alvarez

Dear readers/followers,

HeidelbergCement (OTCPK:HDELY) remains a relatively pressured business – but one with some truly amazing fundamentals and upsides, if you dig a bit deeper. There are concerns – which I’ve fielded before. However, recent results and the ongoing demand will likely fuel further growth, catapulting shareholders into significant and market-beating long-term profit.

I expect no less than a doubling of my position within 5-7 years while earning significant dividends. In this article, I will show you the logic behind my thinking and why I think you should seriously consider HeidelbergCement as an investment.

HeidelbergCement – revisiting one of the world’s largest concrete/cement companies

Since my last article, HDELY has underperformed broader indices by about 2x. This isn’t that surprising, nor is it strange given the energy trends and macro we’ve been in. Rate increases have been quicker than expected, Ukraine has dragged on for longer than expected, and energy pressures have come in harder than expected.

However, let me go ahead and say this.

The share price does in no way reflect the company’s operating performance.

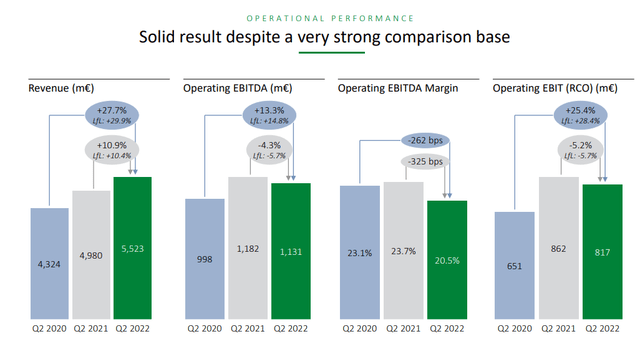

Take a look at how HeidelbergCement has performed despite the ongoing pressures.

Yes, you can obviously see how the pressures in cost and inflation, and energy trickle down from revenues to EBITDA and margin. But note the comparison – and the fact that company price increases manage to increase the top line, while essentially stabilizing EBITDA to levels above 2020 – still impressive.

Like most of HDELY’s peers, the company is internationally diversified. Because of this, regional trends are important.

Regional viewing is mixed. NA is extremely solid – pricing and volumes provide growth while inflation, freight rates, and labor pressure margins. But so far, so good. Europe is solid as well, seeing double-digit revenue growth and EBITDA growth despite ongoing trends. Fuel and energy are the big pressure, here, as you might expect.

The big positive here is Africa/Middle east, with demand fully intact in Sub Sahara/North Africa offsetting pressures.

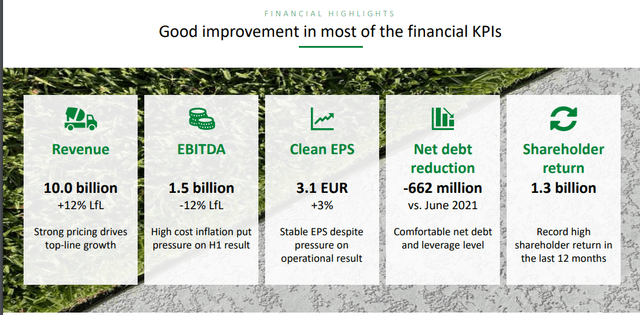

The company is fully working with its commercial excellence plans, increasing cement prices by 22% compared to 2Q21, and all of these price increases are delivering a positive price-over-cost development in June of 2022. Most Financial KPIs are actually very solid.

The company even lowered debt by around €600M. Russia suffered an €87M asset impairment, as the company takes steps to move away from the market.

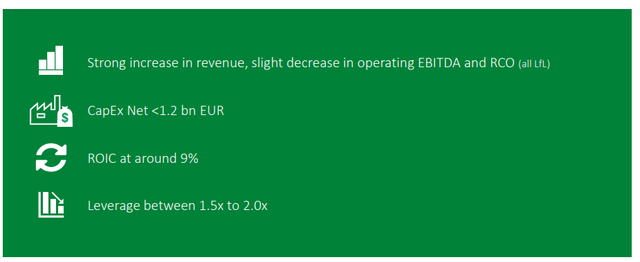

The company’s most recent 2022E guidance calls for a very strong revenue increase based on pricing, with a slight increase in EBITDA and RCO, all on an LFL basis. I would moderate these assumptions to a modest to light drop in EBITDA and efficiency, with ROIC dropping below 9%. Leverage should continue in the corridor of 1.5-2X. High energy prices are in no way able to be offset by price increases, leading to profitability pressures in the company’s home markets. Still, every European company in this sector and adjacent sectors has these issues.

Again, without the Russia/Ukraine situation, I have no doubt that we would be in a very positive situation for the company. However, with energy prices skyrocketing and macro now in chaos, things have taken a turn to the negative.

Because temporary geopolitical situations are impacting the company’s appeal, I believe is that HDELY will normalize once these things, eventually, go away. This also comes with some extreme demand spikes. Imagine the fact that large parts of the Ukrainian nation actually need rebuilding which will require thousands and thousands of tonnes of concrete and cement.

As of 2Q22, the company’s outlook remains as it is.

Despite all the negatives for the company due to macro, the price-over-costs deliver an almost stable result for the quarter. its outlook remains strong, and its fundamentals are very much intact, I believe the only reason against HeidelbergCement at this time is the short-term argument.

And because I don’t invest for the short-term anyway, this really isn’t an argument to me.

Many of the fundamental upsides remain here.

Indonesia is going to be a significant growth factor, and the company’s portfolio optimization makes a lot of sense. Unlike with its M&A in the USA of Hanson, HDELY managed to get a very appealing price for Italcementi. These aren’t the most attractive assets in terms of profitability, but demand is high.

Furthermore, perhaps the most important upside, the current company valuation does not represent the inherent value of its assets. To replace the European and international production capacity for its product, the investments that would need to be made are significantly above the current NAV/share for HeidelbergCement.

None of the current pressures will significantly make HeidelbergCement an unappealing investment. None of these headwinds will make the company a business I won’t be investing in.

What’s changed is that the continued long-term trajectory for the 2025E targets has been broken – and it seems doubtful that all of the company’s targets will be realized, if things continue along this line. We can see this by taking into account what we’ve seen in 1Q22 – that HeidelbergCement posted results in-line with consensus, but with somewhat weaker inflation protection than peers. This is due to its energy hedging policies, which HEI is now trying to change.

I spoke about these energy hedging policies as well as the way the company handles CO2 allowances, but the situation in Ukraine showed just how quickly the situation in such things can change if circumstances change. I now expect the carbon emission allowances to change, and definitely not rise far above €100 for the longer term. I have forecast carbon rights allocation by estimating the company’s market share in various countries, forecasted to be flat until 2025, and a linear decrease of 5% from 2026 onwards, based on company plans – and this is extremely conservative here, all things considered.

Let’s take a look at the company’s valuation and see just how positive things can be said to be here.

HeidelbergCement – The valuation

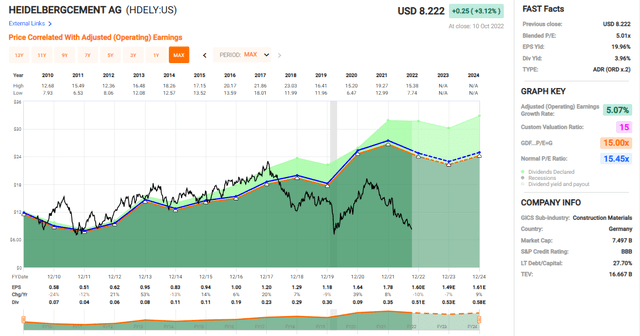

HeidelbergCement is at a laughable valuation. The company is a BBB rated stalwart with billions in revenues – and one of the largest concrete/cement companies on earth, and it trades at a meager 5x P/E.

Oh, you can certainly make the argument that there are significant risks to HDELY’s near-term reversion, and I would completely agree with such an assessment. But if you start to argue that this company is worth no more than 5x P/E, that’s when you’ll have me speaking up here.

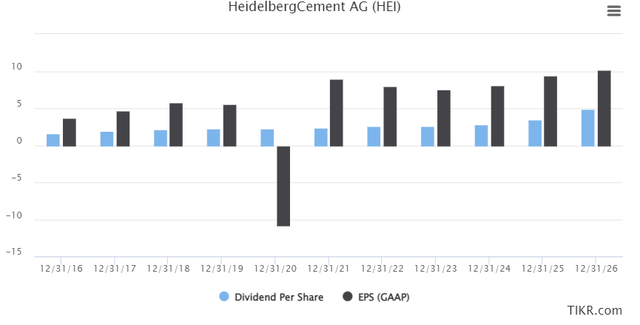

The company may be heading for a lower EPS, but this will likely not influence the company’s dividend for the coming year – it’s likely we’ll in fact see it grow. Take a look at GAAP expectations and dividend forecasts for the native.

HeidelbergCement GAAP EPS/Dividends (TIKR)

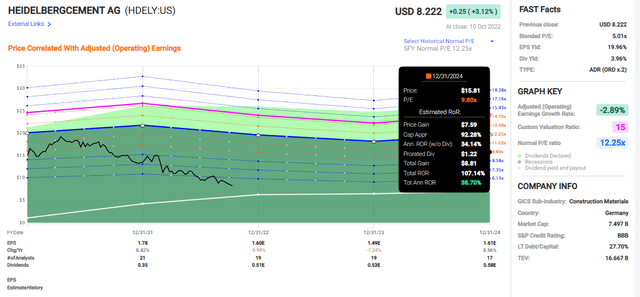

I’m willing to wager that the company manages its earnings quite well over the declining years of 2022-2023, while then growing the earnings back up, and maintaining current impressive dividends at 4-6% depending on when you buy. I’m putting my money where my mouth is as well, due to my high stake in the company – and one I mean to expand to 5%, all things considered.

You don’t need to forecast positively all that high to start getting triple-digit returns. It reminds me of Unum (UNM) or Prudential Financial (PRU) prior to reversal.

If you expect a 9.8x P/E forward, that’s when you start getting around 107% RoR in 3-4 years. And that’s for a company that usually trades between 12-15x P/E. That turns the potential RoR closer to 150-200% for the long term. So when I say that I expect a doubling, that’s actually pretty conservative given where the company currently trades.

S&P Global has significantly changed its own PTs, now coming to around €60/share, which is far less than both my target and the targets of analysts such as AlphaValue. This reflects a lack of conviction that the company will be able to manage the inflation and energy costs this year. less than 6 months ago, the target was almost €90/share.

Out of 19 analysts following the company, most of them still believe pressures are too high here to invest – only 8 have a “BUY” or equivalent at this time. Nonetheless, the average here is implying a 35% upside, which again shows you what sort of credence you can give to analyst averages. It really requires that you drill down quite a bit and make up your own mind with regards to your own targets, expectations, and timeframes.

Competition for HDELY does exist, but the way that concrete works is that competition requires your assets to be close to markets. Concrete isn’t a commodity that wants to be shipped over large distances. The closer to markets or projects you can put your plants, the better – and this is where Heidelberg’s asset base really shines. The replacement value of the company’s massive international asset base is so that for another company to duplicate it, would require massive amounts of capital. Also, concrete as a commodity can’t be easily replaced by anything else yet.

The world is very likely to continue requiring it.

Based on this, I give you my current thesis on HeidelbergCement – a positive one, and one of my higher-conviction “BUYS” out there.

Thesis

- I view the overall thesis for HeidelbergCement as positive. Despite cost inflation and macro risks, the upside for the company is solid, and a full upside seeing a 70-80€+ valuation calls for a 100% RoR inclusive of dividends. That’s what I’m looking for, in a 3-5 year period.

- If you’re unwilling to hold this for a longer-term, you shouldn’t be investing in this company. If you’re willing to wait a few years, while knowing that the company you invest in will be delivering a solid yield and you’re exposed to a superb, fundamental business…then you’re in good company with HeidelbergCement.

- Based on the current thesis, I give this company a “BUY” with a PT of no less than €75 for the long term.

- I increased my exposure from 2% to 3.5% in around 3 months, and I want another 1.5% in the next 2-3 months.

Remember, I’m all about :1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment