Justin Sullivan

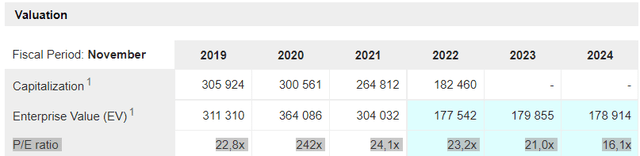

Global clothing retail brand H&M (OTCPK:HNNMY) recently posted below-par Q4 sales numbers, suggesting fundamentals are normalizing lower in the October/November period after a strong September performance. In the near term, the macro outlook remains a key overhang, with the company’s ability to pass through USD-driven COGS inflation, particularly key to protecting gross margins. Thus far, its quarterly underperformance relative to key peer Inditex (OTCPK:IDEXF) keeps me skeptical on this front. Additionally, managing further cost pressures from FX fluctuations and higher energy costs will be challenging and will likely weigh on Q4 operating profitability. The cost restructuring plan should help, but the full benefits will only flow through to the P&L later in FY23, leaving the dividend vulnerable. Net, the current >20x fwd P/E valuation seems pricey relative to H&M’s deteriorating near-term growth prospects and the challenging operating environment ahead.

Q4 Update Falls Short of September Highs

For Q4, H&M reported headline revenue growth of +9.9% YoY in SEK terms, though organic growth would have been closer to ~2% excluding the recently closed Russia/Belarus/Ukraine operations. On an FX-neutral basis, however, Q4 revenue came in flat YoY or a modest ~0.2% decline relative to pre-COVID levels. This will come as a disappointment following the +7% YoY September FX-neutral sales growth. Some context is needed, though – September did benefit from unusually cold weather and a favorable YoY comparison, as well as clearances ending in Russia. In contrast, conditions in October and early November were far less favorable, with unusually warm weather and tougher YoY comparisons, as well as minimal Russia contribution.

That said, this still leaves the final two weeks of November to save the quarter, as weather conditions normalized later in the month. Yet, H&M appears to have suffered disproportionately from the higher promotional intensity at this year’s Black Friday. Of note, H&M underperformed key peer Inditex’s sales print (+20% FX-neutral), as its lack of pricing power has resulted in a comparatively underwhelming full-price sales performance. Expect the widening performance gap to continue in the coming quarters as Inditex’s scale and supplier relationships, as well as its stronger omnichannel presence, translates into better pricing power through a downcycle.

A Less than Ideal Margin Outlook

As there was no call this time around, the full extent of the gross margin and opex pressure won’t be known until earnings in late January. For now, the decline in commodity prices should help raw material inflation and gross margins. The key cost headwind is the supply chain, where higher labor costs amid the China-driven disruptions have left brands like H&M with limited leverage to negotiate pricing lower. In addition to the external pressures, the H&M model also has a sizeable fixed cost base, which entails operating deleverage as revenue growth falters.

The good news for margins is that management is actively working on restructuring the cost structure via a SEK 2bn efficiency plan. Realizing the benefits will take time, though, and for the upcoming quarters, the company will incur significant one-time restructuring costs instead. As the benefits from the cost savings program are only guided to hit the P&L from H2 2023 onwards, this implies a ~50bps opex benefit next year (or half of the projected benefits from the program). With sales volumes potentially turning negative next year and H&M’s operational flexibility still limited, I see more earnings downside ahead.

Dividend Cut on the Horizon?

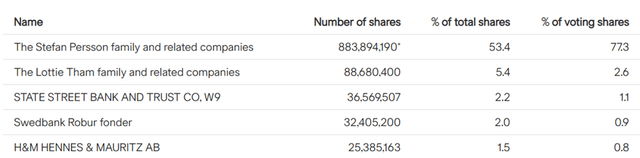

In the face of elevated short interest, the Persson family has increased its H&M stake in the past year and now owns >50% of the equity while also retaining ~77% of the voting power. The key funding source for these purchases has been the dividend, but with a macro slowdown on the horizon and a significant restructuring effort underway, it’s hard to see the dividend not being cut for this fiscal year. Thus, relative to the >SEK 6bn of buybacks by the family in FY22, expect a significantly lower run-rate in the coming year.

Bulls might point to some of the delta being offset by buybacks at the H&M level, though, given the completion of this year’s SEK 3bn buyback program (~3% of the free float). While the strong cash position also supports the case for a new buyback in FY23, the challenging operating environment and the optics of buying back stock after cutting ~1.5k jobs means a suspended buyback is likely on the cards, in my view.

A Disappointing Q4 Sales Update

Net, the latest trading update from H&M fell below increasingly optimistic expectations following signs of retail and consumer improvement in its key markets. Perhaps most worryingly, the weaker exit rate means revenue could remain below pre-COVID levels in the coming quarters – in contrast with the outperformance reported by key peer Inditex. A key reason for the underperformance has been H&M’s lack of pricing power, despite the investments in recent years, which could result in further margin erosion amid a weaker consumer environment ahead.

Lower profits could have a reflexive impact on the stock as well – more P&L weakness drives lower capacity for dividends and buybacks, reducing its appeal to income investors as well as the Persson family’s ability to buy more stock. With the stock still above this year’s low at ~20x fwd earnings, expect earnings downside to drive a valuation reset amid a challenging operating backdrop.

Be the first to comment