Vladyslav Danilin/iStock via Getty Images

N30AS – The latest AerAware test plane. (NASDAQ:ASLE)

Overview

Author

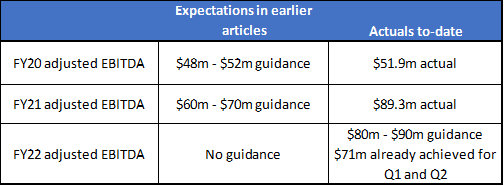

AerSale is an aviation aftermarket products and services company. They optimize the value of mid-technology aircraft made by Boeing (BA) and Airbus (OTCPK:EADSF) (OTCPK:EADSY) and engines made by GE (GE), Rolls Royce (OTCPK:RYCEY) (OTCPK:RYCEF) (OTC:RLLCF) and Raytheon (RTX). Today, their customer mix is mainly private sector, though they have been growing their government customer base.

Their market segment is underserved, inefficient, and fragmented. It’s a regulated industry. Complex FAA regulations serve as a steep barrier to entry for new entrants without extensive experience with the regulators.

This article is an update to an earlier write-up of the company on Seeking Alpha – AerSale Stock: A Boeing Vendor Worth $40.

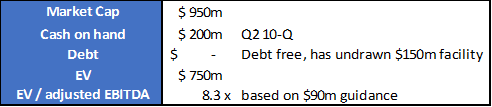

The company continues to meet or exceed expectations:

Author

The company is signaling they will imminently launch a transformational product – AerAware. This project suffered delays, primarily due to COVID. But these have passed and we’re now back on track.

They will increase or beat guidance

Last year, management comically low-balled their earnings guidance, handily meeting their full-year guidance in the third quarter before finally raising their full-year guidance. This year, they’re doing it again.

AerSale’s current 2022 adjusted EBITDA guidance is $80-$90 million. They already have printed $71 million during the first half of the year ($29.9 million in Q1 and $41.1 million in Q2). So to meet guidance, they only need to earn a total $9-$19 million over the next two quarters. Yet again, they’re on track to exceed their full-year guidance within the third (current) quarter.

During the Q2 earnings call, management sensed they had a credibility issue with their guidance and suggested reduced flight equipment sales in H2 were anticipated:

The implied reduction in performance in the second half as compared to the first half reflects an earlier than anticipated sale of our 747 400 freighter at the end of the second quarter, which was planned for the third quarter. Also deferral of two 757 aircraft to the 2023 third-party P2F conversion program in order to benefit from higher margin returns and consideration of the ongoing risks in the global economy.

That’s nonsense. For this current quarter, AerSale already has got two aircraft sales in the bag and another on the way (vs. three in total for Q2).

- N260AS 757-200 P2F sold to Cargojet, delivered in July

- N186AN 757-200 P2F sold to YTO Cargo, delivered in July

- N188AN 757-200 P2F being converted at GYR, due soon

From an accounting / reported earnings point of view, the Goodyear P2F will be a particularly good one because AerSale converted this freighter themselves and they defer recognizing revenue and associated margin for the work performed until the conversion is completed and the aircraft is sold.

There also are a number of other 757s currently undergoing P2F conversion in China which should be completed and sold before the end of the year – N203UW, N204UW, N205UW and N176AA.

Valens Research provides research to institutional clients. One of the offerings involves scanning earnings calls for verbal cues that management teams are lying. It’s based on technology developed by the Israeli military. Valens analyzed the last two ASLE calls, particularly around the AerAware product. Regarding Flight Equipment Sales, Valens had this to say:

Management was highly confident about their pipeline of flight equipment sales, including sales that were completed and in the pipeline, and how strong the opportunities they’re seeing in the space are.

In other words, if management were trying to convince an Israeli counterespionage agent that they weren’t confident about easily beating their full-year earnings guidance, that Israeli agent would probably call BS on management.

New product launch – AerAware

ASLE

AerAware is a helmet mounted Enhanced Flight Vision System (EFVS) which AerSale is in the final stage of certifying with the FAA. This is proven state-of-the-art military technology. It’s the same platform as is deployed in the Joint Strike Fighter F-35. Nothing like it exists for commercial aircraft today.

AerSale relied upon Universal/Elbit (ESLT) to conduct a software validation of the system. COVID/staffing/resourcing issues at Elbit delayed this validation by about a year and there was little AerSale could do about it. This roadblock has now passed and the validation is complete. Some quotes from the Q2 earnings call:

Regarding AerAware, I’m pleased to announce that together with our partner Universal Avionics, a Elbit Systems subsidiary, we’ve completed the software validation process. This represents more than two years of engineering and development effort. And we’re very excited to reach this important milestone. As we’re nearing the commercialization phase of AerAware, we’ve stepped up our marketing efforts with airline operators and have received favorable feedback across the board. We’ve been hearing positive reviews about the system following our many demonstration flights, with pilots frequently noting that AerAware’s advanced technology is decades ahead of anything existing today…

As we believe final AerAware certification will be granted by the FAA in the near term, we are investing in our ability to begin delivering AerAware to our prospective customers. To that end, in July, we ordered $33 million of the AerAware components from Elbit Systems’ subsidiary Universal Avionics, so that we can begin installations at the earliest time…

I can’t overstate how big a milestone we finished with our AerAware product. Finishing two years’ worth of engineering development and software validation is a big deal. The fact that we placed an order for $33 million worth of equipment, ought to give all of you a good idea how confident we are that we’re going to have this system certified in the short run, and that we’re going to have multiple number of customers that will be waiting to take that equipment. So we’re in also — we feel very optimistic and confident about our position vis-à-vis AerAware.

Valens analysis of management’s statements were:

During the Q2 call management was confident that the FAA is going to properly staff the certification flights, and that this is really perfunctory at this point, as they’ve demonstrated the effectiveness to the FAA already… this call had significant confidence on AerAware.

Nick Finazzo said at the Jefferies Industrial Conference, Aug. 10:

AerAware is my favorite one (proprietary engineered solutions). I love it… We are very close to certification on it. We have a number of customers big and small… It is something we believe will be ubiquitous to the airlines industry.

What’s AerAware worth?

AerAware is worth a lot to the company. It’s worth than the rest of the company combined.

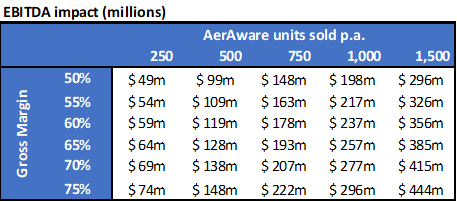

Not sure you believe me? Here’s the math:

- An old list price for the AerSale component of the AerAware system is $395,000 (from Nic Finazzo, Cowen 42nd Annual Aerospace/Defense & Industrials Conference). That conference was 18 months ago. If anything, the price should’ve gone up since then (everything else has!). It’s reasonable for AerAware kit pricing to be higher for larger aircraft and for more modern aircraft that have a longer remaining economic life such as the Boeing 737Max or the Airbus A320neo family. If the B737NG gets a one or two year payback at $395,000 per kit, then a larger aircraft (e.g. widebodies) and a newer aircraft will produce greater economic value which should be “priced-to-value.” The federal government is expected to install AerAware in the two new Air Force One aircraft now under contract from Boeing which will be a marketing coup for this product. At this very high end, the unit price could be over a million dollars out of Boeing’s $4 billion AFO contract.

- I’ve previously estimated a 75% margin for AerAware. There’s some hardware and labor, but AerSales component is primarily IP (the STC). Management hasn’t provided any guidance and this felt reasonable. Recently, at the Jefferies Conference, Nick Finazzo said:

Our historical margin on engineered solutions products has been in excess of 50%. We expect this to continue.

So 50% feels like a reasonable lower bound estimate.

EBITDA impact of AerAware (assuming $395,000 unit price):

Author

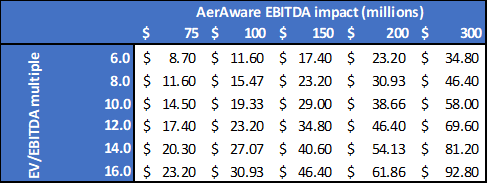

$ per share impact of AerAware

Author

To understand the above, these tables enable you to calculate a range of values of the per share impact of just the AerAware product and should be added onto the value of the rest of the business.

As an example, if AerAware contributes an additional EBITDA of $150 million (say by selling 750 units at 50% margin) and you assign a 10x EV/EBITDA multiple to those earnings, then you would expect the share price to increase by $29 i.e. to 2.5x where it trades today.

How many units can AerSale sell per annum?

That’s a great question and we probably won’t have a definitive answer until AerAware commercially launches and AerSale provide guidance and start announcing sales.

Some useful data points are:

- AerSale estimates the market opportunity at 16,000-plus aircraft

- We have previously identified United Airlines (UAL) as the most likely launch customer with a likely initial order of 500 units.

- Management recently mentioned orders of potentially 1000s of aircraft (both Q2 earnings call and Jefferies conference).

- An earlier article (AerSale: Near-Term Catalysts Could Result In A Doubling Of Share Price) mentioned, “During a conversation earlier this year, CEO Nicolas Finazzo expressed confidence to us that the Company’s annual sales of AerAware could eventually amount to around 1,000 units.”

- China has mandated that all Commercial aircraft operating in China must have an EFVS by 2025. Any operator who does business in China needs to begin preparing for these upcoming regulations.

- Nick Finazzo “the addressable market for this advanced technology represents the greatest opportunity for a single product in AerSale’s history.”

- For operators servicing airports affected by adverse weather, the business case is compelling with a payback of 1-2 years.

In almost every plausible scenario for AerAware sales, margins and EV/EBITDA multiples, you end up with a per share value impact in excess of the current share price today i.e. AerAware really is worth more than the rest of the company combined.

Adding it all together

Even without AerAware, at <$20, AerSale is cheap today. Lower quality peers trade at higher multiples. Once you add in AerAware, it’s difficult to value ASLE at less than $40 per share and $47-plus as suggested by Prescience Point (AerSale (near-term catalysts could result in a doubling of share price – appears entirely reasonable if not a little conservative).

AerSale will be announcing the commercial launch of AerAware very soon. And they almost certainly have several launch customers lined up and ready to go. You will need to be very quick if you’d like to buy a ticket for this flight.

Caveat

It’s only shorthand to say that the three P2F conversions and sales are in the bag for Q3. N188AN was moved from ROW to GYR on March 25, 2022, so there’s some risk that this sale could slip to Q4. On N186AN, planespotters.net reports that this aircraft was delivered to YTO Cargo Airlines on June 16, 2022, and was ferried XMH – HGH on July 11, 2022, so the company might have reported this sale in Q2. It appears that N260AS was sold to Cargojet Airways on July 6, was re-registered on July 8 and began service on July 12, so this is the most definite sale for Q3.

Conclusion

Cowen (COWN), which is in the process of getting bought by TD Bank (TD), advised Monocle Acquisition Corp on their SPAC deal with AerSale and subsequently advised AerSale on their secondary. It would be unsurprising to see their equity analyst imminently upgrade AerSale. They will be among the many observers likely to warm to this company and stock in the coming months. Beat them to it.

TL; DR

Buying ASLE under $30 is good. Buying ASLE under $20 is spectacular.

Be the first to comment