shisheng ling

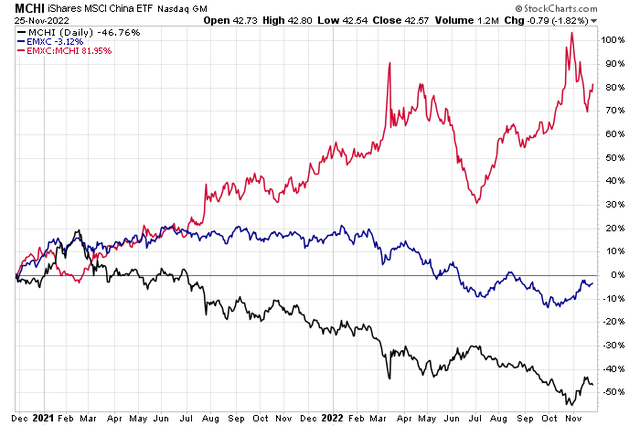

A popular emerging markets play over the past year-plus has been investing ex-China. The iShares MSCI Emerging Markets ex-China ETF (EMXC) has beaten the iShares MSCI China ETF (MCHI) by more than 80 percentage points in the last two years.

Recently, though, China has made a comeback. MCHI, while retreating last week, rallied more than 30% off its late October low. For now, it looks like just a dead cat bounce, but I suggest monitoring relative price action between the ex-China EM fund and MCHI for clues on how China might do going forward.

