D-Keine

Introduction

Suncor Energy (NYSE:SU) saw a strong recovery during 2021 and upon entering 2022, investors could expect a high 7% shareholder yield at worst, if not even a very high 15%+ yield, as my previous article highlighted. They have not disappointed on this front with a large dividend increase seeing their yield at a moderate circa 4.50%, depending upon exchange rates, although their share price remains relatively low versus their peers with an activist investor circling wanting to shake up the business to unlock value via downstream divestitures. Whilst too early to comment upon their resulting strategic review, in my eyes, a low share price is not your enemy in the medium to long-term, as discussed within this follow-up analysis that also covers their recently released results for the second quarter of 2022.

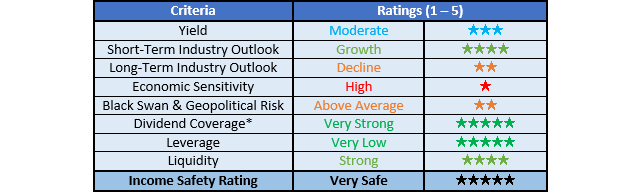

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

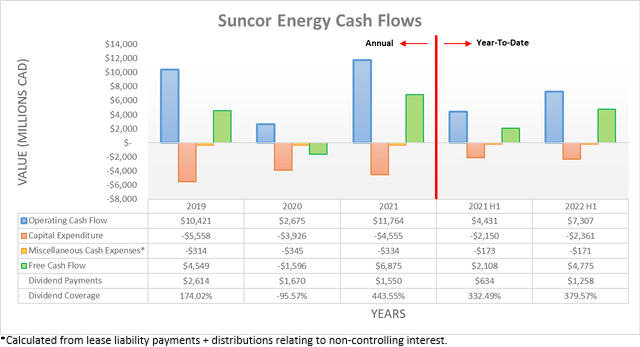

After enjoying a strong recovery during 2021, unsurprisingly, their cash flow performance continued to power even higher during the first half of 2022 on the back of the booming operating conditions seen across the oil and gas industry. On the surface, this is easily evident with their operating cash flow landing at C$7.307b and thus almost a massive two-thirds higher year-on-year versus their previous result of C$4.431b during the first half of 2021. Whilst the latter did not see a material working capital movement with a small draw of only C$146m, the same definitely cannot be said for the first half of 2022 that saw a sizeable build of C$2.066b. If removed from their results, their underlying operating cash flow is significantly higher at C$9.373b and thereby represents an extremely impressive increase that is now slightly more than double their equivalent previous result of C$4.285b during the first half of 2021.

Even more importantly, this change also flows through directly to their free cash flow during the first half of 2022 and thus boosts their surface-level result from an already very strong C$4.775b to an immense underlying result of C$6.841b. In fact, this effectively matches their full-year 2021 results of C$6.875b despite only being half the length of time. If annualized, it would equal a massive free cash flow yield of 23%+ given their current market capitalization of approximately $45b, which translates to circa C$58.5b at the prevailing USD to CAD exchange rate of 1.30.

This free cash flow helped support very solid shareholder returns with the first half of 2022 seeing C$3.38b of share buybacks that came on top of their C$1.258b of dividend payments, making for a total of C$4.638b. If annualized and compared to their current market capitalization, this would represent a very high shareholder yield of almost 16%, thereby matching the expectations from my previous analysis.

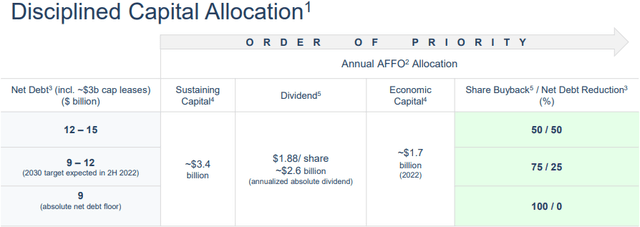

Whilst their free cash flow may soften during the third quarter of 2022 as oil prices have slid back to below $100 per barrel, their share price will still see a very high double-digit free cash flow yield. Even if operating conditions plunged back to their business-as-usual levels of 2021 and thus dragged their annual equivalent free cash flow down accordingly, their free cash flow of C$6.875b during 2021 would still leave a very high free cash flow yield on current cost of almost 12%. This very desirable free cash flow minimizes downside risk since their current share price would still be reasonable even if their booming financial performance subsides. Equally as important, it provides ample capacity to execute their shareholder returns policy, as the table included below displays.

Suncor Energy Second Quarter Of 2022 Results Presentation

It can be seen that their shareholder returns policy sees C$2.6b per annum allocated to dividend payments with the remainder of their free cash flow directed towards share buybacks and deleveraging. The former stands to see its current 50% allocation increase progressively to 75% and eventually 100% as they reach their net debt targets of C$12b and C$9b respectively, the former of which being expected during the second half of 2022.

Their shareholder returns policy is no different than when conducting the previous analysis, although it nevertheless was important to provide as a reminder to explain why their low share price is not your enemy. Even though their share price of $32.62 is far above its 2020 lows of circa $11, it nevertheless is still only broadly around the same level as during late 2019 before the Covid-19 pandemic. This is a stark contrast to their oil sands peers, Canadian Natural Resources (CNQ) and Cenovus Energy (CVE) who see their respective share prices roughly 80% and 100% higher across these same two points in time, which naturally should see the shareholders of Suncor Energy feeling disappointed.

Whilst yes, the idea of a higher share price is obviously alluring for shareholders given the quick profits possible, if thinking further into the medium to long-term, their low share price is not nearly as bad as could be assumed. Since their shareholder returns policy focuses heavily upon share buybacks, a low share price allows these to have a relatively greater effect through repurchasing more shares than if their share price was higher.

I have often stated through my library of articles, I am a fan of dividends over share buybacks but in this situation, at least they are being conducted at a share price that would be reasonable even if their booming financial performance subsides. More so, this lower share count should allow their C$2.6b allocated to dividend payments to provide higher dividends on a per share basis than if their share price was presently soaring much higher. To phrase this another way, despite shareholders missing out on higher capital gains right now, in return they see prospects to receive higher dividends perpetually into the medium to long-term, which helps close the gap and thus in my eyes, makes their low share price less of an enemy to your overall returns.

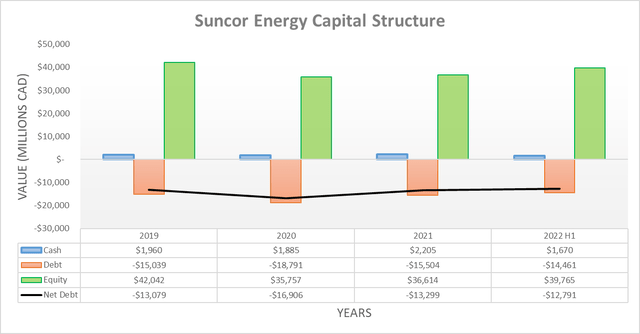

When turning to their financial position, it was positive to see their net debt continued decreasing during the first half of 2022, despite their sizeable C$2.066b working capital build and C$4.638b of shareholder returns. This now sees their net debt down to C$12.791b versus its previous level of C$13.299b at the end of 2021, although if including their leases as practiced by management and forms the basis of their net debt targets, their net debt is now at C$15.699b versus its previous level of C$16.149b at the end of 2021. Regardless of the approach, both have seen similar improvements and if not for their sizeable working capital build, their net debt would have been only C$10.725b or C$13.633b if also including their leases. Since their working capital build should cease or preferably reverse into a draw during the second half of 2022, this means they should have no issues reaching their C$12b target during the second half of 2022 as management expects, thereby seizing the benefits of their low share price.

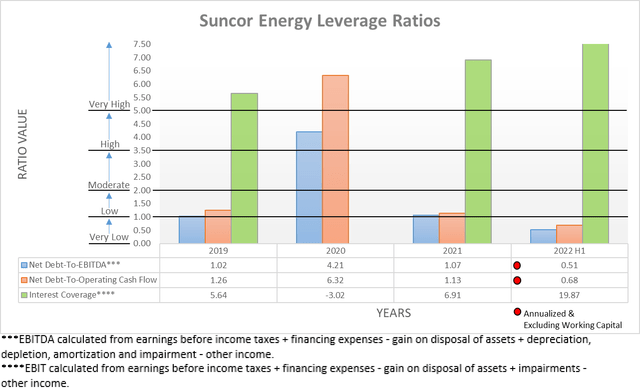

The booming operating conditions during the first half of 2022 made it certain that their leverage would continue its downward trajectory leading up to the end of 2021. This saw their respective net debt-to-EBITDA and net debt-to-operating cash flow decrease to 0.51 and 0.68 versus their previous respective results of 1.07 and 1.13, which are both now beneath the threshold of 1.00 for the very low territory, as was expected when conducting the previous analysis. Even though this already leaves their financial position very healthy and thus capable of returning the entirety of their free cash flow to their shareholders, management intends to build a financial fortress and as a result, their leverage will see further decreases along with their net debt, relative to the influences of the prevailing financial performance.

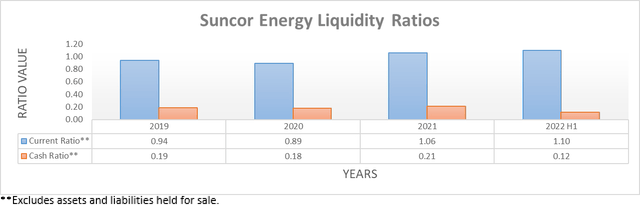

Following the very favorable start to 2022, it was not surprising to see their current ratio edged higher to 1.10 after the second quarter versus its previous result of 1.06 at the end of 2021. Since their cash position dropped to C$1.67b versus C$2.205b across these same two points in time, their cash ratio dropped to 0.12 versus 0.21, respectively. Thankfully, these still indicate strong liquidity and when looking ahead, their large operational size, immense free cash flow and continued deleveraging will help ensure they continue finding support in debt markets to provide liquidity and refinance any upcoming debt maturities if required, regardless of whether central banks further tighten monetary policy.

Conclusion

Even though the idea of profiting from a soaring share price is alluring for shareholders, thankfully their low share price is not your enemy as their shareholder returns policy focuses heavily upon share buybacks. If their low share price remains persistently low, these share buybacks will have a greater effect and thus result in higher medium to long-term dividends on a per share basis. When combined with their very healthy financial position and very desirable free cash flow that minimizes downside risk, I believe that maintaining my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Suncor Energy’s SEC filings, all calculated figures were performed by the author.

Be the first to comment