igoriss/iStock via Getty Images

Airbnb (NASDAQ:ABNB) provides a marketplace for short-term rentals which has witnessed a surge in demand over the past few years. Consumer spending power is declining rapidly and a softening of labor markets is likely to reduce the amount of remote work. A normalization of demand for short-term rentals will pressure Airbnb’s growth and profit margins and it is not clear that this has been priced into the stock.

Market

Despite the claims of Airbnb, guests appear to be attracted to Airbnb by practical attributes (cost, location, amenities) rather than experiential attributes (novelty, interaction). Most Airbnb guests also likely view the service as a substitute for hotels and would still undertake their trip if Airbnb was not available. This suggests that Airbnb is a fairly direct competitor to hotels.

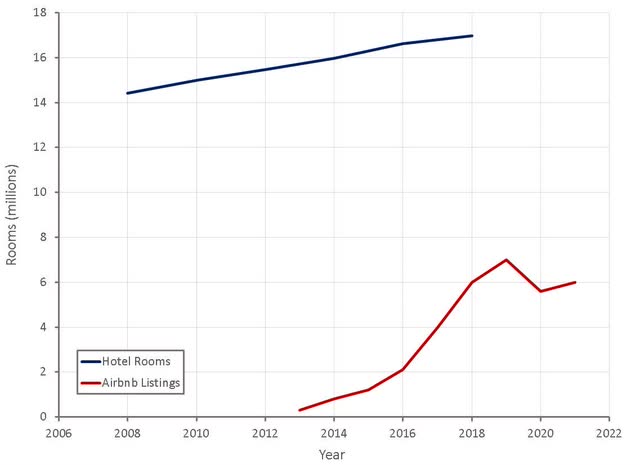

It is estimated that there are 17.5 million guestrooms in 187,000 hotels globally. The hotel and tourism industry typically accounts for about 10% of worldwide GDP. Over the last decade Airbnb has led to a massive surge in accommodation options for travelers, with large implications for the market. Airbnb has more rooms listed on its platform than the top 5 hotel chains have in their portfolios combined.

Figure 1: Hotel Rooms and Airbnb Listings Globally (source: Created by author using data from Statista and Airbnb)

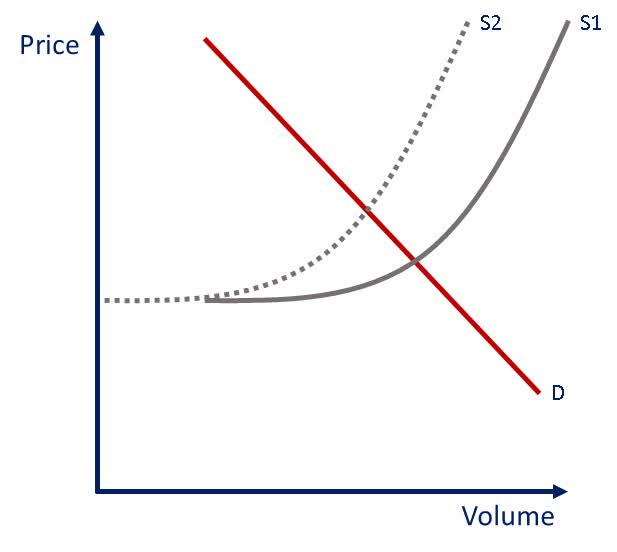

Data indicates that for each 10% increase in the size of the Airbnb market, hotel room revenue declines by 0.4%. Research also shows that there is a negative correlation between Airbnb expansion and hotels’ average daily rates in the 10 US cities with the largest Airbnb presence.

