Nikada/iStock Unreleased via Getty Images

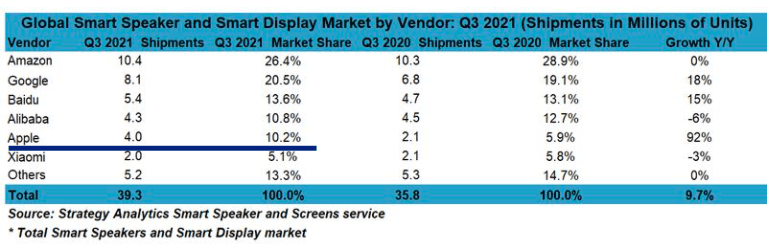

Apple’s (NASDAQ:AAPL) HomePod mini replaced HomePod due to the low customer acceptance of the pricey HomePods. HomePod mini is reported to be doing well in the last few quarters as the lower price point opens a much wider customer base for Apple within the smart speaker segment. According to Strategy Analytics report, Apple’s market share in smart speaker and smart display market has jumped to 10.2% compared to 5.9% in the year-ago quarter. It is still significantly behind Amazon (AMZN) which has 26.4% market share and Google (GOOG) which has a 20.5% market share.

The revenue contribution of HomePod mini will be very low compared to products like iPhone and Services segment. However, it is an important product for Apple in the rapidly expanding smart home devices. HomePod mini will also have a big impact on Apple Music services where the company is facing significant competition from Amazon and Google. Apple is behind Amazon and Google which are building a strong ecosystem of products and services within their smart home segment. Investors should closely look at the market share trajectory of Apple in smart speaker segment to gauge the ability of the company to build future products and services in the lucrative smart home device business.

Jury is still out

The recent report by Strategy Analytics clearly shows that HomePod mini has received better reception from customers compared to HomePod. However, this was to be expected due to the lower price tag. Apple’s smart speaker sales have increased from 2.1 million in Q3 2020 to 4 million in Q3 2021. It has a lot of distance to catch up with Amazon which sold over 10 million smart speakers and smart displays in Q3 2021.

Amazon has a wide range of devices in this segment from Echo Dot to Echo Show. The recent Echo Show 15 by Amazon sports a massive 15.6 inch display and takes a further step in reducing the distinctions between tablet, television, and other display devices. Amazon is trying to saturate this market which will make it difficult for Apple to gain market share in the future.

Strategy Analytics

Figure 1: Increase in market share due to HomePod mini.

It would be very important for Apple to continue to show progress within HomePod mini user base. The initial bump in sales was expected as the lower cost of HomePod mini attracted to bigger customer base. However, in order to show future year-on-year growth, the company would need better promotion. The price difference between Echo Dot and HomePod mini is still quite high.

Important for Apple’s ecosystem

When we look at the total contribution of smart speakers to Apple’s revenue base, it seems very low. If Apple sold close to 4 million HomePod mini at $99, it would have a total revenue of $400 million. This is less than 0.5% of revenue in that quarter. However, the importance of HomePod mini to Apple’s ecosystem of products and services is immense. Apple needs to improve its game within the smart home device markets where Amazon and Google are ramping up their products and services.

Amazon has even launched a home robot called Astro at $999. This shows that the company is ready to experiment with different devices till it gets a hit with the audience. This was the idea behind Echo devices when they were launched and it gave Amazon a first-mover advantage which it has maintained till now in terms of market share.

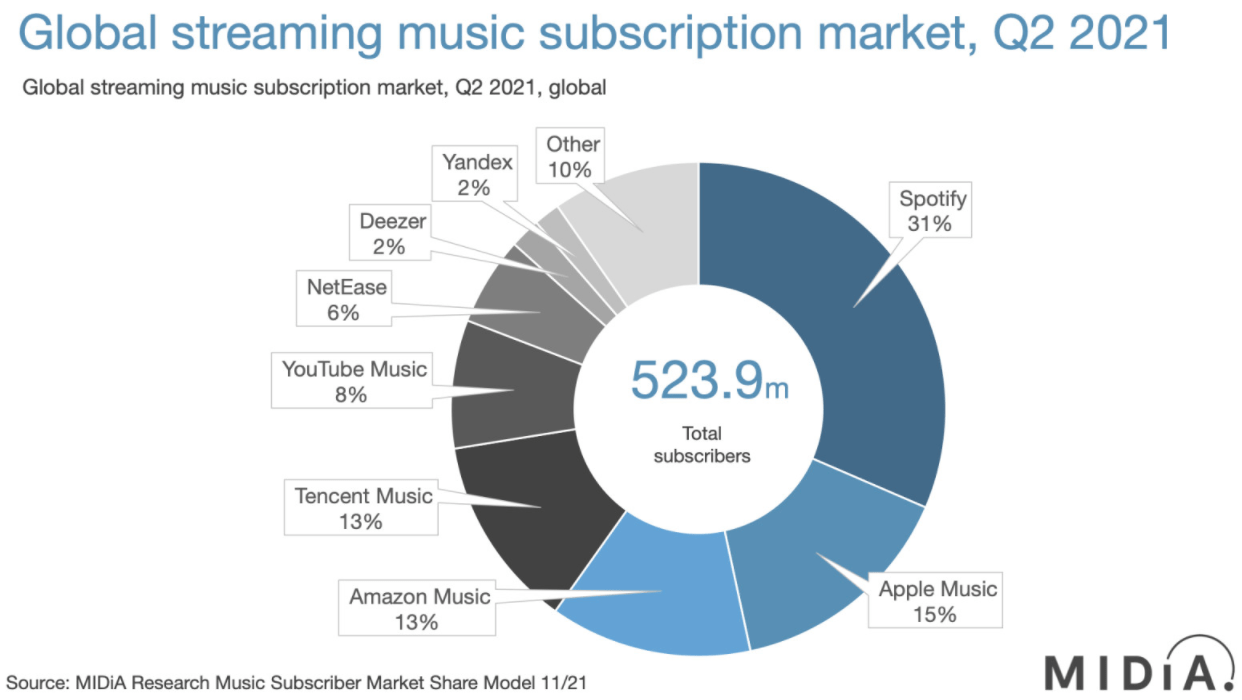

MIDiA Research

Figure 2: Apple Music is closely followed by Amazon Music and YouTube Music.

A recent report by MIDiA Research shows that Apple is closely followed by Amazon Music in terms of streaming music subscriptions. YouTube Music is also showing rapid growth. Apple has not released the number of paid music subscribers in over two years. This could point to a big slowdown in subscriber additions. Having a strong smart speaker market share helps Apple in providing a seamless music streaming service. Apple also depends on its product lines to deliver future high-margin services. We have seen this in the very lucrative licensing agreement between Apple and Google for iPhone and other devices.

Both Amazon and Google have a strong ecosystem of services. If they gain a big market share within smart home devices, they can easily race past Apple in terms of streaming music subscribers, streaming video, and other services.

Apple is at a disadvantage

Apple has a major disadvantage within the smart speaker segment. Both Amazon and Google can monetize their customer base through other services. For example, it is well known that Echo users spend more on Amazon’s ecommerce business which can allow the company to subsidize these devices. Apple does not have this luxury. This is one of the key reasons why it could have discontinued HomePod. The bill of materials for HomePod was estimated to be $218 by Bloomberg while the device was selling for $299. This means that after selling and administrative expenses, Apple was probably selling HomePod for a loss. Apple has enough cash flow to absorb these losses but it would need to show progress in terms of market share and cumulative base of smart speaker users.

Apple is trying to build strong subscription segments. It has launched a number of subscription services in the recent past. However, it needs a must-have anchor service that can attract customers to its subscription ecosystem. Amazon has it due to its Prime membership. Google’s YouTube has announced that it has over 50 million subscribers for Premium and Music service. Apple is trying to build its streaming video service as an anchor service. However, it will take a lot of time and resources for Apple to build an attractive original content library. During this time, Apple Music is the key service that the company can use as an anchor service to gain more customers for its subscription ecosystem. Hence, it is very important to have a strong presence in smart speakers and smart display devices to attract customers to its music streaming business.

Impact on Apple stock

As mentioned above, the revenue contribution of HomePod mini is very low. The margins on this product would also be quite low due to rock-bottom pricing. But if Apple shows another triple-digit YoY growth in this segment, it could be in a strong position against Amazon and Google within the smart home device segment. It is also likely that Apple will launch a smart display device like Echo Show 15. Having similar branded devices helps in creating a more seamless experience within a single household. Hence, HomePod mini could provide a foothold for the company for future devices in the home.

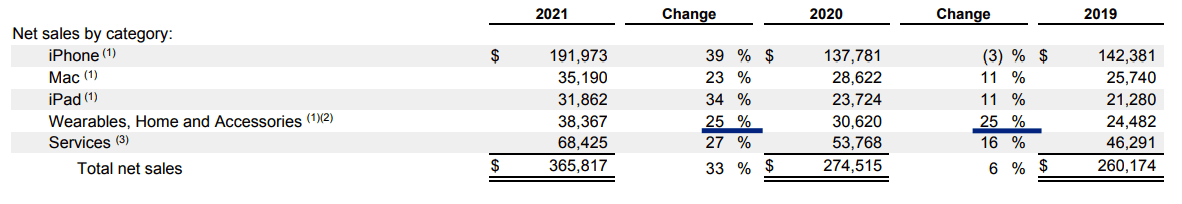

Company Filings

Figure 3: Growth in Wearables segment in the last fiscal.

Apple’s Wearables, Home and Accessories segment showed 25% YoY growth in the recent fiscal. This was quite good. However, all other segments showed a much higher jump in growth rate. The reason for better growth in other segments is the lower headwind of the pandemic in the last fiscal compared to fiscal 2020. This means that we should expect a much lower growth rate in the wearables segment in the next few quarters as the company will have to face tougher comps.

Figure 4: Decline in YoY revenue growth in Wearables segment to 13.9%.

Future growth trends

The Wearables, Home and Accessories segment makes 12% of the total sales of Apple. However, the long-term impact of a poor smart speaker market share is a lot bigger than the impact on revenue base or bottom line. Smart speakers are the main anchor product within smart home device segment. Both Amazon and Google have used the strategy to expand into new smart home products after they achieved a good foothold in the smart speaker segment.

If Apple is limited to a low market share in the smart speaker segment, it would not be able to promote services like music and video streaming. Apple’s management has also used the strong user base of iPhones to add highly lucrative revenue segments like the licensing deal with Google which pays over $10 billion. Poor market share in smart speakers will reduce the ability of Apple to launch new services and it will be a major headwind in the future.

Unless we see another big hit product in this lineup, the YoY growth can dip to single digit in the wearables segment which will reduce the bullish sentiment towards the stock. Apple is already selling at close to 30 times its P/E ratio. This is twice the historic average. The premium stock pricing might not be justified if a major growth segment like Wearables, Home and Accessories reports modest improvement.

HomePod and smart home devices will be the key to Wearables, Home and Accessories business segment in the next few quarters. Apple is facing a number of disadvantages in this segment. It will be important for investors to note the future growth trend within this segment to gauge the growth potential of the stock.

Investor Takeaway

HomePod mini has reported better sales than HomePod according to third-party estimates. A lot of this growth is due to lower pricing. Apple would need to continue to show close to triple-digit growth in this segment to close the gap with Amazon and Google. Both Amazon and Google are catching up to Apple Music. Poor smart speaker market share can hurt the long-term growth potential in the music streaming business. Apple also needs to show growth in HomePod mini to build a foothold in the future smart home devices industry which is turning into a very profitable business where Amazon and Google are putting a lot of resources.

Apple’s wearables segment is showing signs of a slowdown and will be facing tougher comps in the next few quarters. A slowdown to single-digit YoY growth will end up hurting the bullish sentiment for Apple which is trading at twice the historical average P/E ratio. Hence, the future unit sales number of HomePod mini will be very important for the company and the stock.

Be the first to comment