Mario Tama

Fisker (NYSE:FSR) is definitely an EV stock to watch moving forward as the company prepares to start producing its flagship EV, the Fisker Ocean, in November 2022.

Since Fisker currently generates zero revenue, I’ve found it hard to invest in the company over other electric car stocks such as Lucid Group (LCID) or Tesla (TSLA).

Will Fisker get it right the 2nd time around after the company failed several years ago under poor management decisions?

In this article, I’ll discuss the upcoming Fisker Ocean launch and list several reasons why I may consider investing in the company.

Fisker Ocean SUV Launch Update

Fisker sold out its first 5,000 Fisker Ocean One limited edition vehicles and received $5,000 down-payments from each customer.

Fisker Ocean SUV (fiskerinc.com)

These orders represent $350 million in potential revenue once all vehicles are delivered.

The company plans to start producing the Fisker Ocean on November 17th, 2022, which is just around 2 months from now.

The Fisker Ocean is set to start at $37,499 for the base Ocean Sport trim, the middle-trim Ocean Ultra starts at $49,999 while the more premium Ocean Extreme starts at $68,889.

Fisker has 58,000 reservations as of August 2022 with a projected 80,000 reservations by the end of the year.

Demand is so high that the company may expand its 50,000 annual production goal to keep up with demand.

This shouldn’t be a huge issue due to the fact that Fisker outsources 100% of its EV production and focuses on design and marketing.

Fisher has around $850 million in cash on hand to fund production of its initial 5,000 preorders through the rest of the year.

Fisker’s Future EV Pipeline

Fisker already has 2 additional EVs planned for production through partnerships with affiliates such as Foxconn: The Fisker PEAR and Project Ronin.

The Fisker PEAR will start at a base price of under $30,000 and start production in 2024 Foxconn’s newly acquired 6.2 million square foot facility in Ohio.

Fisker’s third vehicle, Project Ronin, will be unveiled in the summer of 2023.

Fisker is not only aggressively scaling the Fisker Ocean SUV, but already has 2 other EVs in the pipeline.

This could make a major dent in the EV industry and place a lot of attention on Fisker.

Competitors such as Tesla, Lucid, and Rivian already have a head start in the EV industry but we don’t know exactly how consumers will respond to the Fisker Ocean.

58,000 reservations is a great sign but I don’t believe these future Fisker models are currently priced into the stock.

I think investors are worried about future share dilution since both Tesla and Lucid offered stock during their early growth phases.

Focus on Deliveries Not Hype

Fisker makes a lot of promises but I’m not sure the company will be able to deliver on them.

FY 2022 capital expenditures are projected to be around $290 million and the company lost $106 million in Q2 alone.

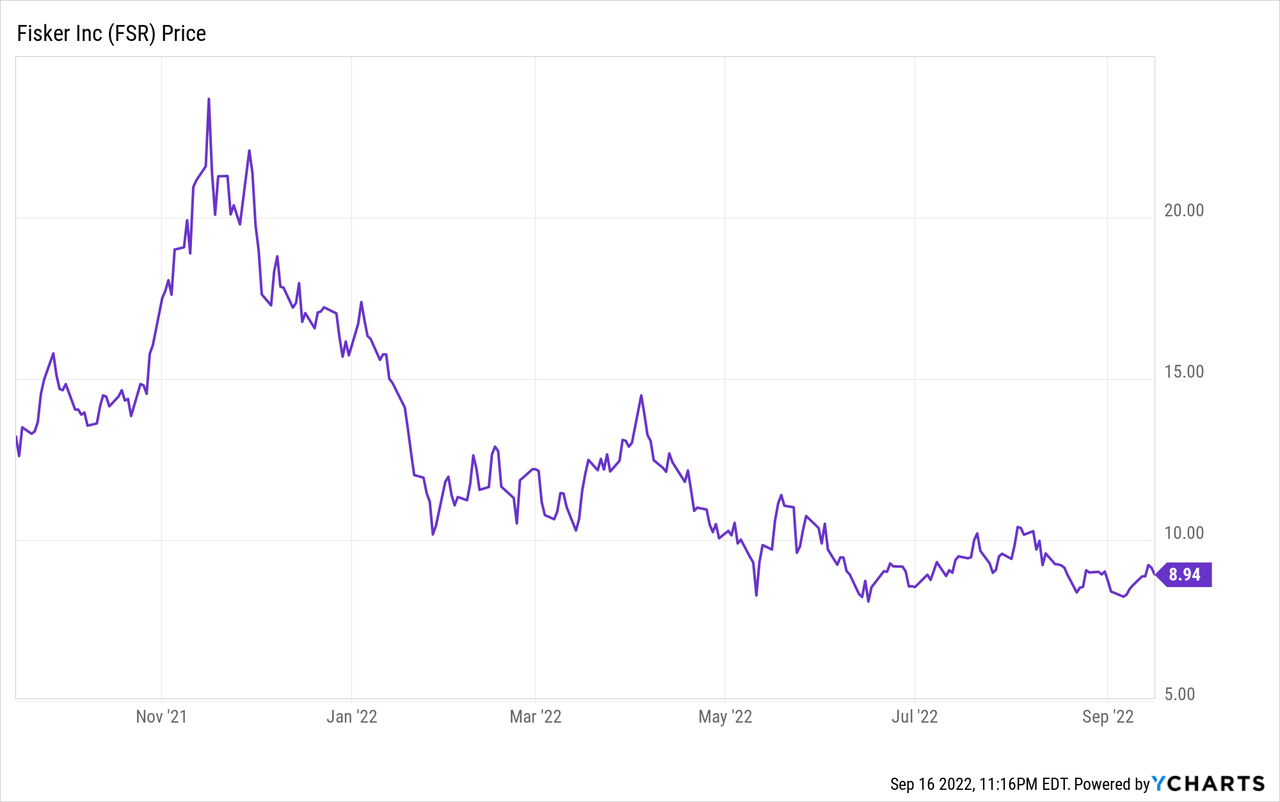

I’m afraid dilution may be the only way to expand production for the Fisker Ocean SUV yet FSR stock is already trading at just $9.

I mentioned in my previous Lucid article that it diluted its stock with an $8 billion offering but LCID’s initial SPAC demand was so high that CCIV was priced at $15 initially.

The market responded pretty well to the $8 billion dilution news and LCID shares are now trading over $16.

Fisker dilution could send FSR shares much lower because the company has a lot less cash on hand than Lucid Motors does.

I love Henrik Fisker’s passion but there is too much excitement right now when Fisker hasn’t delivered a single vehicle yet.

Risk Factors

Fisker is a risky bet on a company that hasn’t delivered on its promises.

I fear several headwinds could send the stock much lower:

- Management fails to deliver its 5,000 Ocean SUVs in a timely fashion while other competitors are gaining market share.

- Fisker must dilute shareholders with a stock offering to raise cash, which could send FSR stock heading towards $5 or lower.

- Supply chain issues cause a slowdown in production via Magna.

- Tesla and Lucid both build their own production factories to control the entire process from design to final product. How will Fisker’s unorthodox decision to outsource production affect the quality of its vehicles?

Fisker is making a bold move by outsourcing its EV production and it could cause the company a lot of future problems.

If Fisker’s initial deliveries have recalls or defects then the company will need to rethink production in the future. That’s my only concern with Fisker at the moment.

Conclusion

I’m rooting for Henrik Fisker. Here’s a guy that launched an EV company around the same time as Tesla but didn’t last long enough to make a lasting impact.

I don’t know how Fisker’s unique business model of asset-light EV production will perform in the long run. Lucid Motors is obsessed with quality and personally tests each and every vehicle before deliveries are made.

It’s obvious that recalls and quality issues may be a problem for Fisker due to its hands-off approach.

I’ll need to see some strong delivery numbers and glowing customer testimonials before I think about investing in FSR stock.

Be the first to comment