Evkaz

ARMOUR Residential REIT (NYSE:ARR) is a firm which invests in mortgage-backed securities. This business model aims to borrow money at one interest rate and buy residential paper assets at a higher yield, thus profiting from the difference. With the use of ample leverage, in theory, this can be a lucrative operation.

In practice, however, ARMOUR has delivered terrible results to shareholders over the past decade. And it continues to face challenging conditions today. The sharp rise in short-term interest rates drives up funding costs. However, long-term interest rates have not risen at the same speed, which has caused lending spreads to compress.

The REIT has struggled to navigate the current macroeconomic backdrop. It has seen large losses on its agency trading operations, which has resulted in an erosion of book value and a generally weak share price performance.

The Company’s Poor Earnings

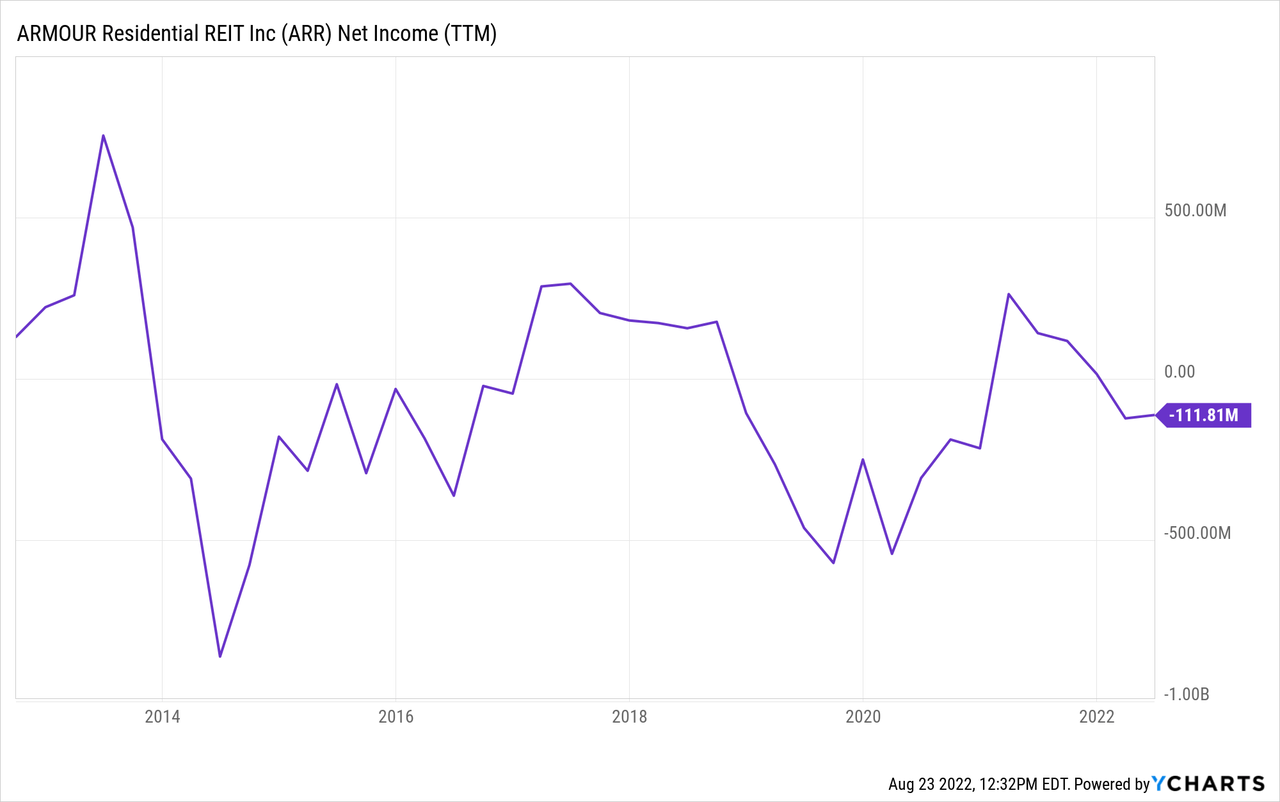

ARMOUR’s business model is based around exploiting opportunities with differences in interest rates between various markets. However, the company has struggled to achieve this in practice. Over the past decade, the company has run outright net losses the majority of the time:

After a brief spurt of profitability in 2021, ARMOUR returned to loss-making territory, and has currently produced more than $100 million of net losses over the past 12 months.

Last quarter alone, the company racked up a $59 million net loss, primarily due to losses in agency trading which more than matched its gains from derivatives and net interest income.

These struggles aren’t new, as the above chart shows. As of last quarter, ARMOUR has now generated an accumulated net loss of $653 million since inception. Needless to say, this is not something that is conducive to long-term shareholder value creation.

Poor Long-Term Returns

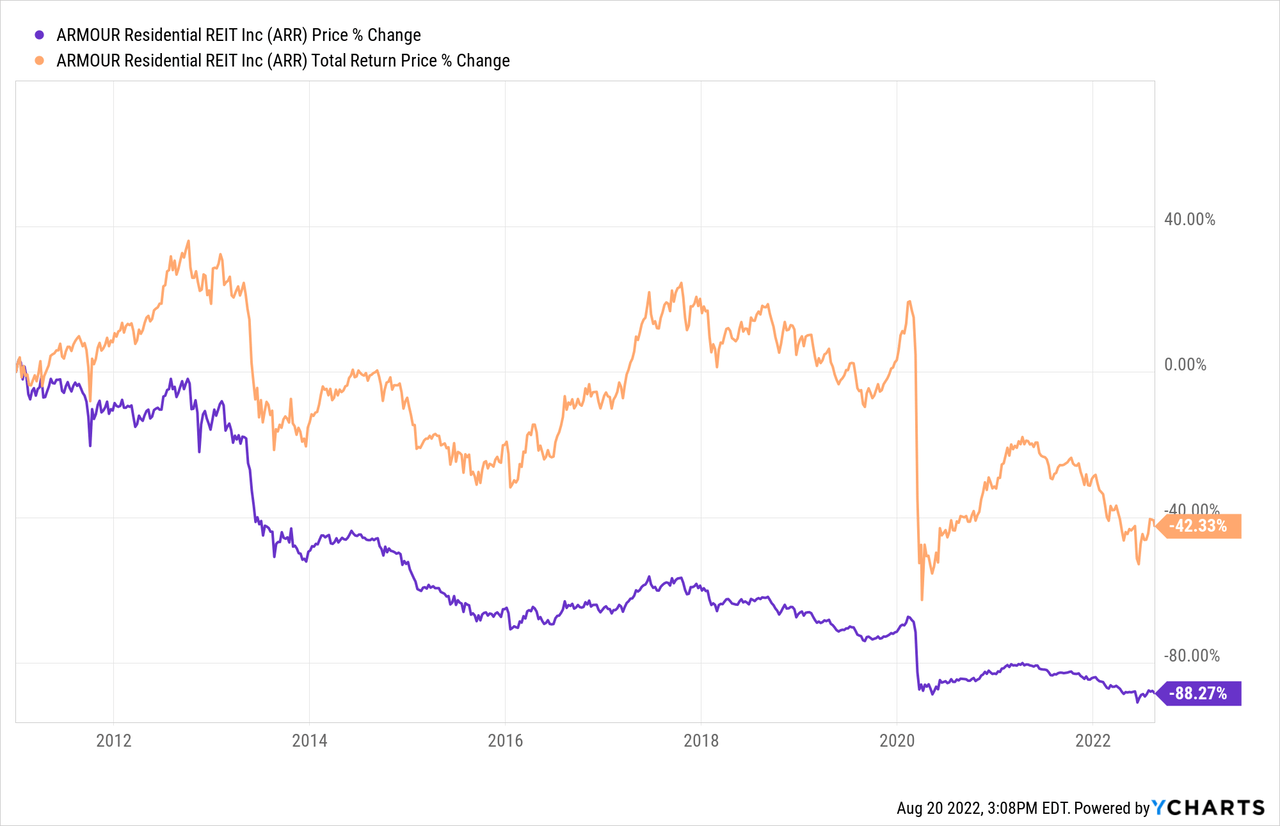

If an investor bought ARMOUR Residential at the end of 2010, just as the great housing bust was ending, you might expect that a mortgage REIT would have produced decent returns for a time. The housing market certainly recovered alright since then.

However, ARMOUR Residential was never able to produce lasting capital gains. Even counting dividends in the total return, ARR stock struggled to ever generate much of a positive total return. And, since 2020, the REIT’s total returns have veered sharply into the negative:

Now, since Jan. 1, 2011, ARMOUR Residential has produced a total return of negative 42%, with the stock price itself down more than 88%. The REIT has operated through rising interest rates, falling interest rates, and various moves in the housing market. It has seemingly proven unable to produce persistent alpha in any economic scenario, and at times, such as 2020, generated devastating losses for shareholders.

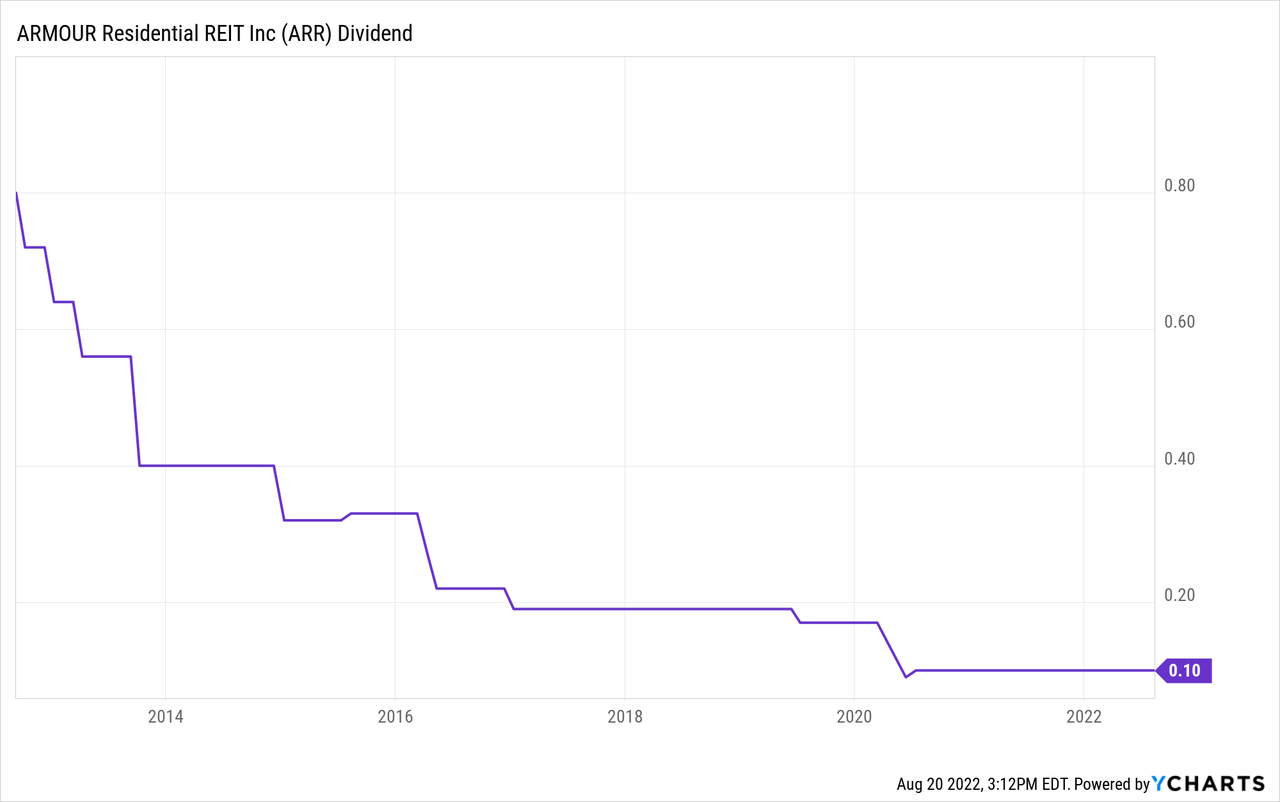

Dividend Is Unsafe, And Has Been Cut Frequently

Investors might still be tempted to latch onto the 16% dividend yield for a time. After all, that is a huge dividend today, and perhaps a shrewd trader could own it and then sell before the company cuts its dividend.

However, a look at the company’s historical dividend record shows that ARMOUR cuts its payout with regularity:

Given the company’s large operating losses, this makes sense. The company isn’t generating the sort of consistent earnings needed to cover its dividend payments. As such, the firm is frequently at risk of lowering its payout. The dividend yield may be 16% today, but that level of capital return is unlikely to persist for all that long.

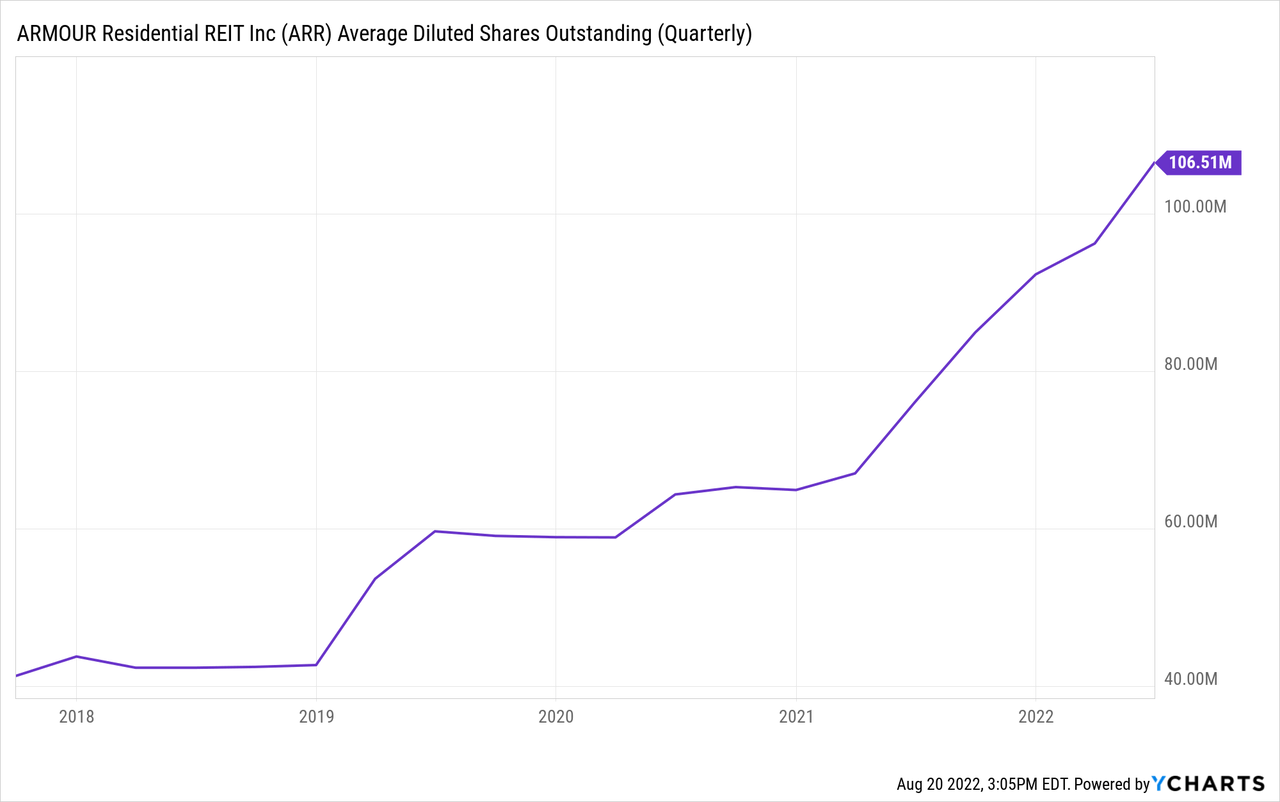

Dividend Yield Comes Largely From Share Dilution

While ARMOUR struggles to generate consistent operating profits, it does have to get capital from somewhere to fund its operations and dividend payouts. Largely, this appears to be from issuing new shares. Incredibly enough, the company has grown its share count from around 40 million to more than 106 million just since 2018:

Investors should always be cautious with firms that offer high dividend yields but which are also frequently issuing new shares of stock to the public.

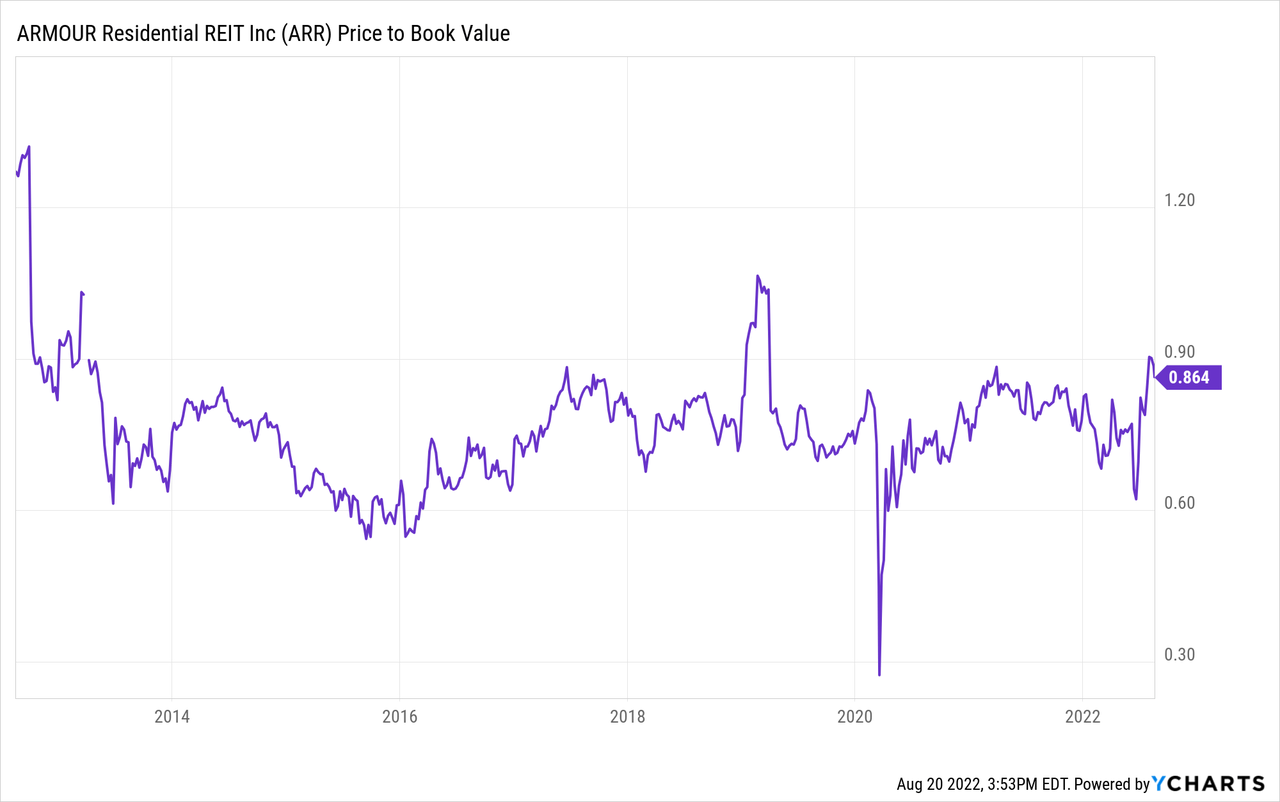

Valuing ARMOUR Residential On Book Value

At first glance, it might seem that you could make an argument for ARR stock being cheap due to its discount to book value. At this point, shares are going for around a 14% discount to book. In theory, this would suggest that investors are getting a good entry point.

Looking back over the past decade, however, ARR stock has almost always traded at a discount to book value:

In fact, the current 0.86x ratio is elevated compared to the REIT’s history. More traditionally, ARMOUR trades closer to 0.7x book on average, suggesting that shares might be 15-20% overvalued at this time on that basis.

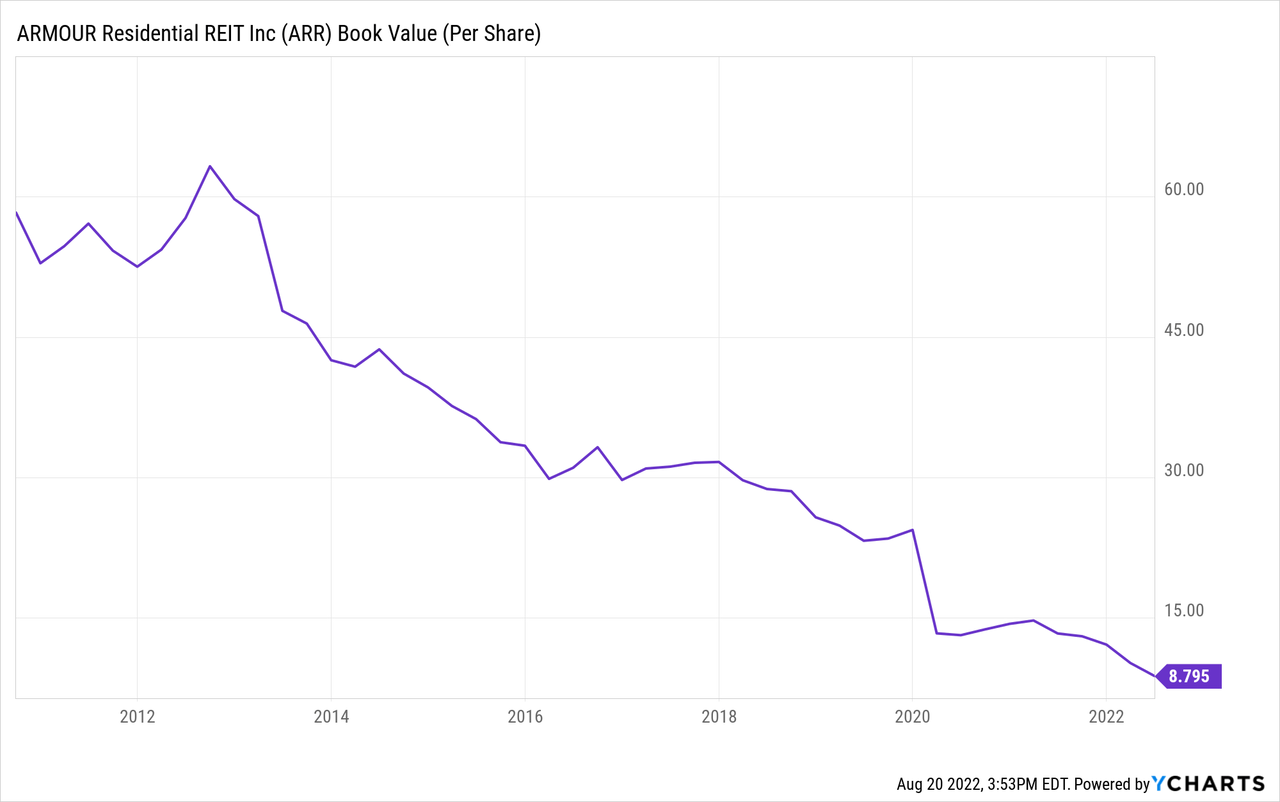

Perhaps more importantly, book value isn’t a fixed target. In ARMOUR’s case, its book value per share is almost always going down:

While it may seem like a margin of safety to buy below book value, ARMOUR’s book value per share has steadily decreased. As recently as the end of 2019, ARR stock had a book value of $25 per share. Now, it is under $9 and has declined most quarters since the pandemic began.

Even in the best of times, such as 2011 and 2016, ARMOUR was merely able to keep its book value per share flat. As such, a 14% discount to book value today is not nearly enough to suggest that shares are an opportunistic find at current prices.

ARMOUR’s Preferred Stock

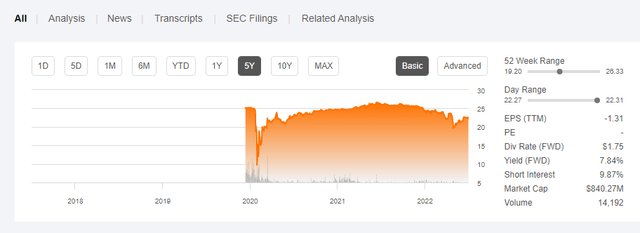

One other thing to consider is that ARMOUR has preferred shares as well, namely the ARMOUR Residential Preferred Class C (ARR.PC) which have a stated yield of 7%. As the price has currently fallen below par value, the preferred shares now yield 7.8%:

ARR preferred stock chart (Seeking Alpha)

As you can see, the preferred shares experienced a gut-wrenching drop during the initial stages of the pandemic, when it was unclear how badly the overall economy would be hit. They soon recovered, however, and have largely traded at or near par since then.

This makes sense. A 7% yield has been fairly attractive given the overall interest rate environment. And, since ARMOUR is consistently willing to dilute its common stock to raise capital, that gives protection to the preferred shares. It seems unlikely that ARMOUR would become incapable of paying its preferred dividend in the near future, since it can always either slash its common dividend and/or sell more stock to the public before the preferred would be endangered.

I don’t think the preferred shares are a great investment by any means. However, if forced to own one or the other, I’d much rather own the preferred stock than the common.

ARR Stock Verdict

At most, perhaps there are trading opportunities in ARMOUR Residential’s shares from time to time. For investors that follow interest rates closely, there may be brief periods where shares can outperform thanks to favorable market conditions.

The company’s long and painful track record, however, makes it clear that this is a poor choice for buy-and-hold or yield investors. The 16% dividend yield may seem tantalizing, but it has weak fundamental support behind it. Another dividend cut would not be surprising.

Be the first to comment