China vs the Rest of EM Trying to Recover

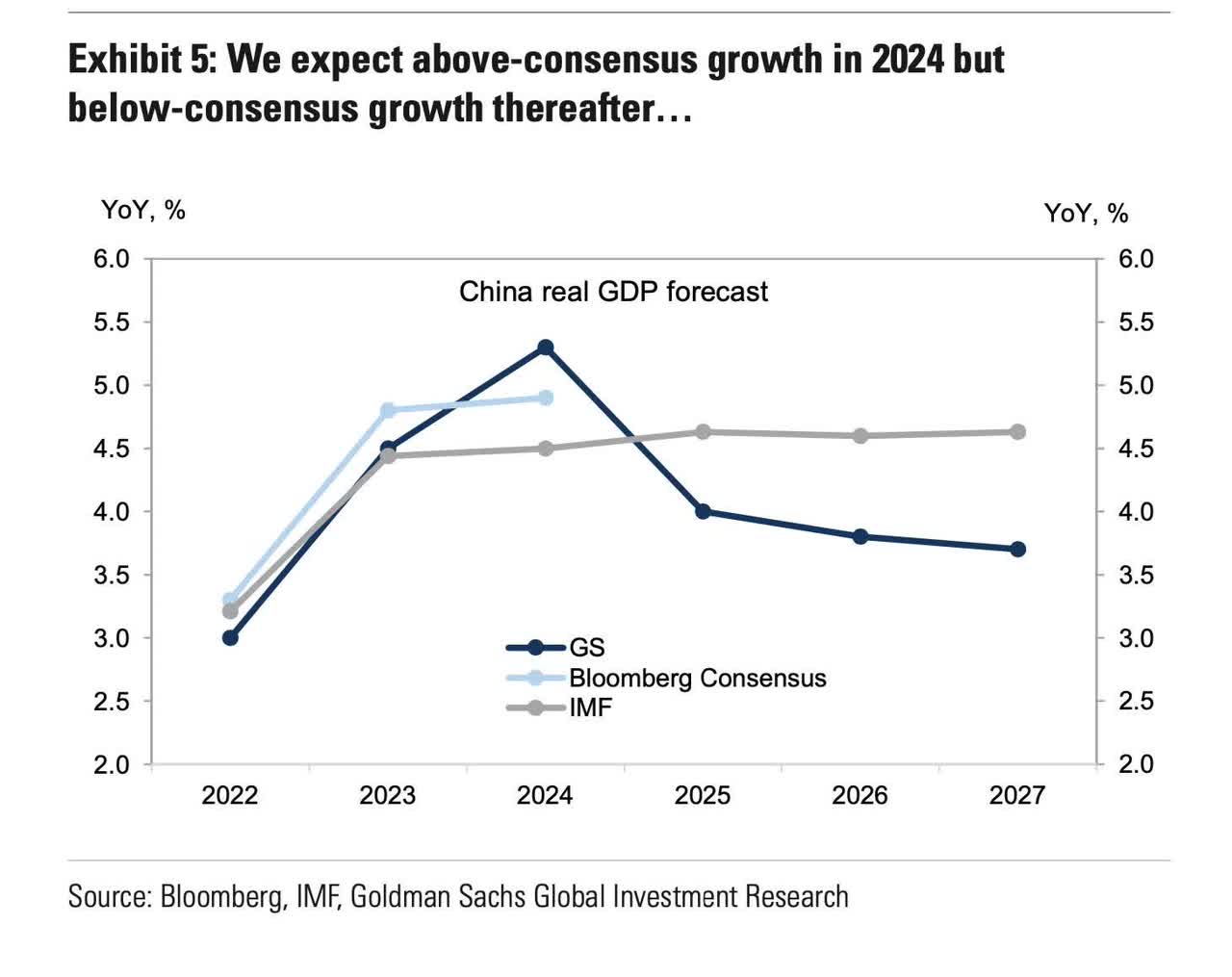

China Growth Forecast to Rebound

Goldman Sachs Investment Management

Near-term, though, an important consumer company has earnings on tap that will certainly move China’s market this week.

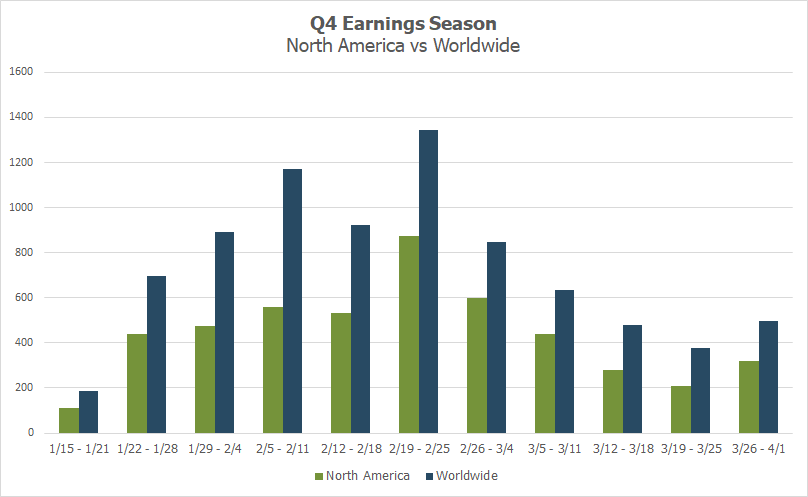

Earnings Season Winding Down

Wall Street Horizon

According to Bank of America Global Research, Pinduoduo Inc. (NASDAQ:PDD) is one of China’s top e-commerce platforms that provides buyers with a broad selection of cost-effective merchandise and a dynamic social shopping experience. Buyers can make team purchases on either PDD’s platform directly or through social channels, such as Wexin and QQ. Leveraging social networks is an effective and efficient instrument to attract users and improve user engagement, and PDD accomplished 76 billion total orders with 869 million active buyers in 2021.

The Shanghai-based $84.4 billion market cap Internet & Direct Marketing Retails industry company within the Consumer Discretionary sector trades at a high 30.8 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. Back in August, PDD reported quarterly earnings that blew past analysts’ expectations.

Recently, shares have enjoyed a rebound in the broader China market despite ongoing negative headlines of renewed zero-covid lockdown measures returning. All eyes are now on Monday morning when the firm reports Q3 results.

The consensus forecast calls for a massive 112% y/y surge in EPADS while sales are seen as having grown 29% from the same period last year. Seeking Alpha reports that PDD has beaten on the bottom line in each of the past eight quarters and that there have been an impressive seven upward EPS revisions – this comes during a time when analyst downgrades have been common across Wall Street.

