PierreOlivierClementMantion/iStock Editorial via Getty Images

My opening thoughts

There aren’t many people in this world – if any – that would argue Apple (NASDAQ:AAPL) isn’t a top-tier company. I certainly won’t go there, but I will recommend that investors stay away from the tech giant for now. Apple shares have rallied throughout the past three years – the company has returned 279% (93% average annualized return) to shareholders compared to the S&P 500’s 73%. Apple is a great stock, and many signs point to continued success in the future. That said, the company is not trading at an attractive valuation, and given the volatility of the stock market today, there are more opportunistic ways to deploy your capital than investing in Apple stock.

I’m not suggesting that investors sell their shares, but I don’t think it would be unwise to hold off on buying Apple for now. We’re all aware of Apple’s wide moat, steady growth, and robust balance sheet, but the fundamentals need to align nicely with the valuation in order for a stock to be considered a good investment. Apple’s fundamentals may be impressive, but its current valuation is a different story. I like to invest in companies that have strong financials paired with a shrinking valuation. Apple doesn’t fit that profile today, and I advise investors to remain on the sidelines for the time being.

Apple’s valuation today and tomorrow

Today, Apple is trading at 29 times earnings, notably higher than its five-year average price-to-earnings multiple of 23x. For mature companies with more predictable growth, observing their historical trading multiples serves as a solid benchmark to determine if they’re fairly valued. Provided that Apple’s current P/E multiple is more than 125% higher than its five-year average, it’s safe to say that the stock is expensive today.

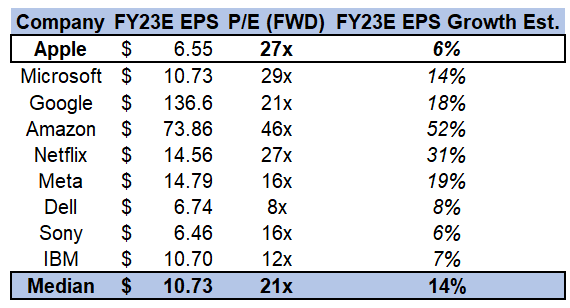

Apple is forecasted to generate an earnings per share of $6.55 in 2023, translating to 6% growth year over year from 2022 estimates and a forward P/E of 27x. When you compare this to Apple’s FAANG counterparts and noteworthy peers, Apple is markedly overvalued. In the table below, you’ll see that Apple’s 2023 forward P/E of 27x is higher than its peer group median of 21x. Likewise, the company’s forward earnings growth of 6% is more than twofold less than its competition, which carries a median growth rate of 14%. In other words, Apple is trading at a higher valuation than close competitors despite being projected to grow at a slower rate – a recipe for overvaluation.

Seeking Alpha Data, Author’s Material

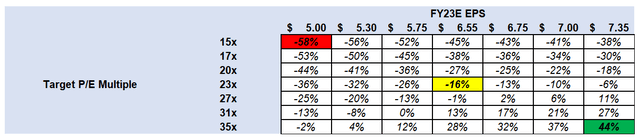

The sensitivity analysis below reveals how different EPS forecasts and target P/E multiples influence my target price for Apple in 2023. If Apple satisfies consensus estimates and generates an EPS of $6.55, my stock price estimate would be $151/share (16% lower than today) when applying a target P/E of 23x (consistent with five-year average). Even if Apple squashes consensus estimates and trades at all-time high multiples, the company’s upside doesn’t appear great. At a target P/E of 35x, an earning per share of $7.35 in fiscal year 2023, which exceeds high estimates, only translates to 44% upside from today’s price levels. It’s certainly possible for Apple shares to climb higher, but the stock doesn’t present an ideal situation, fundamentally speaking.

Will Apple reach a $4 trillion market cap?

Earlier this year, Apple became the first company ever to have a market capitalization surpass $3 trillion. Although the company’s market cap has dipped to $2.92 trillion since then, many investors ponder when Apple’s market value will reach $4 trillion. The law of large numbers is undoubtedly working against Apple. At a $3 trillion market cap, the company represents 14% of the United States’ GDP and exceeds that of the United Kingdom, which has a GDP of $2.76 trillion.

Let’s supposed that Apple can generate an EBITDA of $230 billion by 2030, which indicates an average annualized growth of 7% from $120.2 billion EBITDA in 2021. If Apple shares trade at their five-year historical EV/EBITDA multiple of 16x, the company’s enterprise value would only touch $3.68 trillion by 2030 (30% upside for Apple’s $2.84 trillion EV today). This amounts to an average annualized return of less than 5% through 2030. Again, I wouldn’t be surprised to see Apple shares continue to rally, but fundamentals don’t help the company’s bull case.

Apple’s an exceptional company, but don’t buy today

Apple is perhaps the world’s most successful company, but that doesn’t mean investors should jump on the stock today. If shares of the tech giant fall below its five-year average P/E of 23x, I would then urge investors to consider buying the stock. I’m not proposing that current shareholders exit their positions; rather, I’m insinuating that there are better investment opportunities available on the market today.

Given that current market conditions have led to a sharp decline in many equity prices, investors should be looking to maximize the return potential of their capital. And while Apple is certainly a safe pick, I don’t think the company is an optimal play at the moment. Great companies don’t always make great investments, and given the context of Apple’s situation today, the company fits this description precisely.

Be the first to comment