400tmax/iStock Unreleased via Getty Images

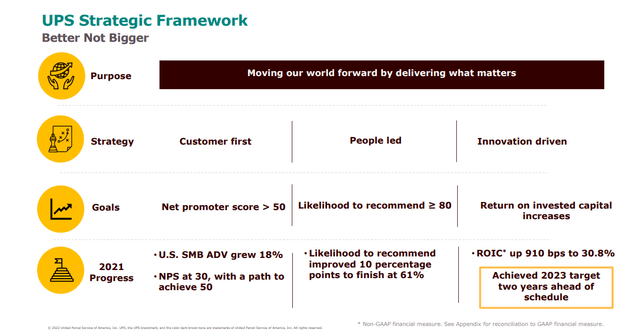

Not every corporate transformation succeeds. In fact, most don’t really accomplish much. However, it seems that in UPS’s (NYSE:UPS) case, their “better not bigger” strategy is paying off and delivering results for customers, employees, and shareholders. Already, the net promoter score is exceeding >50 which is quite good, and the likelihood to recommend is above 60%. And at the same time, ROIC greatly improved to 30.8%, which means the company is two years ahead of schedule in reaching this goal.

Financials

UPS reported a solid Q4 performance, and 2022 margin guidance came in strong, with several of the firm’s 2023 targets likely to arrive a year early. Pricing conditions remain healthy as a result of constrained last mile capacity. Compared to 2020, in 2021, revenue increased $12.7 billion, adjusted operating profit increased from $8.7 billion in 2020 to $13.1 billion in 2021, adjusted operating margin improved from 10.3% to 13.5%, and the one that impressed us the most was return on invested capital (ROIC) going from 21.7% in 2020 to 30.8% in 2021.

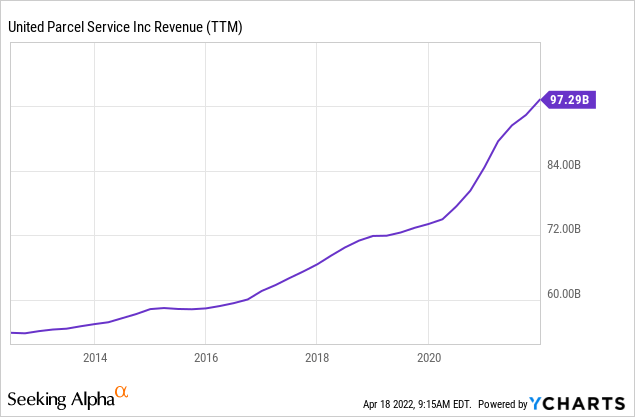

Revenue has been growing at a decent rate for a few years, but we notice an acceleration in the last couple of years, which together with the improved financials is likely what has re-rated the stock and made it move from ~$100 per share to twice as much.

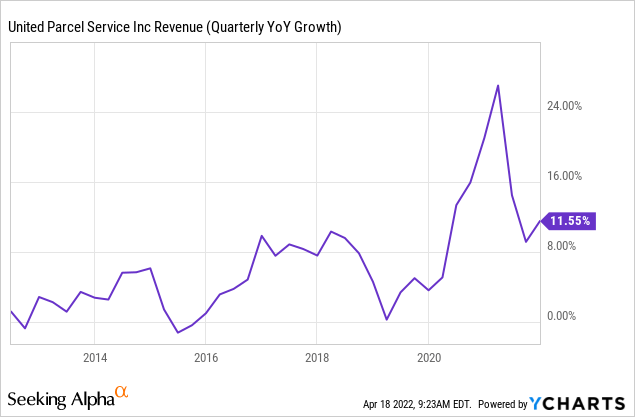

Zooming in on the revenue growth rates, we see that during the pandemic growth accelerated to more than 24%, but has since come back down to ~11% as the economy reopened. Still, 11% is much higher than what the company was growing at before the pandemic, and it will be interesting to see how revenue growth behaves going forward.

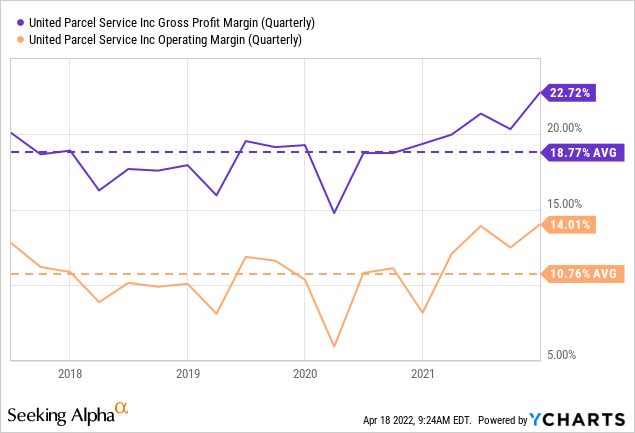

Increased revenue, corporate restructuring, and operating leverage have resulted in improved profitability. Both gross margins and operating margins are currently significantly above their historical averages, and it is expected that they will remain so.

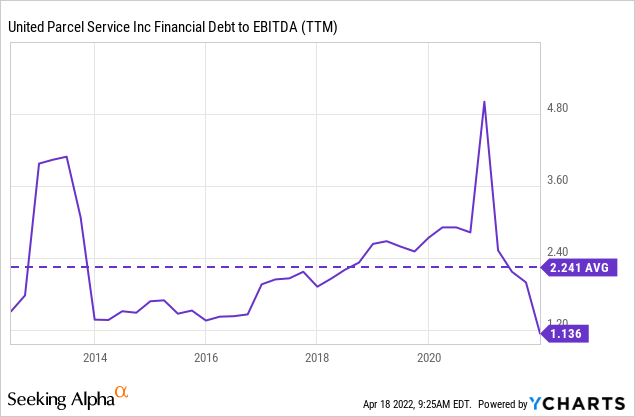

Not only has UPS achieved improved profitability but it has also managed to reduce its leverage through a combination of debt reduction and increased EBITDA. This strong balance sheet is what is enabling the company to now be able to return a more significant part of its free cash flow to shareholders.

Capital Allocation

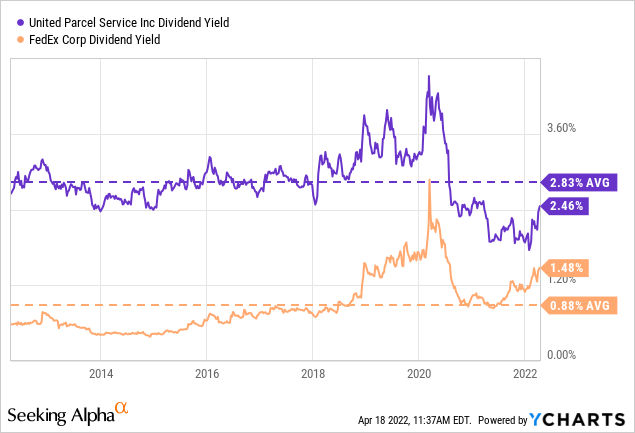

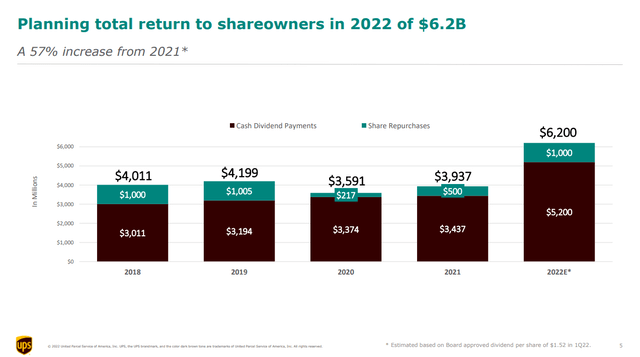

Thanks to the improved profitability and strengthened balance sheet, UPS was able to increase its quarterly dividend by 49% to $1.52 per share, this is the largest increase in the company’s history. UPS is also increasing the amount it plans to dedicate to share repurchases in 2022.

