Scott Olson/Getty Images News

Investment thesis

I am after finding new positions to enrich and strengthen my dividend growth portfolio. I look for very profitable companies that have somewhat of a moat. In this article, I will share my research on The Hershey Company (NYSE:HSY), a chocolate champion known by almost everybody. I will show why I really like the company and why I am considering adding it to my portfolio.

The company

The Hershey Company is the largest producer of quality chocolate in North America, it is one of the leading snack makers in the United States and a global leader in chocolate and non-chocolate confectionery. It owns more than 100 brand names in approximately 80 countries.

The company usually reported its operations through two segments: North America and International and Other. However, at the end of last year, the company completed the acquisitions of Dot’s Pretzels, LLC and Pretzels Inc., and the management of the company chose to begin reporting its operations through three reportable segments: North America Confectionery, North America Salty Snacks and International.

Among its principal product offerings include chocolate and non-chocolate confectionery products; gum and mint refreshment products and protein bars; snack items such as popcorn, pretzels, spreads, snack bites and mixes; and pantry items, such as baking ingredients, toppings and beverages.

The company sells its products mainly to wholesale distributors, chain grocery stores, mass merchandisers, chain drug stores, vending companies, wholesale clubs, convenience stores, dollar stores, concessionaires and department stores. These customers then resell Hershey’s products to end-consumers in retail outlets in North America and other locations worldwide.

As far as the exposure of the company to its retailers goes, last year, approximately 30% of its consolidated net sales were made to McLane Company, one of the largest American wholesale distributors to convenience stores, drug stores, wholesale clubs and mass merchandisers and the primary distributor of Hershey’s products to Walmart (WMT).

Regarding seasonality, typically Hershey’s sales are higher in the second half of the year.

Hershey’s principal market is in the U.S. Last year, 87% of its net sales were in the U.S., while only 13% were from Hershey’s international businesses.

Recent Acquisitions

The company has been also focusing on growing both organically and through M&As. As we already mentioned, last year, Hershey completed two key acquisitions that helped Hershey develop its North America Salty Snacks Division. The deal is expected to make Pretzels and Dot’s generate aggregate annualized net sales over $300 million.

In addition, Hershey also bought Lily’s Sweets, a company that sells a line of sugar-free and low-sugar confectionery foods to retailers and distributors in the United States and Canada. Lily’s acquisition should generate another $100 million in annualized net sales.

For these three acquisitions, Hershey spent $1.6 billion, which tells us that the price/sales multiple was around 4x, which is not very high and actually seems quite reasonable.

Business Strategy and Goals

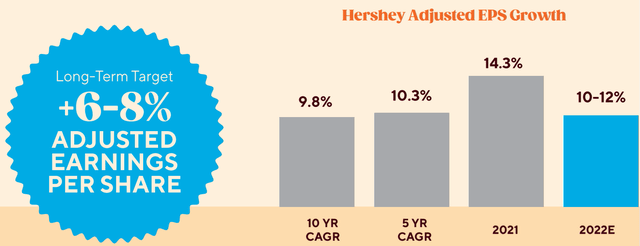

Hershey has built a clear strategy that targets an annual 2-4% net sales growth that leads to an annual 6-8% adjusted EPS growth. The drivers the company focuses on in order to achieve growth are as follows:

- balanced innovation,

- enhanced price-pack architecture,

- more diversification in high-growth segments,

- supply chain scale and adaptability,

- investments in technologies

If we look at the picture below, we see that Hershey actually beat its own EPS guidance as it delivered over the past 10 years a 9.8% CAGR. The outlook for this year seems very promising, too, as the company forecasts its EPS to grow in the low double digits.

Hershey 2022 Annual Meeting of Stockholders Presentation

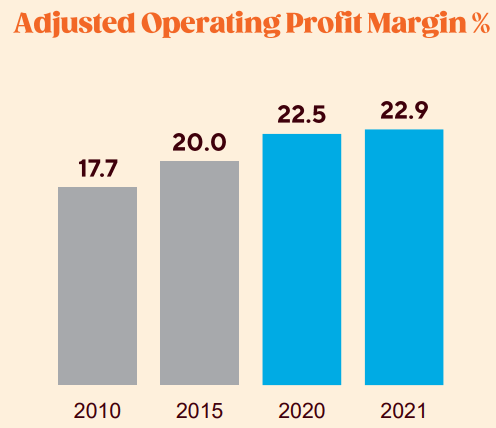

Another slide is particularly interesting because it shows that Hershey has been able to deliver outstanding results due to an improving operating profit margin which, at the end of last year was almost at a very good 23%.

Hershey 2022 Annual Meeting of Stockholders Presentation

Hershey also discloses the margin breakdown per segment. Last year, North America Confectionery, which accounted for 85.6% of net sales, saw an operating margin of 32%. North America Salty Snacks accounts of 6.2% of net sales and reached an operating profit margin of 18.1%. This is the fastest growing segment of the company with net sales that increased 26.7% from 2020 to 2021. The International division accounted for 8.2% in 2021 with a segment operating profit margin of 10.1%.

The reason why the international division has lower margins is that it has a large exposure to emerging economies, where volumes are at the moment more important than high profitability. Hershey is penetrating many markets and saw a net sales growth of 39% YoY in Mexico, of 23.9% YoY in India, and 21.3% YoY in Brazil.

Meanwhile, the company’s balance sheet is under control. In 2021 the total debt increased by $400 million YoY to a total of $5 billion. This was due to the acquisitions we talked about. However, the 2021 EBITDA was $2.4 billion, which leads to a debt/EBITDA ratio of 2.1. I have it as a rule to invest in companies that have a ratio below 3 and Hershey fits into this.

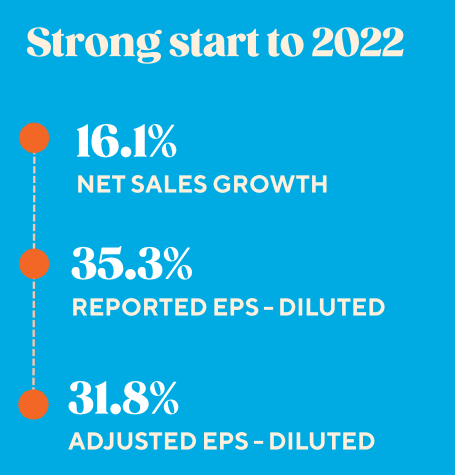

Hershey 2022 Performance

This year, the company started strong, with a net sales growth of 16.1% YoY and very strong EPS growth, as shown in the picture below. This has led Hershey to announce that, for the full year, the company expects to have an overall EPS growth in the double-digits, well above its long-term target.

Hershey 2022 Annual Meeting of Stockholders Presentation

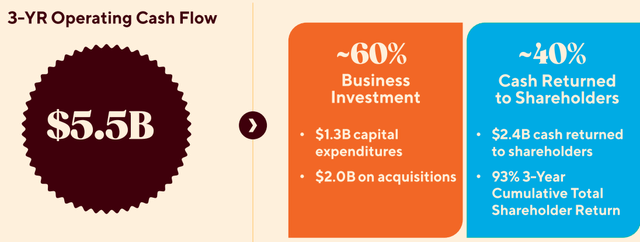

Now, Hershey aims clearly at generating cash flow. Over the past 3 years, the company generated $5.5 billion in operating cash flow, 60% of which has been reinvested back into the business, both through capex and through acquisitions. The remaining 40% is cash returned to shareholders. I like the way Hershey is balanced between business investment and shareholder return. In fact, I think shareholders should consider that the remaining 60% is being spent in order to make the company grow and that this, too, is somewhat money that returns to them, because the more the company grows, the more it is likely to have increasing EPS which then lead to an increase in the stock price.

Hershey 2022 Annual Meeting of Stockholders Presentation

In the last earnings report, Hershey reported very investor-pleasing results.

For the past quarter, its consolidated net sales reached $2.4 billion, an increase YoY of 19.3%. Very important to notice is that the impact of acquisitions on net sales was a 5.3-point benefit, which proves the accretive value that these operations brought. In Q2 adj. EPS diluted increased by 22.4% to $1.80.

