Iryna Drozd/iStock via Getty Images

Intro & Thesis

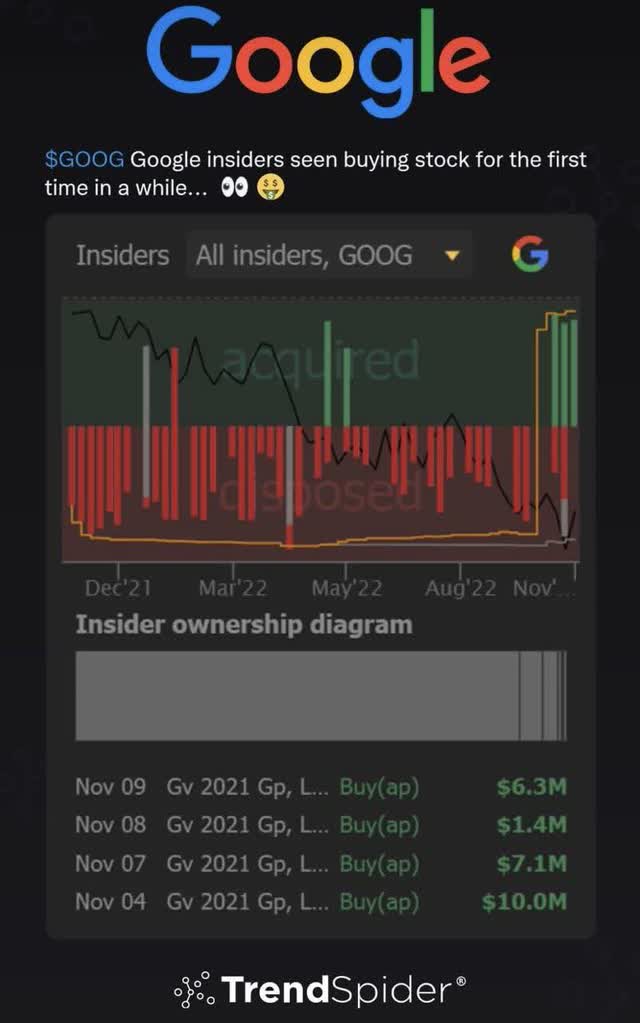

Today I came across a very interesting infographic that prompted me to write this article – according to TrendSpider, insider activity in shares of Alphabet Inc. (NASDAQ:GOOG) has noticeably increased in a positive direction, which has not been the case since the beginning of May this year:

Thanks to the latest CPI print, which beat forecasts by a full 0.2%, the capital markets (not just the stock market) are in bull mode, trying to prove the bears wrong. Google, like other representatives of FANMAG companies, is trying to gain a foothold above its important medium-term moving averages and announce the beginning of a new bull market.

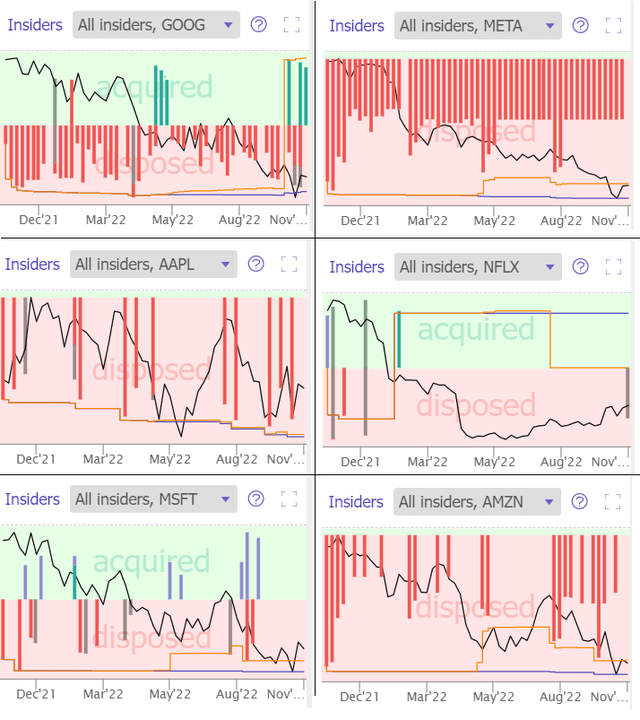

But why am I writing about Google in particular? Because this is the only representative of the sample of mega-cap stocks where a significant intensification of insider trading activity can be observed. I opened the source of the very first infographic above and made a compilation for simplicity:

Author’s compilation, based on TrendSpider’s data

So is it worth following Google’s insiders? I will try to answer this question today based on the analysis of various factors.

Who are the insiders and what they’re actually buying?

