alvarez

Before the Q3 results, here at the Lab, we decided to follow up on HeidelbergCement (Heidelberg Materials) (OTCPK:HLBZF, OTCPK:HDELY) and reaffirm our positive view. We believed that Heidelberg was over-punished on the stock market, looking deeper into the company accounts (after having reviewed its immaterial exposure to Russia/ Ukraine), we checked its home market disclosure, concluding that German capacity production was just 6% of the total company’s output and its home market sales stood at 8% of its turnover. Considering also its debt reduction and lower valuation compared to peers, it was a clear buy. We hoped that you get on board with us, because since then, the company is up by more than 30%.

Source: Mare Evidence Lab’s previous publication

Q3 results

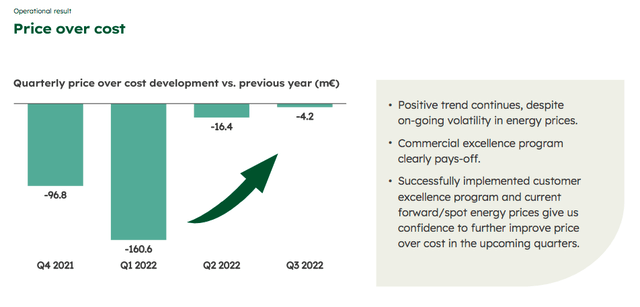

HeidelbergCement reported a Q3 operating EBITDA of €1.19 billion which was up 1.4% on a yearly basis, and above the average consensus collected by the company that was forecasting €1.17 billion. This result was positively driven by favorable currency development with a plus €74 million and was partially offset by negative pricing delta, lower volumes, and scope impact that were at -€4 million, -€23 million, and -€30 million respectively. Despite the price/cost spread still being in negative territory, the company managed to improve its quarterly delta from -€16 million to -€4 million. However, compared to Holcim, HeidelbergCement clearly underperformed. Indeed, the Swiss competitor recorded like-for-like growth of 16.3% and an operating profit growth of 7.7% in Q3. Also in the revenue line, HeidelbergCement’s outcome was lower than Holcim, with a top-line sales growth of 12% on like-for-like growth.

Source: HeidelbergCement Q3 results presentation

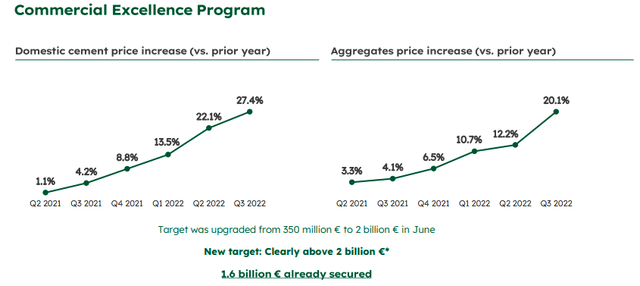

Looking at the quarterly performance, we see a positive trend that confirms that Heidelberg is accelerating its price increases (both in cement and also in aggregates) and in the meantime, they are working on reducing operating costs. This was also confirmed by the CEO’s words: “with cost discipline and energy saving measures, we weathered further increases in raw material prices and energy and maintained our result from current operations at the level of the previous year’s Q3″.

Heidelberg price development (Source: HeidelbergCement Q3 results presentation)

Q3 results were driven by mature markets such as North America which recorded a positive EBITDA evolution of 4.3% on a yearly basis. Southern and Western Europe also performed a good quarter, confirming our thesis on the Italcementi acquisition and the Italian real estate bonuses. Whereas, both Eastern and Northern Europe were below Wall Street consensus. With lower volumes in cement and in aggregates (and higher working capital requirements), the company managed to increase its FCF generation at the just end three-month accounts. This should provide relief at the investor community level.

Another topic that is worth covering is Heidelberg’s carbon footprint. As already mentioned, the company margins are lower than peers for the carbon tax, and the management plan to cut emissions is moving on. As we can see in the press release, the company “has further expanded its portfolio of carbon capture initiatives“. In the US subsidiary, in the Mitchell facility, CO2 emissions were cut by 95% thanks to production modernization.

Conclusion and Valuation

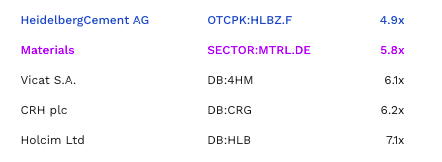

Going to the estimates, the company updated its guidance and continues to forecast a “strong increase in sales” and an EBITDA in the €3.6 – €3.8 billion range. Here at the Lab, we still believe in Heidelberg’s upside. Indeed, both at the P/E level and also on EV/EBITDA, we are confident that the company is currently trading at a discount versus its historical average (Fig. 1) and also compared to its competitors (Fig. 2). Rolling forward our 12 months EBITDA evolution and applying a 5.5x EV/EBITDA multiple, we derive a target price of €60 per share, confirming our buy rating. The company is also pointing out a lower demand for building due to higher interest rates and inflation. However, we positively view the latest data on North America that should be able to offset the weakness in the European market.

Heidelberg P/E evolution (Source: YCharts) Heidelberg discount to peers (Source: Finbox)

Be the first to comment