Woodchips as a Bio-derived Feedstock claudiio Doenitz/iStock via Getty Images

Origin Materials (NASDAQ:ORGN) is a publicly-traded company that recently emerged from a special purpose acquisition company (SPAC), Artius Acquisition, which closed in June 2021. ORGN’s core mission is to replace oil feedstocks currently used to manufacture a variety of materials with renewable and sustainable cellulose-based feedstocks. Origin plans to invest capital generated from its SPAC into chemical plants, two of which should be operational by 2025, making the company’s EBITDA positive. While capital-intensive growth companies are inherently risky, I rate ORGN a buy based on its: (i) innovative technology and chemical pathways to convert cellulose to valuable intermediates and products; (ii) enormous and growing demand for companies to meet low or zero emissions over short time horizons; and (iii) shared confidence by management, insiders, and institutions. These factors, combined with results from a conservative valuation model make a case for a buy.

Origin’s Technology and Mission

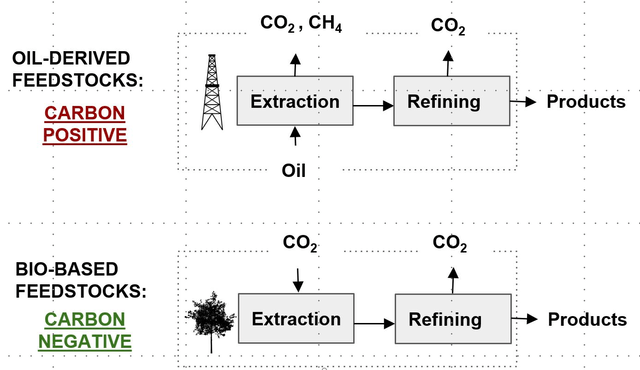

Origin produces chemical intermediates that are used in a wide range of consumer goods while avoiding oil extraction and refining processes that inevitably release greenhouse gasses (CO2 and CH4). Instead, Origin uses plant-based feedstocks that photosynthetically consume CO2 during growth. Figure 1 shows a comparison of these two approaches. Since more atmospheric CO2 is consumed during plant growth than Origin releases during subsequent processing, the process is said to be ‘carbon-negative’. At the end of the day, Origin’s chemical processing pulls CO2 from the atmosphere and provides a means to fix carbon into solid materials including recyclable beverage packaging, clothing, textiles, plastics, car parts, carpets, and tires. Once fixed, carbon will not re-enter the atmosphere, and some of the final products can be recycled.

Figure 1. Comparison of oil-derived and bio-derived materials production. The carbon in the final products is derived from CO2 that has been absorbed from the atmosphere during plant growth. (Seeking Alpha Author Absolute Valuation)

In this article, I will briefly review a few chemical concepts that illustrate ORGN’s technical strategy to market strategy in layman’s terms. Next, I will discuss the growing demand for zero-emission or carbon-negative materials. I will then outline ORGN’s tactical strategy and construct a simple valuation model to predict free cash flows and estimate the stock’s intrinsic value. Finally, I will share some key issues to keep an eye on as ORGN executes its plan. These issues are tied to what I feel are ORGN’s greatest risks moving forward.

Origin’s Technology

Origin makes use of cellulose, the most abundant organic polymer on Earth. Cellulose contains fixed carbon that originates from photosynthesis. Photosynthesis is an astounding natural wonder: sunlight is absorbed, CO2 is removed from the atmosphere, and biomass is created with valuable energy stored in the form of chemical bonds. Scientists have recently discovered pathways to convert biomass into chemicals and products that have been historically derived from oil. By using cellulosic biomass as a feedstock, Origin profits from nature’s photosynthesis by selling their products, and society benefits as CO2 is removed from the atmosphere. A further appeal is that Origin’s feedstocks are not used in food production because cellulose cannot be digested by humans. Therefore, Origin does not use resources that take farmland needed for food crops.

Origin targets the use of cellulose-based materials such as pine pulpwood as their primary chemical feedstock. This resource, also used by the pulp industry, is plentiful, inexpensive, and carries a remarkably stable price, generally varying between $9.29 and $10.11 per ton (Q1 2015 to Q4 2020).

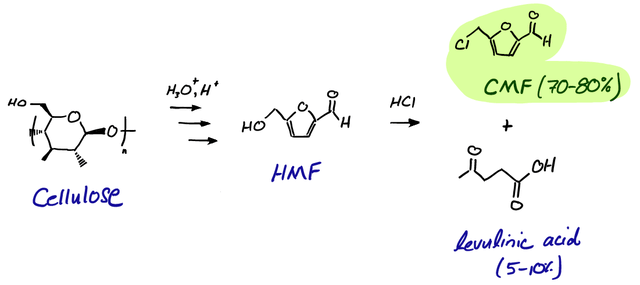

Origin’s main focus is to chemically convert cellulose into a valuable platform chemical, 5-chloromethylfurfural (CMF) and hydrothermal carbon (HTC). This is accomplished by mixing together the wood-based feedstock, water, and an organic solvent. As depicted in Figure 2, the mixture is heated and hydrochloric acid is added. During the process, cellulose breaks down to ultimately form CMF and a few side-products such as levulinic acid. A lot of chemistry occurs in the reactor, but a key advantage is that it is a one-pot reaction. The primary products, CMF and HTC, along with secondary products, furfuryl and levulinic acid, account for practically all of the input carbon from the biomass feedstock. Once the reaction is complete, stirring is stopped and CMF is easily isolated and protected from degradation in the organic phase. Since CMF is the only product in the organic phase, it can be easily separated by solvent removal, thereby avoiding the large capital costs often associated with separation processes. The aqueous phase contains another platform product, hydrothermal carbon (HTC), that can be isolated by filtration.

Figure 2. Simplified scheme showing conversion of cellulose into CMF, which is easily isolated and protected by an organic solvent. (Seeking Alpha Author Absolute Valuation)

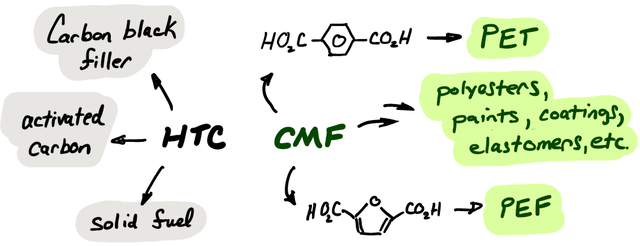

Chloromethylfurfuryl (CMF) is like a two-by-four on a construction site: it is versatile and can be used as a building block for a variety of different products (M. Mascal, ACS Sustainable Chem. Eng., 2019, 7, 5588). Most notably, CMF can be converted to terephthalic acid and subsequently to paraxylene. Paraxylene is a precursor to polyethylene terephthalate (PET), which has a market exceeding $30B and is widely used in products including beverage bottles, packaging, textiles, and automotive parts. CMF can be used as a feedstock for other polymers including poly(ethylene 2,5-furandicarboxylate) (PEF) with a market valued at $24B in 2016, polyesters, and polyurethanes.

Origin’s second main carbon-negative product is hydrothermal carbon (HTC). HTC can be used directly as an energy-dense solid fuel, or it can be calcined to produce activated carbon for food and water treatment. Furthermore, HTC can be used as an additive in tires, foams and dyes, paints, coatings, and agricultural products.

Figure 3. Material flows from HTC and CMF to form a variety of valuable products. (Seeking Alpha Author Absolute Valuation)

Seemingly Inexhaustible Demand for Products

Since Origin’s announcement to go public, a growing list of companies has declared partnerships with ORGN through offtake agreements or capacity reservations. These companies, including Ford (F), Nestle (OTCPK:NSRGY) (OTCPK:NSRGF), PepsiCo (PEP), Mitsubishi Gas Chemical (OTC:MBGCF), and Danone (OTCQX:DANOY) (OTCQX:GPDNF), want to earmark part of Origin’s future production to satisfy their own sustainability goals.

According to Origin’s 2021 Q4 report, demand has multiplied through offtake agreements and capacity reservations from ~$1B in February 2021 to ~ $5.6B in February 2022. In January, ORGN announced a partnership with Mitsui & Co. (OTCPK:MITSY) (OTCPK:MITSF), a global leader in energy, machinery, chemicals, food, etc., and signed a multi-year capacity reservation to purchase new product. Last month, ORGN entered a partnership with the Green Chemistry Division of the Minafin Group to industrialize high-value materials. This signals that ORGN is targeting higher margin specialty products beyond bulk PET.

Thus far, I estimate that ORGN has booked about 20% of its capacity through multi-year customer agreements. As they continue to partner with a growing list of companies with sustainability goals, we can only expect capacity reservations to grow further. I believe Origin will likely fill their production capacity by the time their plants start up. Every time a new partnership is announced, we can expect the stock price will quickly adjust itself upwards.