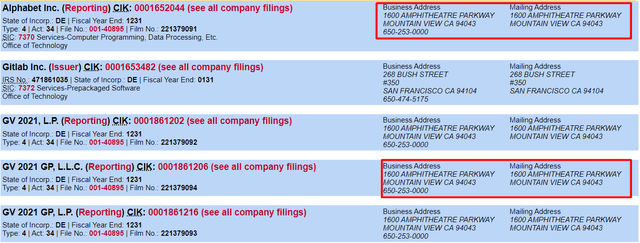

I opened each Form 4 and found that they were not actually GOOG stock purchases. Rather, they were purchases of GitLab (GTLB) stock by GV 2021 GP LLC, the general partner of a GP, of which Alphabet Holdings is the sole member. The mailing and the business address of the companies match, according to SEC:

That is, in effect, Google insiders are not buying shares of their company. It is Google’s venture fund (“Google Ventures“) has spent nearly $25 million since early November 2022 to buy GitLab’s sinking stock.

It appears that the data aggregators that collect the forms from SEC have incorrectly attributed all of GV’s transactions to Google insiders, even though none of them actually bought shares in the company they work for.

So I would recommend everyone to check the original sources carefully before following someone who doesn’t even go where you plan to follow.

Assessing Google’s valuation and expectations

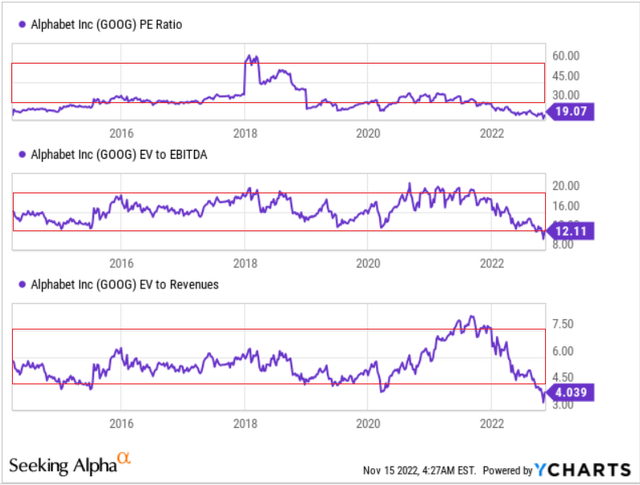

If we look at the TTM valuation multiples, GOOG is currently trading near its most depressing levels, having lost 34% in stock price over the past year.

Note: I’ve added the mid-ranges arbitrarily.

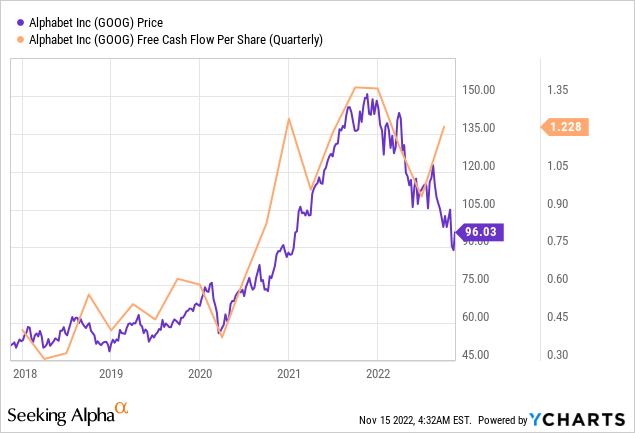

This led to a strong divergence from the level of FCF generation that Google continued to show in 2022 despite all the difficulties – it used to be strongly correlated with share price performance.

The resulting picture leads to potential mispricing that prompts bullish writers to call for buying GOOG shares at current prices – over the past 30 days, 80% of SA writers (28 articles) had a “Buy” and “Strong Buy” rating, while the remaining 20% had a “Hold” rating.

However, a strong FCF is far from the only criterion investors need to pay attention to. Most of the company’s revenue (57.22%) and operating income comes from Google Search, an online advertising business that has already run into a little trouble.

In terms of the revenue lines, Google Search and Other advertising revenues of $39.5 billion in the quarter were up 4%. YouTube advertising revenues of $7.1 billion were down 2%. Network advertising revenues of $7.9 billion were down 2%.

It may appear that this is just a high base effect – the growth of the post-2020 recovery has been so strong that it is now difficult for the company to maintain the “business momentum gained”.

