Oselote/iStock via Getty Images

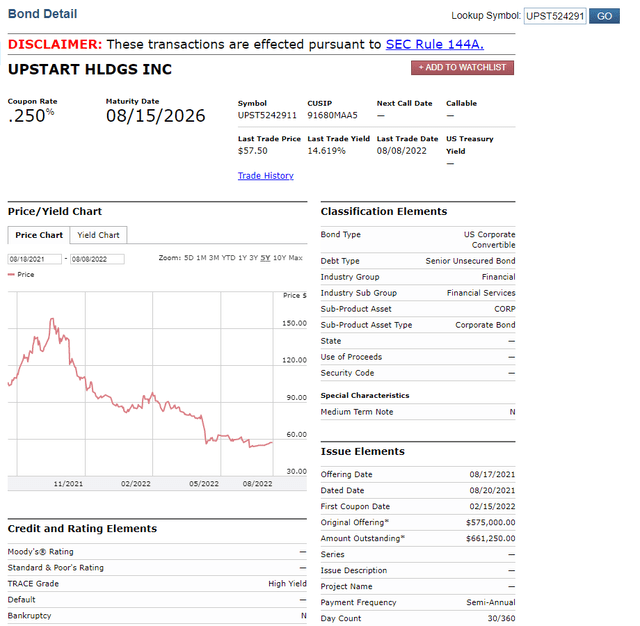

When we recently covered Upstart Holdings, Inc. (NASDAQ:UPST), we highlighted the better risk-adjusted bet in the convertible bonds and also made a bold call.

The upcoming quarterly results will be closely watched to see how UPST navigates the current turmoil. Historically, during economic contractions, everyone flees to safety. Whether this comes from investors preferring large cap over small cap stocks, or banks preferring established lending models vs newer, AI-driven ones. We don’t believe the negative surprises are over and believe investors will see the stock eventually trade near tangible book value.

Source: 15% Yield On Convertible Bonds

That tangible book value is far lower, and it seems silly pressing on that when the stock was down 96% from all-time highs. Well, we knew the Q2-2022 results would be a tell, and boy did they deliver for the bearish view.

Q2-2022

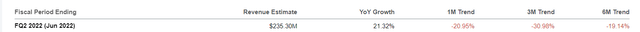

The Non-GAAP earnings per share of $0.01 missed by $0.07, but we all know that those numbers are rather distorted. The revenue ($228.16 million) missed by about $7.00 million versus consensus was a downer, especially considering just how quickly analysts had moved their estimates lower. In the last 1-month alone, revenue estimates were dropped by over 20%.

This is what the shorts have been pressing on. They believe the model has broken and growth is gone. They believe that we have yet to see the full impact of a recession on UPST’s story. UPST’s revenue miss proved them right, again. But this was just the start of the nightmare for the bulls.

Guidance

UPST’s revenue guidance was so bad that it likely caused some intense panic in the bull camp. The company is also looking for losses in Q3-2022, even from an “adjusted” perspective. This is what the entirety of the guidance looked like.

For the third quarter of 2022, Upstart expects:

- Revenue of approximately $170 million

- Contribution Margin of approximately 59%

- Net Income of approximately $(42) million

- Adjusted Net Income of approximately $(9) million

- Adjusted EBITDA of approximately $0

Team Groupthink was going for $246 million, with the lowest estimate for $55 million above that where the company guided.

We would also note that each subsequent quarter was way higher, and all those numbers are looking downright silly. In fact, UPST’s Q2-2021 revenue was higher than this, and by a lot.

Outlook

With a $170 million quarterly revenue run rate, you can bet that there will be at least 8 downgrades on the way. There are also no guarantees that UPST hits that mark, as it has been floundering against the tide. We are going to go out on a limb here and say that UPST misses the 2023 revenue estimate number by at least 50%.

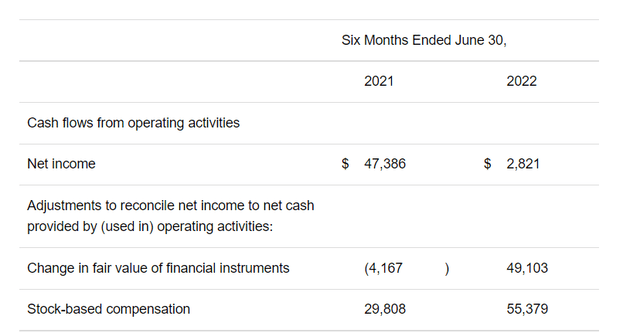

While GAAP profits had left the building a little while back, non-GAAP will also be exiting next quarter. What investors will have is an AI model with $680 million revenue run rate and $110 million of annualized stock-based compensation.

There was one piece of good news here, and that came from the big improvement in the contribution margin. That 59% seems rather odd considering that revenues are tanking, but if correct, it appears that UPST is getting a better handle on its losses. We will be updating investors on this post the conference call.

UPST also purchased 3.5 million shares of UPST totaling approximately $125 million. This was bizarre in our view, as the company should be focused on restoring investor confidence through profitability and growth. 3.5 million share repurchase, does little to alleviate concerns and actually burns through vital cash that the company might need later.

Verdict

35% short interest ratio is what prevents from putting a hard sell on this. The meme crowd has found no fear in the past few weeks. If anything can be squeezed, it is this one, and we don’t want to cross the “hold” line on either direction. Fundamentally, though, this is about as broken as it gets. Revenues are going to go down substantially, and we will likely get more downward pressures when we hit a recession. Reverse engineering profits is very hard, and what we mean by that is you cannot contract into profitability. In our opinion, you can write off even the possibility of GAAP profits in 2023. Retaining talent will be challenging as well, and we believe many employees came on with the idea that this would be a $1,000 stock at some point soon. The best long bet remains the convertible debt, which has risen slightly since we wrote about it, but still has a 14.61% yield to maturity.

Outside a takeover, which is possible since the market cap is so small now, we expect this to move to single digits eventually and trade at tangible book value.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment