felixmizioznikov/iStock Editorial via Getty Images

Company Overview

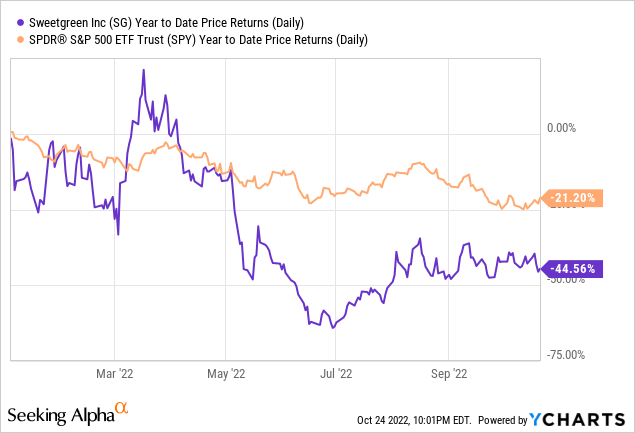

Sweetgreen (NYSE:SG) is an American fast casual restaurant chain founded in 2006 that primarily serves salads. Sweetgreen is a popular brand that has resonated with the millennial segment, with a focus on a fast casual experience that sells healthy and organic salads. Since its founding, Sweetgreen has had a strong growing presence in the U.S., with around ~900 stores across the states. Sweetgreen completed its IPO in late November of last year at $28 per share, raising $364 million through the sale. Since then, the company has seen a substantial decline in its stock price. Year-to-date, the company’s stock is down -44.56%, significantly underperforming the overall market. The company’s market capitalization now stands at $2.0 billion. As our initial coverage, we are recommending a “Hold” rating due to risk concerns.

Salad Pioneer

Sweetgreen has been a first-mover in the salad-oriented fast casual space, bringing about a business model that capitalized consumers’ shift in preference toward healthier and more environmentally sound food products. Sweetgreen has now become a staple in office worker‘s lunch repertoire, and thanks to its quick preparation time and high digital penetration, the company has enjoyed tremendous revenue growth in the past few years despite the headwinds of remote work and pandemic store closures. Furthermore, Sweetgreen has continued to innovate its products and services, and recently the company launched a robust subscription based rewards program that aims to reward loyal consumers and increase user retention. These sorts of innovations have allowed the company to remain in the forefront of the fast casual/salad industry.

Recent Financial Performance

Sweetgreen’s Q2 earnings were stellar, as the company reported a 45% revenue growth on a year-over-year basis. On a same-store sales metric (a good measurement of the company’s per store performance), Sweetgreen saw 16% YoY growth. Though this growth seems solid, the same store sales growth actually saw a severe growth deceleration, as the year before, the company reported 86% YoY growth on a same-store sales metric (likely impacted by pandemic closures the year before). Overall, we find that the financial performance reported in Q2 has been solid for investors. In addition, we saw a marginal decline in the percentage of revenue that comes from digital sales. We like to see high percentage of digital sales, and Sweetgreen has done a masterful job of refining its digital sales process for seamless purchase and pick up. We do not view the decline in the percentage of revenue that comes from digital sales as the post-pandemic return to office has likely contributed to this phenomenon.

Risks

Competition

While Q2 earnings have been good, we believe there are many risks that contribute to our “Hold” rating. Sweetgreen operates in the fast casual segment that is full of large players, such as Chipotle, Panera Bread, Shake Shack, and more. Even when comparing among salad focused fast casual brands, Sweetgreen competes with fairly large and popular alternative brands like Just Salad, Chop’t, Chop & Go, and other smaller brands that will make the market more competitive and saturated. Though Sweetgreen has a strong brand moat and a popular brand following, there will be natural margin pressures from the breadth of competition, as consumers would be sensitive to price and product quality. Competition is likely to also favor more capitalized players in a recession, as Sweetgreen will be forced to conserve cash and limit its cash burn, while profitable players in the industry can leverage its cash flow to take more market share. As of now, it is unclear to us how Sweetgreen will be able to successfully navigate the competitive landscape, and improve the business model to make the business more sustainable and gain a longer-term competitive advantage.

Recession Risk

Sweetgreen faces a particular risk that stems from a recession. Sweetgreen’s products are geared toward the higher-income segment, and sell salads that have a premium price. Sweetgreen’s products are priced from $13 – $14, which are on the higher end of fast casual options, given that competitors like Chipotle and Dig Inn have meals that are priced 10% – 15% under Sweetgreen’s baseline prices. We believe that as recession looms, the risk to the business model and consumer demand remains high for Sweetgreen. As consumer budget shrinks (even for those in the higher-income sphere), consumers will be less likely to splurge $13+ on a salad, and substitute toward cheaper products from other fast casual or fast food restaurants. For a company that lost $40 million in Q2, a revenue shock could spell major downside for investors.

Valuation

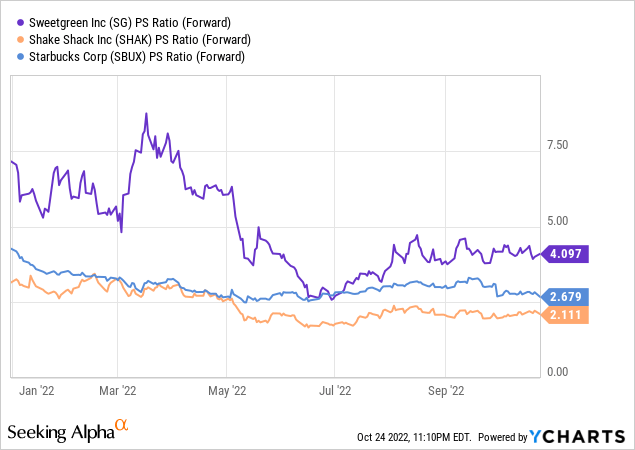

We also believe that valuation at current levels is lofty and therefore do not provide good risk/reward proposition. Sweetgreen does not have direct competitors trading in the public market, so we conducted a P/S valuation comparison exercise with companies that are comparative in the “fast casual” segment such as Shake Shack (SHAK) and Starbucks (SBUX). As seen below, Sweetgreen’s valuation is roughly 50% to 100% higher than the valuation of its mature peers. Even compared to the sector median, the company’s valuation remains ~400% higher than the median P/S (FWD) multiple. Though we agree that growth prospects for Sweetgreen remain higher than Starbucks and Shake Shack in the long-term, we believe the high valuation should caution investors as an underwhelming revenue growth or even a decline in revenue metrics could take out much of the air in the valuation.

Final Word

We are recommending a “Hold” as we believe that there are too many risks that can lead to major downside for the stock. The valuation remains at lofty levels compared to industry benchmarks, and we believe there is just too much risk baked into the stock given the current market conditions. Our “Hold” thesis is likely to be impacted if Sweetgreen products remain more resilient in a weak economic environment and/or the company is able to alleviate margin pressures without sacrificing top line growth. Nevertheless, once the economic picture becomes more clear, we will re-assess our rating on the stock.

Be the first to comment