reklamlar/iStock via Getty Images

As I previously discussed, there are two general styles of dividend investing: high-yield investing and dividend growth investing (aka, DGI). The former is favored by those who are well into their retirement, while the latter works the best for future or early retirees as I showed using Intercontinental Exchange, Inc. (ICE) as the example.

Below, I explain how we at The Natural Resources Hub screen for the best dividend stocks, and present two actionable ideas, one each for high yield and dividend growth-oriented investors.

Dividend yield, dividend growth rate, and expected total return

Dividend yield is the ratio of a company’s current annual dividend compared to its current share price. Dividend growth rate is the annualized percentage rate of growth a particular stock’s dividend undergoes over a period of time, typically one year. The sum of the dividend yield and dividend growth can be called the expected total return, from which one may calculate at what share price an entry should be made so as to meet a hurdle rate of total return.

A high-yield investor may want its dividend-paying stock picks to yield not much less than the CPI, which is currently at 8.3%, so that after an anticipated dividend raise, your dividend income will still beat inflation.

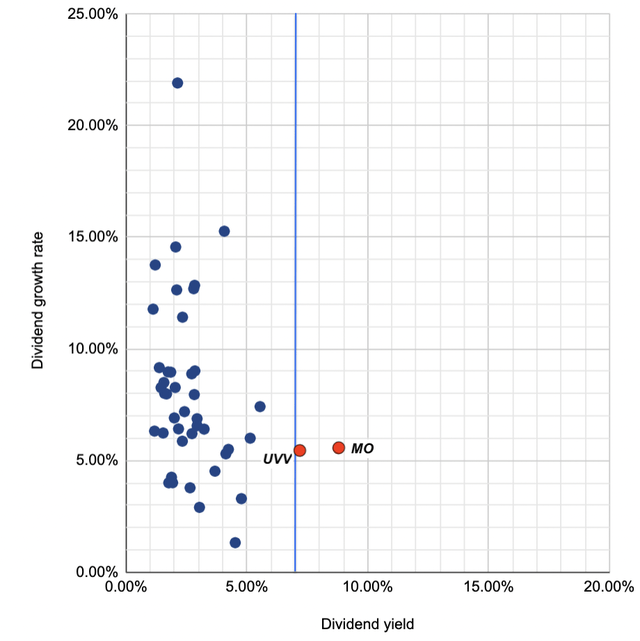

- Among the 45 dividend kings – defined as the stocks that have raised dividends for at least 50 consecutive years, to which I throw in a few that will join the elite group in the next couple of years – only two currently yield 7-8%, namely, Altria Group (NYSE:MO) at 8.78% and Universal Corp. (UVV) at 7.18% (Fig. 1).

- From historical dividend growth data, Universal is estimated to yield 7.57% to cost in 2023, lower than the 8.3% CPI, while Altria is expected to yield 9.27% to cost next year, beating inflation. Therefore, Altria is my pick for high-yield investors.

Fig. 1. Scatter plot of the dividend kings in terms of dividend yield and dividend growth rate, with high-yield dividend investing targets highlighted (Laurentian Research for The Natural Resources Hub based on data sourced from Seeking Alpha and company financial filings)

A dividend growth investor, I assume, expects a >15% rate of total return per year and a >15% dividend yield, in 10 years, to his/her cost basis.

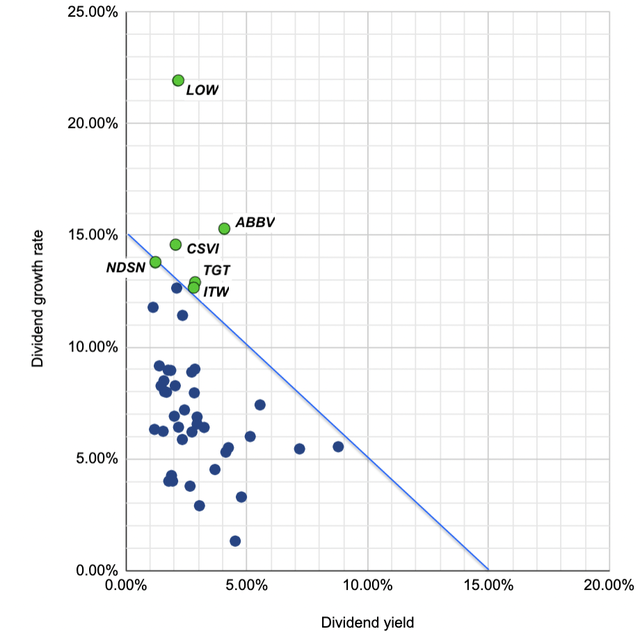

- Of the 45 dividend kings, six stocks boast a >15% expected annual rate of total return and satisfy the first criterion. They are Lowe’s (LOW), AbbVie (NYSE:ABBV) whose dividend history dates back to the pre-spinoff days as part of Abbott Labs (ABT), Computer Services, Inc. (OTCQX:CSVI), Target (TGT), Illinois Tool Works (ITW), and Nordson (NDSN).

