James Rolevink

During the two years since my last article about drone and missile manufacturer AeroVironment, (NASDAQ:AVAV), the stock has taken investors on a roller-coaster ride. Shares are up +160% over 5 years, but tepid over the past 12 months.

While we are bullish on defense industry stocks, we recommend holding AeroVironment shares at the present time. It sports a high valuation. We expect the average price target over the next 12 months to be in the low $90s; then, the stock will be a potential opportunity to accumulate.

Defense

In turbulent times, defense is the best offense. AeroVironment operates in an essential industry: aerospace and defense.

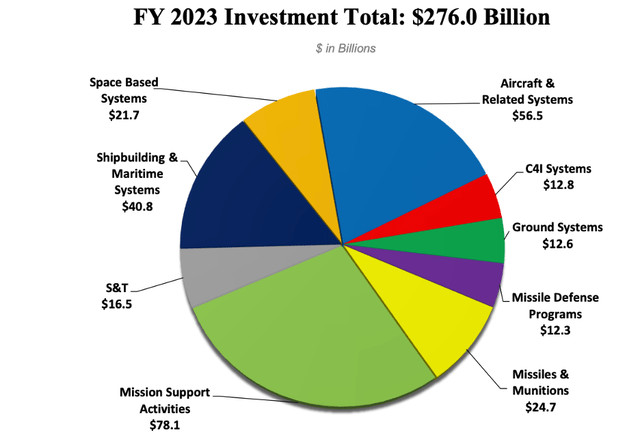

2023 Defense Dept Weapons (comptroller.defense.gov/Portals/45/Documents/defbudget/FY2023/FY2023_Weapons.pdf)

We have been bullish on aerospace and defense industry stocks since the outbreak of the pandemic. We are not ghoulish expecting riots and wars as supply chains crumble. Our premise is based on the following:

- Defense companies produce products always in demand.

- Drone sales to foreign nations bolster trade balances.

- The third reason we like defense stocks is the products must be replaced after use, and buyers make a long-term commitment to a supplier after contracting to buy their systems.

- Smart technology systems like AeroVironment provides are increasingly used in UAVs and missile deployment for military aggressive strikes and surveillance, imaging in agriculture, public safety, construction and mining, criminal investigation and land surveying.

The Company

We like AeroVironment because they primarily sell UAVs and missiles. These are the weapons of choice in modern warfare. For example, nary a rifle was shot in the last two Hamas-Israel conflicts was fired; the antagonists exchanged fire from drones and missiles (Israel also used jet fighters). In the Russia-Ukraine war, the weapons most used are rockets, missiles, and drones.

AeroVironment, Inc. designs and manufactures robotic systems, aerial, and aircraft systems and related services. The company sells to governments and businesses worldwide. It operates through four segments: Unmanned Aircraft Systems (UAS), Tactical Missile System (TMS), Medium Unmanned Aircraft Systems (MUAS), and High Altitude Pseudo-Satellite Systems (HAPS). Its airborne platforms, payloads, and payload integration systems, ground control systems, ground support equipment and other items and services related to unmanned aircraft systems are AeroVironment’s specialties.

They generate revenue from small UAS products, including spare equipment and parts, alternative payload modules, batteries, chargers, repair services, and customer support, and hand-held ground control systems. It develops high-altitude pseudo-satellite UAS systems, as well.

Almost half of the company revenue comes from US Defense Department contracts. Another 33% generates from other government agencies and their subcontractors. Foreign and commercial customers account for 20%. Commercial accounts needing drones generate a small portion of AeroVironment’s revenue.

