are we growth investors when we are buying PAR? Or value investors when we sell PAR and buy Protector etc.? We do not think such a label is relevant. We just want to invest where we see the best long-term risk adjusted opportunities.

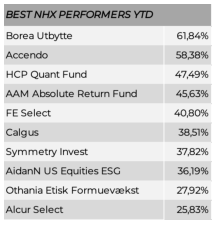

Performance benchmark

Hedgenordics database follows most of the Scandinavian hedge funds and have conducted performance reviews of each. As we mentioned last year we managed to come in at 4th place in 2019. In 2020 we achieved an 8th and in 2021 we improved that to a 7th. This is totally in line with our strategy. As we have mentioned several times we do not expect to come in at the top in a single year. But because we have been in top 10 (out of several hundreds) 3 years in a row our long-term returns look great.

This brings us to the most important measurement we do. Our overall returns since inception. Listed here you can see the best performing funds in Scandinavia with a minimum track record of 5 years at the end of 2021.

Symmetry is currently the second-best performing fund in Scandinavia. This return is delivered over a 9-year period since inception in 2013. The best performing fund Lucerne is from 2015. We hope to get above them over time. But there are also new funds starting up with some great ones that has not been running for 5 years yet that will be hard competitors. At Symmetry we don’t look at it as a hard sprint. We want to participate on the marathon and hope that by working hard we can achieve great results to our investors.

Portfolio

At the end of February 2022, the portfolio consisted of 13 individual names with a weighting above 3 % of our AUM. We introduce new investments in individual reports on an ongoing basis on our website: Nyheder – Symmetry.

The list below is sorted alphabetically and is not an illustration of what stocks is the biggest or largest in % of AUM.

As we have mentioned several times in these letters one of the strategies for Symmetry is to invest behind founders with a deep passion for their business. As can be seen on the previous page 4 of our 13 companies are still run by their founders today. In 7 out of 13 companies it is the “right-hand” or Protégé for the founder that is now the CEO. These are people that have been trained and grown inside the company under the founder before becoming the CEO. Only in the case of TPL and PAR it is “outsiders” that is running the companies. With TPL it’s because the company was founded in 1888 and those is a totally different company today. In the case of PAR, the company desperately needed an outsider that could execute a turn-around. Savneet has quickly started to develop his own strategy and culture and hiring great people around that.

“Wethinkthebiggestassetacompanycanhaveisitspeopleandthe culturetheyhave.”

When I started Symmetry, I did not have a big masterplan around investing in companies that was led by its founders. We don’t really have that today either. We have just experienced that it is these types of companies that we like the most. We think the biggest asset a company can have is its people and the culture they have. It is just much easier for us to do due diligence on that when the people have been there for many years. Also, we have experienced that the founders are better at allocating capital and focusing on long term goals compared to short term results.

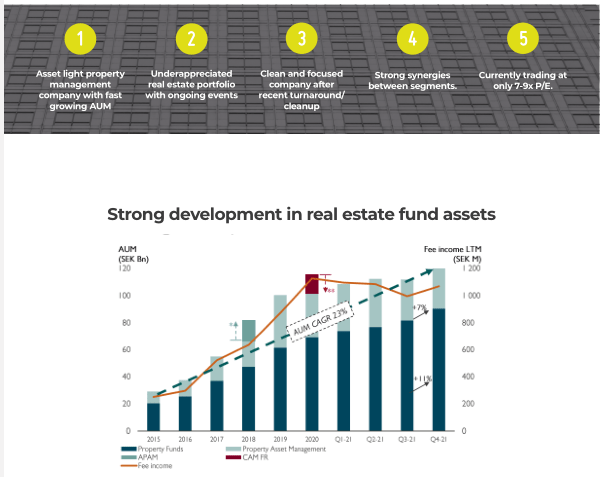

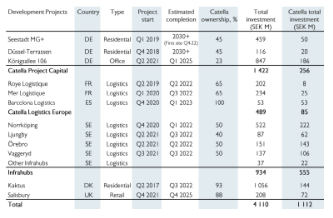

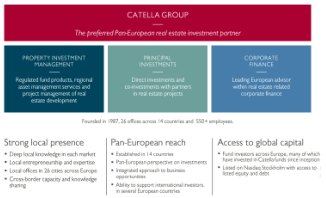

Investment case: Catella

Catella has delivered a yearly AUM CAGR of 23 % over the last 6 years. We do expect Catella to be able to achieve a double-digit AUM growth over the next many years. There is still a lot of demand for high quality real estate from pension funds, insurance companies etc. That is a structural trend that is benefiting Catella.