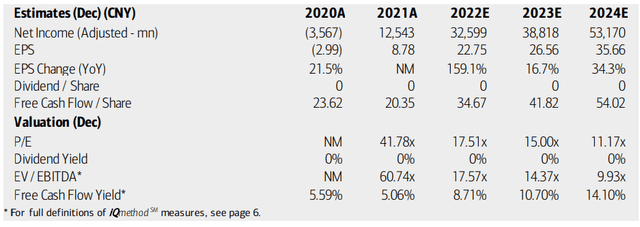

On valuation, analysts at BofA see earnings having risen sharply this year, then cooling in 2023 before another acceleration in 2024. No dividends are expected out of this growth name. Meanwhile, free cash flow per share is impressive with a forecast FCF yield north of 10% in 2023, and the stock trades at 16.6 times next year’s expected total cash flow, which is a little on the expensive side.

What’s positive, though, is that PDD’s operating P/E turns very attractive as earnings normalize, though the EV/EBITDA multiple is a little high. Overall, I like the growth prospects and reasonable valuation. Of course, the elephant in the room is uncertain policies from President Xi who is quite anti-business.

PDD: Earnings, Valuation, Free Cash Flow Forecasts

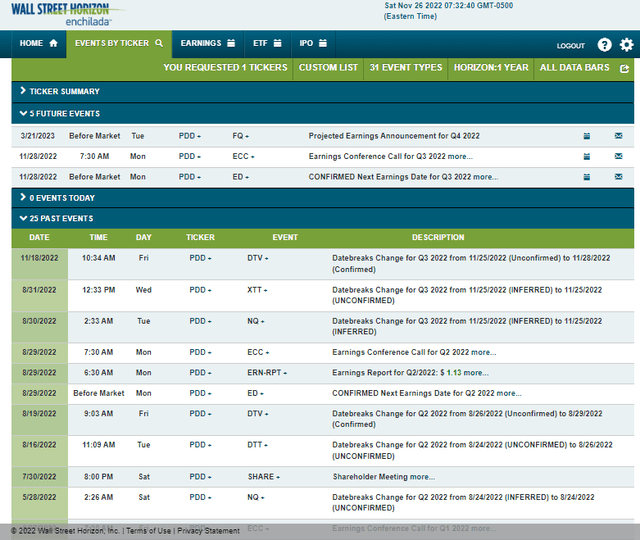

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 earnings date of Monday, November 28 BMO with a conference call following results hitting the tape. You can listen live here. The event calendar is light aside from this week’s earnings.

Corporate Event Calendar

The Technical Take

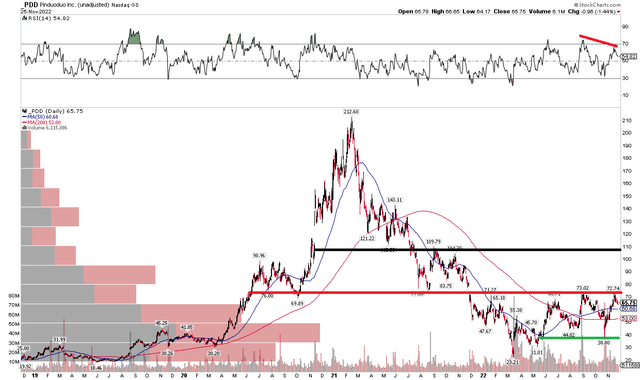

PDD is back at critical resistance on the chart. Three months ago, I pointed out that the stock looked like a favorable risk/reward opportunity. Indeed, the consumer stock rebounded sharply amid broad market weakness. I am more cautious today.

The bulls want to see a breakout above the September peak of $73. If shares rise above that resistance, then a measured move price objective of $107 is triggered using the $39 October low and $73 resistance. There is also possible resistance just above $107 from an important pivot point seen during the middle of last year.

I also spot what was almost bearish momentum and price divergence. It was not technically so since price failed to make a new high earlier this month, but it is at least a sign of some loss of upside momentum.

Overall, PDD is in a holding pattern on the charts after a stellar rebound off its May and October lows.

PDD: Shares Rise to Critical Resistance, Monitoring an Upside Target

The Bottom Line

I like PDD’s valuation now more than earlier this year given proven growth trends, but I am less sanguine about the technical situation compared to my view in August. Overall, shares are a hold – a breakout above $73 would be bullish. Still, long-term investors can place some of their more speculative money with Pinduoduo given its GARP nature.

Be the first to comment