nicescene

The article was first published to members of my service Trade With Beta on 8/21/2022.

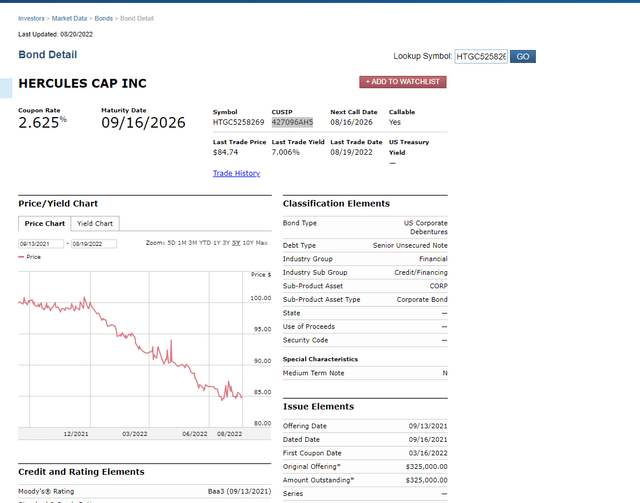

I will start like this: The fixed income market is a complete mess. I have been trading this market any single day for the last 14 years and the events seen in the last 2 years are just mind-blowing. Fixed income spreads are all over the place due to a total lack of liquidity. Don’t take my word for granted, try to trade them and you will most likely agree. This creates a lot of opportunities for greedy short-selling day traders like me and the funny part is that it is extremely hard to capitalize on the mispricings. The income investor on the other hand is the one to profit greatly from the opportunity. There are so many mispricings that it is hard to choose what to present to the yield-hungry public so I decided to share my third largest holding at the moment of writing because it comes with a juicy 7% yield to maturity with an investment grade credit rating. The investment in question is the 9/16/2026 2.625% HTGC bond of the BDC Hercules Capital (NYSE:HTGC) with a CUSIP 427096AH5. This is a regular bond that trades on the bond market and hopefully, it is easy to be found by the CUSIP number.

HTGC and its debt

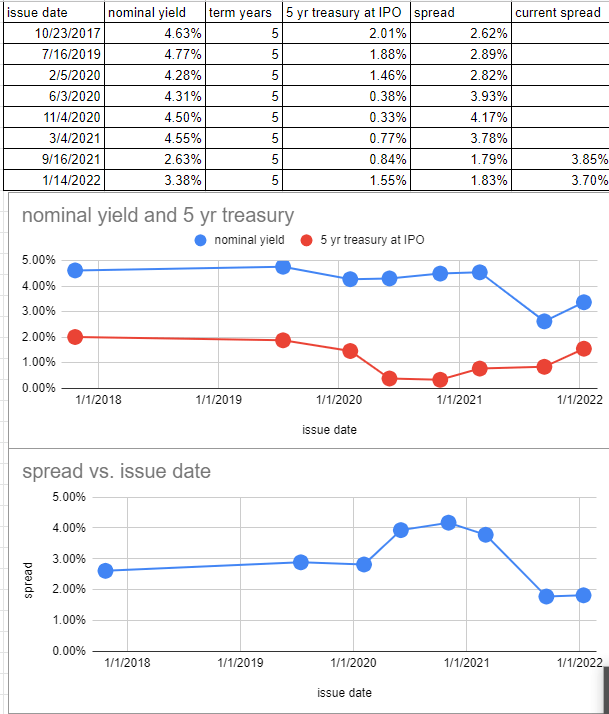

To make the article as small as possible and straight to the point, I will concentrate mostly on spreads. These are the regular bonds issued by HTGC in the last 5 years that have 5 years term:

Historical Yield Spreads Of HTGC 5-Year Notes (Author’s Spreadsheet)

Before the Covid Panic of 2020, HTGC was able to issue 3 5-year bonds at a maximum spread of 2.89%. Then for a while in 2020 all credit spreads widened and the company had to issue at similar nominal yields but the spreads went to as high as 4.17%. Just a year later the company was able to issue at a lower than 2% spread to the 5-year treasury. The reason behind this might be that the bond issued in September 2021 was rated by Moody’s. This is a game changer in general. At the time of writing this article, the bond in question has a very large seller at 7% YTM while the 5-year treasury is at 3.10%. The spreads are back to the levels of 2020. Does this make sense is the question we are all asking ourselves? If I have to answer based on my financial understanding, I would definitely say that given all the recent financial and political data around the world, it is quite reasonable for credit spreads to widen. With this in mind, the reader has to understand that the 7% YTM of the bonds is not some once-in-a-lifetime opportunity that will make you sleep well at night and will get you as rich as Elon Musk in a year. It is very possible that the market pricing of this bond is correct. And here comes the headache. Why would anyone recommend an investment if it is fairly priced? The simple answer to that question is that nobody at the moment has any idea what part of the market is fairly priced. If we assume that HTGC bonds have widened in relation to strong financial logic we have to examine how the credit spreads are behaving in other parts of the fixed income market.

Credit profile

HTGC has just recently been reviewed by Fitch and received a BBB- rating.

Moody’s is also considering HTGC to be an investment grade issuer:

The public doubts rating agencies but in entities as simple as BDC and Closed-end funds one has to be pretty sure that the analysts whose professional duty is to evaluate credibility, are most likely giving a fair assessment. The BDC structure is regulated by law and most BDCs are not even willing to leverage to the max even though they are now allowed to take more leverage compared to CEFs.

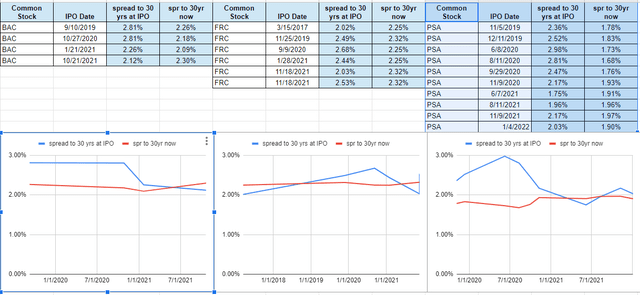

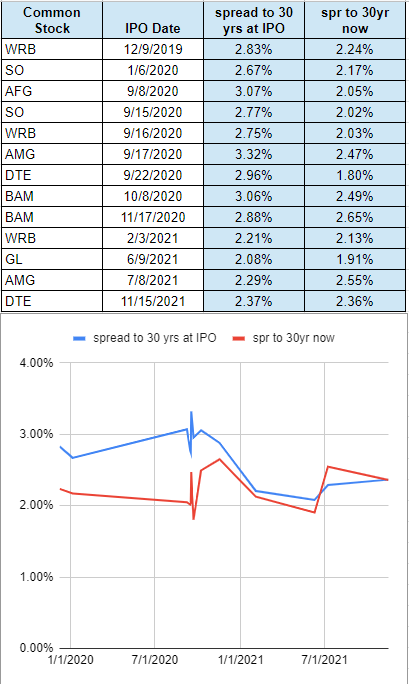

Credit spreads in investment grade preferred stocks

Here I have chosen to show the spreads of 3 of the largest and most significant issuers of preferred stocks BAC, FRC, and PSA:

Yield Spreads (FRC, BAC, PSA) (Author’s Spreadsheet)

The current spreads for BAC are 0.3% lower than the average, for FRC are 0.08% lower than the average and for PSA are 0.47% lower than the average for the examined period. The picture is quite similar to any of the high-quality preferred stock. None of them at the moment has widened significantly and all of them are at least 0.4% lower compared to 2020 levels.

Credit spreads in investment grade exchange-traded debt

Here I have chosen the only comparable bonds and keep in mind that there is not much ETD with 5-year terms so the benchmark here is the 30-year treasury again:

Baby Bond Spreads (Author’s Spreadsheet)

On average, any bond from the list issued in 2020 has narrowed its spread by 0.72%. So definitely the investment grade ones with longer maturity have not widened their spreads to treasuries and none of them is trading at the spreads seen in 2020. This has to mean that HTGC is as distressed as 2020 because otherwise, the current pricing of the bonds makes no sense at all.

How distressed is HTGC at the moment?

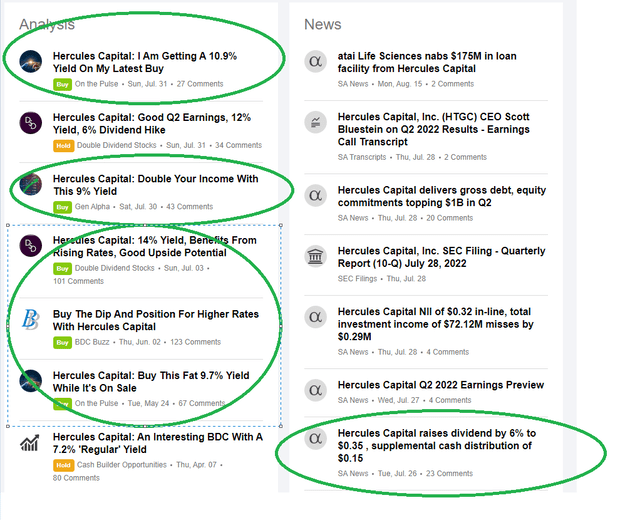

Just opening our favorite website to see the sentiment:

HTGC Sentiment And News (Seeking Alpha)

In addition to the rise in dividends and 5 out of 7 articles being a buy recommendation, I have to remind you that the public pays $14.85 to own the common stock and this is 39% above book value. Since HTGC is a simple BDC this means that the public is so certain in the alpha generated by management that the public is just fine overpaying the NAV to receive this tasty 9.43% dividend yield. There is just no way that the market consensus is to pay a 40% premium while the market consensus for the bonds is to widen the credit spread to Covid levels. Something here is totally wrong.

