bluebay2014/iStock via Getty Images

Situation Overview

The equity of Altice USA (NYSE:ATUS) is down over 50% YTD and ~80% from its peak in May 2021. The drivers behind this drastic move are twofold. Fundamentally, the entire cable industry is facing increased competition from fiber-to-the-home (FTTH) and fixed wireless access (FWA). FTTH is a technically superior product compared to cable. FWA competes well on price and ease of installation. Specific to Altice, a period of cost-cutting and underinvestment in its infrastructure put it in a weaker competitive position, resulting in net subscriber losses recently. To combat competition, Altice decided to reinvent itself by overbuilding its own network with fiber, which is going to take FCF away from share buyback until 2025 when the fiber buildout is expected to be completed. Combined with a levered balance sheet, it’s not difficult to understand why Altice will be in the penalty box for the foreseeable future.

Thesis

The underlying assumption is that Altice should re-rate higher as the fiber buildout target is reached by 2025, and so investors can take advantage by adopting a PE-style approach. This becomes a simple math exercise: the entry multiple is roughly 7.5-8.0x and fiber assets are going for mid-to-high teens, and there is an opportunity to earn an attractive IRR north of 20%.

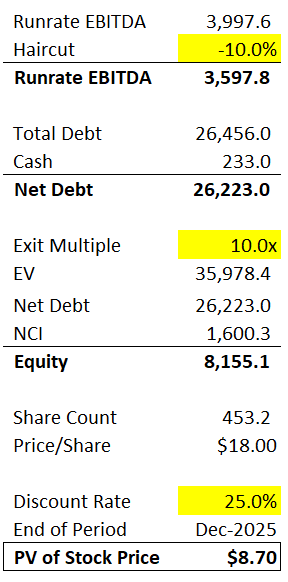

For illustration purpose, I took a 10% haircut to the run-rate EBITDA and assumed a 10.0x exit multiple. Since there is a time component, I discounted the implied share price at 10.0x multiple back to the present at a 25% discount rate, giving me $8.70/share, which is just slightly higher than where the stock is trading. In other words, subject to assumptions, Altice’s equity value could growth by 25% to the end of 2025. At 12.0x exit multiple, a 50% IRR translates to a $9.00/share stock price.

Author’s Estimate

Risks

The valuation risk stems from either a lower EBITDA and/or lower exit multiple. On the EBITDA front, Altice is spending some capital to ramp up on customer service and salesforce, which I believe should at least stabilize the current EBITDA level. Also, there is already some conservatism built in with the 10% haircut, which is roughly 85% of the 2019 level. On the multiple front, this is entirely subjective, but I feel like a +40% margin business with futureproof’ed technology (i.e., fiber) and mostly duopoly market structure deserves a double-digit multiple.

The execution risk is if the fiber buildout is over-budget and/or the timeline gets extended. Given the inflationary pressure and labor shortage, this is a primary risk investors need to underwrite. It seems like Altice is on track for the 2.5 million FY2022 target. I also take a little bit of comfort in that other parts of the Altice empire have completed fiber buildouts in the past, so there should be some institutional knowledge either on the know-how and/or sourcing of material side. Lastly, a recession could ease the inflationary pressure and the labor shortage issue.

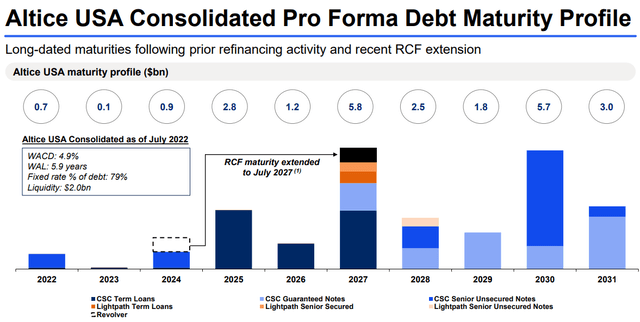

Altice is levered ~6.5x, so there’s plenty of financial risk. Thanks to the FCF profile of the base business, Altice should be able to internally fund the buildout plan. Also, Altice doesn’t have much major maturity wall until 2025.

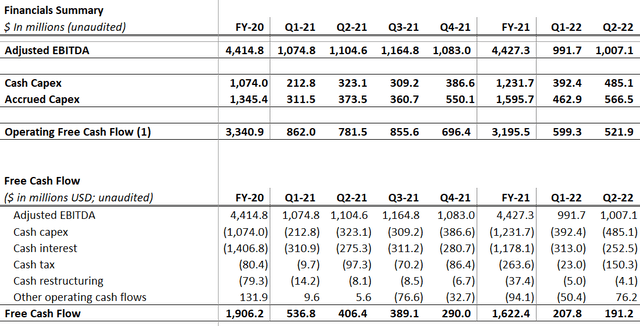

Investor Relation Website IR Presentation

Other Catalysts

Altice confirmed that there are interests for its Suddenlink footprint. One near-term catalyst could be a sale of the Suddenlink asset, and apply the proceeds to a combination of deleveraging, accelerated fiber buildout and/or share buyback. While the rumored $20 billion ask for Suddenlink seems unrealistic, any deleveraging transaction should be welcomed by the equity market. Subsequent to a hypothetical Suddenlink sale, the standalone original Optimum footprint could be sold as well, effectively liquidating Altice USA and ending Patrick Drahi’s US cable rollup aspiration.

Conclusion

Overall, I view Altice as a semi-deep value and semi-turnaround situation. Altice is cheap for a reason (but too cheap for what’s there), but the company is creating its own catalyst by becoming a fiber company. Altice also has the FCF and an accommodative debt maturity schedule to allow for the turnaround to happen. The strategy itself is not a tall order – fiber is the better product, both in terms of customer experience and technical maintenance. Patient investors who are willing to pretend to invest in a private company will be rewarded.

Be the first to comment