alexsl/iStock via Getty Images

By Thomas Triedman

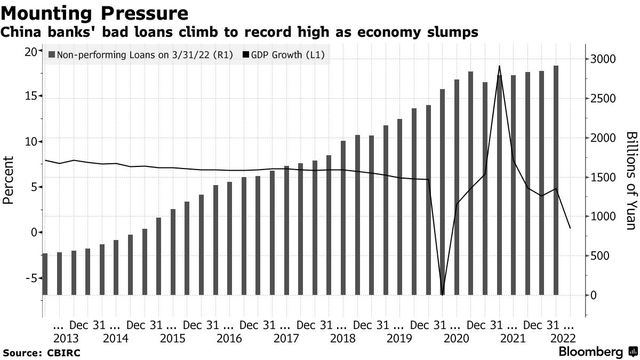

Many homes in China are sold before they are fully built, an important source of cash for developers that often allow them to pursue multiple projects at once. However, once Beijing started to take aim at these highly leveraged developers, homebuyers began to lose faith in the ability of these developers to complete their building projects without the usual stream of cash. S&P Global Ratings estimates that 2.4 trillion yuan, or 6.4 percent of mortgages, are at risk due to a loss in confidence in the property sector and mortgage boycotts across the state. Deutsche Bank AG estimates that at least 7 percent of home loans are in danger. Non-performing “bad” loans (shown as bars on the chart above) have climbed to a record high as, importantly, output growth (the black line) has fallen. This combination – more bad loans with lower GDP – spells trouble for the Chinese economy and the property sector.

Source: Bloomberg

As households and businesses begin to fear recession and become reluctant to take on more debt, they are more likely to cut back on spending and investing, potentially leading to a balance sheet recession and accelerating the mortgage rout in China. Additionally, with less disposable income, homebuyers would have an increasingly hard time servicing their debt, creating even more loan delinquencies and putting more pressure on outstanding mortgages. There is no real good outcome for banks: They must decide whether to help developers finish the housing projects, thereby adding more exposure to delayed real estate projects, or to ditch these projects altogether and take on immediate losses. In a worst-case scenario, current forecasts suggest that China’s banks will face mortgage losses of $350 billion, potentially spurring a credit crunch across the financial system. For context, however, financial crises are notoriously hard to predict; many forecasters have been calling for an immediate Chinese real estate and financial crisis for the past couple of decades years without any success.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment