Kunakorn Rassadornyindee

Early this morning, Genuine Parts Company (GPC) released its three-month numbers and once again results were incredibly good. We suggest to check up on our previous analyses: love at first sight and long only. Aside from our buy case recap based on i) the aging car population in the macro regions where the company operates, ii) fewer new cars sold (due to macroeconomic uncertainty, supply chain disruption and semiconductor shortage) that lead to higher maintenance repair, and iii) solid fundamentals (dividend aristocrat status and ample liquidity for accretive M&A); today, we would like to add a iv) point: increase car complexity.

Here at Mare Evidence Lab’s tower, we are not super fun of full EVs, but we believe that a hybrid vehicle system will be the solution over the medium-term horizon (before hydrogen will be cost-competitive). This should support Genuine Parts sales over the long-term horizon.

Half-year Results

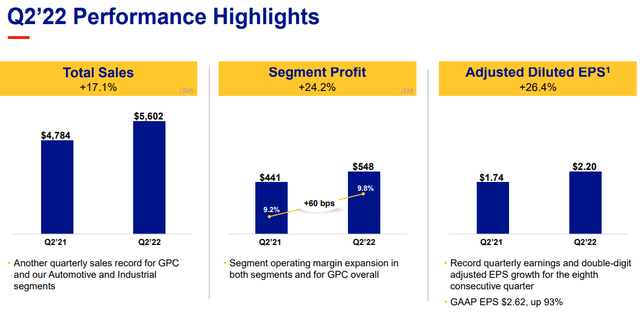

Topline revenue stood at $5.6 billion compared to the $4.8 billion recorded in the same period last year. This growth was supported by Kaman Distribution Group integration and was partially offset by the currency effect. Looking at the segment profit performance, the Automotive Parts Group division delivered a plus 10.9%, reaching €323 million. In addition, the Industrial Parts Group segment recorded an increase of almost 50% at the operating profit level, reaching for the first time a double-digit margin (10.6% to be precise) and in value absolute a $225 million profit.

GPC Q2 Financial Snap (Genuine Parts Company Q2 Presentation)

Conclusion and Valuation

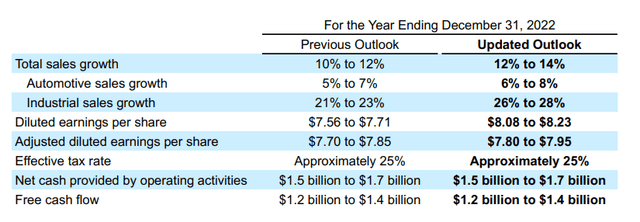

Our internal team believes that it’s now time to review upwards our buy rating. Genuine Parts is constantly delivering better results and is currently providing higher guidance for 2022 (already positively reviewed after the Q1 update). We used to value the company with a “conservative” profit margin of 8.5%, we are now forecasting a 50 basis point increase, maintaining our long-term growth rate at 2.5% and a WACC of 5.8%. Then, we derive a target price of $165 per share (compared to the previous one at $155). Aside from the valuation, the company has a strong balance sheet with a superb FCF generation. We appreciated GPC’s capital discipline strategy with its M&A optionality (thanks also to a fragmented market). Given the past track record coupled with its dividend aristocrats status, we are all in with GPC.

Be the first to comment