Cinefootage Visuals/iStock via Getty Images

Investment summary

We’ve been keeping a close watch on upcoming stories in the cardiovascular space and there’s one name that sticks out abundantly right now. enVVeno Medical Corporation (NASDAQ:NVNO) [formerly Hancock Laffe] presents with a compelling value long-term value proposition for those prepared to sit on the sidelines and wait. The company’s VenoValve and enVVe segments look to provide a remedial breakthrough in the common disease segment of chronic venous insufficiency. With its novel approaches, the company is working its way through clinical trials at present, and positive readouts from these are sure to impact favourably on its share price, by my estimation. At present I rate NVNO a hold, and I provide no price target.

Unique exposure to venous insufficiency

NVNO’s main priority is on developing solutions to treat patients with chronic venous insufficiency (“CVI”). This is a relatively common condition producing symptoms that can become quite limiting from a functional standpoint. CVI occurs when the one-way valves situated in our legs begin to fail.

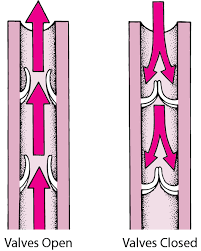

Normally, these valves act in unison with the return of blood to the heart from the lower extremities. Contraction of the gastrocnemius and soleus muscles [calf muscle] when walking also helps this mechanism, much like squeezing juice from an open bottle. Without the valves in place, there’d be no mechanism to physically block the flow of blood against gravity. A simple illustration of the valve mechanism and the breakdown of the valves’ utility is observed in Exhibits 1 and 2.

Exhibit 1. “Normal” venous return of de-oxygenated blood where one-way valves close to prevent back-flow of shunted blood.

Data: MSD Manuals 2022

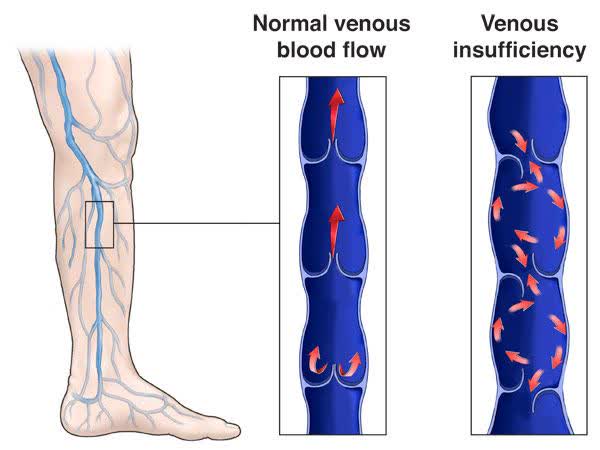

Exhibit 2. Compromise of the venous return system whereby the one-way valves fail, allowing back-flow and presenting various signs and symptoms.

Image: RWJ Barnabas Health

The resulting symptoms range anywhere from lymphedema, pain on walking [claudication], skin discolouration, ‘varicose veins’, and venous ulcers. There can also be a combination of symptoms at one time. CVI is quite prevalent in western countries as well. Camporese and colleagues (2022) illustrated that prevalence ranges from 5–30% of the population, although that varicose veins are present in 73% of women and 56% of men. Meanwhile, Maeseneer and co-authors (2022) showed the incidence ranging from 0.2%–2.3%, and that disease progression was estimated to impact c.32% of patients.

NVNO’s lead product candidate is the VenoValve, that is a bioprosthetic porcine device that’s been designed to replicate the design and function of the one-way valves in the veins.

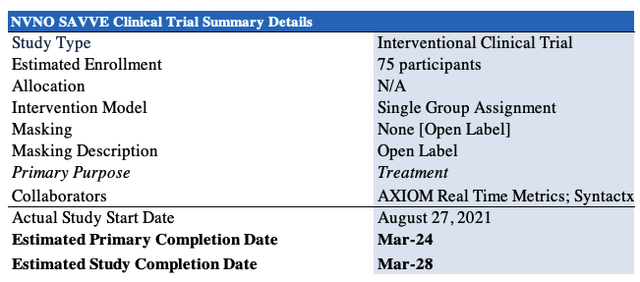

VenoValve is actually a surgical procedure that implants the device into the effected veins in order to restore correct flow. It involves a “5–6 inch incision in the upper thigh under general or regional anaesthesia“, per NVNO. Currently, VenoValve is being investigated in the company’s own Surgical Antireflux Venous Valve Endoprosthesis (“SAVVE”) study. Summary details of the study, set for primary completion date in March 2024, are observed in Exhibit 3.

Exhibit 3. SAVVE clinical trial summary

Image: HB Insights. Data: Clinicaltrials.gov

An educational video on the study and the procedure itself can be found here.

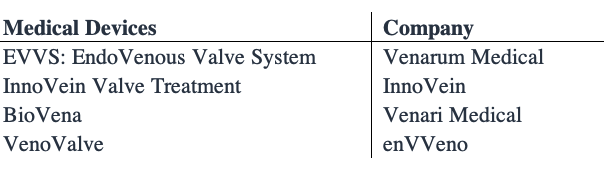

NVNO isn’t the only company pushing ahead with innovation in the space, although it does boast the only FDA approved pipeline. Below are the other names within the space [each private companies] alongside NVNO competing in the CVI treatment domain.