Low Grades

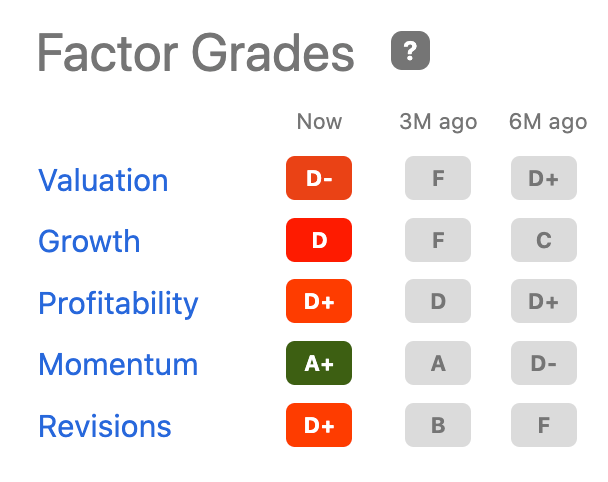

AeroVironment consistently gets low performance grades. The shares have a low beta of 0.66. But the shares have gained less than 6% over the past year and short interest is on the rise now closer to 4%.

The share price was ~$60 in June ’20. It subsequently skyrocketed to $137 in early 2021, then plummeted to $56 in January ’22, and is closing out the second week of August ’22 topping +$103. Clearly, AeroVironment is not for those with low risk tolerance. Shares are up 6.27% for the year, during which shares hit a 52-week high of $114.

Quantifiable signs have been in the red for a long time, except for momentum, and continue to show weakness. Seeking Alpha’s Quant Rating is a “hold” but moving in the “sell” direction. Sentiment in the financial world is bullish on AeroVironment. SA authors consistently rate the stock a buy or strong buy since June 2021.

SA Factor Grades AVAV (seekingalpha.com/symbol/AVAV)

Downer Valuation

It is our opinion that the share price will slip into the mid-$90s before they climb much higher factoring its historical multiples (PE Ratio, PS Ratio, PB Ratio and Price-to-Free-Cash-Flow), the company’s past returns and growth, and our future estimates of the business performance. Over the trailing 12 months, the return on equity is -0.69%. Asset growth is -1.04%.

Hedge funds and corporate insiders are selling, about 127K shares over the last quarter and three-quarters of a million dollars in stock over the last three months, respectively. The company scheduled its next earnings report for September 6, 2022. We expect Q1 ’23 earnings to be around $0.11 compared to the same quarter last year reported at -$0.17. In Q4 ’22, AeroVironment reported EPS of $0.30.

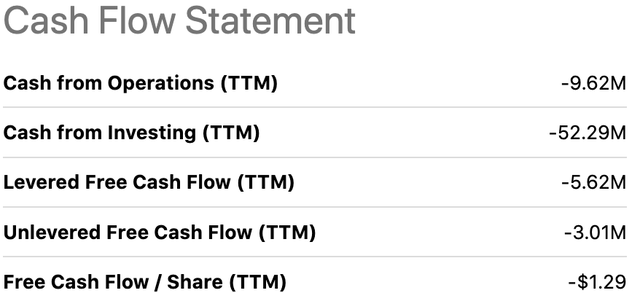

Another downside is the lack of a dividend for long-term investors. The company’s cash flow is in negative territory. In June ’22, management reported $216.57M in debt; this is up from the previous quarterly report of $190.4M.

Cash Flow (AeroVironment, Inc. (AVAV) Stock Price Today, Quote & News)

Its stock price composure and revenue growth seem indestructible, i.e., this is a low-risk investment, in our opinion. Yet, for example, its EBIT spikes and tumbles; over the last 6 quarters:

- -0.001B. Jan ’21

- +0.018B Apr ’21

- -0.012B. July ’21

- +0.003B. Oct ’21

- -0.014B Jan ’22

- +0.013B Apr ’22

Last Shot

We do not foresee any dark vulnerabilities. The best way to describe our sentiment about AeroVironment is investor angst. It is the putative consensus in the financial community, too.

Its market cap is $2.55B, allowing it to make acquisitions that are supportive of the company’s mission. AeroVironment bought Arcturus UAV in 2021 and Planck Aerosystems this year. The latter enhances AeroVironment’s UAV systems capabilities for operations from moving vehicles and sea-going vessels. We believe the best potential opportunity for retail value investors is when the stock pulls back 10% to 12%. You can subscribe to SA here if you want to read the reasons and other articles about AVAV.

Be the first to comment