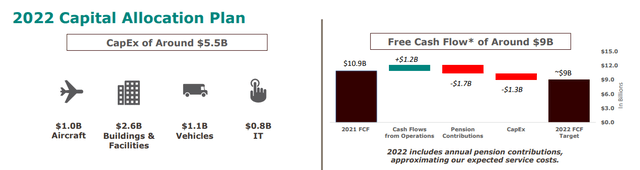

UPS is also planning to invest heavily on its network, with CapEx plans of ~$5.5 billion for aircraft, buildings, vehicles, IT, etc. All things considered, the company is guiding to ~$9 billion in free cash flow for 2022, which is pretty good in our opinion even if slightly lower than that of 2021.

The main risk we see with the CapEx plan is inflation, which is going to increase the price needed to pay all those new aircraft, trucks, etc. We believe the company might end up spending more than the $5.5 billion it is targeting if it is to complete the purchases it has planned.

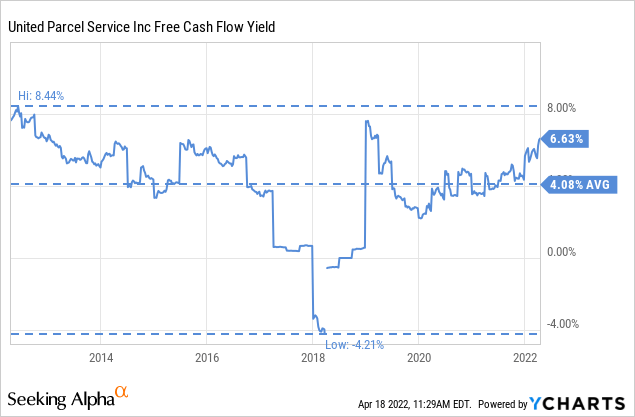

At current prices, the free cash flow yield is a very attractive 6.63%, which is significantly above its historical average, and an attractive absolute value.

Competitive Moat

UPS has a strong competitive moat for several reasons, including efficient scale, cost advantage, and network effects.

The network effect occurs when the value of a particular service increases for both new and existing users as more customers use that service, which is the case with UPS. Efficient scale is when a market of limited size is well served by one company or a small handful of companies.

The company created its moat by assembling an integrated global shipping network that’s unlikely to be matched by any but a few global players.

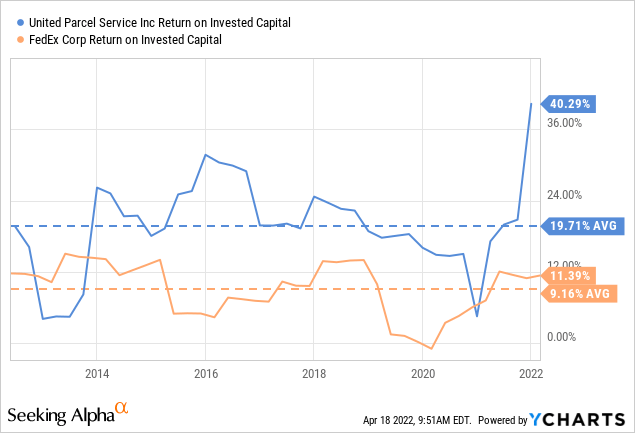

UPS earns higher margins and returns on capital than FedEx (FDX), which reflects a stronger competitive moat. One of the reasons is that FedEx still earns a majority of its revenue in its low-margin express segment and does not utilize assets in an efficient manner as UPS. UPS produces superior margins via greater package volume, concentration on high-margin ground shipping, and the use of a single network rather than parallel air and ground operations.

Valuation

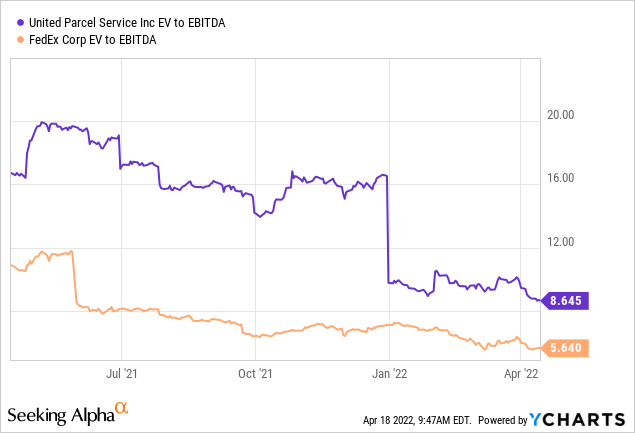

Valuing the shares using an EV/EBITDA multiple, we see that they are reasonably valued at 8.6x, even if they are somewhat more expensive than competitor FedEx. We believe the premium over FedEx is warranted, given the stronger moat the company has, which is reflected in higher returns on invested capital (ROIC).

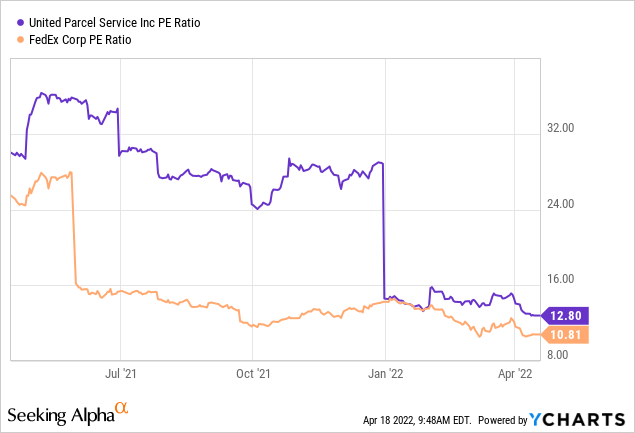

Looking at the P/E ratio, we see that UPS is also more expensive when using this metric than FedEx, but by a smaller margin than that of the EV/EBITDA ratio. We find a P/E ratio of 12.8x very reasonable for a company of UPS’s quality.

Historically, UPS has offered a higher dividend yield than FedEx, and that is before the 49% recent increase. With this increase, the dividend yield is going above its ten-year average to a very attractive 3.2%.

One of the main reasons we believe UPS deserves to trade at a premium to FedEx is its much higher ROIC, which historically has averaged more than 10% higher.

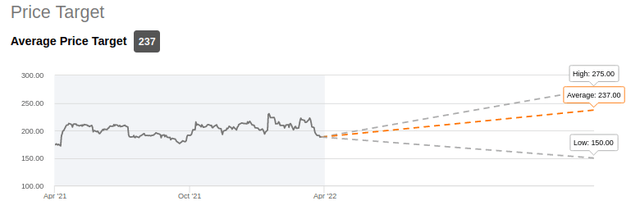

Price Target

The average price target that analysts have is $237, which we find reasonable but a tad high given that it is an 18.4x P/E on the estimated $12.88 earnings for FY22. We believe a more moderate 15x P/E is more appropriate to have some margin of safety, which results in a price target of $193. In any case, at current prices, we believe investors can obtain returns in the high-single digits to low-double digits, depending on the actual performance of the company over the next few years.

Risks

We do not see too many risks with the company, and historically, it has already overcome a lot of challenges and come out stronger. Still, the main risks in our opinion are:

- A deep recession that meaningfully reduces the amount people spend on online purchases.

- Amazon (AMZN) continuing to grow its own delivery network and potentially offering it to rival e-commerce competitors at lower prices than UPS/FedEx.

- A potential labor strike that could freeze its operations for some time.

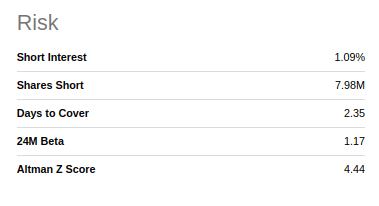

In general, we think the company is fairly low risk, and that is reflected in the low short interest that it has as well as the high Altman Z-score it has of 4.4.

Seeking Alpha

Conclusion

UPS is a relatively safe company paying a solid 3.2% dividend yield at current prices, and it is showing that its “better not bigger” strategy is bearing fruit. Its ROIC is already up 910 bps to 30.8%, as well as revenues and operating margins are already around 2023 targets. The valuation is reasonable, and we think investors can do a lot worse than buy shares in UPS at these prices.

Be the first to comment