HTGC company profile and a hypothetical proposal to management

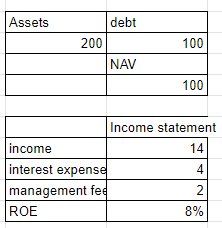

As per the last report, the company has $2.87 bln of assets with $1.54 bln of debt and $1.3bln of equity. The Assets yield is around 10%, the fees and general and administrative expenses are around 2.2% and the interest plus loan fees stand at 3.6% on debt and 1.9% of total assets. The ROE is close to 12%. If everything stands still and there is no increase in non-performing loans one can expect to generate 12% ROE from the company. When HTGC trades at a 40% premium to book value one can expect to earn 8.5% on his investment in HTGC. Most of the debt HTGC holds in its portfolio is so far away from investment grade and still, the debt of the company is investment grade. Now imagine for a second if the same management creates a simple CEF that invests in the bonds of HTGC at a 7% yield. This CEF will most likely get an A rating by any rating agency. It will be possible for the fund to finance at way lower rates. Here is a simple calculation for the management of HTGC assuming they create a term structure CEF invested in their own bond with interest expense on the term preferred A-rated preferred stock of the fund of 4% and 1% in management fees:

Hypothetical CEF Invested In HTGC Notes (Author’s Research)

Not bad for a leveraged investment in a BBB- rated bond. And if the market gets crazy enough and sells the hypothetical A-rated term preferred stock, they can make another CEF with it as an asset. All these scenarios are written for fun but the simple calculations in them are financially sound in contrary to the recent pricing of the HTGC debt.

Fair Value, duration, and how to buy the bond

This is the bond in question:

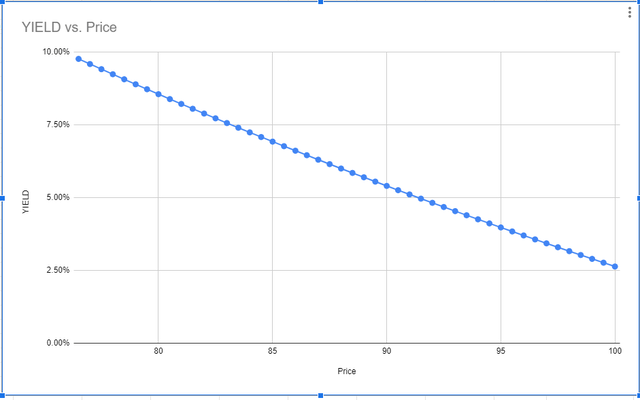

It does not trade on the exchange and one would need to be able to trade bonds on the bond market to trade it. I use Interactive Brokers to trade bonds and it is pretty simple as long as you have the permissions and print the Cusip number in your order entry window. There is still a large seller and this yield is not to be missed. The Price/Yield chart of the bond looks like this:

Price/YTM Chart Of The Bond (Author’s Research)

If the bond is to fall to 8% YTM, its price has to fall to 81.5% of par. So on a 1% rise in yield, the price will fall around 4%. This is what low duration means. To determine fair value I will just look at the behavior of the exchange-traded debt of the company HCXY which is a 6.25% note that matures in 11 years and trades above par. If HCXY trades at close to 6% YTM then the 2026 notes have absolutely no reason to trade higher than 6%. On top of that, the pre-Covid spreads at which HTGC was issuing even before being an investment grade issuer were around 2.8%. Since HTGC is now paying rating agencies to rate its debt and is a valid investment grade issuer, I personally see no reason for the bonds to trade with a higher spread of 2.8% to the 5-year. My personal fair value would be 2.3% above the 3-year treasury which is higher at the moment compared to the 5-year. This brings my fair value estimate of the bonds to be a 5.5% YTM or a price of 89.5% of par. With a current price of 84.7% of par, this represents a capital gain potential of close to 6%. Any fixed income trader knows that this is an insane potential for an investment grade bond with 4 years duration.

Conclusion

7% from an investment grade bond of a BDC company trading at a 40% premium to NAV with 4 years to maturity that has widened its credit spread to Covid levels while the whole exchange-traded fixed income has narrowed significantly is a must-own investment for any investor interested in maximizing his risk-adjusted returns. This pricing is not supposed to last unless the whole market is mistaken and only this bond is fairly valued. This is a strange, strange market.

Be the first to comment