Catella principal investments have (in our opinion) huge upside to book value. In contrast to other real estate developers Catella does not take a huge risk in these projects. They often have partners that finance most of the projects while Catella achieves a bigger share of the projects in exchange for “doing the work”. At the same time principal investments is a great place to develop properties that they later can sell to their funds to grow AUM.

Catella has 3 different legs that diversify the income streams but have great synergies between them. The corporate finance segment is important to source new projects and to help PIM and PI with consulting services. PI can develop projects before they are finished and cash flow positive and then sell them to the funds when they start to produce cash flows and those increase AUM.

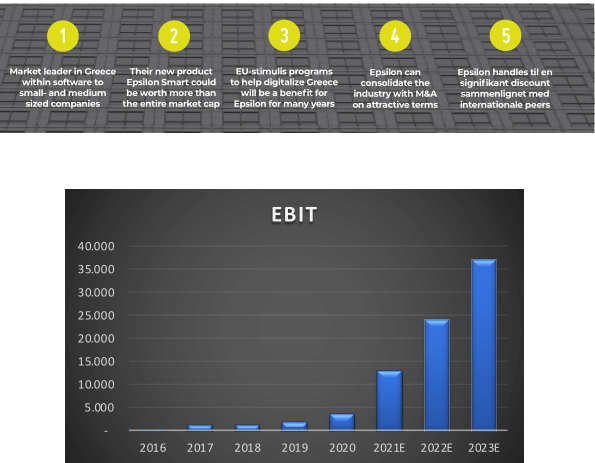

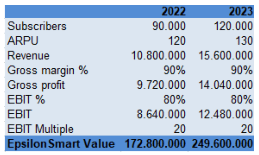

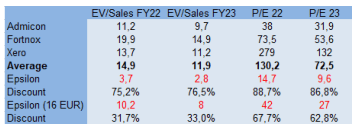

Investment case: Epsilon Net

Epsilon Net is an attractive growth story trading on cheap multiples. The earnings from Epsilon have been growing year after year. Something we expect to continue over the next years. This will create a lot of shareholder value.

We think their new product Epsilon Smart could be worth more than the entire market cap today. Because the big inflow of new subscribers happened in Q4 2021 it hasn’t fully been consolidated in the financials yet. We think the market will change its perception of Epsilon when the 2022 results start to reflect this.

Today Epsilon only trades at 3x revenue and 10x earnings. This is a discount of 70-90 % compared to international peers (500% upside). Even if the stock was to rise 200 % to our 16 EUR target it would still be a 50 % discount to peers.

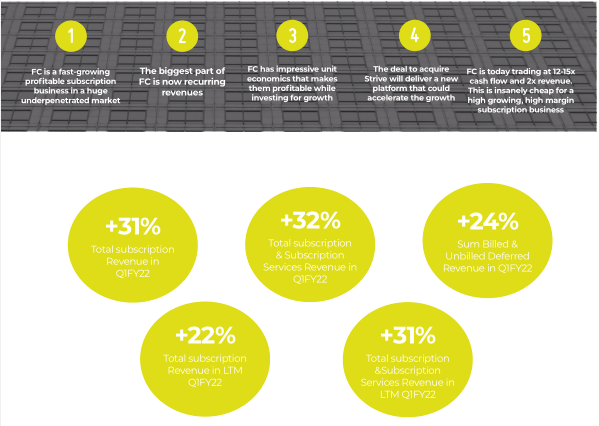

Investment case: FranklinCovey

FranklinCovey started the new year on a strong path with revenue growth of 27 % and 31 % in the subscription business. EBITDA grew 170 % YoY. FC will in FY22 roll out the new Strive platform that has the potential to increase ARPU, Retention and LTV – improving the already good unit economics.

FranklinCovey has been through a transformation from an Ad-hoc training business to a high-margin subscription business. FC is now on the other side of that transformation. These have in our opinion created a compounding story that will last for years.

Why is it that FranklinCovey in contrast to many other subscription businesses can grow fast and be profitable while doing so? The answer is in their unit economics. They have 90-100 % revenue retention. When you combine that with a high first order, the payback time is short and LTV high on each customer. At the same time, they have a lot of multi-year contracts. This gives the client partners/sales force the ability to focus more on new logos than retention.

FC is a company with superior unit economics. And still, it trades at 2x revenue and 15x cash flow. We can imagine this will change over time.

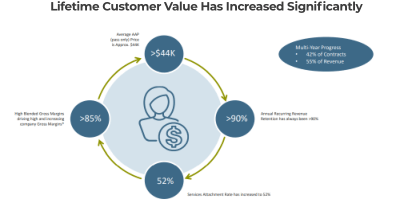

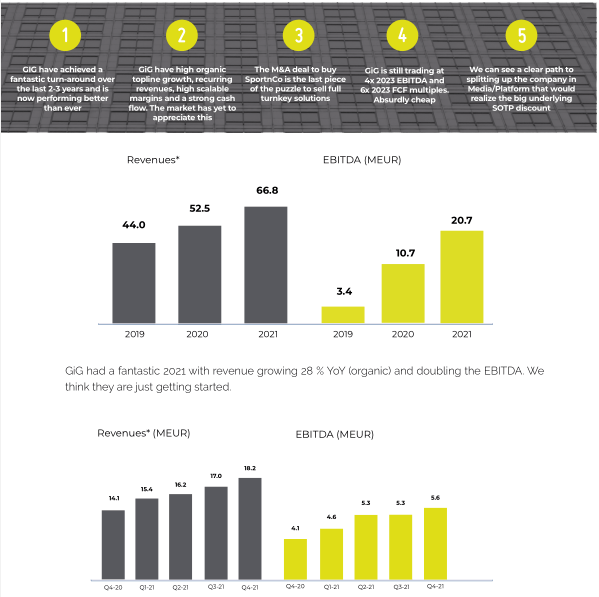

Investment case: Gaming Innovation Group

GiG had a fantastic 2021 with revenue growing 28 % YoY (organic) and doubling the EBITDA. We think they are just getting started.

An important piece of the puzzle was the deal to buy SportnCo that secures them with a strong Sportsbook platform and is finalizing their tech stack. As can be seen above GiG (dark blue) and SportnCo (light blue) do not have a lot of overlapping technology but supplement each other. At this time both are licensed in 25 countries with only a few overlaps that will save a lot of money in the future.

We think the current valuation is way too low. In 2023 when SportnCo is fully consolidated we think EBITDA will be in the 45-50 EUR range with a free cash flow of around 40 million EUR. The enterprise value today is around 250 or 6-7 forward free cash flow. This is for an asset light business that is growing topline +20 % YoY mainly with recurring revenues.

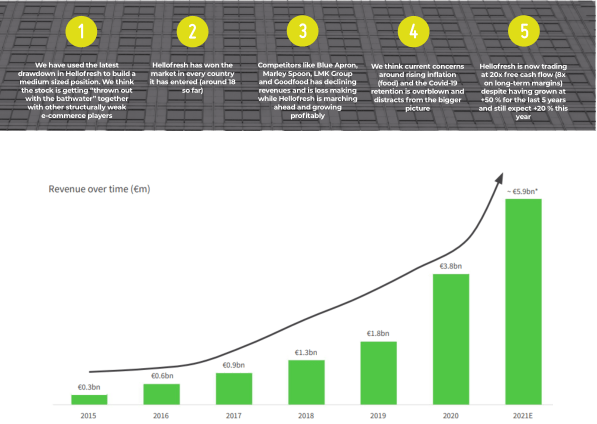

Investment case: HelloFresh

Hellofresh have managed to grow revenue 20x (from 0,3 to 6,0 billion EUR) in just 6 years. They have achieved this while going from cash burning to profitable and is now doing share buybacks. Even though the business got a Covid boost it was a structural grower before Covid.

Hellofresh manage to open up in new markets and constantly take market share from competitors in existing markets. Even if meal kits will only growth 5-15 % per year from here we see big upside in “ready-to-heat” meals, breakfast, supplemented groceries from Hellofresh market etc. This will improve AOV and basket size and thereby improve unit economics and margins.