The reported gross margin was 42.1% in Q2 2022, which is equal to a 440 basis points decrease compared to 46.5% in Q2 2021. As the company reported, this decrease was primarily driven by derivative mark-to-market losses, combined with higher supply chain costs and unfavorable mix, which was partially offset by sales growth. If we look at the adjusted gross margin, Hershey actually reached 34.9%, which equals a 250 basis points decrease instead of the reported 440 basis points.

This makes me quite confident this drop isn’t a real issue at all, but it is partially linked to external conditions. In any case, Hershey maintains a gross margin above 40% which is very high.

However, Hershey also pointed out that as sales increase, this growth should more than offset by higher supply chain costs, elevated advertising and merchandising levels and increased incentive compensation costs. This makes the company confident that it will keep on delivering higher reported and adjusted earnings per share growth.

Moving down toward the bottom line, Hershey reported an adj. operating profit of $526.9 million up 14.7% vs Q2 2021, resulting in adj. operating profit margin of 22.2%, a YoY decrease of 90 basis points. Again, we see some inflationary pressure eating a bit of the margin, but the good net sales increase still had a big impact on the total operating margin.

I was also interested in seeing the new three division breakdown.

North America Confectionery

Hershey’s North America Confectionery segment net sales in Q2 were $1.9 billion a YoY increase of 12.9%. The income was $618.9 million in the second quarter of 2022, a 11.6% YoY increase. The segment margin of 32.4% saw a slight decrease of 40 basis points, which proves that in North America Hershey’s pricing power is already almost at pace with inflation.

North America Salty Snacks

Hershey’s North America Salty Snacks segment net sales in Q2 were $256.3 million a YoY increase of 99.9%. This is quite understandable as the division is new and it sees as its major brands the newly acquired Dot’s and Pretzels, which combined brought a 71.6-point benefit to the sales. This division is indeed where Hershey aims at a fast growth. We know, in fact, that SkinnyPop brand retail sales increased 16.9% YoY and resulted in a ready-to-eat popcorn share gain of approximately 130 basis points. Pirate’s Booty brand witnessed a retail sales growth of 32.4%. Dot’s Homestyle Pretzels brand also had a big boost resulting in a retail sales growth of 45.4% YoY, thanks to the fact that Hershey leveraged its distribution footprint around the States. As a result, in the pretzel category the brand enjoyed a market share gain of almost 340 basis points.

International

Hershey’s International segment net sales in Q2 were $207.2 million, a 21.3% YoY increase. Its segment margin of 14.8% saw a decrease of 130 basis points, which is linked to the fact that Hershey is exposed to markets where margins are a bit lower compared to the ones enjoyed in the U.S.

Pricing Power and Marketing

Another important aspect of the report was linked to pricing power. In fact, Hershey reported that organic constant currency net sales increased 14.1% driven by pricing and volume gains across segments. Net price realization contributed 9.5 points to net sales growth driven by price increases. The remaining 4.6 points come from volume growth. In addition, the company slowed down its promotional activity as it would not have been able to fulfill on time increasing orders.

This was one of the topics discussed during the Q&A of the earnings call. In fact, Hershey saw high demand during Q2 from retailers as they ordered much in advance to have their shelves ready for the “candies season” that starts around Halloween. As a consequence, Hershey pulled back on advertising spending in order not to waste money and get ready to invest more on marketing in the next quarters. This is what Hershey’s management said regarding this topic:

We saw a pretty strong inventory replenishment in the second quarter as we commented. A portion of that was a pull-forward from the second half, so really a timing move. So as we look at the back half, we’re really not seeing any additional meaningful inventory replenishment in the second half guidance.

This will pull away some pressure on Hershey’s supply chain, helping it move towards a more normal way of operating.

1H 2022 at a glimpse

Now, before we move on, let’s take a look at the key margins Hershey released for the first six months of the year.

Gross margin reached 44.6% vs. 46.1% in 2021. The reasons behind this decrease are the same that we saw for the quarterly results.

The operating profit margin was 23.4% vs. 23.6% in 2021, showing that the company improved its efficiency to offset some of the negative impacts linked to the economic environment.

Net margin, too, didn’t go down as much as gross margin, as it was 16.8% vs. 16.3% in 2021.

Overall, we are before a very profitable company. Not by chance, it is awarded an A grade from Seeking Alpha’s Quant Ratings. In addition to margins, Hershey is also a top performer when we look at the return on total capital employed which is an 18.45% almost 200% more than the industry average. It is also very efficient in terms of employee profitability which shows a net income per employee of $91,520, almost 300% more than the industry average. Just to get an idea, Kraft Heinz (KHC) has a ROCE of 4.38% and a net income per employee of $42,138, while Hormel Foods (HRL) has a ROCE of 7.77% and a net income per employee of $50,092. In a few words, this shows how profitable chocolate is.

Outlook

The company raised its full-year financial outlook as follows:

| 2022FY Outlook | Prior Guidance | New Guidance |

| Net sales growth | 10%-12% | 12%-14% |

| Adj. EPS growth | 10%-12% |

12%-14% |

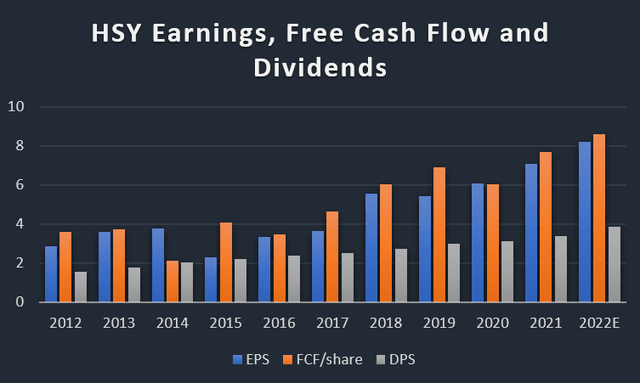

With this new guidance, we can project Hershey’s EPS. I prepared a chart where I show the EPS growth along with the free cash flow per share and the dividend per share. In this way we get a grasp of how well the company has been executing its business model, leading to constantly and steadily improving results. Most importantly, Hershey is usually able to have a free cash flow conversion rate above 100%, as the graph shows.

Author, with data from Seeking Alpha

Clearly, growing EPS and FCF lead to growing dividends. Hershey is a dividend investor favorite as it has a payout ratio that is currently around a safe 44%. Though it just hiked its dividend by 15%, the yield is however a low 1.82%, which does make the stock a bit expensive at the moment. However, if we forecast a dividend 5-CAGR of 8%, we should have a dividend per share of $6.08 in 2027 which would make a forward yield of 2.6%. Holding the stock for five years and collecting all the dividends would give a total return of 13%.

These are not alluring numbers, but it is reasonable to expect that as they are achieved, the company will be also reporting growing top and bottom line numbers which should help support the stock price.

