GoodLifeStudio

Fiverr (NYSE:FVRR) was one of the major beneficiaries throughout the pandemic as the company reported outsized growth throughout 2020 and 2021 sending the stock price soaring over 1000%. At the time, this explosive rise appeared justified, Fiverr and its sector had been transformed. The platform’s reach expanded as it added a significant number of new buyers to the platform, not only that but these buyers were spending more than before.

The reality, though, was that Fiverr was going to have to keep growing at an incredibly fast pace to support its valuation. As soon as 2022 came, the picture completely changed, the company was facing an uncertain consumer environment. The latest quarterly print reflected those troubles, as Fiverr missed on the top line and put forward weak guidance. There were some positives concerning buyer and seller trends, but these were overshadowed by the top and bottom line figures. Looking at the ‘big picture’, the potential for large long-term returns is still there – Fiverr has made material reinvestments to become a leader in the freelance services industry (still anticipated to grow at a fast pace over the long term). But over the near term, there is likely to be more pain for shareholders than any gain.

Q2: The Good, The Bad And The Ugly

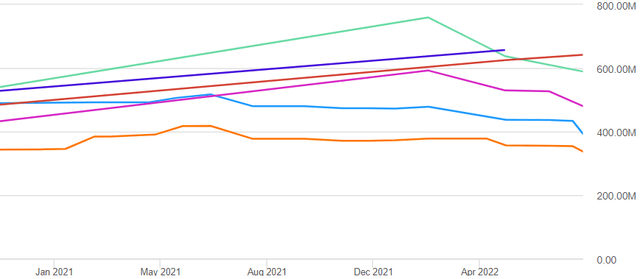

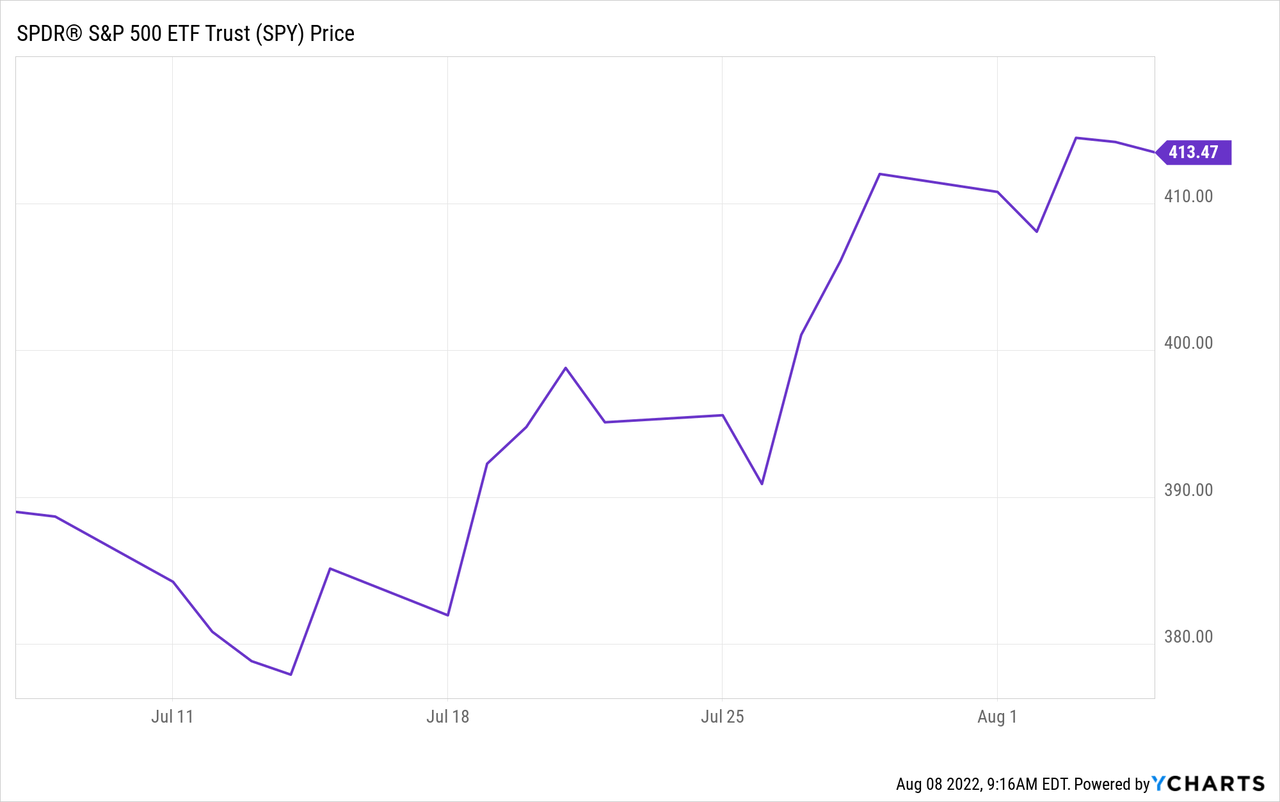

Considering the depressed stock price, coming into the quarter, it felt like Fiverr didn’t have to do much to see a rally. This was further supported by the S&P bouncing back off lows when Fiverr reported:

Indeed, this was the case, Fiverr rallied nearly 30% over the following days, which occurred despite the price actually dropping immediately following the results. For those reasons, I wouldn’t look into the price action too much, it is more sentiment than anything.

First, we are going to take a look at the positives from the latest results, though there is a lot less to draw on than when discussing the bad and the ugly. The most notable positive came from the spend per buyer figure, which jumped to $259, not only increasing 14% YoY but also 4% sequentially. It’s well known that Fiverr invests a lot in marketing, so as the business looks to scale in the future, retaining high-value buyers will be a key influencing factor in giving Fiverr the ability to taper marketing spend. There is a lot of discussion around investor communities about the poor quality of Fiverr offerings (generally arising from personal experiences), however, buyers with an annual spend of over $10k increased 60% YoY. Certain buyers love the service, and the number of those who do is growing faster than the average buyer.

Now into the bad and the ugly. For high-growth tech stocks right now, the challenge they are facing is whether they can continue growing revenue at double-digit rates through economic headwinds. This is particularly relevant for some, like Fiverr, where despite the significant drawdown in stock price, it’s still pulling forward a lot of growth. Despite incredible growth over the last two years, revenue is still relatively minute in comparison to the market cap. Fiverr did just about achieve that growth in Q2, as revenue came in 13% higher than the previous year at $85 million. This fell $1.71 million short of market expectations, however.

The disappointment came in the guidance. Fiverr expects Q3 revenue to come in between $80.5 and $82.5 million. Even if management is being cautious, this was well below the consensus of $87.74 million. This means for the FY, Fiverr is only expected to deliver YoY growth of around 13%. Considering there were a number of analyst revisions on the back of Q1 results, this guidance was really poor.

Analyst revenue estimates (Seeking Alpha)

Due to the headwind, Fiverr is now planning on reducing reinvestments for growth. This is a complete change from management commentary on strategy in Q1 results, where there was still a willingness to plough forward with investments. Management discussed this on the Q2 call:

What we’ve seen throughout Q2 was a worse than anticipated headwind during the quarter. And we’ve seen a more expensive growth. As a result of that macro change and given the fact that from a technically standpoint, we are in a recession. I mean, we have two consecutive quarters of negative GDP. Inflation continues to be high, and there is pressure certainly on small and micro businesses and we felt that. And because of that change in environment, we decided that since growth has been more expensive, it doesn’t actually constitute or justify to grow at any cost.

Whilst most likely the right decision by management considering the current environment, this is not what the market wants to be hearing from a high-growth business like Fiverr. The company instead now wants to focus on long-term sustainable growth. I think this reflects management concerns about the longevity of the coming crisis (highlighted by the discussion of recession), and that if Fiverr was to continue to reinvest, cash reserves may start to dwindle, and raising capital on favorable terms in this environment isn’t exactly easy.

Valuation

This now brings me to Fiverr’s current valuation, even after the large decline in stock price, Fiverr still trades at just below 5x Forward sales. If Fiverr was growing in the high twenties this would look attractive, but the business is barely set to grow in the double digits this year. It’s hard to predict whether the company is going to build on that in ’23 considering the recession risks and how prolonged a recession would be if it did come. Growth this year will also mean that Fiverr will likely lap tough comps again in ’23, with a significant reduction in marketing spend and a less accommodating economic environment, growth isn’t looking too promising in ’23.

Fiverr also needs this growth as it feeds into the bottom line. Margins have been squeezed over the last couple of quarters, the Adjusted EBITDA margin in the last quarter was just 5.4%, down 450 Basis points in comparison to the last year. This meant Adjusted EBITDA was just $4.6 million, Fiverr’s forward EV/EBITDA Is still just over 75, very expensive considering the company is expecting to achieve that *adjusted* profitability after reigning in on reinvestment.

Bull Case – Enduring Brand And Relative Cheapness

On a more positive point, I do believe Fiverr’s brand is enduring, shown by an active buyer count that is growing YoY – 4.2 million at the end of the last quarter. Whilst a growth slowdown is in line with revenue growth slow down, Fiverr does have a large base of buyers to fall back on if the going gets tough. In other words, I don’t believe Fiverr is going away any time soon.

Fiverr also looks very cheap (like many pandemic beneficiaries) on a relative basis. The company’s stock price fall has been astounding and completely changed the complexity of Fiverr’s valuation. Investors will know, however, that these are now different times, the previous valuation was based on Fiverr’s potential and expectation for continued fast growth, but the company wasn’t able to deliver that.

The Bottom Line

Q2 results provided a good summary of why Fiverr’s stock fell so hard from its highs. The company is in the midst of a growth slowdown when the valuation couldn’t accommodate this. The economic challenges Fiverr face are unlikely to ease anytime soon, and management seems to agree, lowering guidance and reducing reinvestments. For those reasons, even though buyer trends and Fiverr’s market position is strong, I have to maintain a ‘hold’ rating.

Be the first to comment