Fig. 2. Scatter plot of the dividend kings in terms of dividend yield and dividend growth rate, with dividend growth investing targets highlighted (Laurentian Research for Natural Resources Hub based on data sourced from Seeking Alpha and company financial filings)

- Based on historical dividend growth data, two stocks deliver a >15% dividend yield to cost and satisfy the second criterion. They are Lowe’s (15.44%) and AbbVie (16.83%).

- According to Seeking Alpha peer comparison, AbbVie is of higher margins and a stronger balance sheet than Lowe’s, although both stocks have similar forward valuation multiples. In terms of payout ratio, Lowe’s (27%) beats AbbVie (42%). However, AbbVie currently yields 4.06%, much higher than the 2.13% yield of Lowe’s. The higher current yield of AbbVie means its expected total return is less dependent on future dividend raises. Since a bird in the hand is worth two in the bush, I pick for AbbVie for dividend growth investors even though Lowe’s is not a bad choice.

Altria

As pointed out by a fellow Seeking Alpha author, in spite of the negativity about smoking, sin stock Altria continues to post respectable sales growth on the back of its strength in pricing power and non-cigarette businesses.

- Indeed, its top line, gross income, and operating income grew at a CAGR of 1.62%, 3.66%, and 4.63%, respectively, in the last decade. (Its net income fluctuated a lot, mainly due to non-cash adjustments to equity interests, e.g., in 2021.)

- Altria actually improved margins in the last 10 years, suggestive of a thriving business. Its gross margin increased from 55% to 67%, operating margin from 43% to 58%, and leveraged FCF margin from the mid-20s in percentage to 37%, from 2013 to 2022.

With an 8.78% dividend yield – the highest among all dividend kings, Altria has an expected rate of total return as high as 14% per year. If you have a lower bar of 10% annual total return, my calculation indicates you could buy the stock all the way up to $84 per share. The stock changed hands at $42.82 apiece as of October 7, 2022, which gives an income-oriented investor a sufficiently large margin of safety.

- The above assessment is built on the assumption that Altria will continue to raise dividends in the foreseeable future. I do believe Altria will endure the next recession well, and will not cut dividends, considering the cigarette maker never cut dividends, not even once, in the past 52 years that include some eight recessions.

How could Altria be so cheap? A slew of risk factors keep many investors away from the sin stock. Firstly, unfavorable litigation outcomes may adversely impact its financial performance. Juul Labs, of which Altria owns 35%, agreed to pay $438.5 million to over 30 U.S. states to settle a two-year probe over its marketing practice of E-cigarette and vaping devices. Juul had to lay off staff, suspend international expansion, and consider a potential Chapter-11 bankruptcy filing. Secondly, the commercialization of new products, e.g., IQOS devices and related Marlboro HeatSticks, in the U.S. market may or may not lead to success. Thirdly, demographical changes may result in shifts of adult tobacco consumer behavior. As a good case in point, pot smoking, already more popular in America than tobacco smoking, continues to build momentum.

AbbVie

AbbVie has a portfolio of pharmaceutical products, diversified across immunology, hematologic oncology, aesthetics, neuroscience, eye care and other areas.

Its psoriasis and arthritis drug Skyrizi, cancer drug Imbruvica and especially inflammatory treatment Humira are the so-called blockbusters. These drugs underpin its above-industry profitability, as can be seen in its high gross margin (70.72%), net margin (22.04%), leveraged FCF margin (32.48%), and ROE (92.36%).

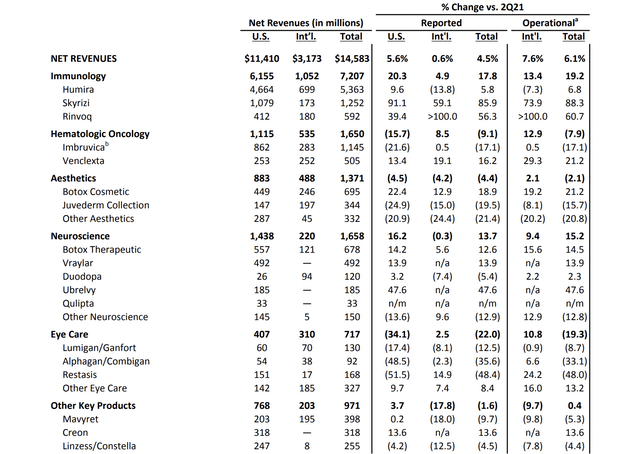

Net revenue came to $14.6 billion in the 2Q2022, increasing by 4.5% over the same quarter one year ago, thanks to (temporarily) regained strength in Humira sales and rapidly rising importance of Skyrizi and Rinvoq, offset by declining sales of Imbruvica and eye care products (Table 1).

- Revenue from aging blockbuster Humira is expected to continue to decline in the foreseeable future. Humira’s patent will expire next year in the U.S. In international markets, competition of emerging biosimilars caused Humira sales to drop 13.8% year-over-year.

- On the other hand, growth momentum of Skyrizi and Rinvoq is extremely encouraging. Recent EU human medicines committee recommendation of extending Skyrizi to treating adult Crohn’s disease may lead to further expansion in its sales. In a few years, increasing sales of Skyrizi and Rinvoq are expected to offset lost Humira revenue.

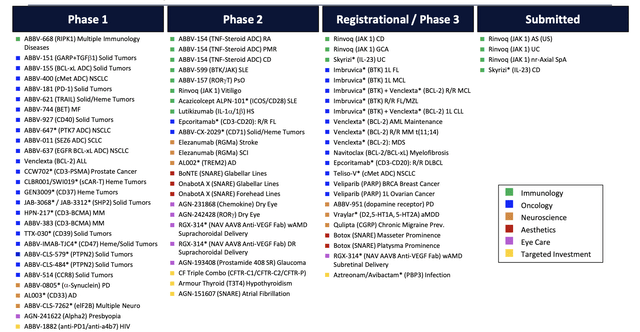

- Further down the road, AbbVie has a robust R&D pipeline covering each of its core business segments (Fig. 3).

Table 1. Key product portfolio of AbbVie, shown with revenue for the 2Q2022 (AbbVie)

Fig. 3. AbbVie R&D pipeline (AbbVie)

AbbVie has an expected rate of total return of 19.33% per year. The company said it would continue to raise dividends despite possibly weaker revenue growth in the next couple of years, allowing payout ratio to creep above the current 42%. If AbbVie can maintain the historical dividend growth rate (15.27%), the stock is projected to yield 16.8% to cost by 2032.

At $138.76 per share as of as of October 7, 2022, the stock traded at a forward P/E non-GAAP multiple of 10.1X, a bargain for a pharmaceutical stalwart. The low valuation multiple reflects the uncertainties faced by AbbVie. As discussed above, the elephant in the room is the loss of exclusivity on Humira, while Skyrizi and Rinvoq need time to ramp up in sales. Once such an uncertainty is in the rear-view mirror, however, AbbVie will end up having some of the lowest loss of exclusivity exposure in the industry for the rest of the decade, according to AbbVie vice chairman and president Rob Michael. Supposing his outlook holds water, the best time for a dividend growth investor with a 10-year time horizon to make an entry into AbbVie is somewhere between now and end-2024.

- Additionally, competition in the neuroscience segment may be intensifying. On October 8, 2022, FDA approved Daxxify injection for temporary improvement of moderate to severe frown lines, thus creating a new rival to Botox.

Drug-makers are known to weather recessions reasonably well. For that very reason, investors tend to flock to the pharmaceutical industry, causing the drug stocks to outperform the broader market.

Investor takeaways

Dividend kings form a fertile corner in the market where income investors pick high-yield and DGI stocks.

Our screening of dividend kings leads to the identification of two ideas that are in or near the window of opportunity:

- Altria offers an inflation-beating dividend yield and respectable dividend growth, underpinned by its thriving business. The current share price gives high-yield investors a large margin of safety.

- AbbVie is a DGI target. Its aging blockbuster Humira is in the process of being replaced by two emerging drugs hence the undervaluation. However, dividend growth may not suffer as much as perceived, thus creating a value opportunity.

A global recession, should it happen, is believed to have little impact on the financial performance of both companies. So, a generational opportunity may arise for investors who have been waiting on the sidelines to make an entry into two dividend kings, if their share prices go down with the broader market.

Be the first to comment