Khanchit Khirisutchalual

Introduction

I’ve been looking at beaten-down stocks of companies with a stable business and a history of high profitability. My shortlist at the moment is topped by Heidrick & Struggles International, Inc. (NASDAQ:HSII). It’s an international executive search firm that has been around since the ’50s, and it just posted the highest quarterly revenues in its history. In addition, the company has over $300 million in cash and its Q2 net income was $24.1 million. Yet, the market valuation has declined by over 30% since the start of 2022 and stands at $599.2 million as of the time of writing.

In my view, Heidrick & Struggles is significantly undervalued from a fundamentals point of view at the moment, as it seems that it can finish 2022 with a net income of over $80 million. Let’s review.

Overview of the business and financials

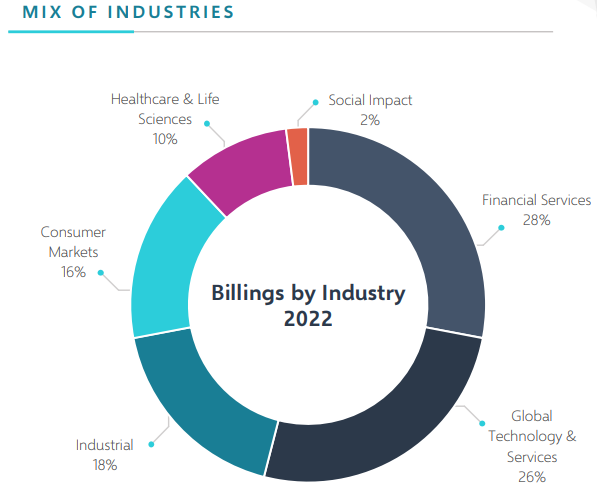

Heidrick & Struggles was founded in 1953 and is among the oldest U.S. firms in the relationship-intensive executive search industry. The company specializes in the placement of top-level senior executives, and also provides consulting and on-demand talent services. Heidrick & Struggles provides executive search services primarily on a retained basis and it currently has a team of more than 450 consultants across the world. It serves over 70% of the Fortune 1000 companies. Heidrick & Struggles has a diversified client base, and no sector accounted for over 25% of revenues in H1 2022.

Heidrick & Struggles

The company has had a quarterly dividend of $0.15 per share since 2019, which was increased from the $0.13 per share which were distributed starting 2007. This translates into a dividend yield of almost 2% as of the time of writing, which I think is a decent level.

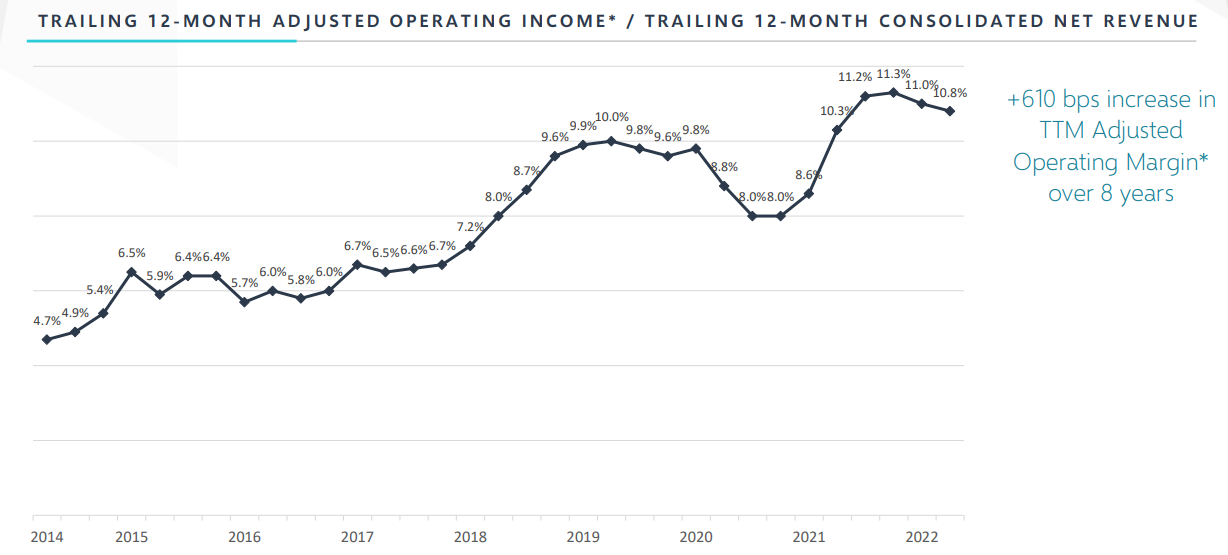

Turning our attention to the financial performance of the business, Heidrick & Struggles has been growing rapidly despite the effects of the COVID-19 pandemic, and its revenues surpassed the $1 billion mark in 2021. This is two times higher compared to 2014. In addition, the company has significantly improved its operating income margin over the past decade, and it currently stands at over 10%.