Exhibit 4. Competing names in the CVI treatment continuum

Data: HB Insights

Entry into transcatheter valves

NVNO also announced this week that it is developing a non-surgical transcatheter based replacement venous valve. It is calling the device enVVe and is also being designed for the treatment of CVI. The company has filed for its first in human (“FIH”) testing of the system and hopes to receive approval by the end of 2022. The clinical trial, called the Transcatheter Anti-reflux, Venous Valve Endoprosthesis (“TAVVE”) FIH study, is being conducted in Columbia.

If successfully commercialized, the enVVe valve would be the lowest delivery profile on the cardiovascular market of only 4.3 millimetres when crimped, and would be delivered via over the wire single-stage, coaxial pull system. Another differentiator is that the procedure doesn’t need to be performed in an operating room, and doesn’t require general anaesthesia. I’m awaiting more info on this as we speak as the latest developments were only announced this week by the company. A sample image of the new device is seen in Exhibit 5, pulled from the company’s description on it.

Exhibit 5. The enVVe device – a transcatheter based delivery system

Image: NVNO Company Website

Potential legal overhang?

Curiously, combing through NVNO’s 10-Q from the last quarter and its 10-K earlier in the year, it described an ongoing case regarding a former employee where NVNO was served with a cicl complaint in the Superior Court for the State of California in July FY20. The case, entitled Rankin v. Hancock Jaffe Laboratories, Inc. et al, was brought to the limelight only to be followed by a second complaint against the company and its CEO. Below is the company’s description of the case and the potential implications:

“The complaints assert several causes of action including a cause of action for failure to timely pay [the former employee’s] accrued and unused vacation and three months’ severance under his July 16, 2018 employment agreement, defamation, unlawful labor code violations, sex-based discrimination, and unfair competition, and seeks damages for lost wages, emotional and mental distress, consequential damages, punitive damages and attorney’s fees and costs.

The company has denied all claims in both matters (which have now been consolidated) and has filed a counterclaim asserting that [the former employee] has breached his employment agreement with the company to the company’s damage.

The company continues to believe it has meritorious defenses to both matters which are currently set for trial on October 24, 2022. As of the date of these financial statements, the amount of loss associated with these complaints, if any, cannot be reasonably estimated.”

The case is set for trial in around a month’s time as mentioned, and this could potentially be an interesting time to watch the company’s share price. It is not well understood exactly what the former employee is seeking in the proceedings, however there could be a chance an overwhelmingly negative outcome could inflect on the stock at that time. Definitely keep a close watch around that time if following this name.

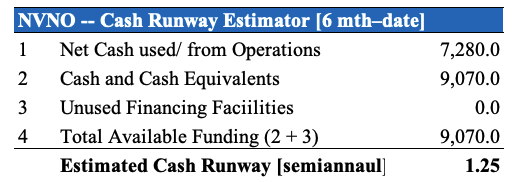

Cash burn

The company churned through ~$4 million (“mm”) in the last quarter primarily to fund the SAVVE study and for other payments. Last year it had raised additional capital and had $9.1mm in cash and equivalents on the balance sheet, although it used $7.28mm in cash for the 6 months to June 30 2022. Based on these inputs, I’ve estimated the company has around 9 months of cash runway on its current balance [and assuming the same burn rate as last period] until it will need to raise additional cash.

Exhibit 6.

Data: HB Insights Estimates

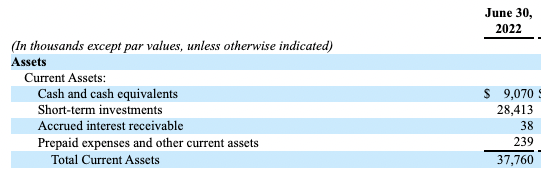

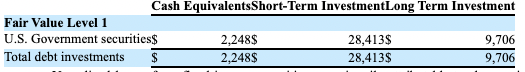

To offset any drains to liquidity, NVNO’s also allocated c.$28.4mm to additional marketable securities as an additional liquidity buffer, as seen in the Exhibits below. In all this provides the company with $35.5mm in net working capital and this is more than sufficient to continue operations and financing clinical trials mentioned throughout this report for the time being.

This is relevant because the cost of capital is increasing and capital is also being swept up and taken out of the market amid the current economic landscape. I want the company to have as long a cash runway as possible right now because of these reasons. Simply, raising capital won’t be the conducive environment it has been over the past 10 years, into the coming decade. Looking ahead, this is a key risk facing all commercial stage medtech’s.

Exhibit 7. NVNO current position.

Data & Image: NVNO 10-Q FY22

Exhibit 8. NVNO short-term investments help create additional liquidity buffer.

Data & Image: NVNO 10-Q FY22

Conclusion

Given it’s stage in the growth and commercial cycle I continue to rate NVNO a hold. All estimates of future cash flows based on the current stage of clinical trials NVNO is in would be wildly speculative, and the predictability of these is marred by numerous macro-headwinds at now. Not to mention an ever increasing discount rate that is set to continue surging into the coming years. NVNO is absolutely a name to watch from the sidelines, and updates around its VenoValve and now the enVVe procedures are sure to inflect on its share price – particularly positive trial data.

Be the first to comment