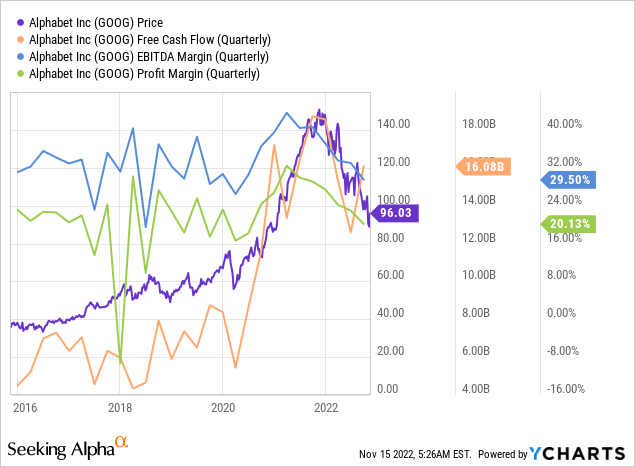

However, in my opinion, one of the reasons for the multiple contraction is the sharp decline in margins, which has continued for several quarters without a rollback:

The biggest question now is what’s priced in and what’s not.

In my opinion, the margin decline (above) is already priced in, as is the 21.09% and 5.36% decline in EPS in Q4 2022 and Q1 2023, respectively, based on Seeking Alpha Earnings Estimates. However, the current share price just as well suggests a rapid recovery in EPS from Q2 2023 to the end of 2024:

The course of the GOOG stock in the near future will very much depend on how these expectations change.

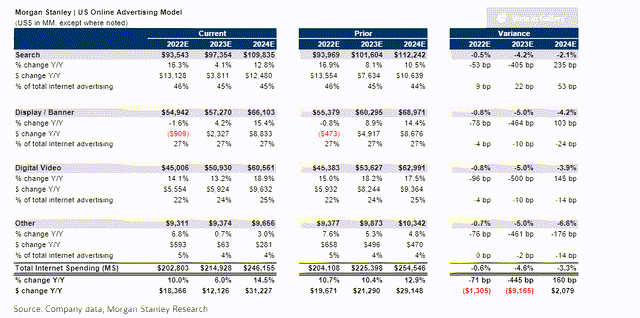

As part of the analytics that we examine at Beyond the Wall Investing, I took a look at a recent report from Morgan Stanley which provides forecast data for the U.S. online advertising market (FY2022 and 2 years ahead):

As you can see, the bank’s analysts conclude that the “Total Internet Spending” in the U.S. will increase by only 6% in FY2023 (compared to the current rather weak 2022 figures). Of the total growth, the “Search” segment (again, almost 60% of Google’s revenue) is set to add only 4.1% YoY – these figures cannot keep up with what 44 analysts forecast (+13.15%) for the growth of GOOG’s total revenue at the time of this writing.

However, this would keep up with previous estimates (+8.1%, see above) and would be explained by the dominance of GOOG in this market and the presence of the “Cloud” segment, which continues to grow very rapidly (+37% YoY in Q3 2022).

My impression is that even though Google’s EPS estimates have already been revised downward 7 times since March 30, 2022, further downgrades are imminent, no matter how much the recent share price performance tries to convince us otherwise.

TikTok, Google’s faster-growing counterpart in the “YouTube Ads” segment, has already lowered its target for this year’s ad revenue to $10 billion from at least $12 billion (down 16.7%), Wall Street Journal reported a few days ago. The situation in the advertising market is becoming more complicated as inflation continues to put pressure on manufacturers and economic activity in the country – marketing budgets are being cut and will most likely continue to be cut as long as end consumers are forced to spend a larger portion of their income not on “overconsumption” but on necessities (mainly rent and energy bills).

Francois Trahan [Twitter: @FrancoisTrahan]![Francois Trahan [Twitter: @FrancoisTrahan]](https://static.seekingalpha.com/uploads/2022/11/15/49513514-1668512358220255.png)

Therefore, I believe that what is priced in today is not yet realistic enough – most likely we are in for more down revisions to Alphabet’s EPS and revenue figures (not to mention companies without the same level of the moat). So the best prices for buying GOOG are most likely waiting for us in 2023, not now.

Bottom Line

From what I have read in recent weeks about the macroeconomic environment we find ourselves in today, I conclude for myself that the recent explosive rally in tech stocks is just the result of one-time relief from subsiding inflation. This growth is not supported by other fundamental factors that affect our future.

The disinflationary 2023 trend has been clear for a long time – we have seen it confirmed recently and everyone exhaled at the same time. But everybody forgot that we should expect unemployment to rise and, as a result, the economy to slow down and easily slide into an earnings recession.

Jeff Weniger [Twitter: @JeffWeniger]![Jeff Weniger [Twitter: @JeffWeniger]](https://static.seekingalpha.com/uploads/2022/11/15/49513514-1668512809077493.jpg)

If this really comes true, Google’s low 20x P/E could easily turn into a P/E of 25-30x, and by no means at the expense of a rising “P”.

In the long run, I am confident that Google will do well – the company has too big a moat and good growth prospects for the “Cloud”. But the company’s earnings estimates still seem too high, and it seems we have not reached the bottom of the market yet.

There are many more interesting and overlooked companies on the market today, in my view. Therefore, I rate Alphabet as “Neutral”.

Be the first to comment