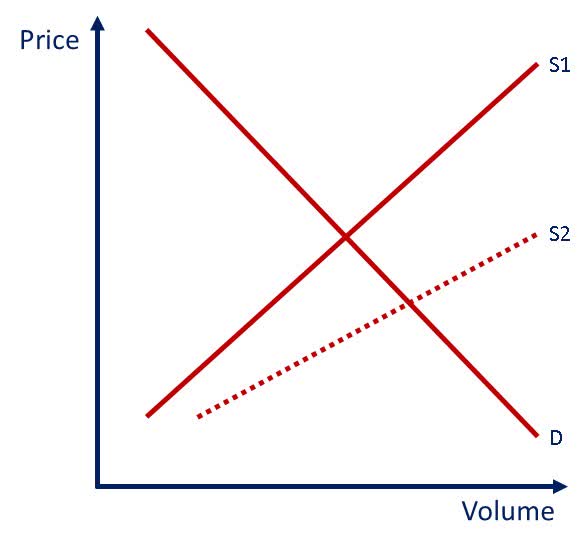

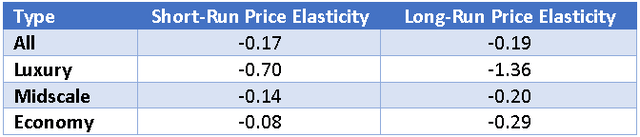

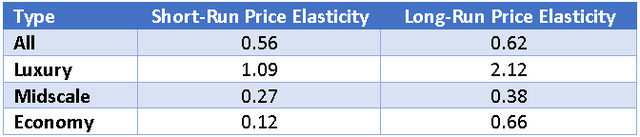

This is not surprising, as research indicates that the price elasticity of demand for hotels is inelastic in both the short and long run. Meaning that an increase in supply that leads to lower prices would be expected to reduce industry revenue.

Figure 2: Illustrative Impact of Airbnb on Short-Term Stay Supply (source: Created by author)

Price and elasticity is considerably larger for higher quality hotels and is greater over longer periods of time. Elasticity also tends to increase with data disaggregation, as price increases in a particular market (quality or geography) may incentivize people to choose an alternative city or type of accommodation.

Table 1: Hotel Price Elasticities of Demand (source: Created by author using data from https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1291&context=jhfm)

Airbnb’s value proposition generally falls under unique properties or properties that are relatively inexpensive for their size / quality. The average daily rate for hotel rooms in the US was approximately 130 USD in 2019. The average daily rate for short-term rentals in the US is 288 USD, although this is difficult to compare to hotels due to the difference in listing types.

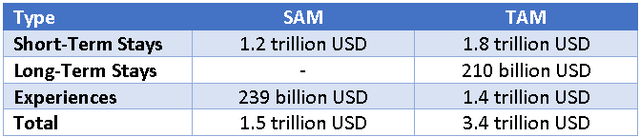

Airbnb estimate that their serviceable addressable market is currently 1.5 trillion USD, and that their total addressable market is 3.4 trillion USD. Airbnb’s current level of bookings indicates something like a 4% penetration of the SAM and a 2% penetration of the TAM. Due to the inelastic nature of hotel demand, Airbnb may find that their addressable market actually shrinks as their business grows.

Table 2: Airbnb Addressable Market (source: Created by author using data from Airbnb)

The hotel and short-term rental markets have been significantly impacted by the pandemic. Demand initially plummeted due to travel restrictions, but has since surged due to pent up demand and high consumer savings.

The remote work boom during the pandemic also potentially increased Airbnb demand by allowing workers to travel while continuing to work. The COVID pandemic caused a spike in remote work, with nearly a third of employees still working from home part time or full time as of August 2022. If this is the case, a reduction in remote work could create significant headwinds for Airbnb.

Part of the reason that remote work has proven relatively sticky, could be due to employee preference and the relatively high bargaining power of employees due to current labor market conditions. An economic slowdown and subsequent slackening of labor markets could rapidly change this situation and reduce the amount of remote work.

There appears to be a preference for laying off remote employees, with 60% of surveyed managers stating it’s more likely that remote workers will be cut first. The survey was of 3,000 managers across a wide spectrum of sectors, including health care, finance, retail, software, and construction.

