Sundry Photography

We were previously bearish on Broadcom (NASDAQ:AVGO), but we believe it’s time to move AVGO to buy. Our bullish sentiment is based on our expectation that AVGO is well-positioned to outperform expectations in 2023, driven by new products with higher ASP offsetting unit growth moderation.

AVGO stock dropped 20% YTD. We expect the worst days are behind for AVGO as we believe it’s better positioned now to outperform expectations for next year. The stock rallied a slight 3% after the company announced its 4Q22 earnings report. AVGO came in ahead of revenue and EPS estimates yesterday, reporting EPS of $10.28, beating expectations by 1.65%. AVGO reported revenue of $8.9B, achieving a 0.33% surprise to expectations. We expect the company to continue outpacing expectations in 2023. We’re constructive on AVGO as management successfully controlled double-ordering in its semiconductor business and is taking measures to only ship to true market demand over the past year. We recommend investors buy the stock at current levels.

New products allow space for higher ASP

We expect AVGO’s expansion of its silicon, software, and hardware connectivity products to enable ASP growth and hence boost top-line growth for 2023. We believe AVGO is well-positioned to benefit from the hyper-scale data center growth and increased storage demand. AVGO reported an upbeat sales forecast for 2023 from corporate customers and the broader data center industry. While we expect normalized demand toward 1H23, we believe the moderating unit shipment will be offset by higher ASP for new products.

AVGO’s 4Q22 reported a server and storage-related sales growth of 9% sequentially and 50% Y/Y. We expect the company to continue enjoying demand as it offers new products with higher bandwidth and improved supply from its foundry. AVGO announced upgrading its 51TB Ethernet Switch Tomahawk 5, a family of high speed, high radix, low latency, Top Rack Ethernet switches that will enable the expansion of hyperscale storage clusters. The latest addition to the 51TB Ethernet Switch Tomahawk family is Tomahawk 5, which delivers the highest bandwidth switching chip on the market with the lowest power consumption. AVGO introduced other new products touching on their connectivity end-markets as well. We expect the full new product portfolio to enable higher ASP in 2023 and incite revenue growth.

Double-ordering under control

Double ordering has been a major concern for companies within the semi-space, and AVGO is no exception. Customers fall into double-ordering behavior when concerns about chip shortage and supply chain issues surface. We believe the main threat of double-ordering is that it inflates the order numbers creating an unrealistic image of demand, as well as traps semis into the cycle of shipping orders they will not be paid for. We’re more constructive on AVGO now as management exercises discipline in shipping orders to avoid giving into the double-ordering cycle. In 4Q22, AVGO reported a 26% Y/Y growth in their semiconductor solutions segment and a lower 4% Y/Y growth in infrastructure software segments. We expect the grunt of double-ordering to have passed in 2H22 and expect demand to normalize now as supply improves toward 2023.

While we expect double orders are under control, we still believe the company will face some near-term churn. AVGO’s industrial-related sales decline 4% sequentially. We attribute the decline to weakened demand from Chinese customers. We expect macroeconomic headwinds and weakened demand to pressure the stock toward 1H23. Still, we believe AVGO is a buy as new products and higher ASP drive revenue growth for 2023. Additionally, we expect AVGO’s $61B acquisition of VMware, Inc. (VMW), a leading provider of multi-cloud services for all apps, to provide further diversification to its revenue base.

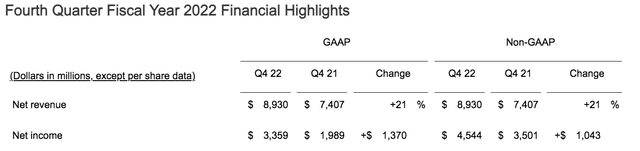

The following graph outlines the 4Q22 highlights for AVGO.

Valuation

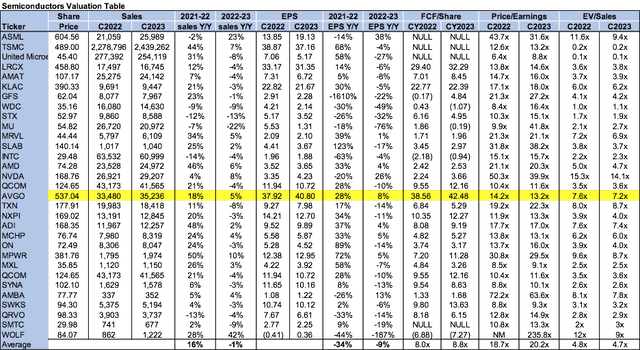

AVGO is relatively cheap. On a P/E basis, the stock is trading at 13.2x C2023 EPS $40.80 compared to the peer group average of 20.2x. The stock is trading at 7.2x on EV/C2023 Sales versus the peer group average of 4.7x. We believe the stock provides an attractive entry point at current levels and recommend investors buy into AVGO’s 2023 growth prospects.

The following table outlines AVGO’s valuation compared to the peer group.

Word on Wall Street

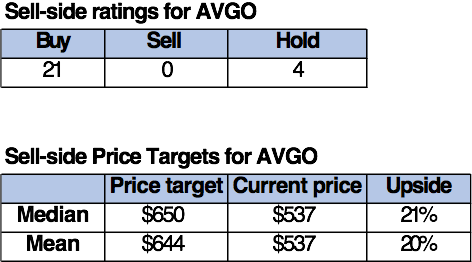

Wall Street is overwhelmingly bullish on the stock. Of the 25 analysts covering the stock, 21 are buy-rated, and four are hold-rated. The stock is currently priced at $537 per share. The median sell-side price target is $650, while the mean is $644, with a possible upside of 20-21%.

The following table outlines AVGO’s sell-side ratings.

TechStockPros

What to do with the stock

AVGO has had a rough year alongside the larger semiconductor peer group. We expect AVGO is now better positioned to outperform expectations for 2023. We believe AVGO’s management is taking all the required steps to manage the issue of double ordering, which was our main concern in late August. We expect the new product cycle to allow space for higher ASP and drive revenue growth for 2023. We see favorable risk-reward for AVGO in 2023 and recommend investors buy the stock.

Be the first to comment