canakat

Introduction

After the unit price of Energy Transfer (NYSE:ET) posted a very strong 40%+ rally year-to-date leading up to early June, much of this quickly evaporated as they were caught in the broad energy sector sell-off over recession fears. Whilst not ideal for the wealth of their existing unitholders, now that their unit price is seemingly stabilizing, it presents investors with an amazing deal whereby they can pay nothing for their upcoming distribution growth and as a result, generate significant alpha.

Background

Despite initially fighting to sustain their distributions during the onslaught of the Covid-19 pandemic in early 2020, they ultimately relented later in the year and halved their distributions to help shore up their balance sheet, much to the disappointment of income investors. Thankfully 2021 saw a strong recovery that few expected beforehand and as a result, when entering 2022 their top priority swung around from the balance sheet to reinstating their previous distributions, as per the commentary from management included below.

“So if you really look at this, returning to the — at least the $1.22 that we talked — that we had previously, back before we had reduced the distributions, that is moved up to a top priority, but we clearly have these great projects we’re talking about, likewise, these capital projects, then you blend in the debt paydown likewise. Unit buybacks, I would probably put as behind those 3.”

– Energy Transfer Q4 2021 Conference Call.

Thankfully thus far into 2022, these have not just been merely words with management already providing two consecutive distribution increases in the lead-up to the release of their last two quarterly results. Whilst their current quarterly distribution of $0.20 per unit remains significantly below its previous level of $0.305 per unit, thankfully they have ample free cash flow to execute their goal.

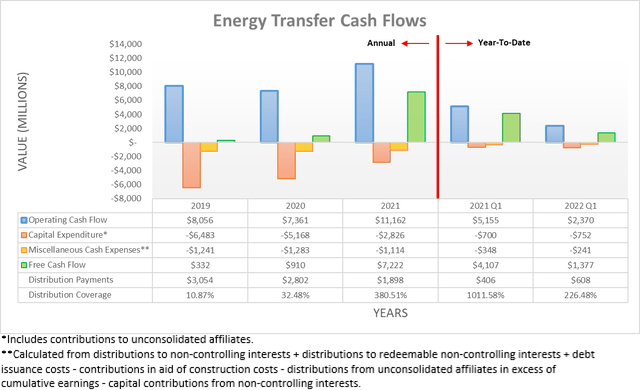

Since they routinely declare their distribution attributable to the second quarter within the last ten days of July, we are now literally days away from seeing where it lands this time and given their ample free cash flow, it makes further growth a very high probability. Whilst on the surface, their cash flow performance during the first quarter of 2022 appears terrible with their operating cash flow of $2.37b less than half year-on-year versus their previous result of $5.155b during the first quarter of 2021, this was due to the start of 2021 seeing a massive one-off boost from the freak Texas Winter storm dubbed Uri, thereby skewing this comparison.

If looking elsewhere within their financial performance to make judgments, thankfully they have significantly increased their guidance for 2022 to now see adjusted EBITDA of $12.4b at the midpoint and thus barely down only a minimal circa 5% year-on-year versus their storm-boosted previous result of $13b during 2021. Since their cash flow performance broadly follows in tandem given their positive correlations, their underlying operating cash flow during 2021 of $10.647b that excludes temporary working capital movements should see a similar magnitude change for 2022, thereby leaving an estimated operating cash flow of circa $10b.

They forecast growth capital expenditure of $1.95b at the midpoint for 2022, which should make for a total capital expenditure of circa $2.55b given their usual maintenance capital expenditure of circa $600m seen during 2021, as per their first quarter of 2022 results presentation. Once subtracted from their estimated operating cash flow, this leaves estimated free cash flow of circa $7.45b and thus ample to fund higher distributions. Given their latest outstanding unit count of 3,085,533,650, it would cost $3.764b per annum to reinstate their distributions to their previous annual level of $1.22 per unit and thus merely half of their estimated free cash flow, thereby leaving a margin of safety to further deleverage. If interested in further details regarding their cash flow performance or their financial position, please refer to my earlier article, which focuses on these topics, whereas the focus today rests upon their current valuation and the amazing opportunity that I feel it presents investors.

Discounted Cash Flow Valuations

Despite their prospects to rapidly grow their distributions in the short-term as they work towards reinstating them back to their previous glory, they are still a mature partnership that faces low growth in the long-term as they already dominate the United States midstream industry. This means that their intrinsic value is heavily dependent upon the future income they can provide their unitholders, and thus can be estimated by utilizing discounted cash flow valuations that replace their free cash flow with their distribution payments. If interested, further details regarding the inputs utilized for these valuations can be found in the relevant subsequent section.

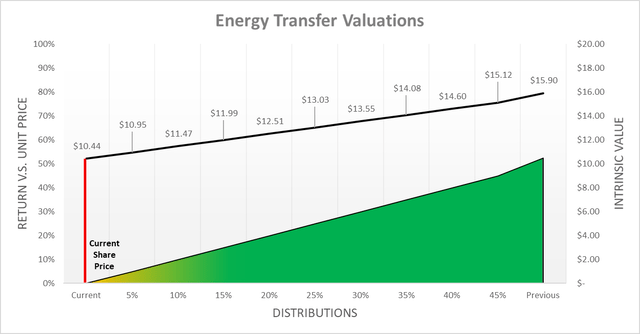

When approaching valuations, there are numerous ways thanks to the infinite number of imaginable future scenarios, although following their outlook for distribution growth, accordingly, these should center around the extent of their future growth, as the probability of a reduction is negligible. In my view, a bearish scenario would see their quarterly distributions completely frozen at their current level of $0.80 per unit and thus see zero growth perpetually into the future. Conversely, a bullish scenario that is comparable would see their quarterly distributions reinstated to their previous level of $0.305 per unit, representing growth of 52.50% versus their current distributions, before then remaining unchanged perpetually into the future. Meanwhile, the remaining scenarios that reside in between this range see distribution growth at various levels of growth with 5% intervals to represent a range of middle-of-the-road scenarios, all of which similarly carry zero growth subsequently into the future.

After reviewing the results, they show that their current unit price of $10.43 is essentially right on the intrinsic value of $10.44 for the bearish zero growth scenario, literally a mere penny difference. To phrase this another way, this means that their current unit price only reflects the value of their current distributions and thus by extension, investors can buy now and pay nothing for their upcoming distribution growth, which in my eyes, makes for an amazing deal given the very high probability of seeing further distribution growth as soon as later this month.

Following this outlook and the previous discussion surrounding their cash flow performance, I feel the bullish scenario whereby their previous distributions are reinstated is far more likely than their bearish scenario, which produces an intrinsic value of $15.90. This is a very impressive 52% higher and thus would see investors generating significant alpha with a strong margin of safety given their solid fundamentals and the current valuation that reduces downside risk by seemingly ignoring their upcoming distribution growth. By providing a variety of results, readers can cross-reference their own views with these valuations as they may vary from my own.

Whilst their distributions are not necessarily going to experience a one-off increase before remaining unchanged during the subsequent years, two considerations should be remembered. Firstly, they are a mature partnership and thus their medium to long-term earnings growth should be fairly minimal and, thereby, the same should apply to their distributions once they have reversed their distribution reduction of 2020. Secondarily, no one can see the future, and thus in my eyes, it would be pointless to attempt to create a range of scenarios guessing their exact distribution growth each year, as this would ultimately prove no more accurate. In my mind, a very desirable investment is one whereby their units are still attractive under a range of scenarios with minimal downside risk from even a bearish scenario, as seen this time.

Valuation Inputs

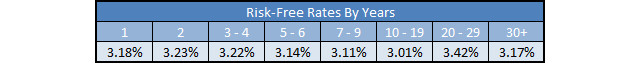

When conducting these discounted cash flow valuations, they utilized a cost of equity as determined by the Capital Asset Pricing Model. The inputs were a Beta of 1.04 (as per Barron’s), an expected market return of 7.50% and risk-free rates per year that track the United States Treasury yield curve on July 19th, 2022, as the table included below displays.

Author

Conclusion

When it comes to investing, there is never a “sure thing” but the odds can be stacked in our favor by carefully selecting investments. Such as this situation, where their units are still seemingly only priced for zero distribution growth, despite the very high probability of seeing upwards of 50%+ growth as their previous distributions are reinstated in the coming year. Since this presents an amazing deal whereby investors can pay nothing for their upcoming distribution growth, it should not be surprising that I continue to believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Energy Transfer’s SEC filings, all calculated figures were performed by the author.

Be the first to comment