13threephotography

GSK (NYSE:GSK) ADRs have been nothing to write home about over the past few years. But the last quarter has been significant for the company as its consumer healthcare segment was finally spun off into a new company, Haleon (HLN). GSK’s focus is now only on its pharmaceuticals business. This article analyses how its financials look post demerger, in the context of a challenging macroeconomic environment. It then assesses whether its market multiples are in line with both its performance and risks. It concludes that despite some concerns, its price has likely overcorrected for now.

Advantage Defensives

To start with, as a defensive stock, it has a relatively limited downside in the slowdown. This is evident in just the fact that while the S&P 500 (SP500) was down by 21.4% year-to-date (YTD) as of 4 October 2022, GSK saw a lower fall of 14.8%. However, it’s hardly the only pharmaceutical defensive stock around. And if there are more resilient investing opportunities available, the case for buying GSK might still be weak. Its UK-based peer, AstraZeneca (AZN), has declined by just 2.5% YTD, for instance. In the past month though, GSK fell notably lesser than AZN, which calls for a closer look at the opportunity it presents.

GSK in the Macro Context

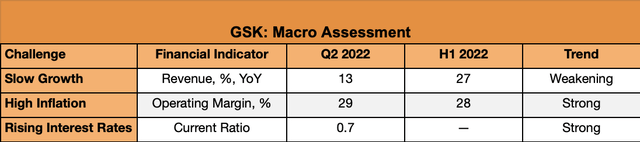

To do so, its financials are assessed in the context of a three-part macroeconomic framework, that’s been applied to other analyses as well. The first part of this approach involves considering the demand conditions it faces as the economy slows down. The focus of this entire exercise is on available adjusted results, that exclude numbers for its consumer healthcare business.

Sources: GSK financial results, Author’s Estimates

Slowing Demand

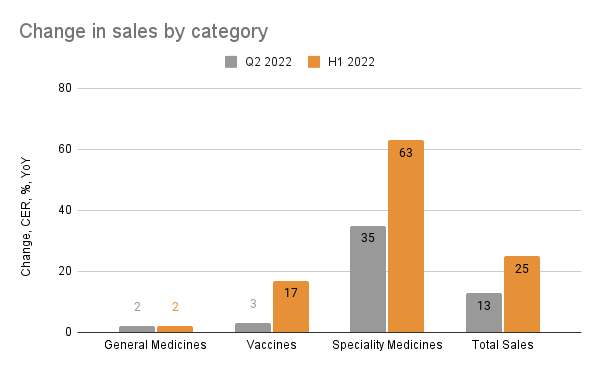

It’s clear from the second quarter’s (Q2) growth numbers, that there’s already a visible slowing down. Sales growth in the first half of the year (H1 2022) was far faster both at actual and constant exchange rates (CER). At CER, growth slowed down to 13% in Q2 2022 while it was at 25% in H1 2022 (see chart below) year on year (YoY) suggesting that much of the growth happened in Q1 2022. To be fair, the comparison doesn’t give a full picture, like a few years of quarterly data would, but it’s still indicative.

In terms of categories, growth has slowed down for both vaccines and specialty medicines, while it has remained muted for general medicines. GSK explains that the normalization of the US CDC’s purchases and generic competition for general medicines have impacted sales. The latter is a point to underline since continued competition could erode its growth further. The outlook is underwhelming too. Even with upgraded sales expectations for the full financial year, they are expected to slow down further to 6-8%. The company does say that growth would be impacted by “a more challenging H2 2021 sales comparator”, which is some comfort, however.

Source: GSK financial results

Inflation proof and debt in check

Its operating profit growth has also slowed down dramatically in Q2 2022 to 6% YoY at CER compared to a 27% rise in H1 2022. While at any other time this would be a red flag, the company points out that it’s because of lower margin COVID-19 sales. Moreover, the company’s profitability is strong with an operating margin of 29%. This is an important indicator to consider now that inflation is high. Clearly, the company isn’t coming under pressure though. With a current ratio of 0.7x for Q2 2022 and a net debt to equity ratio of 0.94x, it also looks well placed to manage its debt in the face of rising interest rates.

In total, though, the macroeconomic framework suggests that while the overall picture looks alright, its slowing revenue growth is one to watch out for. It is hard to get a big picture on the slowing down, because of data limitations but it shouldn’t be ignored either.

Potential gains from GSK

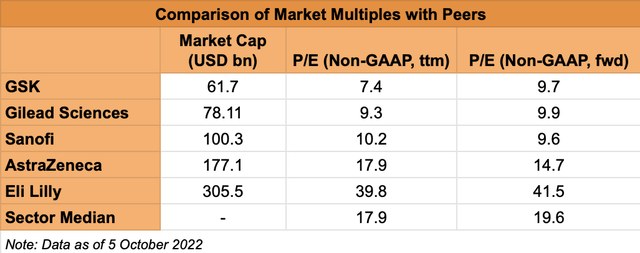

Even keeping in mind the sales come-off, there could still be an upside to the GSK stock price. Here’s why. Its non-GAAP twelve months trailing (TTM) P/E is at 7.4x, which is way below the sector median of 17.9x. Just comparing the sector median alone, however, might not be entirely comparable because it covers the entire gamut of the healthcare sector, not just pharmaceutical stocks.

To circumvent this, it was compared with peers with the closest market capitalization. AstraZeneca is added to the mix because of its geographical affinity. Considering the average of two peers closest to GSK in market cap and also AstraZeneca reveals an average P/E of 12.5x. The forward P/E by the same calculation is at 11.4x. Even with these, a 15% upside to the GSK share price is possible.

The actual upside could be more muted, however, considering that GSK’s forward P/E is at around the same levels as that for Gilead Sciences (GILD) and Sanofi (SNY). This does suggest that whichever way we look at it, it’s clear that there doesn’t seem to be a downside to the GSK price at the very least. Its dividend yield of 5.2% also works to its advantage, with the next payout due in November 2022. In sum, there could well be some gains to be made from buying GSK.

It’s not that pharmaceutical companies’ P/E needs to stay at present levels, though. Consider Eli Lilly (LLY), which represents the opposite end of the valuation spectrum. With a P/E of almost 40x, it’s also the biggest peer by market capitalization. It’s something to keep in mind, but I’m not inclined to base investment calls on it for now.

Risks to GSK

The potential upside to GSK might be hamstrung by the potential impact of litigations over Zantac as well. The heartburn drug was pulled from the US market in 2020 for risks of being carcinogenic. There are however differing views on how the story will play out. While some analysts, like at Jefferies, expect it to be a drag on GSK’s financial, others are less so.

Conclusion

On the whole, GSK looks like a buy to me just because it looks undervalued at present levels even while it pays a dividend. I wouldn’t call it a long-term buy yet or even one with enormous upside, but there is some opportunity to profit from an investment in it both through some price upside and dividends. Its financials do call for deeper analysis, which will become possible as more data for the demerged entity is available. It does nevertheless look strong enough to weather macroeconomic challenges despite a slowing down in revenue growth. Its robust profitability and manageable debt put it in a good position and as a defensive, it has a limited downside as well.

Be the first to comment