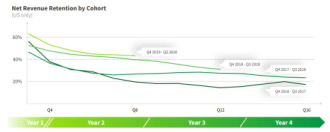

Because Hellofresh is a subscription-based E-commerce business (like Naked Wines) it falls in between chairs. Analysts that cover subscription businesses think retention is too low and analysts who cover eCommerce don’t understand the subscription part.

In our world we can see the irony that people doubt the unit economics of a fast-growing company that is cash flow positive and doing buybacks while having no problem doubting them in heavily loss making SaaS-companies.

We think Hellofresh is a category leader with a great business model and management team that is trading at cheap multiples.

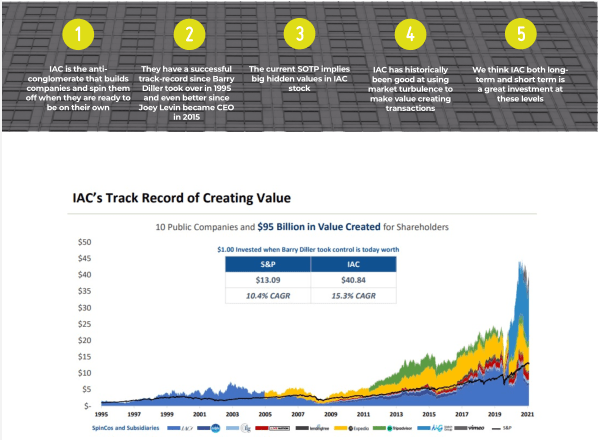

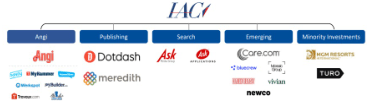

Investment case: IAC

Only a few people have heard about InteractiveCorp/IAC. IAC is about building scalable online businesses and do a “spin-off” when they are ready to be on their own. Even though people don’t know IAC most people know many of the spin-off’s including Match Group (Tinder), LendingTree, Expedia and Tripadvisor.

If you had bought 100 $ worth of IAC in 1995 and kept all spin-offs the value at the end of 2021 would have been 4.000 $ or +15 % compounded annually. That is comparable to 1.300 $ or 10 % for the S&P. The track record since 2015 when Joey Levin became CEO is even stronger.

The biggest asset today comes from the world’s biggest digital publishing house Dotdash/Meredith and ownership stakes in Angi, MGM, Turo (pending IPO). They also have a cash cow in Ask Media Group and early-stage venture cases like care.com, Vivian and Bluecrew etc.

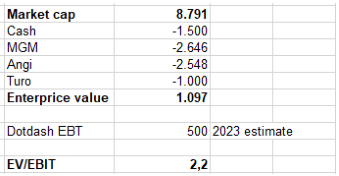

When we look at a SOTP of IAC today the enterprise value is around $1 billion This is around 2x EBIT for Dotdash/Meredith in 2023. And then you get Ask Media Group (+100 million in yearly profits) care.com (leading marketplace for care in USA) and a lot of other venture bets for free.

At the same time, we see more upside than downside in Angi, MGM and Turo at these levels. The cash position has historically been allocated at high incremental ROI.

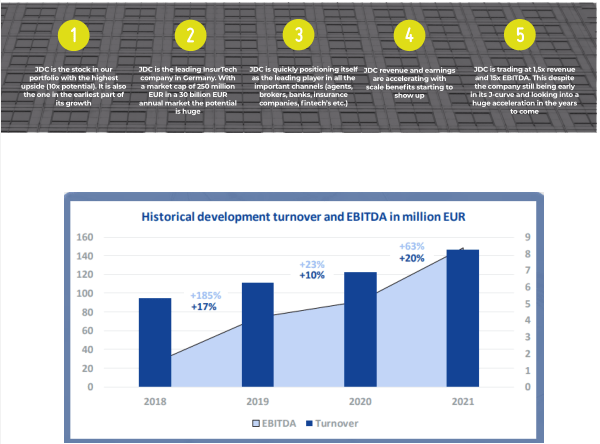

Investment case: JDC Group

JDC had a fantastic 2021 with revenue growing +20 % YoY and EBITDA growing 63 % YoY. At the same time JDC is guiding for 17 % revenue growth in 2022 and minimum 35 % EBITDA growth. From 2023 they guide for +20 % revenue growth with rising margins.

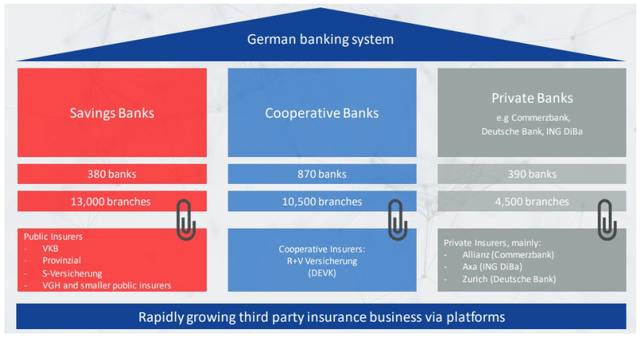

JDC is winning the market because they have the best technology. They aggregate data from more than 200 insurance companies. They process, structure, analyze and visualize these data in App’s and through smart API’s that is used by brokers, agents, fintech’s, banks etc. By facilitating the data and payments between insurance companies and the sales channels JDC takes a “cut” of all the payments.

JDC revenue is growing and recurring in nature because they take a yearly cut of the rising premiums on the contracts on their platform.

Recently JDC have established themselves as the provider of insurance solutions to German savings banks. They will roll this out during 2022 and 2023. At the same time, they landed a pilot project with R+V with cooperative banks.

JDC has a marmarket cap 250 million EUR. We would not be surprised to see that above 1 billion EUR within a few years and above 2.5 billion EUR in 5-10 years.

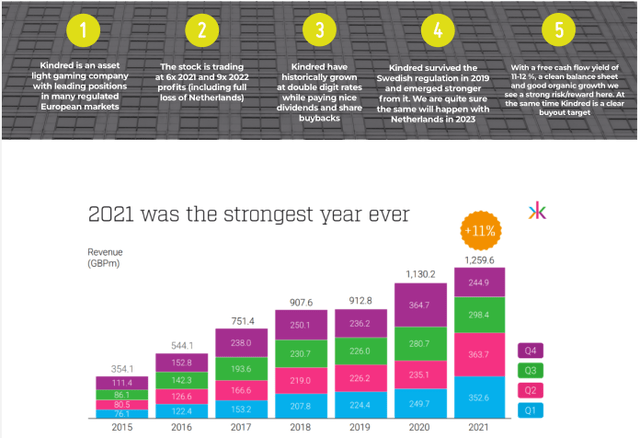

Investment case: Kindred

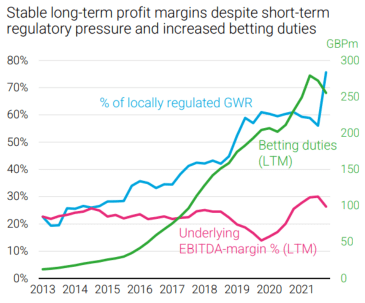

Kindred had a strong 2021 with the best numbers in the history of the company. This despite a bad Q4 that was influenced by the removal of the Dutch market and low sportsbook margins. Kindred has over the last 10 years shown that they are one of the strongest players in regulated markets in Europe. We think investors should see through short-term regulatory headwinds and focus on the bigger picture. In 2019 Kindred was influenced by the Swedish regulation (and tighter UK regulation). But the year after they absorbed this and emerged stronger.

In 2022 Kindred will be influenced by the removal of the Dutch market. They left in Q4 2021 and expect to get a license in the summer of 2021. But as they have to pay taxes in Netherlands and invest more in marketing, we should only see the positive effects again in 2023. Netherlands was also the last big piece of regulation that needed to happen. Now they are +80 % of the revenue from regulated markets. Historically regulation has delivered a short-term drop in EBITDA margins but over time they have come back to +20 %.

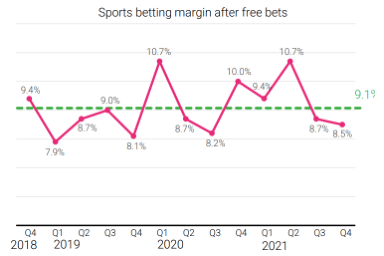

Another factor that influenced Q4 2021 negatively was a low sportsbook margin. It is important to remember that this fluctuates from quarter to quarter but is stable around 9 % over time.

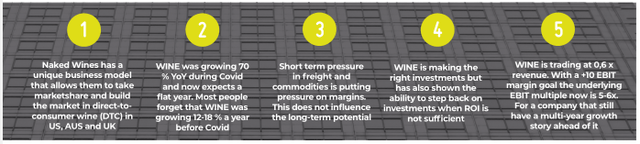

Investment case: Naked Wines

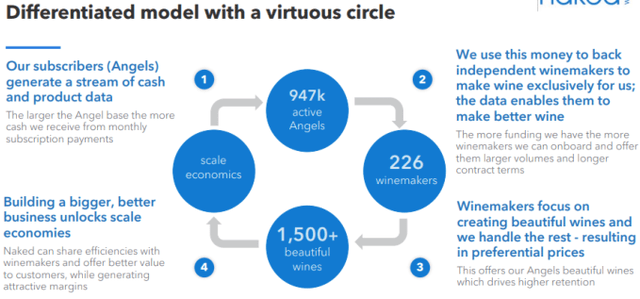

Naked Wines has a business model that is a win-win for both Angels (wine-drinkers) and the suppliers (wine-growers). Most wine-drinkers just want some good “value-for-money” wine and the ability to buy it in a nice interactive interface where they can communicate with each other and the producers. The producers do not want to spend time on marketing, distribution and administration. They want to concentrate on making the wine and communicate with the customers.

Nakeds model has scale advantages, that again creates barriers to entry for new players. The more Angels WINE has the more producers they can fund. This helps with a broadening inventory on the platform and gives them a scale advantage in data and logistics.

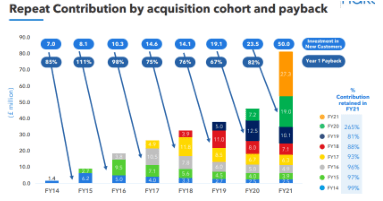

Naked Wines is a data-driven company. The goal is not to optimize for short-term earnings but to create most long-term shareholder value. This is done by building cohorts of loyal angels that buys wine month after month and year after year repeatedly.

We are convinced that the market will soon see through the short-term struggles that WINE has (hard comparison and logistic issues) and instead look at the long-term potential.

Investment case: Par Technology

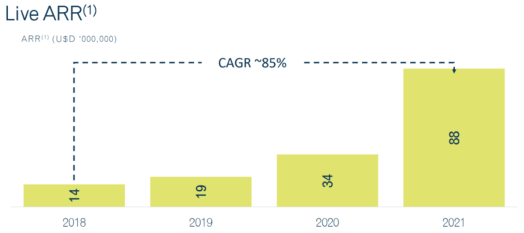

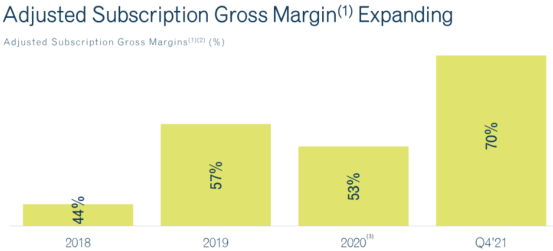

ARR has grown 85 % per year because of high organic growth and strategic M&A.

At the same time PAR has improved its gross profit margins a lot to +70 %. A margin they expect to keep improving in the future.

The investment case for PAR is that restaurants will need more and more technology in the future (POS, Loyalty, Payment, Delivery etc.) and that PAR has a good position as the leading enterprise POS provider to capture and win that market.

With a good balance sheet (+ ability to sell government units) PAR has the muscles and flexibility to continue building and buying the blocks to create a true unified tech stack that restaurants desperately need.

We are full of confident that Savneet is the man to deliver on that.

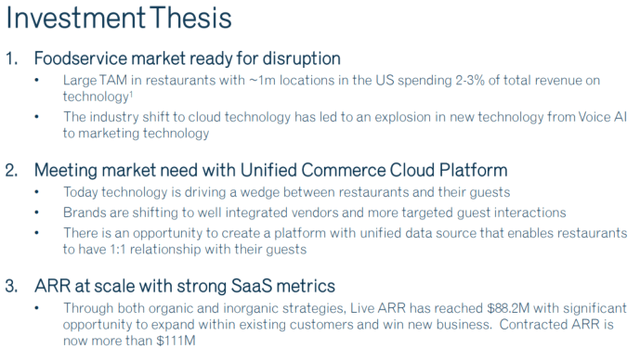

Investment case: Protector Forsikring

Protector has grown the premium volume with 18 % yearly for 13 years. Together with dividends and share buybacks they have delivered a +20 % shareholder return for the same period.

Despite that track record you can still buy Protector at a single digit earnings multiple today.

The winning culture of Protector has given them sustainable lower costs than competitors. Protector use this cost advantage to share them with policyholders and thereby improving growth rates without sacrificing profitability.

In the best Berkshire Hathaway style Protector understands that float can give improved investment returns that will deliver best-in-class shareholder returns. Here we are lucky that Protector’s portfolio is managed by Dag Marius Nereng. He is an outstanding CIO that has outperformed the market (on both stocks and bonds) by a wide margin.

We are convinced that Henrik (CEO), Hans (Deputy-CEO) and Dag Marius (CIO) together with the rest of the Protector team will keep delivering extraordinary shareholder returns for years to come.

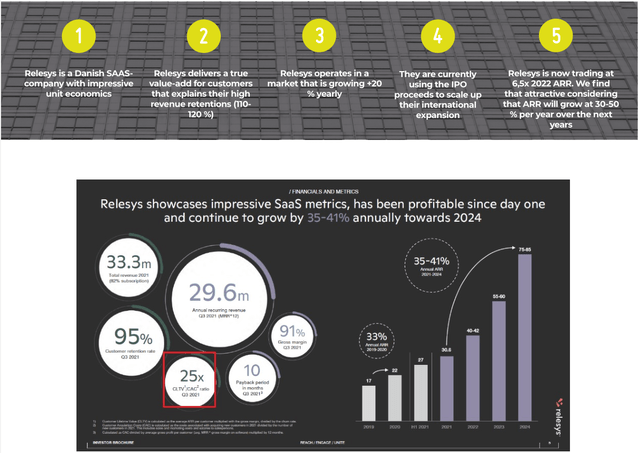

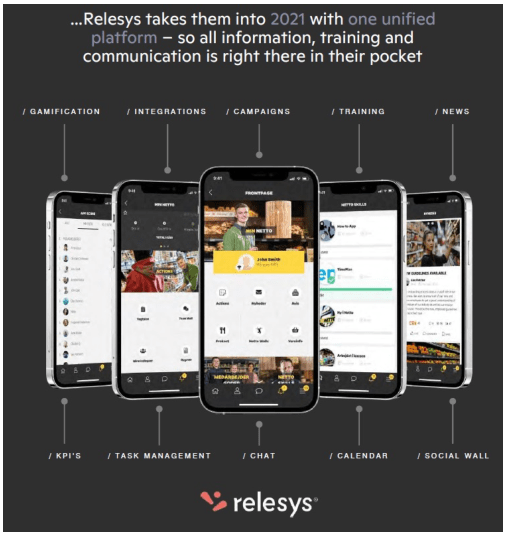

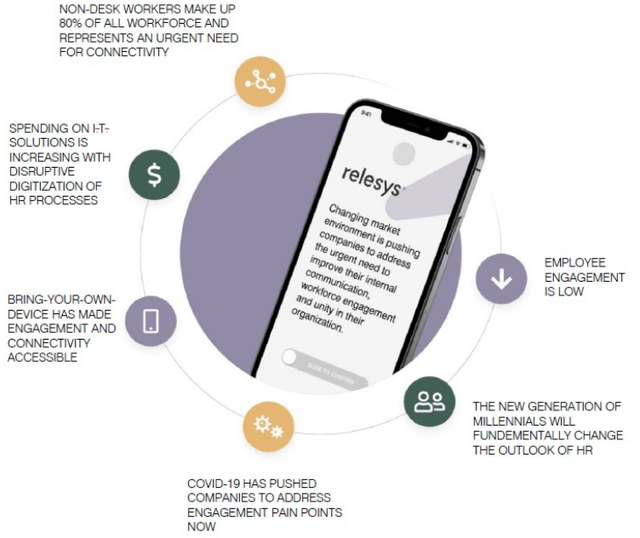

Investment case: Relesys

Relesys has historically grown the ARR with 30-40 % per year while being profitable. This also means they didn’t have to raise capital before. They have been funding the growth internally so far with impressive unit economics. With an LTV/CAC of 25x and payback time of only 10 months they had the ability to grow without sacrificing the profits.

Relesys understood they could grow faster than the 30-40 % per year and with more investments in the business. They then decided to IPO in December 2021 to raise 70 million DKK to fund the growth plan.

The product is hitting a lot of super trends at the moment. They basically help companies with a white-label app where they can engage frontline or non-desktop workers. The app is gamified which makes it interactive and fun. The result is that companies have seen +80 % of the employees use the app in their spare time (think about ROI here with a 1-2 EUR per month cost)

Relesys have big success on the Danish home-market and have seen early success in both Sweden and Netherlands. They now decided to accelerate the growth and move into both UK in 2022 and US in 2023.

We are comfortable that the two founders Jesper and Jens-Ole with their great team can create a growth story with great shareholder returns.

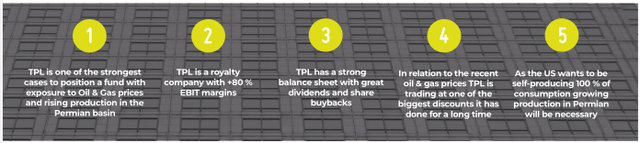

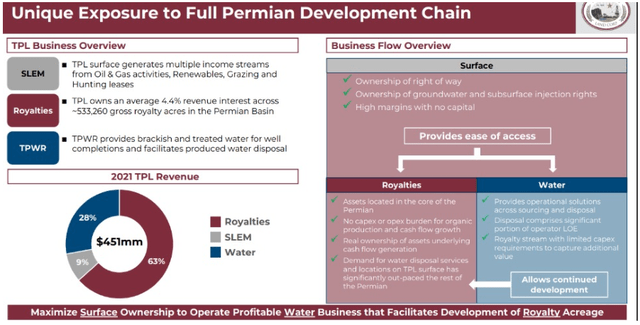

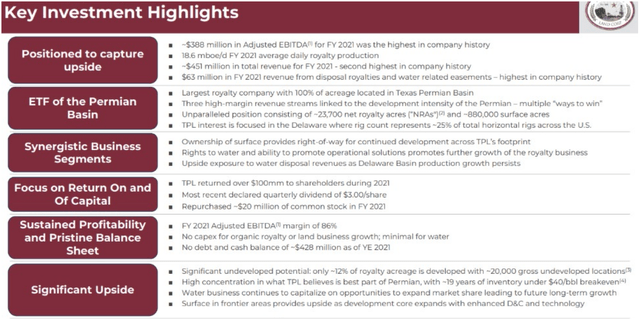

Investment case: Texas Pacific Landcorp

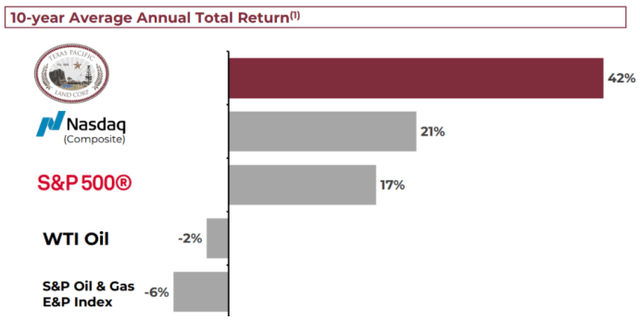

Only a few people know TPL. But actually, it has been one of the best performing stocks over the last 10 years with a +40 % shareholder CAGR.

TPL owns 500.000 acres of land around the Permian basin in Texas. The primary source of income is from royalties from Oil & Gas companies that have production on their land. On top of that they have related revenue streams like delivery and removal of water (used in fracking) and leasing of terminals for storage and land for solar power and windmills.

TPL is a multi-year growth story that we think can compound for many years. The fact that the US wants to be self-producing with all oil & gas will create a lot of demand for further exploration and production in the Permian basin where TPL controls a lot of the land. We expect increasing production for many years with rising prices that will deliver fast-growing royalty income to TPL.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment