Lim Weixiang – Zeitgeist Photos

While shares of Nucor (NYSE:NUE) have traded off of their 52-week high considerably alongside many other cyclical stocks, shares have been a remarkable performer over the medium term and are nearly triple from where I last wrote up the company, recommending a buy. This elevated performance may create concern the stock has substantial downside in the event of a sharper economic downturn. I actually do not think this is the case. I remain long NUE stock and am a buyer of the stock.

Seeking Alpha

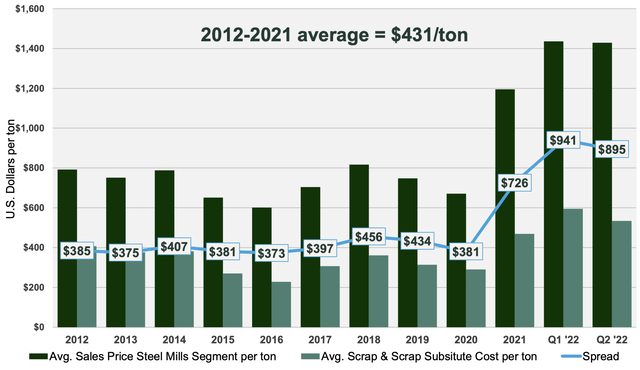

Now, I think it is safe to say that 2021 and the first half of 2022 exceeded what anyone could have expected in 2020. Steel prices surged as construction picked back up and supply chains struggled, causing a windfall for companies like Nucor. There also has been a fundamental shift in the steel market. President Trump imposed tariffs on Chinese steel, and President Biden has continued this policy, protecting the industry from competition (or product dumping) from China. These tariffs increasingly appear to be a permanent fixture of US policy, which will all else equal keep steel margins higher, particularly when demand rises.

Nucor

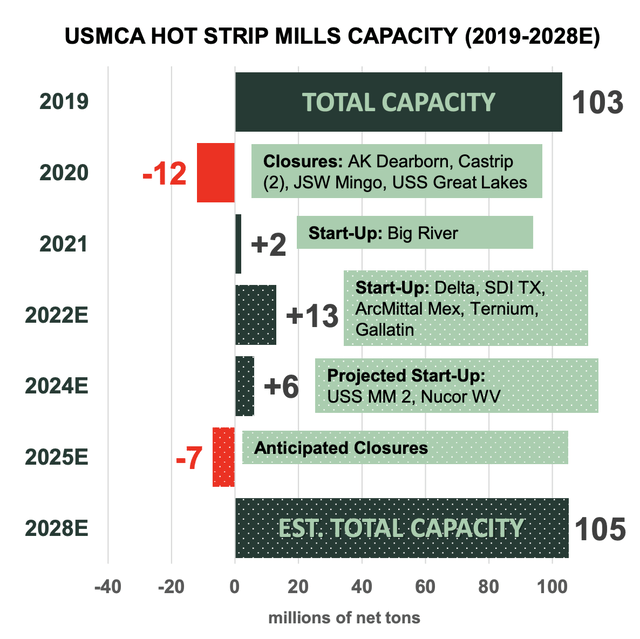

At the same time, there has been limited investment by the industry as a whole in increasing steel capacity (Nucor being an exception to this). North American steel production capacity is expected to be just 2% higher in 2028 than 2019. That is just a 0.2% per year growth rate. The slowest the US economy has ever grown over a 10-year period is 11%. Now, steel demand can grow more slowly than the overall economy, but with this little increase in supply and tariffs in place structurally, the market is set to remain relatively tight with margins that will come down from recent levels but can stay above 2012-2019 levels.

Nucor

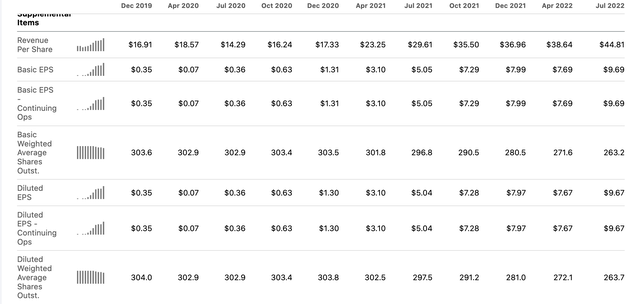

Now, Nucor’s earnings will come down. As you can see below EPS soared in 2021, and over the past twelve months, the company has earned $32.59. Trading at an under 4x trailing P/E, the market is pricing in earnings to moderate significantly. This was inevitable and in the price as steel margins will not stay $800 forever.

Seeking Alpha

In the company’s second quarter, it earned a record $9.67 or $3.5 billion in adjusted pre-tax income. Alongside higher prices, the company is benefitting from greater capacity with steel mill shipments up about 10% and sales to outside customers up about 7% relative to 2019 even as supply chain issues kept production lower in Q2 2022 than Q2 2021. Reflecting the fact that the environment is moderating, management is guiding to about $6.30 in Q3. It is down sequentially, but that still represents an annual run-rate of $25 for a 5.7x P/E. Shares already reflect further deceleration from this Q3 pace at that multiple.

Now given the stock was $56 to end 2019, investors may view that as a potential downside target. However, management has taken advantage of Nucor’s incredible profitability over the past two years to transform the company in several ways. First it has aggressively been buying back stock. In 2019, there were 305 million shares outstanding. At the end of Q2, its share count was down to 263 million. During Q3, the company bought back another 5 million shares taking its share count down to about 258 million.

At the end of 2019, that share count resulted in a market capitalization of $17 billion. At its current share price and Q3 estimated count, its market cap is $29.8 billion. So, while the stock has more than doubled, its value is up 75%. This is power of large cash-funded buybacks. Now, that’s still up a lot, but management has done more than buybacks.

Additionally, this year the company has done $3.5 billion of acquisitions after $1.4 billion last year. These acquisitions have also diversified Nucor’s business into things like garage doors. This diversified product mix should somewhat mute volatility and also increase cross-selling opportunities in its steel products business, creating revenue synergies. Essentially, a return to the Q4 2019 value of Nucor should equate to a $22 billion market cap ($17 billion plus $5 billion in acquisitions) or $85. That’s 50% higher than its Q4 2019 level and speaks to how Nucor has taken action to structurally increase its shareholder value.

Further in addition to M&A, Nucor has used its cash windfall to grow organically to build out more capacity and take market share in the US steel market. It is spending about $5 billion on cap-ex from 2020-2022, or about $3.5 billion above its replacement needs. That is another $13.50 a share, meaning based on the 2019 earnings power and multiples, the downside for Nucor would be $100 not $58.

I would also emphasize that these projects are already paying dividends. Completed 2020-2021 capital projects cost $1 billion and were expected to generated $175 million in EBITDA, in 2021 they did $675 million. There are another $5.3 billion in projects coming online between now and the end of 2025 that should generated a further $900 million in EBITDA in normal market conditions, providing over $2 per share in incremental free cash flow.

Nucor is a larger, more diversified company today than in 2019 with a substantially lower share count. Its outperformance from the end of 2019 should not scare you away as the valuation floor is closer to $100 than $60.

While that is the floor, I want to talk about upside as that is the reason to own the stock. The question is where do earnings settle out from the $6.30 Q3 guidance. I think about a $100 reduction in steel margins from the Q3 pace into the $500s (i.e. below the peak but above the 2015-2019 period given supply constraints) is a reasonable central case for next year and would be about an $8 hit to EPS. Slower volumes in products should be offset by the completion of several new projects coming online next year, and leave me with 2023 earnings of about $15. That leaves the company positioned to continue to take out 8-10% of the share count on an annual basis via buybacks, further supporting EPS growth.

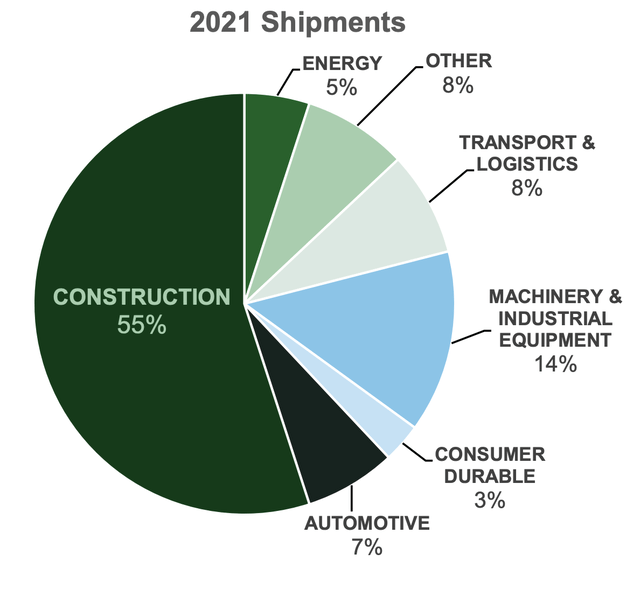

There are reasons why I don’t think investors should assume a more dire downturn. Last year, shipments largely went to the construction sector. Much of this construction is nonresidential (infrastructure uses more steel than a single-family house).

Nucor

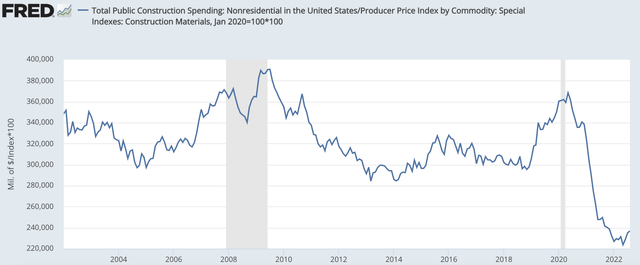

In 2021, congress passed the bipartisan infrastructure bill to spend $550 billion on new projects. It takes time for these projects to ramp up given permitting etc. In fact, real government construction spending is now $100 billion below its pre-COVID level. As the BIF spending begins to ramp up next year and states spend on infrastructure given strong budgets, this will be a significant tailwind for Nucor. With government spending about 40% of nonresidential construction, this will help to offset any weakness in the private sector from higher rates.

St. Louis Federal Reserve

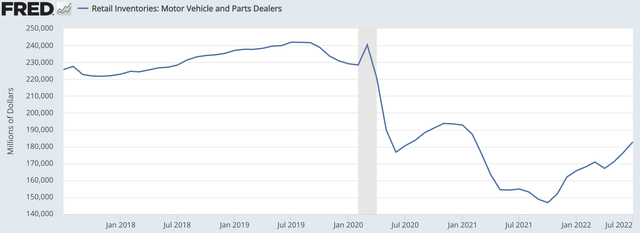

Looking at other components, the energy sector is doing well given high oil and gas prices, and the auto sector is a major potential tailwind. Auto inventories are still about $50 billion below their pre-COVID level. As this sector normalizes production and inventories, that will support steel demand.

St. Louis Federal Reserve

These demand factors combined with Nucor’s shrewd management of the economic cycle, using its excess profits in recent years to make the company stronger and increase shareholder value leave me feeling optimistic about the stock’s future.

I would also note Nucor has paid dividends 48 straight years. It has increased its dividend from $0.40 to $0.50 since the end of 2019 and I expect another dividend increase later this year. At its 2019 share count, the dividend cost the firm $488 million vs $516 million today, a mere 5% increase. This creates plenty of capacity for further increases, and I expect at least a 10% hike this December.

Nucor is a cyclical company, and as a result it will trade at a discount valuation. With earnings moderating, there will be some question as to where the “normal” run rate is. Fortunately each day it remains in this excess profit environment is a day it buys back more stock, reducing that share count and increasing its EPS capacity. Based on my expectation of further moderation but margins staying above last decade’s level, thanks to tariffs, supply constraints, and resilient demand from government, energy, and autos, this company can earn $15 next year. I think NUE deserves at least a 10-12x multiple for a $150-180 share price while I see downside under a sharper economic contraction to $90-100, levels at which I would aggressively buy more shares. Nucor has proven to be a strong generator of shareholder returns, and I view it as a core long-term holding.

Be the first to comment