Stewart Sutton/DigitalVision via Getty Images

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) recently reported second quarter earnings, displaying a simply outstanding level of profitability. We also get an extra-juicy dividend this quarter thanks to a catch-up payment. On the downside, the 40% yield others point too is likely now behind us and net debt appears to have returned to the company. Despite these seeming downsides, I will explain why the debt is not as big of a deal as you might think and analyze ZIM’s dividend safety (a double-digit yield is still in the cards for 2023).

Fabulous Earnings That Remain Impressive Even If Rates Continue To Fall

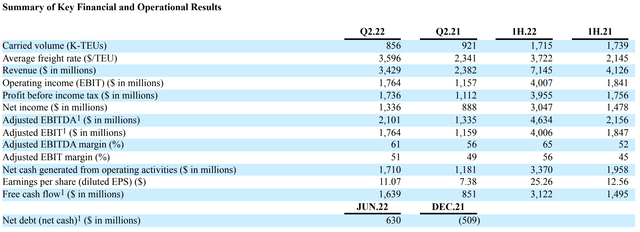

ZIM posted impressive results for the second quarter, with net income of $1.36 billion, or $11.07 per share (a 50% increase from a year ago). The company carried about 7% less cargo volume compared to the second quarter of 2021, but made up for lower volume with much higher freight rates.

The second quarter of 2022 saw ZIM achieve an average freight rate of $3,596 per TEU. This is equivalent to $7,192 per FEU (the metric used by Freightos’ Container Index).

ZIM Second Quarter 6-K

While $7,192 for the second quarter is 35% down from the Container Index’s peak of $11,109 in September 2021, it is still 54% above quarter two of 2021’s FEU-equivalent freight rate of $4,682.

Freightos Baltic Index (FBX): Global Container Freight Index

Since the second quarter, freight rates have continued to fall, currently standing at $5,820 for the Freightos Global Container Freight Index. This level is still 24% higher than the second quarter of last year. However, given that rates were rising during this period last year (peaking in September), the comparables for the third quarter are going to be much tougher for ZIM and other container names.

Additionally, going forward, ZIM has slightly more expensive charters and fuel costs that will put some slight pressure on margins (though even at $4,000 rates, those shouldn’t be a huge deal).

Despite these falling rates, the good news is that ZIM is still very, very profitable. At rates lower than today’s in the second quarter of 2021, ZIM was still raking in $888 million in net income. There is still an unknown risk as to where rates will normalize, but even if rates drop another 25%, ZIM is bringing in cash hand over first.

As I mentioned in my previous article on ZIM, there are routes where rates continue to climb or have not fallen as hard as the Asia to West Coast route that sees so much volume. And if ZIM can execute on its “global-niche player” strategy, then perhaps it can capture some of those higher rates.

Dividend Not Quite The Oft-Flaunted 40%, But Still Generous

ZIM updated its dividend policy this quarter to pay out 30% of net income each quarter.

Commencing with the dividend for the second quarter of 2022, ZIM intends to distribute a dividend to its shareholders on a quarterly basis at a rate of approximately 30% of the net quarterly income (up from 20% of net income) of each of the first three fiscal quarters of the year.

The company still aims to pay out 30-50% of its total net income annually, with an outsized fourth quarter payment still in the cards. This quarter’s dividend of $4.75 was disproportionately large because it included 30% of this quarter’s net income, as well as a 10% catch-up payout of last quarter’s net income.

Combining the catch-up with the original Q1 payout gives us $4.27, which is substantially (28%) higher than the Q2 payout of $3.33 once you’ve moved back the $1.42 catch-up payment to where it belongs. This decrease (alongside sliding shipping rates and falling EPS) suggests that ZIM’s trailing 40% yield is not to stay.

Though authors love to talk about ZIM’s yield in the highest terms possible (and a 40% yield does sound good), what really matters is not the company’s trailing yield but how much we can expect it to yield going forward. This is why I have been much more conservative in my predictions, quoting a 20% yield in the past, which I admitted was likely an underestimate for this year at least. But better to be on the lower side.

With the company’s new dividend policy, nothing really changes on an annual basis, but dividend payments are more consistent. This became clear on the conference call, with the company confident in paying 30% annually as it expects to remain profitable longer-term:

So that’s meant at the end of the day that we would always end up or very likely always end up with a significant higher dividend payment once a year when we release our full-year financials, if it is just only because we would catch up from 20% to 30%.

As we feel confidence in our ability to continue to generate quarter-after-quarter ongoing profit then we feel there is no real reason to hold back for the first three quarters then to catch up to get to at least a 30% once a year, hence why we have made that change today.

This is good news for investors. But back to the question of yield. I, personally, think that a promoting the expectation of a 40% ZIM yield is slightly disingenuous. Yes, the company does currently have an outrageous yield and yes it really does have a trailing 40% yield, but this cannot last forever.

Now, that does not mean the music is going to stop completely, just slow down. For example, if rates slide to around $4,500 per FEU, which is just below the average for 2021’s second quarter, ZIM could still post a net income of $800 million per quarter. At a 30% payout, the company would still have an annual yield of 16%—not 40%, but not too shabby. If the company were to payout 50% of its income (still a possibility, albeit perhaps less likely as ZIM may become slightly more conservative in the current environment), then the company could be yielding 26.6% annually.

Balance Sheet (Q)II: The Return of Debt???

If you, like I did, read ZIM’s 6-K for the second quarter, you might have noticed this little tidbit snuck in there:

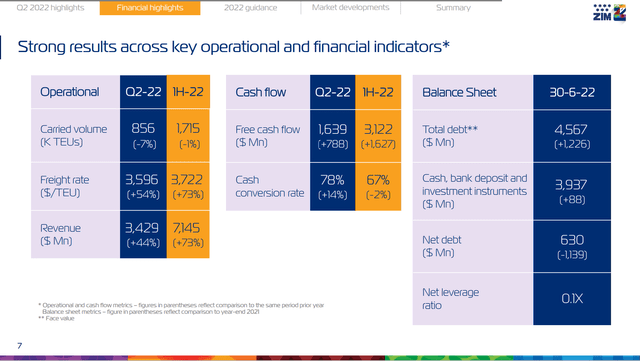

Net leverage 1 ratio of 0.1x at June 30, 2022, compared to 0.0x at December 31, 2021

You might have also noticed this slide from the company’s earnings presentation:

ZIM Second Quarter Earnings Presentation

Well, if you were not a party to a very lively discussion about the proper manner to account for lease liabilities in my last ZIM article, let me bring you up to speed.

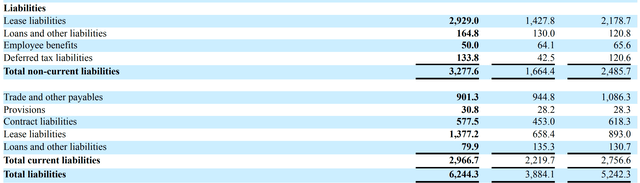

ZIM does not have “debt” as many would conventionally think of debt. Save for $244.7 million in “Loans and other liabilities” that is hardly significant for a company with $946.8 million in straight-up cash.

ZIM Second Quarter 6-K

The vast majority of ZIM’s “total debt” of $4.567 billion is composed of lease liabilities. Now, this is not debt per se but represents operating leverage; ZIM has an obligation to pay for charters it has signed in the future. But it also receives the right to use vessels in exchange for those payments and does not have to pay interest on that underlying principal on its balance sheet. So, in reality, as long as ZIM can continue to employ its ships profitably, this is nothing of a concern at all (even though I expect the leverage ratio the company reports may climb up some as EBITDA drops).

Valuation

As noted in the above excerpt from the company’s presentation, ZIM has $3.94 billion in cash and short-term securities. And while the company has a “total debt” larger than that on a technical level in its accounting, the payment of lease liabilities is paid by as an operating cost of the leased vessels at the same time as ZIM is using them to earn a hefty net income. As a result, ZIM functionally has two thirds of its $5.9 billion market cap in cash. Even at current rates, ZIM could conceivably have its entire market cap worth of cash on its balance sheet by the end of the year (though inevitably it will pay out 30% of Q3 and Q4 net income in dividends).

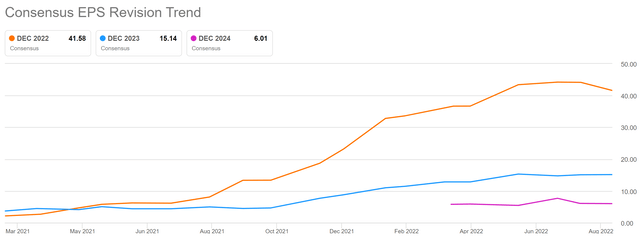

ZIM is a hard company to value given its cyclical nature, but with functionally no debt outside of lease liabilities, the company has enormous room to maneuver and excellent margins. Current earnings estimates for ZIM show the company’s EPS dropping like a rock for 2023.

ZIM Earnings Revisions (Seeking Alpha)

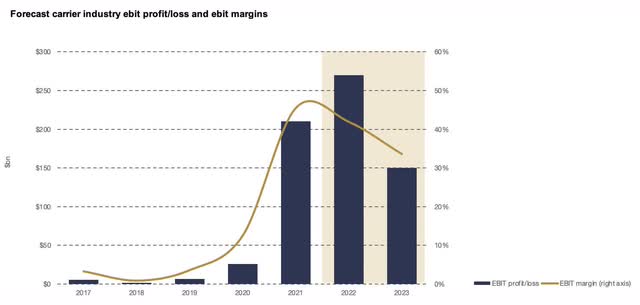

However, a recent forecast from Drewry Maritime Research, expects overall industry profits (topping $270 billion this year) to fall to $150 billion next year.

Forecast Carrier EBIT Profit/Loss and Margins (Drewry Maritime Research)

Though this is significantly less than 2022 earnings, this shows that one of the industry’s leading analysts expects profits to normalize at a much higher level than ZIM’s EPS projections would suggest. If ZIM’s EPS come in as Drewry’s industry projection suggests, the company would post $22.87 in profit for 2023. This lines up roughly in line with my projections for $8 in dividends on $4,500 normalized FEU rates. At such levels, the company is trading at a price to earnings ratio of 2.15—and that is ignoring the third and fourth quarters of 2022. Overall, all signs point to ZIM being cheaply valued.

Takeaway

ZIM’s second quarter was fantastic. The company is still immensely profitable. However, rates are also still falling. And a 40% yield may be now becoming an artifact from the fantastic 2021-2022 rate peak. Nonetheless, ZIM is being valued as if the company might as well cease to exist come December. And that is far from true. ZIM has the potential to remain a super strong earner for years and pay out a “more modest” 16% yield in 2023. ZIM’s comparables (due to a somewhat delayed but sharp ascent in rates in the first half of 2021) for the third and fourth quarter are going to be much tougher than this quarter, and that may weigh on its share price.

In the end, ZIM is certainly a seemingly-riskier play than it might have seemed in 2021 when everything was on the up-and-up for shipping, the company still has many good days ahead and is offering a more-consistent double-digit yield.

Be the first to comment