JasonDoiy

PayPal (NASDAQ:PYPL) started the week off as one of the worst performing stocks as it grapples with the aftermath of a PR crisis over the weekend that drew backlash from both investors and users. The stock lost as much as 7% of its value since Friday, with declines during Monday’s session alone surpassing 5% to mark its “biggest intraday decline since July 26”.

A #boycottpaypal outcry broke out on major social media platforms over the weekend, shortly after the company incorporated new terms within its “Acceptable Use Policy” (“AUP”) that included a $2,500 fine to users deemed to be spreading “incorrect information”, which would have come into effect November 3. The company swiftly retracted the clause, citing it was published in “error”. However, said efforts were “too little, too late”, as user discontent over PayPal’s dabble in “information policing” – something that has cost rival tech companies spanning Meta Platforms (META) to Twitter (TWTR) a fortune – has led to a flurry of account closures on the digital payment platform, wringing out the little hope it had for reviving total payment volume (“TPV”) and transaction revenues in 2H22 after multiple quarters of muted post-pandemic performance. The company’s earlier hopes of improving monetization of its expansive user base is now at risk given the latest PR mishap, which comes at an inopportune time as consumer spending also looks to soften further through 2023 ahead of a looming economic downturn.

As mentioned in our previous coverage on the stock, PayPal’s marked fundamental improvement in 2Q22 paired with its clearly laid out restructuring plan that would involve consolidation of focus on three of its core growth areas – namely, online checkout (“Checkout”), peer-to-peer payments (“PayPal” and “Venmo” apps), and digital payment processing (“Braintree”) – only represented the beginning of a potential turnaround for its battered valuation over the past year. And the company’s continued ability to deliver positive progress on its internal restructuring efforts remain a key focus area for investors, as it would determine whether it can remain a market leader in digital payment processing amid ongoing digital transformation tailwinds. Sustained margin expansion and revenue reacceleration were two core expectations for PayPal in 2H22 for any hopes of jump-starting renewed upsides in the stock. Yet, the company appears to be taking two steps back for every step forward with the latest PR crisis that has compounded the growing pains from near-term macroeconomic challenges, making it a risky investment still.

PayPal Should’ve Just Apologized

PayPal implemented a controversial update to its AUP over the weekend which included a clause that would find users $2,500 for the spread of misinformation. The update immediately sparked backlash from both users and investors, citing concerns that PayPal was overstepping users’ freedom of speech, with some even going to the extent of accusing the digital payment platform for outright “censorship”. A quick search of PayPal online and nothing short of disappointing commentary pops up – even high-profile figures like PayPal’s ex-President David Marcus and Elon Musk have chimed in on the criticism.

The company immediately removed the clause from its updated AUP, citing it was published in error, which inadvertently led to even more public backlash. The company apologized for the “confusion” caused by the debacle but not the debacle itself, leaving users unfazed as there was no direct address to why or how such a misinformation clause even came about.

To punt the latest PR crisis as a mere “error” implies larger problems at hand from our perspective. It implies that either internal controls over review and approval of policy documents were deficient – since writing up the AUP would and should have garnered significant oversight and a rigorous review process by senior management, including counsel – which draws skepticism over reliability of other areas pertaining to financial disclosures, or suggests that the company’s ongoing internal restructuring efforts remain a mess. Either way, PayPal’s latest crisis underscores the fragility of its credibility and reputation among both investors and users, compounding near-term pains stemming from a rapidly deteriorating macroeconomic outlook.

Looming Macro Impacts

On the macro front, the Fed’s steadfast commitment to bringing 40-year high inflation back on track towards its 2% target, which includes raising rates into restrictive territory at the cost of economic growth, spells further headwinds for PayPal’s post-pandemic recovery plan. While recent “SpendingPulse” data released by Mastercard (MA) shows consumer spending remained “relatively stable” in the three months through September, macro conditions have weakened rapidly following the Fed’s third consecutive jumbo interest rate increase of 75 bps, and their unanimous hawkishness on reining in inflation at all costs.

The combination of rising interest rates, stubbornly high inflation, looming recession risks, and surging dollar, among other macro challenges, implies a further slowdown in consumer spending in the current quarter and through 2023. As a result, investors are already expecting nothing less of “in line to slightly better than expected performance” from the payments processing industry – including PayPal – which makes management commentary on forward guidance a key determinant to where the stock might be headed over coming months:

Investors we spoke with agree that Q3/22 prints are likely to be pretty good given the Jul-Sept data trends, but are much more concerned around FY23 numbers, which based on Street estimates, look like they need to come down.

Source: RBC Payments, Processors & IT Services Weekly Update (October 9, 2022)

Recall from our last coverage that PayPal’s comeback plan involves a combination of focusing on growth across its core platforms (i.e. Checkout, PayPal, Venmo, Braintree), cutting costs to achieve annualized efficiencies of $900 million by year-end ($1.3 billion by 2023), and increasing monetization of its massive active user base of 426 million consumers and merchants.

Yet, at least two of three of the initiatives are now at risk, given rapidly changing economic conditions and now a PR crisis that could have been partially salvaged by a genuine apology (for those who follow the electric vehicle sector, an apology and acknowledgement of mistake similar to the one by Rivian (RIVN) for its pricing mishap earlier this year would have sufficed to stem the outflow of buyers, or in the case of PayPal, account holders/users).

As mentioned in the earlier section, deteriorating macroeconomic conditions mean TPV in which PayPal processes on its platform and charges fees on would slow as consumers taper back on spending. Meanwhile, the latest flurry of user account cancellations risks a deceleration in user growth, and could derail PayPal’s earlier optimism on improving user monetization. This creates a double-whammy on PayPal’s margins, as driving factors to both top- and bottom-line are expected to get squeezed as a result of near-term headwinds.

Quantified Implications of Near-Term Headwinds

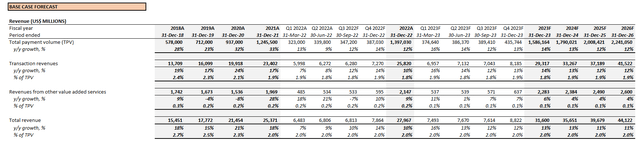

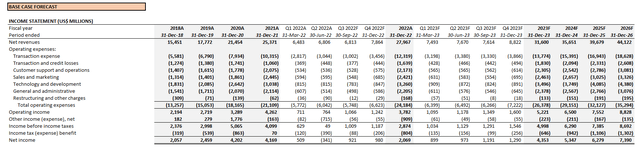

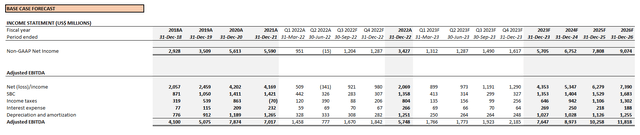

In order to gauge the bear case cost of both PayPal’s latest AUP mistake and deteriorating macroeconomic conditions on its fundamental and valuation prospects, we have adjusted near-term growth expectations in our latest base case forecast.

The Bear Case

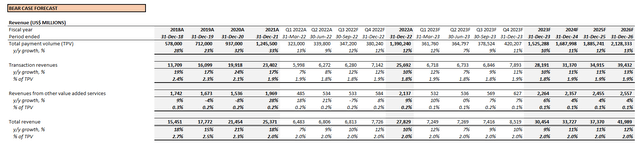

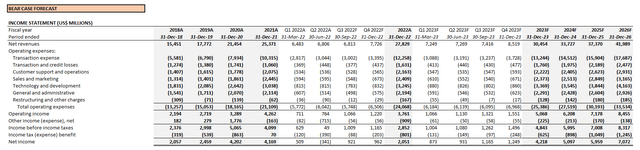

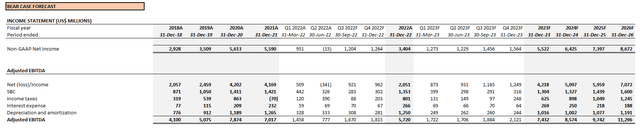

Considering anticipated weakness in TPV and deceleration in monthly active user monetization and growth as discussed in the earlier section – or worse, a decline in monthly active users, though unlikely given the Venmo partnership with Amazon (AMZN) beginning later in the quarter and seasonality tailwinds – we have revised our full year 2022 transaction revenue growth forecast for PayPal from 14% in the base case to 10% in the bear case. Forecast revenues for 1H23 have also been revised downward in anticipation of sustained near-term macro headwinds with the Federal Reserve eyeing to raise its policy rate from the current 3% to 3.25% range, to 4.6% next year.

PayPal Bear Case Forecast (Author) PayPal Bear Case Forecast (Author) PayPal Bear Case Forecast (Author)

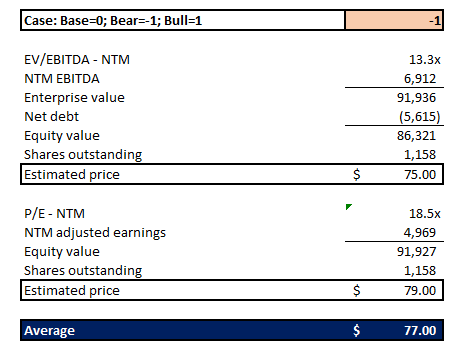

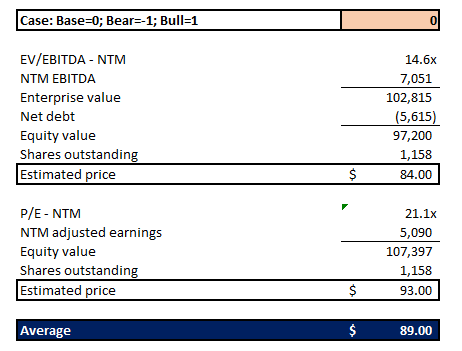

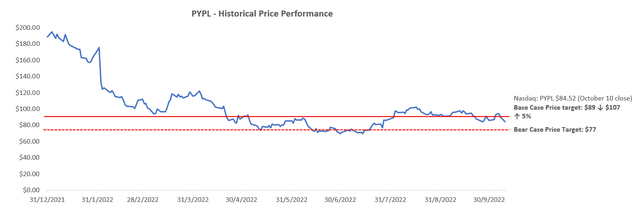

As a result, the stock could find itself dropping below the $80-level to as low as $77. The bear case PT is set based on PayPal’s current forward valuation multiple of about 13.3x EV/EBITDA and 18.5x P/E, applied on the bear case forecast discussed above. The methodology aims to reflect the valuation impact stemming from anticipated downward adjustments to PayPal’s near-term fundamental performance as a result of looming recession risks – a trend that buyside analysts have already implemented across the digital payment processing cohort – instead of further multiple contraction.

PayPal Bear Case PT (Author)

The Base Case

We are maintaining our previous fundamental forecast for PayPal as the base case, which would be in line with management’s guidance for 14% 4Q22 revenue growth and continued acceleration from rolling off of tough pandemic-era and ex-eBay (EBAY) comparables from prior years. The assumptions applied remains reasonable in the base case, considering Amazon’s upcoming implementation of Venmo payment processing on its platform, paired with upcoming seasonality tailwinds, would help draw additional TPV to PayPal, and potentially serve as a partial offset to any near-term macro-driven slowdown and/or impact from a deceleration in active user growth.

PayPal Base Case Forecast (Author) PayPal Base Case Forecast (Author) PayPal Base Case Forecast (Author)

However, we are revising our 12-month PT for PayPal under considerations that valuation multiples have contracted meaningfully since the Fed’s last interest rate hike of 75 bps in late September, as recession risks have elevated since it became clear the committee would be fixed on tightening “more aggressively” until there is structural evidence that inflation is back on track towards the 2% target. Our revised base case PT for PayPal is now $89, down from the previous $107. The $89 PT is derived by equally weighing the estimated price from a forward EV/EBITDA assumption of 14.6x and forward P/E assumption of 21.1x, which compares to the peer group average of 12.9x and 18.5x, respectively, to reflect PayPal’s earnings premium to peers.

PayPal Base Case PT (Author)

PayPal_-_Forecasted_Financial_Information.pdf

Final Thoughts

Under today’s volatile market climate, investors continue to look for nothing short of everything to compensate for elevated market risks in the near-term, spanning inflation impacts on corporate earnings margins, to rising borrowing costs’ impact on valuations and global economic growth. For PayPal, although it boasts a profitable business with robust free cash flows, its near-term growth profile may not recover as well as initially expected given rapid macro deteriorating that harbingers a potential decline or deceleration in TPV in 4Q22 through next year, which have now been compounded by pains of widespread boycotting of the platform by users.

The company has a lot of credibility to restore still before both investors’ and users’ confidence returns. Paired with increasing competition in the fintech space, which we have discussed in the previous coverage as a core investment risk facing PayPal, the company risks becoming obsolete with its growth and profit trajectory being structurally derailed, causing the stock to stay entrenched in the current slump if its restructuring efforts do not yield positive progress soon.

Be the first to comment