Valuation

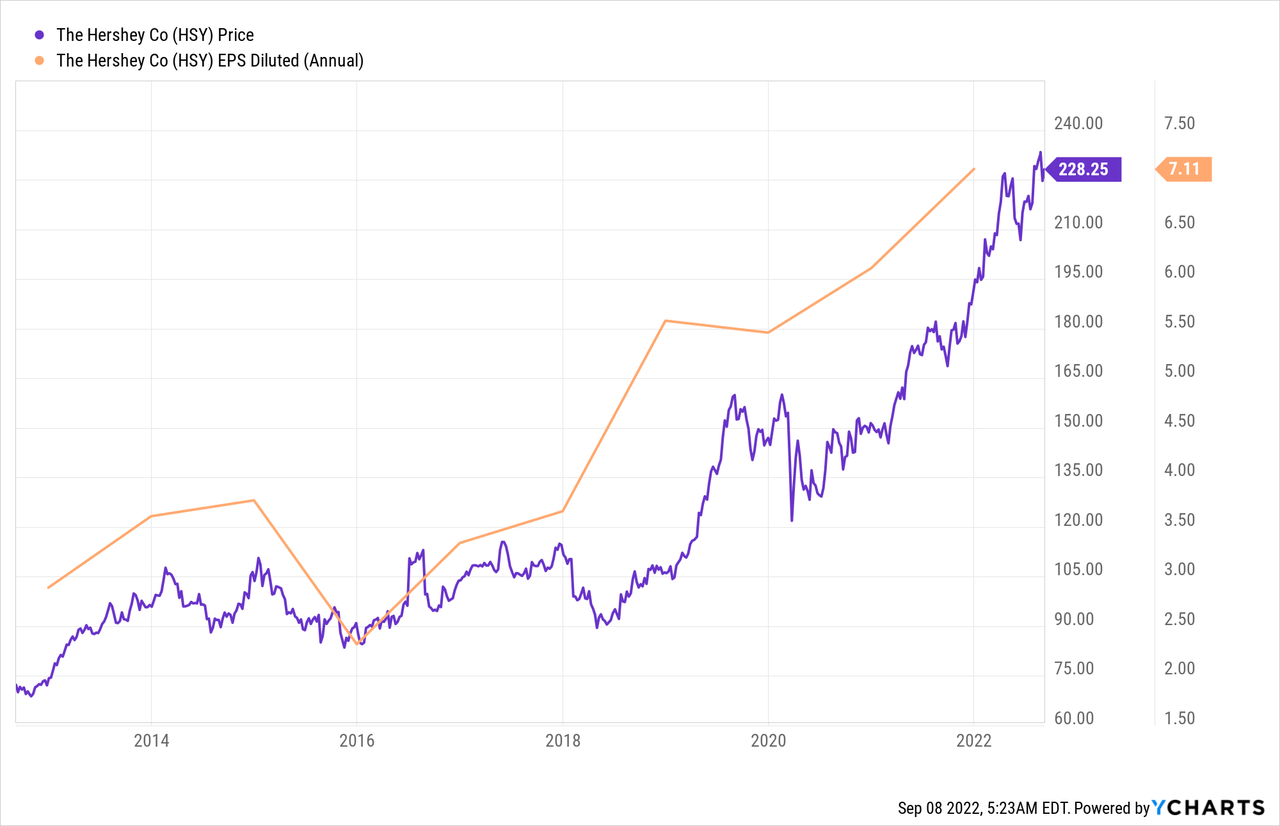

At the moment, investors have bought heavily into the stock pushing it to its ATH. This made many people think Hershey will come down in price. However, as we can see from the chart below, the stock didn’t do anything else than follow its EPS. No matter how we look at it, this appears to be a stock where the fundamentals do drive the stock price over the long term.

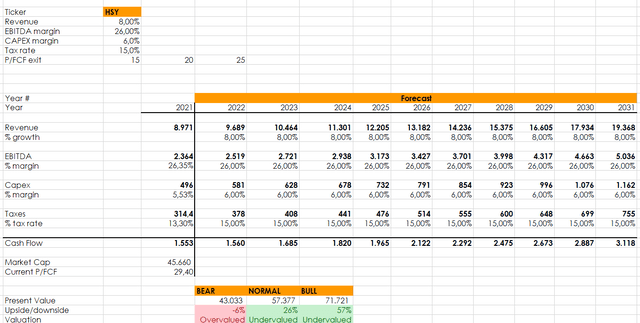

Here is my discounted cash flow model which has the assumption that the overall annual growth of Hershey in the next ten years will be at around 8% given its strong pricing power and its investments in new acquisitions. I assumed Hershey will not change its EBITDA margin of 26% and that it will keep its capex at around 6% of total revenue.

Author, with data from Seeking Alpha

I chose three different scenarios based on three different price/fcf multiples. They are below the current multiple of 29 the stock is trading at. Even with lower multiples, aside from a bear scenario, we are still before a company that can deliver an upside. The stock is not a bargain as of now, but it does trade at a premium for its quality and reliability. Some investors may wait for a pull back and/or a higher starting yield.

As for me, Hershey is currently on my watchlist and I am considering initiating a small first position in my dividend growth portfolio. This is why between a hold and a buy I am slightly more inclined to give it a buy rating, suggesting, in any case, to add cautiously given the current market conditions.

Be the first to comment