utah778/iStock via Getty Images

Today, investors face a problematic experience given sky-high equity valuations, ultra-negative bond real yields, and a generally lackluster economic environment. In light of weak stock performance and an abysmal decline in the bond market, wise investors have shifted their portfolios toward those few assets that benefit from inflation. Most notably, gold (and metals in general), energy, and agricultural commodities – all of which have risen in value over recent months as the value of fiat currency has diminished.

Over the coming months, it seems this year’s most vital trends will only accelerate. Like most countries, the United States is starting its peak gasoline demand season with the lowest oil inventory levels in many years. Aggravating matters, Russia is now demanding that Europe purchase energy products using Rubles instead of U.S. dollars, a demand that may not be fulfillable and, if fulfilled, will diminish the value of flailing the “petrodollar” system. On that note, it appears that efforts from western nations to break Russia’s economy have not been very successful, as the Russian Ruble has recouped almost all of its ~70% losses that occurred during the onset of sanction efforts last month.

I emphasize these points not to elicit an emotional response from readers but to encourage a realistic view of today’s global economic and social environment. Times are changing. While the future, as always, remains to be determined, it is becoming clear that investors in the U.S. and Europe must brace for a remarkable shift in global financial and economic power. The fundamental factors that have enhanced the U.S. dollar’s value, such as F.X. trade dominance, are likely to end. This concept is well-understood by many such as Ray Dalio in his recent viral video “Principles for Dealing with the Changing World Order.” While I do not necessarily agree with all of his points, it does appear that we are facing the end of a many-decade economic cycle. As such, the market’s reaction to these changes is doubtful to have any precedent within most investors’ lifetimes today.

Understandably, many investors have reacted to the situation by denying the magnitude of these changes or taking the narrative, “My portfolio recovered just fine after 2008, 2001, etc., so I don’t need to prepare this time.” While those were indeed periods of significant volatility, they did not come with accelerating and ill-contained inflation and immense global commodity shortages, making it nearly impossible for the U.S. government (and Federal Reserve) to stimulate the economy via liquidity creation.

Accordingly, investors would be wise to position themselves in a resilient manner that makes them not overly dependent on government stimulus. Additionally, given fixed-income yields remain far below inflation, older investors may be wise to focus on distribution (with high cash levels) instead of buying the many potentially toxic high-yield assets that plague the markets today. There are many ways investors can achieve such a portfolio, but I would like to share my approach as a starting point.

Traditional Assets May Be More Fragile Today

When constructing an intelligent portfolio, we want to focus on “anti-fragility” or assets that generally benefit from volatility and uncertainty. It may be best to make a portfolio with nearly flat performance most of the time but tends to rise during periods of greater volatility. For older retired investors, I believe this approach is superior to trying to invest in high-yield assets, as most of those generate decent returns during “normal” periods but have the potential to decline by well over 50% during a difficult period. Examples of “toxic” fixed-income assets that I’ve covered in-depth include:

If your portfolio happens to be highly concentrated in any of those assets, I recommend reading the linked article and deciding if such investments are suitable. However, with inflationary forces growing consistently by the month for two years now, it seems clear that most fixed-income assets are unlikely to deliver positive returns after inflation (and taxes). Additionally, recent volatility and the immense flattening of the yield curve have dramatically increased the downside risk of fixed-income assets, arguably making them riskier than traditional equities.

An Anti-Fragile Portfolio For A Changing World

Assets that benefit from uncertainty include most commodities (GSG) and volatility ETFs such as VXX. Of course, these assets have no yield, so investors may also want to consider infrastructure MLPs (MLPX) and potentially emerging market local currency bonds such as EMLC. While emerging market local currency bonds are historically quite “fragile,” this was mainly because over the past decade, inflation has been far higher in emerging markets than in “developed countries.” However, as commodity prices soar, many commodity-exporter emerging markets will likely see their currencies strengthen compared to the U.S. dollar, particularly if the “petro-dollar” system is permanently impaired.

Of course, while all of these assets have some benefit from uncertainty, risk-reward profiles differ significantly between them. Younger investors may want to take a slightly more aggressive approach with higher allocations to strategic commodities such as volatility ETFs. Established investors focused on portfolio resilience may consider more gold and other secure assets. As such, I’ve created two model portfolios for each investor type, both to minimize losses in regular times and maximize gains in abnormal periods. This is done by measuring the “fragility” of each portfolio holding as the average correlation of each asset to the S&P 500 (SPY), long-term bonds (TLT), and the U.S. dollar index (UUP). See the data below:

| Ticker | Annual STD | Yield | Corr: S&P 500 | Corr: Long-Term Bonds | Corr: U.S. Dollar | “Fragility” | Weight Port. A (High Risk) |

Weight Port. B (Low Risk) |

| (VXX) – Long VIX | 81.31% | 0.00% | -0.77 | 0.29 | 0.05 | -0.15 | 20% | 5% |

|

(EMLC) -EM Lcl Currency |

11.22% | 5.52% | 0.54 | -0.06 | -0.44 | 0.01 | 10% | 20% |

|

(MLPX) -MLP & Energy Infra. ETF |

33.57% | 4.64% | 0.65 | -0.22 | -0.02 | 0.14 | 10% | 20% |

|

(GLD) -Gold ETF |

14.33% | 0.00% | 0.05 | 0.26 | -0.41 | -0.03 | 5% | 30% |

|

(DBA) -Agricultural Commodity ETF |

13.15% | 0.00% | 0.25 | -0.18 | -0.09 | -0.01 | 15% | 5% |

| (SLV) – Silver ETF | 28.41% | 0.00% | 0.22 | 0.07 | -0.32 | -0.01 | 15% | 5% |

| (XOP) – Oil & Gas E&P ETF | 49.94% | 1.22% | 0.59 | -0.35 | 0.02 | 0.09 | 15% | 10% |

|

(DBB) Base Metals Commodity ETF |

18.22% | 0.00% | 0.30 | -0.14 | -0.23 | -0.03 | 10% | 5% |

| Port A. – High Risk | 14.46% | 1.20% | -0.16 | 0.07 | -0.13 | -0.07 | ||

| Port. B – Low Risk | 12.93% | 2.15% | 0.30 | -0.08 | -0.26 | -0.01 |

These portfolios both include four direct commodity ETFs: gold (GLD), silver (SLV), base metals (DBB), and agricultural commodities (DBA). Total direct commodity weighting for the “High risk” portfolio is 60% and 55% for the “low risk” portfolio. Both portfolios also have exposure to the oil & gas producer ETF (XOP) and the energy & infrastructure MLP ETF (MLPX).

The primary difference between the two portfolios is the “high risk” fund’s higher 20% weighting toward the long volatility ETF (VXX). VXX is a more volatile asset that decays over time but rises dramatically during periods of volatility. In comparison, the lower-risk portfolio has a higher weighting toward dividend-paying ETFs EMLC and MLPX, giving the portfolio a ~2.15% overall yield. Additionally, the lower-risk portfolio has a higher gold weighting and lower annual volatility standard deviation of 12.9% compared to 14.5% for the higher-risk portfolio. Of course, realized volatility in the future may be different as all measures above were taken using daily performance from late 2018 to today.

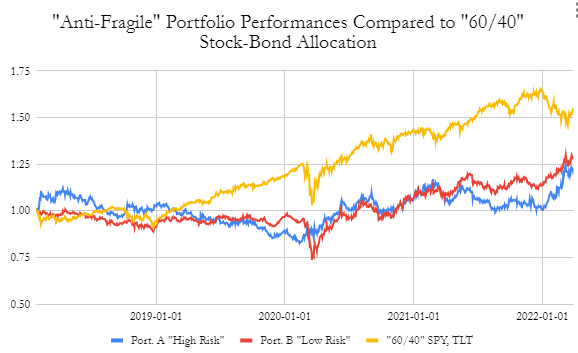

As mentioned earlier, the goal in building these portfolios is not consistent returns but, instead, nearly flat performance during “good times” and positive performance during volatile periods. In my opinion, this is the ideal way to position a portfolio today to secure long-term wealth. This aim appears to be satisfied by each portfolio’s 2018-2022 performance. Both have correlations to the S&P 500, long-term Treasury bond market, and U.S. dollar index less than 0.3X, meaning both portfolios have no strong dependence on the most critical macroeconomic assets. The realized relationship does appear to change over time and has become more negative, meaning these portfolios tend to rise as the stock-bond complex slips. See below:

Daily Rebalanced Performance of Both “Anti Fragile” Portfolios vs. “60/40” Stock-Bond (Data Source: Yahoo Finance (Adj. Close Prices))

Past performance is not strongly indicative of future performance, but these results generally align with my aim. During healthy stock and bond market performance periods, dividends and returns from the “more exposed” assets such as MLPX and EMLC offset declines in substantial anti-fragile assets like VXX. During periods of weakness, such as the ongoing one and the one in 2020, MLPX and EMLC tend to see less severe declines while VXX rises dramatically, creating net-positive returns. Additionally, high commodity allocations in both portfolios offset the impacts of growing inflationary pressures which are deadly for bonds and weight on most stocks.

The Takeaway

The primary risk in both portfolios is a significant decline in commodities, particularly energy, as both funds have considerable exposure to the energy industry. In my view, energy is perhaps the best place to invest today, considering it’s one of the few market segments with low valuations and strong macroeconomic fundamentals. However, if there is a surge in global energy production, both portfolios will likely decline, with the “riskier” portfolio probably falling more.

On the flip side, a continued rise in gasoline prices and other commodities would likely cause both portfolios to rise. In my view, this remains the most likely potential considering the lack of solid responses against rising commodities and inflation from global governments and corporations. Putin’s recent demand for European countries to pay for gas in rubles is yet another potential bullish catalyst for commodities as that may not be a fulfillable demand.

These two portfolios are just two potential examples of how investors can avoid exposure to risk while keeping up with inflation. Ideally, each portfolio is designed to beat inflation in the long run, but nothing should be seen as certain in today’s world. Still, in the future, and barring a catastrophic financial risk event that causes widespread market shutdowns (such as one which Russia has faced of late), I expect both portfolios to either hold their wealth or continue to rise despite economic weakness.

Investors with significant equity allocations that do not wish to reduce exposure entirely could consider adding a few assets from these portfolios as a means of hedging against inflation and recession risks. Even more, those who would like lower volatility than these portfolios have could hold a more prominent cash position. While it is true that cash loses value against inflation, investors have near-record-low cash levels today. Cash is king when nobody has it, and everybody needs it. In reality, it may be best to keep cash allocations above 30% today to have sufficient liquidity for potential future fire-sale opportunities.

Be the first to comment