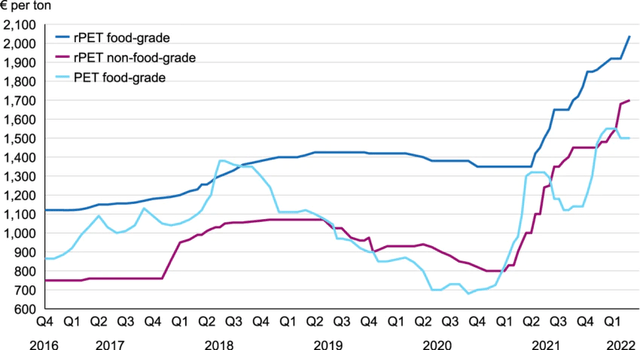

It is my understanding that Origin’s most valuable and demanded product is PET. Their second plant, Origin Plant 2, will be primarily producing PET. PET is an excellent entry product for Origin to start making zero-carbon materials. Throughout 2021, the PET spot price increased to as high as $1900 per metric ton. The plot in Figure 4 shows historical prices in Euros of food-grade recycled PET (r-PET) and food-grade virgin PET (PET). The price has risen by ~ 25% since ORGN went public. Furthermore, the US imports of PET exceed its exports, suggesting continued PET price strength. Origin is well-positioned to help satisfy this ever-growing need.

Figure 4. Market prices for rPET food-grade, rPET non-food-grade, and PET food-grade (October 2016 – February 2022) (polymerist.substack.com)

Origin’s Production Plant Road-mapping & Valuation

Origin is currently constructing their first plant, Origin 1, in Sarnia, Ontario. They also have concrete plans for a second, much larger plant, Origin 2. In addition, ORGN plans to build five more plants by 2030. They remain on target with their timeline to complete Origin 1, with $70 million additional capex investment, by the end of 2022, and some tasks have been completed ahead of schedule. Origin 1 should be capable of processing 49 million lbs. of biomass per year and is expected to generate $122 M in revenue.

Origin’s second plant, Origin 2, will be located in Geismar, Louisiana. This plant will be significantly larger than Origin 1 and will draw from Louisiana’s timber mills and managed forests. When construction is completed, and the plant is operational in mid-2025, it will produce plant-derived PET for packaging, textiles, and apparel applications alongside HTC fuel as its major side-product. The biomass input of Origin 2 will be about 2.2 billion lbs. per year, and the plant’s production capacity is estimated to be 2.4 billion lbs. per year. Assuming that Origin will be able to fill capacity and sell products at an average price of $0.29 per lb., they can expect a continuous revenue stream exceeding $700 million per year. This is comparable to ORGN’s current market capitalization of about $900 million and should push the company to become EBITDA positive in 2025.

Beyond the capital raised by the SPAC, Origin is planning additional financing through private equity bonds. They also plan to take advantage of the Infrastructure and Jobs Act to obtain tax-exempt bonds. Additionally, ORGN has laid aside $100M of cash as contingency to deal with unexpected issues.

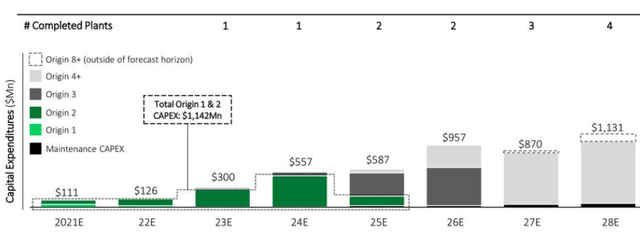

Figure 5. Origin’s expected capital expenditures for investment in biomass conversion plants. (Origin’s Investor Presentation, November 2021)

Origin has ambitious plans to produce over eight plants by 2030, some of which will target products beyond CMF and HTC. Figure 5 shows how CapEx investment will be made for these plants. Beyond 2025, their plan calls for about $1 billion investment per year. It is very difficult to model the profitability of a company that far into the future, and, therefore we will focus on investments being made now. The data shown in green in Figure 5 are CapEx investment estimates for the Origin 1 and Origin 2 plants. These numbers are more accurate and will form the basis of my discounted free cash flow analysis.

I built a simple discounted free cash flow valuation model by assuming that Origin only builds the Origin 1 and Origin 2 plants and all free cash flow is generated from those two investments. I consider this valuation to be conservative, because, after commissioning the plants, Origin will have credibility and experience, adding to its value beyond those two plants.

Origin has provided ‘base-case’ Revenue and EBITDA projections in their investor presentation. This base-case scenario represents a lower bound to projected earnings because it considers only satisfying existing customer orders. The Origin 2 plant is projected to be finished in 2025. Therefore, the base-case 2026 EBITDA number of $296 million is taken to reflect earnings only from Origin 1 and Origin 2 at full production.

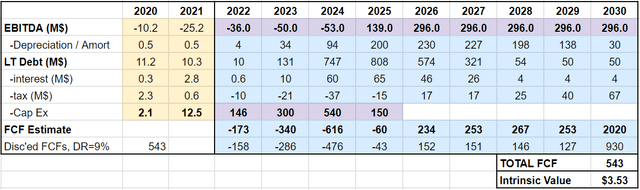

My simplified model assumes that all of Origin’s current cash holdings will be directed to pay for anticipated EBITDA losses accrued over the next few years due to the high CapEx investments. Once its cash is expended, the model assumes that financing will be obtained at 8% interest, growing debt, while keeping $50 million cash on the balance sheet. Once EBITDA is positive, debt will be paid and cash will be accumulated. Free cash flow (FCF) is calculated at the end of each year by starting with EBITDA, subtracting CapEx, taxes, and interest. Taxes are calculated at 25% of EBITDA but are corrected for depreciation. All CapEx investments are depreciated evenly over five years. The numbers for this base-case scenario are shown in Figure 6. Each year’s FCF stream is discounted by a rate of 9% to calculate its present value. FCF in the terminal year, 2030, is calculated as eight times the FCF of 2029 and is also discounted to present value. The sum of all FCF is then divided by the total number of shares to determine the stock’s intrinsic value. Origin’s intrinsic value for their base-case scenario is $3.53 which is about 56% of its current value.

Figure 6. Table showing discounted free cash flow model based only on projected earnings from two plants running at base-case scenario. (Seeking Alpha Author Absolute Valuation)

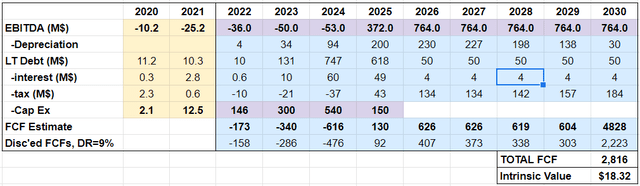

While that analysis sounds pitiful, Origin’s management believes, as do I, that they can obtain a premium on new customer orders. They also believe that they can add production trains to each plant, doubling their capacity. Page 38 of last November’s investor presentation outlined expected revenue and EBITDA numbers for this more optimistic limit. Figure 7 shows how the numbers change if the same discounted FCF model is applied using the more optimistic EBITDA numbers. In that case, Origin’s intrinsic value is $18.32, nearly triple its current share price.

Figure 7. Table showing a discounted free cash flow model based only on projected earnings from two plants running with significant additional revenue beyond base-case scenario. (Seeking Alpha Author Absolute Valuation)

The most likely outcome is probably somewhere in between these two cases. However, there is a shared confidence by management, insiders, and institutions that Origin is moving in the right direction. Since August 2021, insiders have continued to purchase shares (+ 237k shares), raising their stake to over 1.5%. Since the SPAC closed on June 28th, 2021, many shares have been transferred to institutions who now have over 28% stake. Recent institutional buyers include large funds such as Vanguard and Blackrock. A group of 4.5M shares is subject to forfeiture if the stock does not hit $15 by 6/2024, $20 by 6/2025, and $25 by 6/2026. This represents a stock growth rate exceeding 25% per year and shows the management’s high confidence in their stock price growth.

Key Risks

Delays and Shutdowns. Big capital projects are inherently risky, and one of the largest risks is delays. Origin 1 appears to be on schedule and will be operational by the end of 2022. However, Origin 2 could be delayed for numerous reasons, with supply chain issues being one of the greatest concerns. Beyond supply chain issues, there are possible delays or shutdowns due to permitting, utility availability, and the COVID-19 pandemic. Using the valuation model above, a delay of cash flows by one year will adversely affect the stock price by about $1 for the base-case scenario and $2-3 for the more optimistic scenario.

Inexperience beyond Pilot Plant Level. It is one thing to produce a few kilograms of materials, it’s an entirely different ball game to generate tons of product each day. In addition to running and scaling up the plant, there are logistic challenges related to selling and distributing products. Investors should pay attention to progress and problems that Origin experiences as they attempt to scale up their business activities.

Sensitivity to Prices and Interest Rates. While cellulose feedstock prices have shown good stability in the past, other price variations may adversely affect Origin’s plans. The price of PET is important, because it directly connects to Origin’s profitability. Inexpensive oil will make it easier for competitors to produce products at lower prices. Lastly, many expect increasing interest rates. Higher capital costs can negatively impact Origin’s path forward, because they will need large financing sums to pay for their enormous capital expenditure.

Take-home Message

Origin’s approach to producing bio-sourced intermediates and products from cellulosic feedstocks appears to address a growing demand for carbon-negative materials. Their major product, CMF, can be used as a building block to make a variety of chemical products allowing the company to pivot along with industrial demand. I rate the stock as a buy because I believe: (i) the technological approach is sound with a limited need for product separation and purification; (ii) companies will continue to demand carbon-negative materials to reach their own sustainability goals and Origin’s orders will be filled; and (iii) the pricing landscape for cellulosic feedstocks and PET products will likely remain favorable. Investors should keep a close eye on new customer contracts that Origin announces as well as their progress to getting the Origin 1 and Origin 2 plants up and running.

Be the first to comment