Heidrick & Struggles

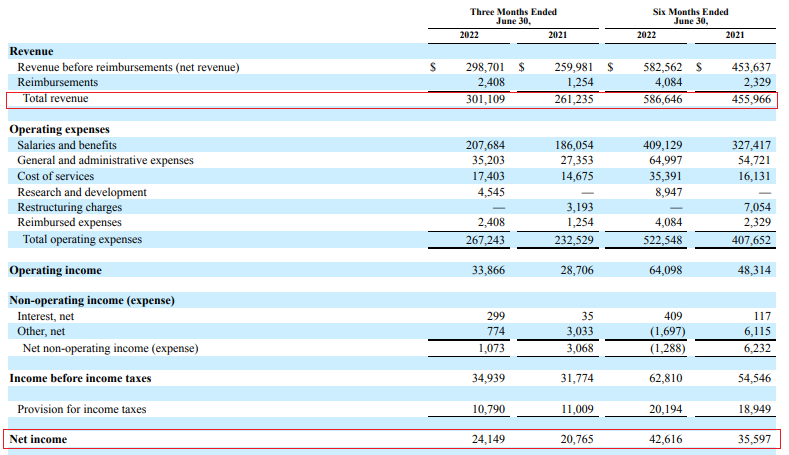

In Q2 2022, the revenues of Heidrick & Struggles surpassed the $300 million mark for the first time ever while the net income topped $20 million. While the company expects revenues to come down to between $260 million and $270 million in Q3 2022, it seems that a net income of $80 million for the full year is within reach.

Heidrick & Struggles

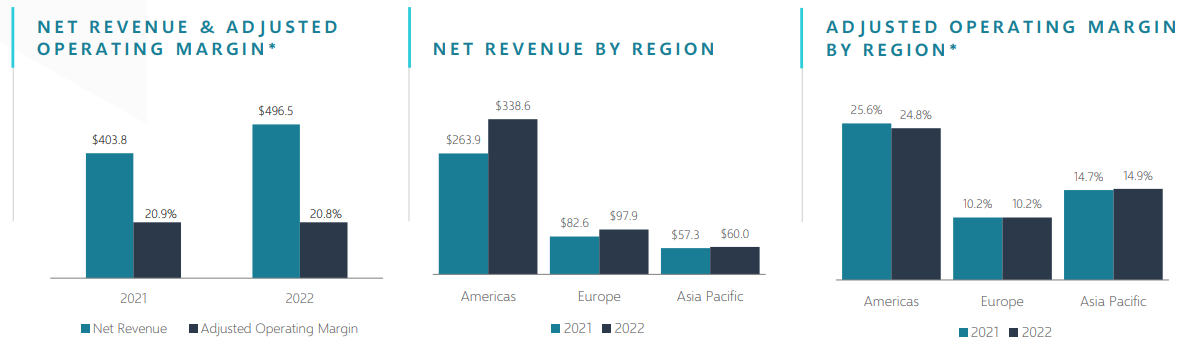

You see, the majority of the revenue growth in H1 2022 came from the executive search segment in the Americas, which is the most profitable part of the business with an adjusted operating margin of 20%. During the Q2 2022 earnings call, Heidrick & Struggles said that there is a lot of momentum in its business and that a large part of the expected decline in revenues during Q3 is due to the summer holiday season when hiring activity usually drops.

