Nordroden/iStock via Getty Images

The Q1 Earnings Season for the Silver Miners Index (SIL) is just around the corner, and one of the first companies to report its results is Hecla Mining (NYSE:HL). Overall, the company had a softer start to the year than 2021, reporting a 4% decline in silver production and a 20% decline in gold production. Fortunately, a higher gold price will pick up some of this slack, and Hecla should see much higher production from Lucky Friday as the year progresses. While I don’t see the relatively weak Q1 production results as an issue, I continue to see Hecla as expensive vs. other precious metals names, trading at over 1.60x P/NAV.

Hecla Mining Operations (Company Website)

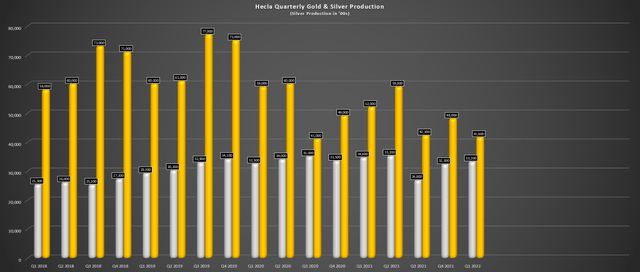

Hecla Mining released its preliminary Q1 results this week, reporting quarterly production of ~3.32 million ounces of silver and ~41,200 ounces of gold. While this was an improvement sequentially for silver production after a tough H2 for its Greens Creek Mine, production was down sharply on a year-over-year basis. This was largely related to lower grades at Casa Berardi due to mining lower grade surface tons from the 160 Pit and equipment delays affecting mine sequencing at Lucky Friday. Let’s take a closer look below:

Hecla Mining – Quarterly Gold/Silver Production (Company Filings, Author’s Chart)

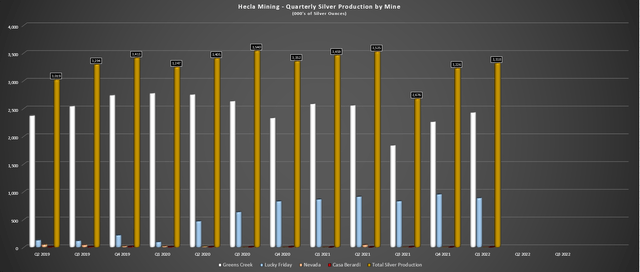

As shown in the chart below, we saw a meaningful improvement in production at Greens Creek (white bars), with silver production increasing to ~2.43 million ounces in Q1, up from ~2.26 million ounces in Q4 2021. This was driven by slightly higher grades and was a welcome improvement from a tough Q3 due to below adequate staffing at the mine. However, on a year-over-year basis, production was well below the ~2.59 million ounces produced in Q1 2021 and the H1 2021 average production of ~2.57 million ounces. Gold production at the mine was also lower, coming in at ~11,400 ounces of gold vs. ~13,300 ounces in the year-ago period.

Hecla Mining – Quarterly Silver Production by Mine (Company Filings, Author’s Chart)

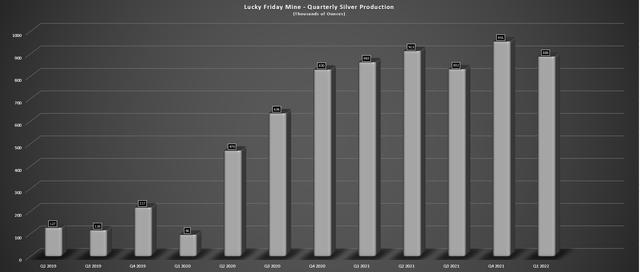

Fortunately, Lucky Friday did have a solid quarter. Most importantly, the future for this mine continues to look very bright with the implementation of the new Underhand Closed Bench [UCB] mining method, which is expected to improve safety, tonnage, and production. During Q1, Lucky Friday saw a slight sequential decline in production due to equipment delays which affected mine sequencing in the period. However, silver production of ~888,000 ounces was up from Q1 2021 levels (864,000 ounces) and should average more than one million ounces per quarter for the remainder of the year.

Lucky Friday Mine – Silver Production (Company Filings, Author’s Chart)

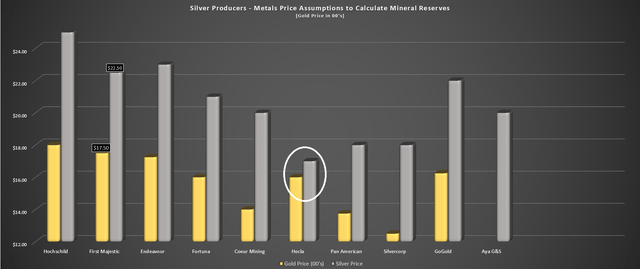

One key differentiator for Hecla, and its Lucky Friday Mine specifically, is that while many silver producers like First Majestic (AG) are working off sub-7-year mine lives based on reserves, Lucky Friday has an industry-leading industry 17-year mine life. This gives investors great visibility into future production and certainly helps put investors at ease vs. some other miners where we could see a cessation of production by 2030 at some assets. As the chart below shows, Hecla calculates its silver/gold reserves at much lower prices yet still has very respectable mine lives (14 years at Greens Creek).

Silver Producers – Gold/Silver Prices Used to Calculate Reserves (Company Filings, Author’s Chart)

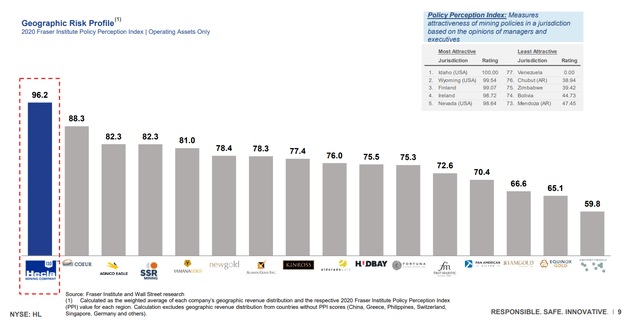

Hecla’s attractive jurisdiction profile (Idaho, Alaska, Quebec) relative to peers combined with its industry-leading mine lives at its two key assets certainly justifies it trading at a premium to most of its peer group. The other differentiator I’ve discussed previously is that Hecla is more insulated than its peers from inflationary pressures due to operating high-grade, low-volume underground mines. In the previous decade, this may not have been a talking point. However, with high-single-digit inflation readings, this is certainly one factor worth considering when it comes to stock selection in this sector.

Hecla Mining – Political Risk Relative to Peers (Company Presentation)

Finally, while it was a satisfactory start for Hecla’s silver operations, Casa Berardi did see much lower production, which is the company’s gold mine in Quebec. During Q1, the mine saw gold production of just ~30,200 ounces, down from ~37,300 ounces in Q4 and ~36,000 ounces in the same period last year. This was related to lower-grade surface tons from the 160 Pit and was largely expected. However, combined with lower gold production at Greens Creek, this did dent the company’s gold production in the quarter.

Metals Prices

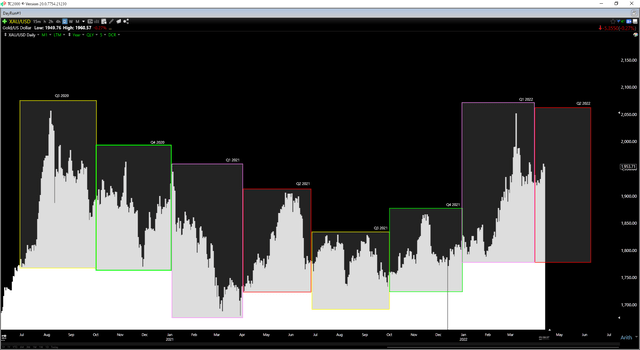

The good news is that while gold production was down, the metal price has been helping Hecla out a little, with gold trending higher during Q1 and holding above the $1,900/oz level in Q2. This should help to pick up some of the slack in Q1 from a revenue standpoint, which was set to be a difficult quarter due to lapping tough year-over-year comps from the attempted silver squeeze in Q1 2021 and the strength in silver in Q2. Assuming the gold price can average above $1,900/oz in Q2, Hecla will be able to lap its tough comps better than I initially expected at the beginning of the year.

Hecla’s average realized silver price in H1 2021 was ~$26.40/oz, hence why I noted in previous updates that it would be up against difficult year-over-year comparisons.

Gold Futures Price (TC2000.com)

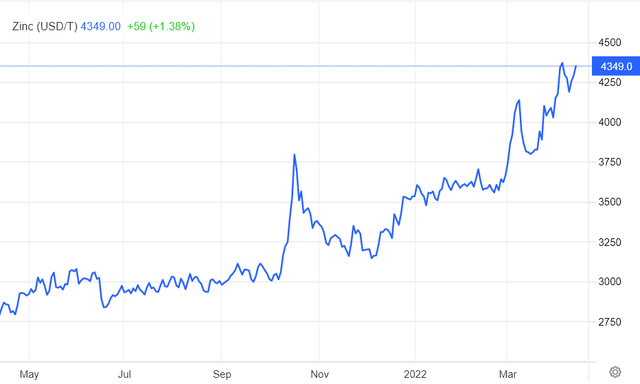

The other piece of good news is that zinc prices have not shown any signs of slowing down and are sitting at their highest levels in more than a decade. This will help Hecla out from a by-product standpoint at its silver operations and could help offset some of the cost creep from inflationary pressures. So, with a solid reserve update in Q1, rising zinc prices, and a gold price that continues to levitate above $1,960/oz, Hecla is in a much better position than it was at the time of my last update in February. Let’s take a look at the stock’s valuation below:

Zinc Prices (Trading Economics)

Valuation & Technical Picture

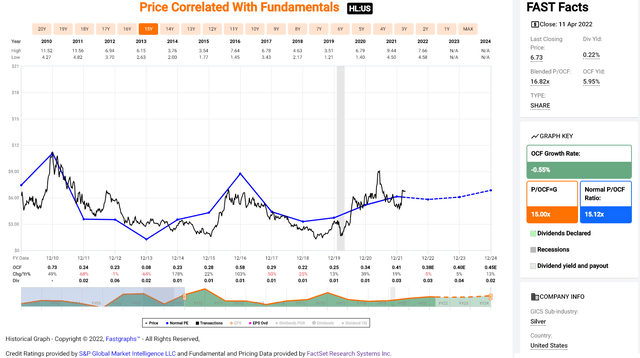

While Hecla’s year is off to a great start and Lucky Friday production will climb as the year progresses, I believe that some of this positivity is priced into the stock. This is because Hecla currently trades at ~17x FY2022 operating cash flow estimates, which is slightly above its 15-year average of ~15.1x cash flow. From a P/NAV standpoint, Hecla doesn’t offer much margin of safety here either. The reason is that it trades at a market cap of ~$3.65 billion vs. an estimated NPV (5%) on its mining assets of ~$2.70 billion, with some value ascribed to its Nevada operations if they can be restarted.

Hecla Mining – Historical Cash Flow Multiple (FASTGraphs.com)

At first glance, this might seem like a minimal premium to NPV (5%), and it certainly is a reasonable valuation compared to First Majestic (AG). However, if we subtract ~$540 million for net debt and estimated corporate G&A, Hecla’s net asset value is just shy of ~$2.2 billion. So, Hecla currently trades at just over 1.65x P/NAV, which is a lofty valuation for a company with just three assets, even if they are in Tier-1 jurisdictions. It’s important to note that this is a reasonable valuation relevant to other silver names sector-wide. However, I see much better value elsewhere if we compare this valuation to all available precious metals producers.

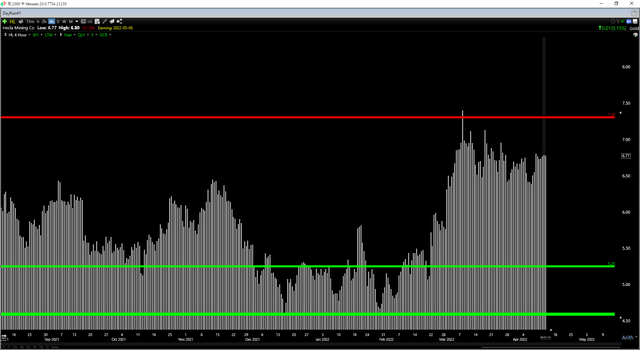

HL Daily Chart (TC2000.com)

Finally, moving over to the technical picture, Hecla is currently trading in the upper portion of its expected trading range, with overhead resistance at $7.30 and no strong support below until the $5.45 level. This doesn’t mean that the stock can’t go higher, but with $0.60 in potential upside to resistance and $1.35 in potential downside to support, its reward/risk ratio comes in at 0.44 to 1.0. Generally, to justify entering new positions, I prefer a reward/risk ratio of at least 5-to-1 for small-cap names, which would require a dip below $5.65 for Hecla to make the stock attractive. To summarize, the stock is nowhere near a low-risk buy point currently.

Hecla Mining Operations (Company Presentation)

For investors looking for primary silver producers that they can sleep well at night with, Hecla is arguably the go-to name, with long mine lives, safe jurisdictions, and solid margins. However, given the option between paying ~1.65x P/NAV for Hecla or less than 1.0x P/NAV for Alamos (AGI), with the latter having higher growth, I struggle to see a value proposition for Hecla. So, if one must have silver exposure, Hecla is a solid buy-the-dip candidate, but I continue to favor other producers elsewhere in the sector.

Be the first to comment