sturti/E+ via Getty Images

Co-produced with Treading Softly

The word is in. The market is reacting. The Federal Reserve decided it was time to get off its laurels and put in at least a token effort to fight inflation.

This time it was a raise of 0.25% and forecasting 6 more increases, to bring us to 1.75% by the end of the year. They felt this would help fight inflation, while also not cratering the economy into a recession.

Many feared a more hawkish move. High Dividend Opportunities members get our weekly market outlooks and we’ve discussed the Dovish position of the Fed, and we weren’t surprised. These moves represent a “Dovish” tightening policy. No shock and awe. This is a Federal Reserve we can expect to make slow, careful movements, with a bias towards erring on the side of fiscal accommodation.

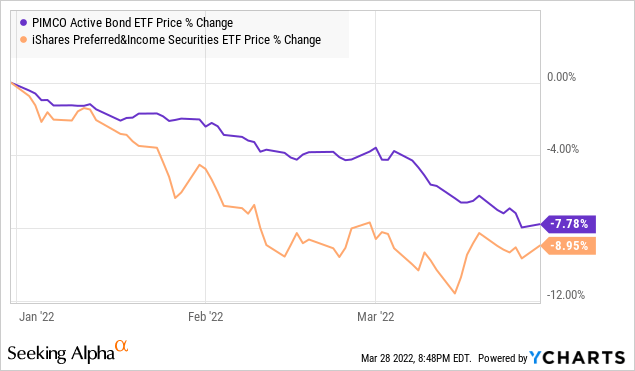

Regardless of the Fed’s careful moves, or attempts at them, inflation and rising rates expectations have hammered on bonds and preferred values.

Yet the change in their trading value does not impact some major benefits behind fixed income:

- They still mature or redeem at their liquidation value

- They still have priority in interest payments or distributions

- They still provide steady income

So with values dipping heavily along with the market, investors can now get the same income as before, but at even better yields than previously available.

Today, I want to look at two oversold funds investing in the fixed income space to lock in that excellent income, but with even better yields than before.

Pick #1: DFP – Yield 7.5%

“The market” is right, prices on fixed-income should come down. The question is how much? This is where the market has overshot to the downside, providing us with a buying opportunity. Excluding the COVID disruption, Flaherty & Crumrine Dynamic Preferred and Income Fund‘s (DFP) price and NAV are the lowest since early 2019. In early 2019, the Fed’s target rate was 2.25% and the 10-year Treasury was over 2.5%.

With a Federal Reserve that might raise the target rate to 1.5% by the end of the year, we are comfortable saying the market overcorrected to the downside in the fixed-income market.

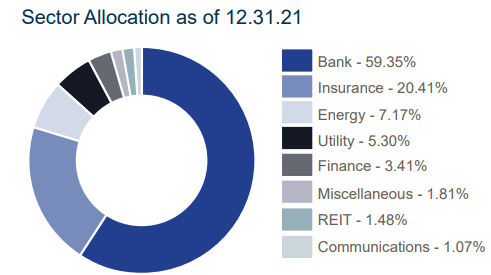

DFP invests in preferred shares issued by banks, insurance companies, utilities, and other defensive sectors. (Source: DFP Fact Card)

DFP Fact Card

These are solid, reliable sectors that we can expect to be able to pay their bonds and preferred equity obligations in any economic conditions. Over 40% of DFP’s portfolio is “investment grade”. DFP is an excellent buying opportunity to take advantage of the market’s over-enthusiasm at running away from fixed-income.

Pick #2: PDI – Yield 11.1%

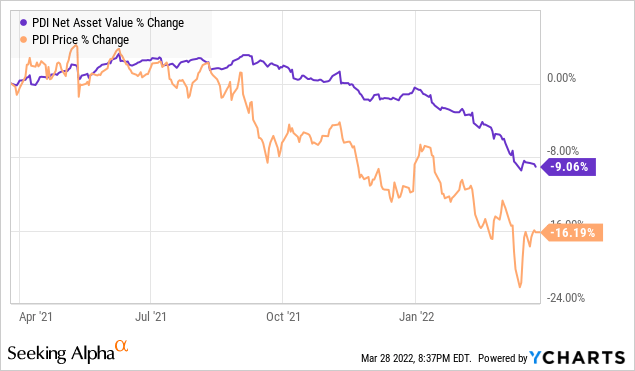

PIMCO Dynamic Income Fund (PDI) is a fund that has been caught up in the rush away from fixed income. Importantly, this sell-off has impacted PDI’s share price far more than its NAV.

NAV is the best way to measure the results of the fund manager and is the actual results being produced by the manager. Ultimately, this is what funds the dividend.

The share price is what people are willing to pay to own shares of the fund. It is much more susceptible to the whims of investors. We’ve talked of the market as being a “voting machine” and a “weighing machine” and CEFs are a classic example. The market price is the voting machine telling you how popular a fund is at a given time, the NAV is the weighing machine telling you how the fund is actually performing.

Right now, the market’s sentiment towards fixed-income is bad and that has led to negative sentiment toward PIMCO’s funds as well. Yet NAV continues to hold up well, and more importantly to us, PDI’s dividend coverage is improving as yields rise.

Earlier this month, the news was reporting about PIMCO’s potential multi-billion dollar loss due to exposure to Russia. The news report is true but lacks context. PIMCO’s approximately $2.5 billion in exposure is across all of its funds. The investment of $2.5 billion out of over $2.2 trillion in assets under management is a small loss in the grand scheme.

On the individual fund level, the Russian exposure is immaterial, and whatever impact there was is already significantly reflected in NAV as the value of Russian investments crashed last month. PIMCO updates the NAV of its funds daily, this is an example of how the news can create buying opportunities. Investors panicked over something that was reported without context and sold off PIMCO funds far more than is justified.

This is why I take market prices with a grain of salt. The market is moody, over-reactive, and irrational. What really matters is how much cash is coming into my pocket every month. PDI is paying an 11% and dividend coverage is improving. Buy PDI, and send a thank you letter to the crazy neighbor who sold it.

Dreamstime

Conclusion

By buying the irrational selling of others, we can lock in excellent long-term income for decades to come! This is a key aspect of our Income Method, the ability to look through the noise and confusion brewing over the seas of the market and whipping up waves. A brave and wise captain knows when the storm must be avoided or when an opportunity exists by entering into the fray.

For the fixed income market, this is a storm we’re willing to enter to benefit from extra-high yields provided by the panic and fear of others. You can steer your ship in behind us, or you can avoid the storm.

In the end, I want your retirement to have an abundance of income. So you can enjoy all the opportunities that retirement has to offer. Years and years of relaxation, stress-free, and surrounded by the ones you love. There is a time to battle the storms and a time to avoid them. For the HDO Model Portfolio, this is a battle worth waging to gain the prize of excellent low-risk income.

Will you join us?

Be the first to comment