Heidrick & Struggles

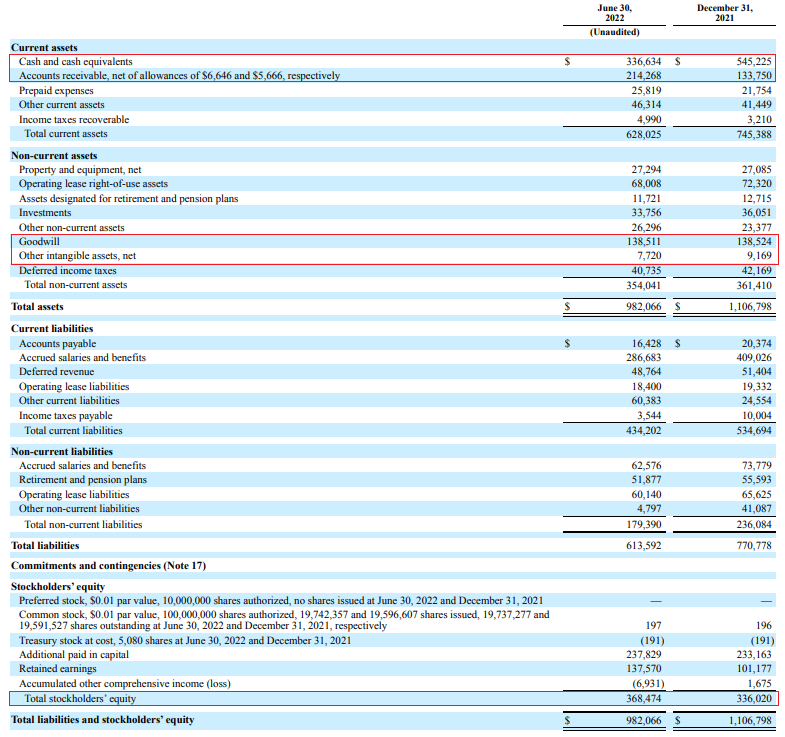

Turning our attention to the balance sheet, I think the situation looks good at the moment. It’s an asset-light business with almost no capital expenditures and cash and receivables accounted for more than half of the asset base as of June 2022. Heidrick & Struggles has no debts and its net book value (shareholders’ equity minus goodwill and intangible assets) stood at $222.2 million at the end of Q2 2022.

Heidrick & Struggles

Sure, a company trading at 2.7x book value might appear expensive at first sight but there is a lot of value in the relations the company has built over the past 59 years that isn’t reflected in the financials. In addition, Heidrick & Struggles is trading at just 7x P/E on a TTM basis at the moment. Overall, I think company has built a solid business over the past few decades and that it should be trading at something like 10x P/E. This would put the share price at around $40.30. It’s a level which it had in April 2022, but it seems that the stock was caught in the broader market selloff due to recession fears. Considering Heidrick & Struggles just posted the best quarterly results in its long history, I think that this selloff was unjustified and that it’s likely the share price will return to levels of above $40 in the coming months.

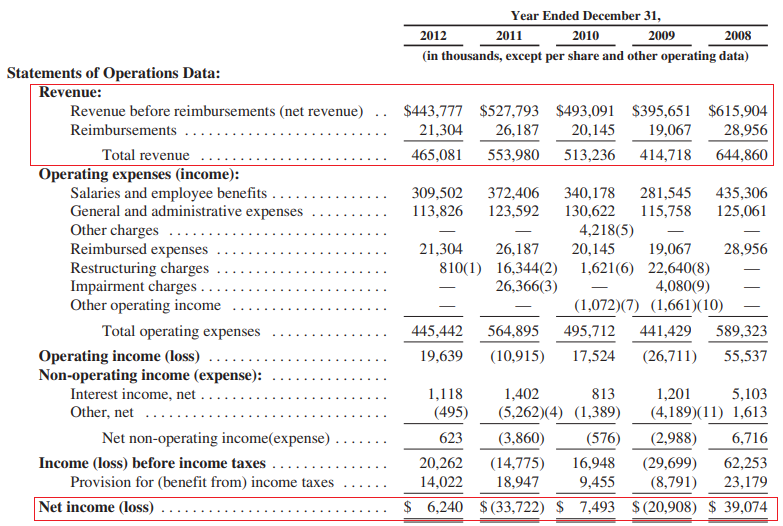

So, what are the risks for the bull case? Well, the major one is that a global recession could affect top senior executive hiring at large U.S. companies. This is the bread and butter of Heidrick & Struggles and this means that a recession could have a significant impact on its profitability. Looking at what happened during the Great Recession, we can see that the company slipped into the red in 2009 and 2011 and it took it until 2018 to get revenues back to 2008 levels.

Heidrick & Struggles

Yet, no two recessions are alike and it’s impossible to predict how this one will turn out. In addition, Heidrick & Struggles appears better prepared to weather a storm this time around. The operating income margin is 220 bps higher compared with 2008 and the company’s cash balance is $102.1 million higher compared to December of that year.

Investor takeaway

Heidrick & Struggles just posted the strongest quarterly financial results in its history and is trading at just 7x P/E on a TTM basis. The market valuation of the company has declined significantly over the past few months, and it seems that the main reason for this is fears that a slowing global economy will push it in the red.

This is a company whose financial performance is sensitive to business cycles, but I think that fears are overblown at the moment and that it looks undervalued. Overall, I rate Heidrick & Struggles as a speculative buy and I think its stock can recover to $40 in a few months unless macroeconomic conditions in the USA continue to deteriorate.

Be the first to comment