JoZtar

Sooner or later in life, we will all take our own turn being in the position we once had someone else in. ― Ashly Lorenzana

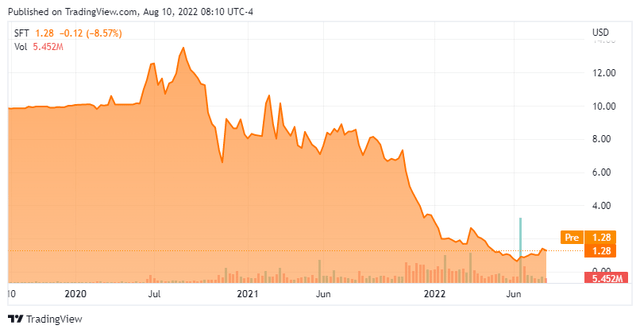

Today, we put the spotlight on Shift Technologies (NASDAQ:SFT) for the first time in this column. The company is in what has become a fast-growing part of auto retailing market, but one that has attracted myriad competitors. Despite solid revenue growth the stock finds itself deep in Busted IPO territory. The company just announced a major acquisition. Can the shares rebound? An analysis follows below.

Company Overview:

Shift Technologies is based in San Francisco. The company provides an ecommerce platform for buying and selling used cars and is in both the Retail and Wholesale parts of the market. Shift’s platform enables mobile digital transaction, such as at-home car searching, scheduling an on-demand test drive, and purchasing at home or at the preferred site of a test drive, as well as provides financing and services. It also offers add on services such as vehicle service contracts wheel and tire coverage, and prepaid maintenance plans.

The company came public via a merger with sponsored blank-check company, INSU Acquisition late in 2020. In March of this year, Shift agreed to acquire certain assets of Fair Technologies for a combination of cash and shares of Shift’s Class A common stock. Part of the purchase was financed via notes at 6% interest due in 2025. Fair Technologies ran an online auto marketplace and the deal expanded the company’s inventory, capabilities and added engineering and design team talent. The purchase provided customers greater access to a larger selection of owned and third-party vehicles for a test drive or direct purchase. The stock currently trades around $1.30 a share and has an approximate market capitalization of $110 million.

First Quarter Results:

On May 11th, the company posted first quarter numbers. The company had a GAAP loss of 70 cents a share, more than a dime a share less than expectations. Revenues rose more than 105% on a year-over-year basis to nearly $220 million. Even that robust growth was nearly $15 million below the consensus. The company sold 6,741 ecommerce vehicles during the quarter, up over 50% from the levels of 1Q2021.

Second Quarter Results:

The company reported second quarter results yesterday. Once again the company missed expectations both on the top and bottom lines. Shift Technologies posted a non-GAAP loss of 64 cents a share as revenue growth slowed to some 44% on a year-over-year basis to $223.7 million. The company also disclosed it will acquire CarLotz (LOTZ) in an all-stock deal. CarLotz had just over 2,400 vehicle sales in the second quarter.

Growth is noticeably slowing in recent quarters. Year over year sales comparisons are also going to get harder in coming quarters as the company focuses on more profitable sales. In addition, overall autos sales are contracting as one can see here in July auto sales that show all the major manufacturing seeing significant demand challenges. This is due to higher interest rates, continued supply chain challenges and ebbing demand due to a fast slowing economy, which is likely in recession as I detailed earlier this week.

Analyst Commentary & Balance Sheet:

The analyst community is largely negative on the company at the moment. Since the last earnings report, four analyst firms including William Blair and BTIG have maintained downgraded the shares to a Hold rating. Only Piper Sandler ($9 price target) and Cantor Fitzgerald ($4 price target) have remained in the Bull camp.

Approximately 20% of the shares outstanding are currently held short. There has been no insider activity in the shares for more than a year. The company ended the first quarter with just over $105 million worth of cash and marketable securities on the balance sheet after burning through $88 million worth of cash during the quarter. $38 million of that was to build inventory and additional funds were used for last year’s incentive payment. Management anticipates cash burn will be reduced substantially in the coming quarters. Long term debt stands at approximately $145 million.

The company believes its just announced merger with CarLotz will result in considerable synergies and lower costs once the companies are integrated. It sees breakeven EBITDA now sometime in 2024. The company plans to reduce its operating hubs from 10 to 3 (Los Angeles, Oakland and Portland). The combined entity is looking to implement major workforce reductions. Shift Technologies also plans to continue to optimize its inventory mix and assortment to favor value vehicles, which it defines as vehicles older than eight years or over 80,000 miles. These vehicles have higher profit margins.

Verdict:

The current analyst consensus has the company losing some $2.20 a share in FY2022 even as revenues increase nearly 60% to $1 billion. That loss is expected to drop to just over $1.75 a share in FY2023 on revenues of $1.5 billion. It should be noted there is wide range of projections for both losses and sales growth among the analyst community on Shift Technologies at the moment. In addition, the CarLotz deal has not been factored into these projections yet.

At this point in its journey, one could say Shift Technologies loses money on every sale but makes it up on volume as the old adage goes. The problems Shift has encountered in trying to make this fast-growing part of the auto retailing market profitable is hardly unique to itself. This sector has attracted numerous competitors like Carvana (CVNA) and Vroom Inc. (VRM) which I recently posted an article around.

Every name in the space in encountering the same main issue. Sales growth is just not resulting in profitability and all entrants are primarily burning cash and destroying shareholder value. In Shift’s case, it looks highly likely the company will have to do yet another capital raise in the near future. The combination with CarLotz has the potential for significant synergies as well as integration risks. Until there is a major shakeout and consolidation in this sector, I am avoiding the entire space.

Violence does, in truth, recoil upon the violent, and the schemer falls into the pit which he digs for another. ― Arthur Conan Doyle

Be the first to comment