Ika84/E+ via Getty Images

Description

Natural Grocers (NYSE:NGVC) (“the company”) is a middle-sized chain of natural and organic groceries and dietary supplements in the US. The Company is focused on providing high-quality products at relatively affordable prices and strives to generate long-term relationships with its customers through nutrition education to help them make informed health and nutrition choices.

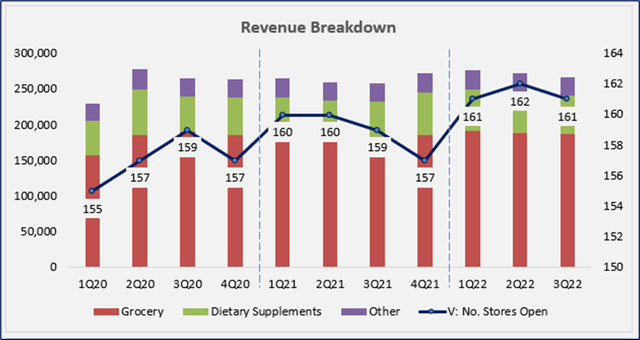

The Company generates revenue from three segments: grocery, dietary supplements, and others.

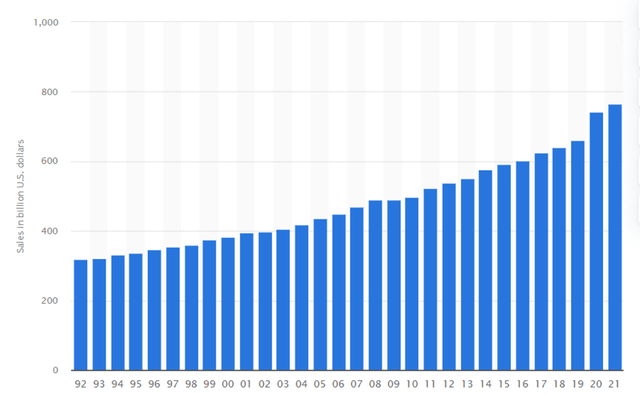

The Company is, relative to the U.S. grocery market, a minor player with its 0.14% share. However, from 2017A to 2022E it was able to expand its market share from 0.12% to 0.15%.

In fact, while the overall market grew at a CAGR of 5.2% over the 2017-2021 period, the company’s revenue grew at a CAGR of 8.2% (1.58x the market’s CAGR) over the same period. This is a positive trend that I expect to continue in the future driven by the consumers’ shift toward healthy food.

Company Valuation

Competition

The company operates in a fragmented, and highly competitive industry, with few barriers to entry. The competition is represented by companies like Whole Foods, The Fresh Market, Kroger (KR), and Walmart (WMT).

An industry with few barriers to entry reduces the company’s ability to increase its earnings due to competitive pressure and this represents a headwind to its stock performance. However, I believe that the company possesses an added value as represented by its nutrition education and its commitment to providing the best organic food at a relatively affordable price.

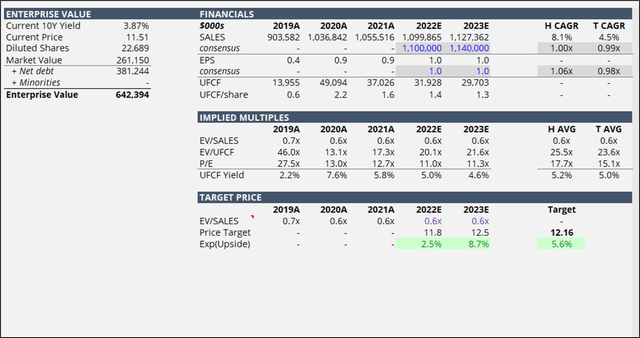

Valuation

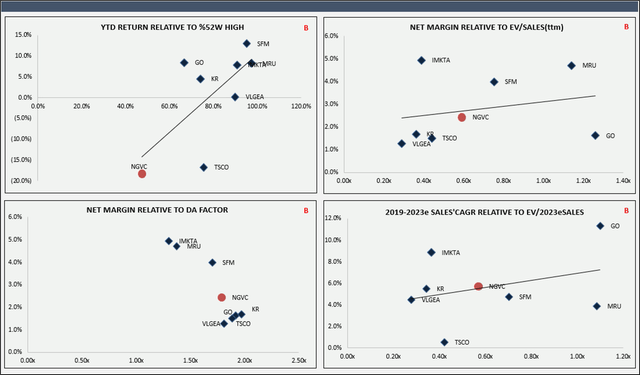

The company is trading at an EV/SALES of ~ 0.59x TTM, which represents a premium relative to the peer’s median EV/SALES of ~ 0.51x TTM.

I believe that the company is almost fairly valued.

During the 1Q22 the Company showed a path to a brighter future driven by its margin expansions that were a result of the ability to leverage strong sales into higher profitability (the company was and is able to pass inflation impact via pricing). In fact, the market rewarded the company with a strong stock performance. However, it was short-lived, with gross margins falling from 28.4% in 1Q22 to 27.6% in 3Q22 (back to its norms of 27.5%).

Another point of concern that someone may raise looking at the company’s financials is the long-term debt. Having a NET DEBT/EBITDA of ~ 5.94x TTM seems something worrisome at the first glance. However, there is not much to worry about since most of its debt is composed of operating and finance lease obligations.

Overall, I don’t see many good reasons that make me willing to invest in this company. Investing in a business with low barriers to entry is never a good idea by itself, but when coupled with below comps top-line growth, inability to grow its margins, and continuous stock dilution (on average 0.4% YoY), it’s a pass for me. However, I do see a light at the end of the tunnel. In fact, I believe that the company can increase its earnings in two ways: first, by expanding its presence in the U.S.; second, by closing less profitable operations.

Having said that, I expect the company to maintain the current valuation of EV/SALES of ~ 0.59x.

In terms of downside risks, here are a few:

- Competition, If the competition will be perceived as being a key driver of slower growth, it would negatively affect the company’s share price.

- Consumer squeeze, hence a switch to lower-priced products. Such an outcome may reinforce risk number one.

In terms of upside risks, here are a few:

- Better-than-expected ability to capitalize its {N}power members

- Better-than-expected store expansion in the U.S.

Technical Analysis

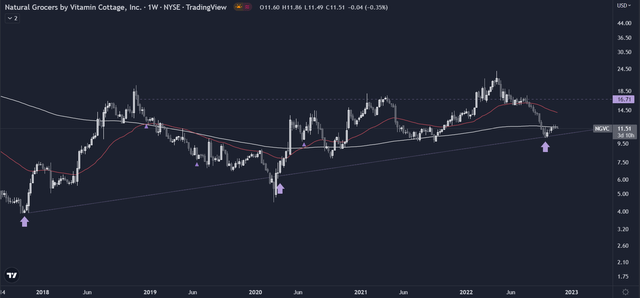

Below, you can see represented the price action over the last 5 years. Overall the trend is upward, with higher lows but almost the same highs. It seems that the stock bounced again on its trendline, but it is struggling to go above the SMA(200), with the reason likely to be driven by the market expecting to see the 4Q22 results.

For those looking for a potential swing here, I would be cautious, due to a low momentum coupled with the stock being below both EMA&SMA.

Final Remarks

I rate shares as HOLD with an estimated fair value of $12.16/share, which would represent a 5.6% upside from the current price of $11.51.

Having said that, for a risk-tolerant investor, there are better opportunities in the “Cash is King” market environment. In fact, even if the company carries a dividend yield of 3.48%, the potential upside is not compelling, which makes it look unattractive.

Be the first to comment