The pandemic also appears to have caused a shift towards longer stays, which again could be related to remote work. Stays of 28 days or more remain Airbnb’s fastest-growing category by trip nights compared to 2019. Long-term stays have increased almost 90% since Q2 2019. Nearly 50% of Airbnb’s nights are 7 days or longer and nearly one fifth of Airbnb’s business is over 28 days. This could be part of the reason why Airbnb’s business has performed well relative to hotels. This outperformance is also likely due to Airbnb’s greater reliance on leisure travelers, rather than business travelers.

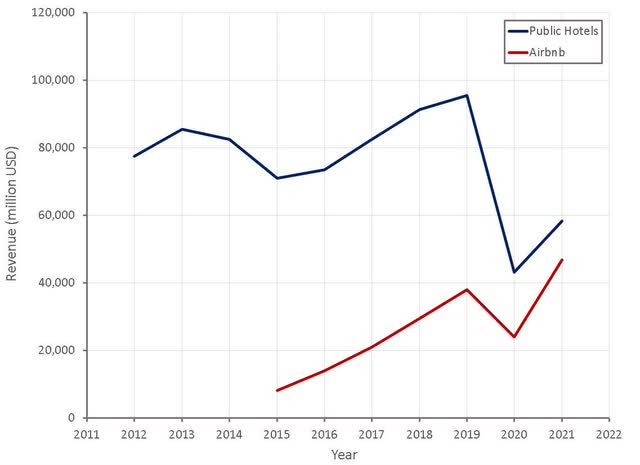

Figure 3: Publicly Listed Hotel Company and Airbnb Revenue (source: Created by author using data from company reports)

The pandemic saw a large increase in both the supply of and demand for short-term rentals. Occupancy rates have been above historical norms and as a result, so have average daily rates. The market has begun to correct somewhat, but is still extremely strong.

Airbnb

Airbnb provides a platform that is essentially an online marketplace for short-term lodging rentals and collects a fee from hosts and guests for acting as a broker. The company was founded in 2008, and similar to Uber (UBER), its success has largely come on the back of providing trust to enable a new market.

Airbnb’s solution to the trust problem includes host and guest profiles, integrated messaging, two-way reviews, risk scoring, watchlist and background checks, cleanliness standards, secure payments, fraud and scam prevention and insurance. Importantly, the review system provides a scale based advantage, as guests and hosts with a longer history and a greater number of reviews are more likely to be trusted. Collectively, hosts and guests have written more than 430 million cumulative reviews as of September 30, 2020.

The approach of hotels to the travel industry has historically been a one size fits all approach, which may have limited the size of the market. Airbnb is enabling far greater diversity in the types of properties available and providing travelers with access to more unique experiences. Airbnb has over 7 million listings in approximately 100,000 cities around the world.

Airbnb’s existing supply should already be raising questions about the potential for further growth. Within the hosting segment, Airbnb can add more properties within existing cities, add properties in new cities or increase the utilization of existing properties. Adding properties in existing cities is already becoming problematic in some areas due to negative externalities. Taken too far, this will increasingly result in regulatory pushback in the future. Airbnb may also have limited scope to add properties in new cities. Looking at the size distribution of cities globally, Airbnb will need to penetrate smaller cities (<10,000 population) to meaningfully expand, and it is not clear that there will be tourist demand for this.

Airbnb’s business model has moved the risk of utilization to hosts, in the same way that Uber shifted the risk of utilization to drivers. This is a potentially favorable situation if hosts have an under utilized asset, where any additional usage provides a high marginal benefit. Many hosts are likely to have properties completely dedicated to Airbnb though, and low utilization and inefficient management relative to hotels could be problematic in the long-run.

Airbnb’s average occupancy in 2021 in the top 20 US cities was approximately 28%. This compares to a typical hotel occupancy rate of 66%. Airbnb’s relatively low occupancy rates indicate that increasing demand is the most viable growth avenue. In 2019, 54 million active bookers worldwide booked 327 million nights and experiences on Airbnb’s platform. The number of loyalty members for larger hotel companies indicates that Airbnb still has room for meaningful expansion of the number guests.

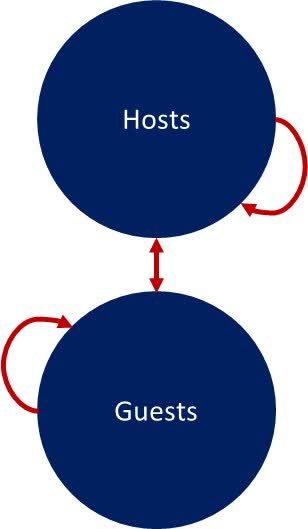

One of the advantages of Airbnb’s business, is the fact that they have become the standard in the category, leading to low host and guest acquisition costs. There is also an element of network effects to this, where supply and demand attract each other and awareness builds through word of mouth. It is also common for guests to become hosts and for hosts to be guests. As a result, 79% of Airbnb’s hosts signed up directly to the platform in 2019. Approximately 90% of all traffic to Airbnb comes through direct or unpaid channels. This allowed Airbnb to drastically cut marketing spend during the pandemic without completely destroying traffic.

Figure 4: Airbnb Network Effects (source: Created by author)

Airbnb has developed an extremely strong brand, with “Airbnb” now used as a noun and a verb in a way that very few products or services ever achieve. Airbnb’s establishment of the category has a lead to a close association between the company and the short-term rental market, often resulting in a large amount of free publicity. For example, there are around 500,000 articles written about Airbnb every year. This potentially provides Airbnb with a competitive advantage and could contribute to lower customer acquisition costs.

In 2019, 84% of Airbnb’s revenue resulted from stays with existing hosts. In addition, 69% of Airbnb’s revenue in 2019 was generated from stays in that year by repeat guests.

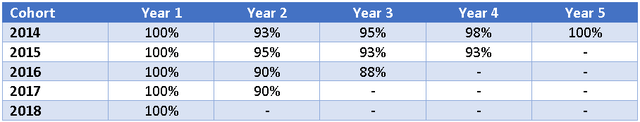

Table 3: Host Revenue Retention (source: Created by author using data from Airbnb)

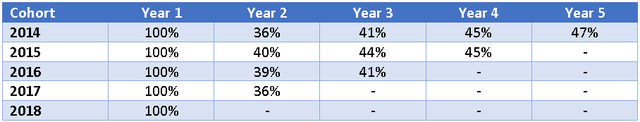

As the business matures and growth normalizes, it should be expected that a large percentage of revenue will come from repeat guests, which will ease the burden of sales and marketing expenses.

Table 4: Guest Revenue Retention (source: Created by author using data from Airbnb)

Airbnb is expanding their product portfolio to support future revenue growth as their primary business begins to mature. AirCover for guests and hosts is an insurance product that provides personal liability coverage and protection against property damage. This helps to reduce trust concerns and provides an additional revenue stream for Airbnb.

Airbnb Experiences are 2-3 hour experiences that are hosted by a local, and represent an expansion into adjacent travel categories. The popularity of experiences remains to be seen, but Airbnb’s brand strength could allow them to increase their presence in areas like travel booking and experiences.

Airbnb also acquired HotelTonight, to assist in their transition to becoming a comprehensive travel marketplace. HotelTonight is a travel agency and metasearch engine focused on booking last-minute lodging in the Americas, Europe, Japan and Australia. Airbnb continue to view individual hosts are their core business though, rather than hotels.

Airbnb is also yet to leverage their control of discovery to extract more value. Airbnb could potentially allow hosts to increase the visibility of their property on the platform for a fee. This type of initiative would have to be carefully managed though, as it risks tilting the platform towards professional hosts and may alienate many hosts.

Airbnb’s Superhost program pairs prospective hosts with some of Airbnb’s best hosts, so that they can learn how to provide a high quality service. Since Airbnb launched this product, nearly 0.25 million people have gone through the Ask a Superhost program. This service potentially encourages new hosts to list a property, helping to increase Airbnb’s supply. Superhosts may also help other hosts to provide guests with better experiences, leading to more demand over time.

Pandemic Tailwinds

Airbnb was a significant beneficiary from the COVID pandemic for a number of reasons. For example:

- Restrictions on travel likely pushed travelers towards more diversified inventory

- Remote work likely contributed people taking more / longer trips

- Higher disposable incomes likely increased demand for travel

Research indicates that the income elasticity of demand for hotels is positive, greater for premium inventory and larger in the long-run.

Table 5: Hotel Income Elasticities of Demand (source: Created by author using data from https://scholarworks.umass.edu/cgi/viewcontent.cgi?article=1291&context=jhfm)

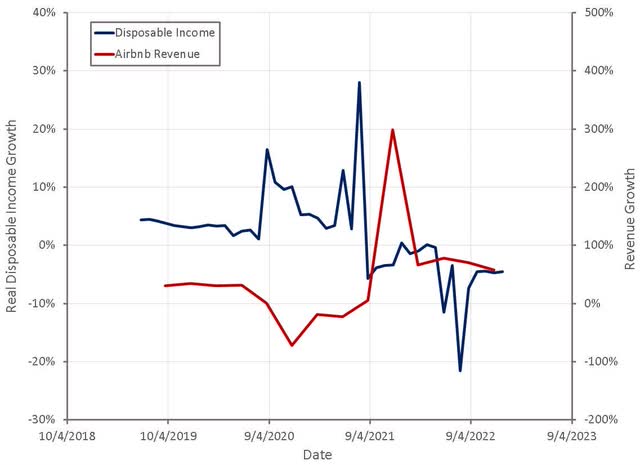

The spike in disposable income during the pandemic would therefore be expected to increase the demand for hotels and short-term rentals. This was obviously impacted by restrictions on travel early in the pandemic though. Once travel restrictions began to ease, Airbnb’s revenue increased dramatically, as would be expected. Real disposable income is now decreasing rapidly though due to a normalization of fiscal policy and high inflation, which will potentially pressure Airbnb’s revenue going forward.

Figure 5: Real Disposable Income Growth and Airbnb Revenue (source: Created by author using data from Airbnb and The Federal Reserve)

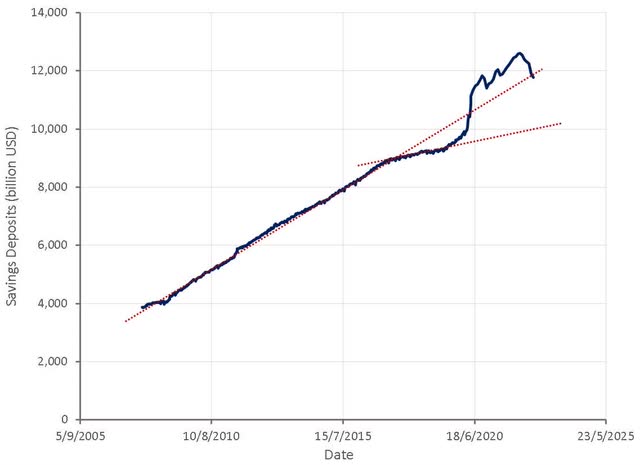

Accumulated savings from the pandemic are probably providing a short-term buffer against this though. Consumers are currently eating into existing savings and increasing debt, as they spend at unsustainable levels. This situation can probably be maintained for another 12 months or so, but at some point consumer spending will moderate and travel is one area likely to take a hit.

Figure 6: US Savings Deposits (source: Created by author using data from The Federal Reserve)

Regulatory Risk

There are a number of externalities associated with Airbnb’s business model that create increased regulatory risk as the business scales. Airbnb generally does not increase the supply of housing, but shifts rentals from the long-term to the short-term market, which has a tendency to cause higher home prices and rents. Approximately 66% of Airbnb listings are for an entire home or apartment and over two-thirds are rented year-round. One study of Manhattan’s Lower East Side found that full-time Airbnb listings earned 2-3x the median long-term rent on average. A number of studies have suggested a link between the concentration of Airbnb properties in a neighborhood and rising rents. A wider study of the US suggested a 10% increase in Airbnb listings led to a 0.42% increase in rents and a 0.76% increase in house prices. This impact is also likely to be non-linear, with a certain concentration of Airbnb listings eventually leading to dramatic increases in home prices and rents. As Airbnb begins to approach these types of levels in more popular cities, the risk of regulator action dramatically increases. In addition, some areas have been overwhelmed by tourists, with locals complaining that their quality of life has been degraded.

Figure 7: Potential Impact of Airbnb on Housing Market (source: Created by author)

This has led to tension between Airbnb and some cities over issues like:

- the number of nights each year a property can be rented out

- the hiring of entire homes

- licensing

- tax requirements

- how rules should be enforced

A number of prominent tourist destinations already have short-term rental restrictions in place, including:

- Amsterdam

- Barcelona

- Berlin

- London

- Palma

- New York City

- Paris

- San Francisco

- Singapore

- Tokyo

Restrictions include a limit on the number of days a property can be rented in a year, licenses for short-term rentals, outright bans and minimum lengths a property can be rented for.

While Airbnb points towards the benefits of its platform as potential reasons to avoid restrictions, research indicates that the costs far outweigh any potential benefits. Evidence indicates that Airbnb increases the supply of short-term travel accommodations and lowers prices, but high accommodation prices are not a pressing economic problem, unlike home prices. There is also little evidence that an increased supply of Airbnb listings leads to an increase in travelers, as Airbnb seem to be a nearly pure substitution for other forms of accommodation. This means that there is likely to be limited spillover benefits to the wider economy from an increase in Airbnb listings.

At an individual city level, Airbnb’s regulatory risk is limited as none of Airbnb’s top 10 cities contributed more than 2.5% of revenue or 1.5% of active listings during 2019. The externalities of Airbnb’s business model are present across all cities though, and the company could face greater restrictions from a broad range of cities going forward.

One of Airbnb’s attempts of addressing this problem is the launch of Airbnb Categories. By categorizing properties by what makes them unique, Airbnb can highlight these properties and distribute demand across more geographies.

Financial Analysis

Airbnb’s recent financial performance has been strong, driven by strong demand for travel. Relative to the 2019 period, bookings were up 24% in the most recent quarter and spending on the platform was up approximately 70%.

ADRs have increased significantly over the past few years and a lot of this has been driven by a geographical mix shift. About two-thirds of that increase has been price appreciation, and about one-third due to mix. As travel patterns normalize, ADRs are likely to moderate somewhat, with negative consequences for revenue growth and margins.

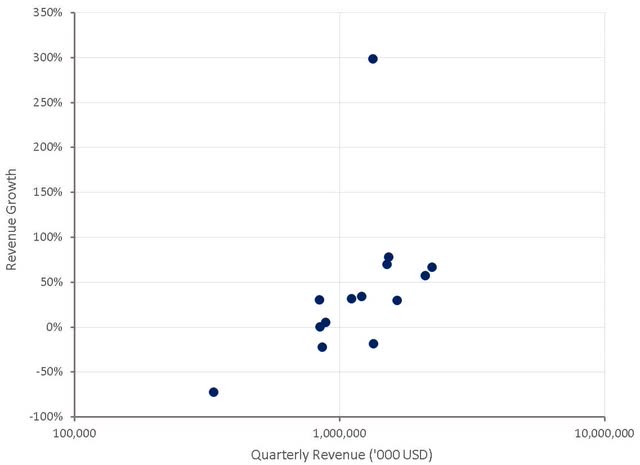

Figure 8: Airbnb Revenue Growth (source: Created by author using data from Airbnb)

According to TSA data, this summer was the first holiday period where travel surpassed pre-COVID levels.

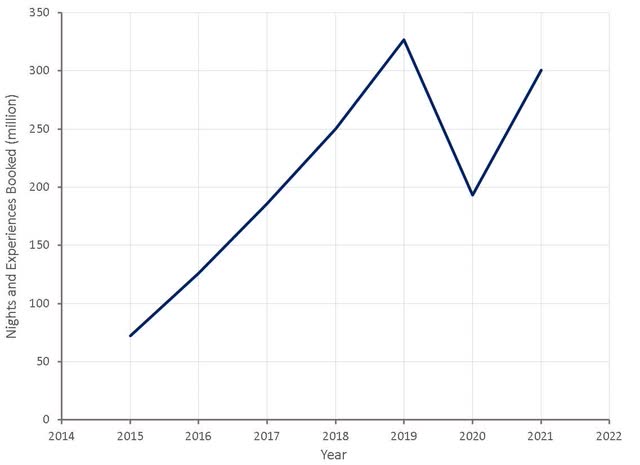

Figure 9: Airbnb Nights and Experiences Booked (source: Created by author using data from Airbnb)

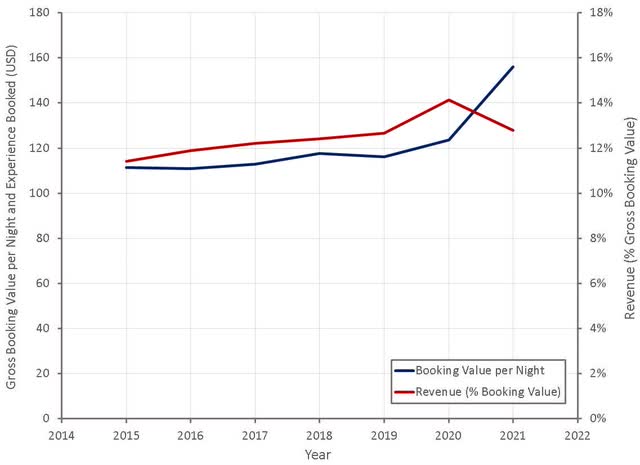

Airbnb’s booking value per night has shown a tendency to increase over time and may eventually converge with that of comparable hotels.

It is unclear how much revenue Airbnb is ultimately able to extract from booking values. Airbnb’s dominant position in the market could allow them to increase fees significantly over time, but hosts incur substantial costs providing the service and hosting may no longer make sense with higher fees.

Figure 10: Airbnb Gross Booking Value per Night and Take Rate (source: Created by author using data from Airbnb)

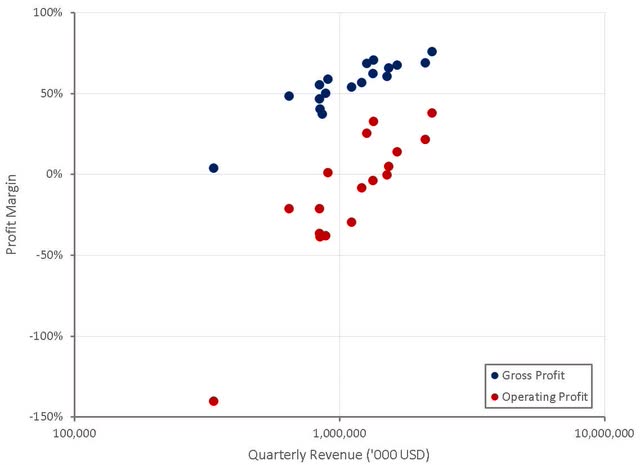

Airbnb has been progressing towards sustainable profitability as the business has scaled, but the COVID pandemic caused a discontinuity which raises questions about Airbnb’s margin structure going forward. At the beginning of the pandemic, Airbnb’s revenues plummeted and the company took drastic actions to reduce their costs. For example, Airbnb moved towards a functional organizational structure and cut out a lot of marketing costs. When Airbnb went public, they had forecast EBITDA margins of over 30% in the long-run, but accelerated revenue growth and a lower cost base have quickly progressed the company towards this point.

Current levels of profitability may not be sustainable though. If a reduction in consumer spending results in lower demand, Airbnb may be forced to increase its spending on marketing. ADRs are also likely to come down over time, and Airbnb has suggested that margins are sensitive to ADRs.

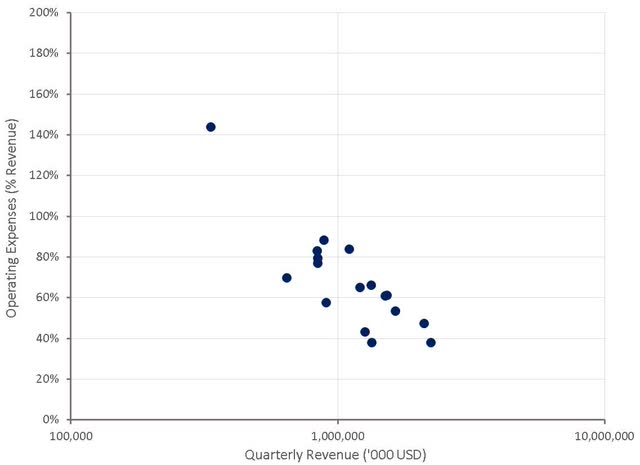

Figure 11: Airbnb Profit Margins (source: Created by author using data from Airbnb) Figure 12: Airbnb Operating Expenses (source: Created by author using data from Airbnb)

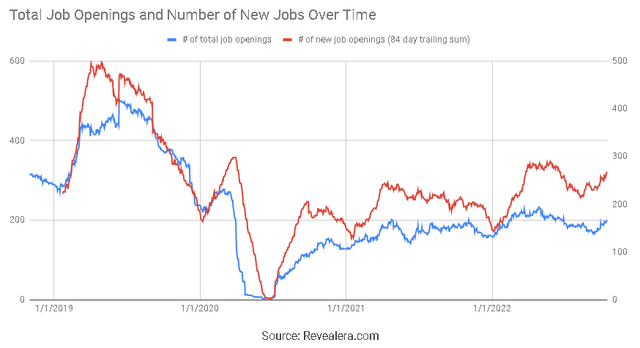

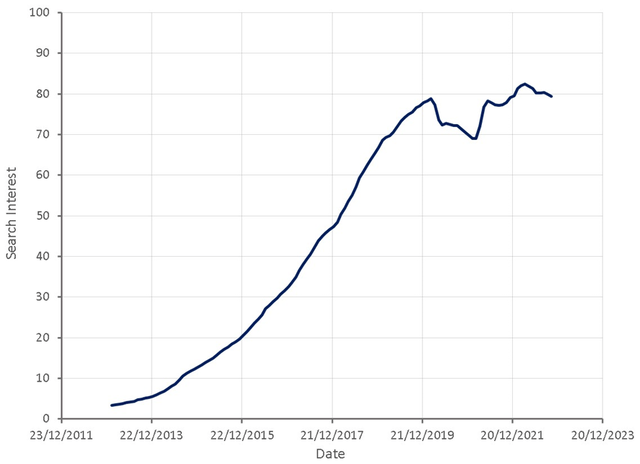

While Airbnb is likely to face lower demand at some point in the next 12 months, there is no indication that this process has begun to occur. For example, Airbnb continues to increase hiring and search interest in Airbnb remains robust.

Figure 13: Airbnb Hiring Trend (source: Revealera.com) Figure 14: “Airbnb” Search Interest (source: Created by author using data from Google Trends)

Conclusion

Airbnb is likely to face headwinds in the short-term which may pressure the stock price. This is not necessarily that important for the long-term value of the company though. Airbnb’s core market is maturing, but there are still a large number of growth levers, and incremental revenue is likely to have high margins.

Be the first to comment