ipopba/iStock via Getty Images

Investment Overview

On January 4th 2021, I spotlighted Vericel Corporation (NASDAQ:VCEL) as a rapidly growing and profitable biotechnology company that had multiple growth levers and expansion opportunities. The company’s solutions are proprietary, patented (certain products), and more effective than competing offerings and alternatives. After highlighting the company at a price of $30.60 per share, the Company reached a high of $68.94 before declining back to the mid 30’s today. The drivers of this decline largely appear to be temporary. Given the growth outlook for the VCEL, investors currently have the opportunity to pick up a high-quality company at a reasonable price.

Company Overview

Vericel is a biotechnology company that researches, develops, manufactures and distributes advanced treatments and therapies primarily for the sports medicine and severe burn markets. The company’s core products include MACI, a restorative cartilage repair solution designed to treat cartilage defects of the knee, and Epicel, a permanent skin replacement solution for severe burn victims with deep dermal or full thickness burns.

MACI is the first tissue-engineered autologous cellularized scaffold product approved by the FDA. In non-medical terms, MACI creates a repair tissue that allows patients to resume an active lifestyle. The engineered tissue repairs knee defects (cartilage chips, fractures, etc.) and helps restore knee and joint function. Competing solutions have traditionally focused more on repair and pain management, while lacking the restorative benefits of MACI.

Epicel is the only FDA-approved autologous epidermal product available for large total surface area burns in both adult and pediatric patients. It’s a critically important treatment option when little skin is available for autografts. From the annual report-

“Patients suffering catastrophic burns over a significant portion of total body surface area (TBSA) have few options for permanent skin coverage. When undamaged skin is available, a procedure known as meshed split-thickness auto-grafting can be considered. However, this option becomes less viable as the percentage of TBSA burn increases. Epicel is a potentially lifesaving therapy and represents the only FDA-approved option for patients with TBSA burns greater than 30%” Source: Company Annual Report

For removal of scar tissue from burns, VCEL’s NexoBrid solution has concluded phase 3 trials, with FDA approval likely for mid-year 2022 (this product has already received EU approval and is in use overseas). NexoBrid is a topically-administered biological product that enzymatically removes nonviable burn tissue, or eschar, in patients with deep partial and full-thickness thermal burns.

Updated Investment Case

For a complete overview of the strengths of VCEL’s solutions, I recommend briefly reviewing the original investment case, found here. Although the stock price has declined over the last few months, VCEL continues to have a strong growth outlook, backed by proprietary solutions and with quality management. For investors with a long-term view, these factors are likely to lead to market-beating returns in the coming years.

Over the last 6 months, there are two primary reasons for the decline in stock price. First, growth stocks have been hit hard during the recent market selloffs. VCEL certainly hasn’t been immune to this dynamic, but this is likely a temporary headwind for the company, since VCEL has demonstrated that it can achieve growth and profitability, and continue to execute on future growth opportunities.

In mid-2021, the company also received a Chemistry, Manufacturing, and Controls notice from the FDA related to Nexobrid. Note that Nexobrid is licensed technology from Mediwound. Management has been closely working with Mediwound to remedy the core issues and in its recent conference call noted that “we remain on track for a midyear resubmission of the NexoBrid BLA, which would position NexoBrid for a potential commercial launch in the U.S. in the first half of 2023.” Also, Nexobrid is already in use in the EU, so there’s a good chance the issues in the US can be rectified.

Having established that the current issues are largely temporary, let’s turn to the longer-term investment case. Vericel’s solutions benefit from operating in a market segment that is largely recession-resistant. Serious sports injuries of knee and severe burns are generally not areas where treatment can be put off indefinitely. VCEL solutions, therefore, benefit from a relatively consistent string of demand.

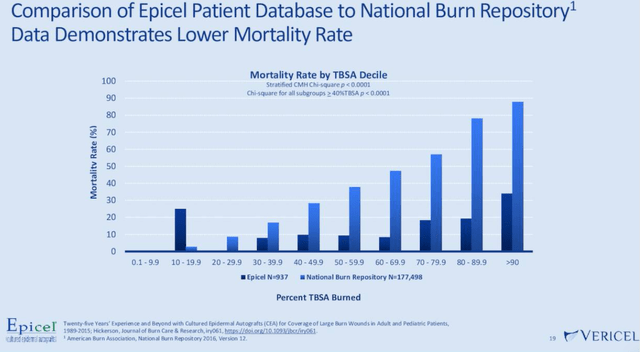

The growth thesis for VCEL will also continue to be supported by the fact that the company’s solutions face limited competition and strong barriers to entry. MACI, VCEL’s cartilage repair and restoration solution, is patented thru 2028, while the company will enjoy exclusivity on Nexobrid thru 2029. Further strengthening the market outlook for MACI is that the engineered tissue repairs knee defects (cartilage chips, fractures, etc.) and helps restore knee and joint function. Competing solutions have traditionally focused more on repair and pain management, while lacking the restorative benefits of MACI. At the moment, competing offerings simply are not able to provide all of the quality of life enhancements that MACI can offer. Meanwhile, for its burn care business, as seen in the chart below, Epicel has significantly lowered the mortality rates for severe burn victims.

Quarterly Earnings Presentation

With proprietary and more effective solutions, more growth is set to come for VCEL. Currently, the total addressable market for MACI is $2 billion annually. In 2021, VCEL grabbed roughly 5% of this market with revenues of $112M. Clearly, there’s room for significant expansion given the effectives of MACI vs. traditional solutions.

Moreover, management recently noted that VCEL continues evaluate and develop solutions for the ankle. Although the MACI ankle program is likely a couple of years away, it would meaningfully increase MACI’s TAM to $3 billion annually. Growth opportunities are not limited to the sports medicine segment. Although Nexobrid’s approval has been delayed, upon commercial release, management believes there’s a $400M annual addressable market opportunity.

Leadership clearly believes that the best is yet to come for both its sports medicine and burn franchises, as the company continues to invest in growth and production capabilities to support future business volumes. On the Q4 conference call, management noted:

“Finally, we’re very pleased to have announced plans earlier this month for a new state of the art advanced cell therapy manufacturing and corporate headquarters facility in the Boston area. The new facility, which is expected to begin commercial manufacturing in 2025, will significantly increase our manufacturing capacity and demonstrates our confidence in the continued growth trajectory for MACI and Epicel in the years ahead.” Source: Quarterly Earnings Call

Overall, with more effective proprietary products that are not easily duplicated, favorable market outlooks/conditions, and leadership that has demonstrated a track record of execution and growing the business, the VCEL investment case remains strong.

Financial Update & Outlook

Over the last five years, revenue has increased 2.5x at VCEL from $63 million in 2017 to $153 million in 2021. Sales growth has been very consistent, above 20% annually for 3 out of the last 4 years. The only exception was 2020, when MACI revenues dropped significantly due to widespread lockdowns across the U.S. Quarterly revenue is also remarkably consistent, with the company having achieved sequential growth in 11 of the last 12 quarters.

Quarterly Earnings Presentation

Turning to the company’s outlook, management is guiding to $178M – $189M of revenue in 2022. The low-end of this range indicates 16% YoY revenue growth, while the high-end would be 20% annual growth. It appears quite likely that VCEL will beat the low end of this target, as the company has performed above consensus analyst revenue expectations in 9 of the last 11 quarters.

Vericel is a business that has proven it can scale. Gross margins were 53% in 2017, but had expanded to 68% by 2021. In the long-run, management believes the business can achieve 70%+ gross margins. After also achieving net profitability in 2020, VCEL somewhat disappointingly flipped back to unprofitability and a net loss of $7.5M in 2021. The core driver of the loss was $34M of stock-based compensation, where the fair value of options and restricted stock units awarded in the period and the expense recognized exceeded the original plan. While the increased stock price throughout the year played a large role here, $34M is a lot of stock-based compensation for a company the size of VCEL, and this amount warrants further monitoring going forward.

Despite the compensation impacts last year, VCEL leadership has demonstrated strong financial management of the company. Currently, VCEL has $68M of cash on the balance, no debt reported over the last five years, and current liabilities of just $26M.

While net income declined year-over-year due to the stock compensation issues discussed earlier, free cash flow increased 70% YoY, going from $13M in 2020 to $22M in 2021.

Analysts continue to have a positive outlook on VCEL. The consensus revenue estimates calls for $184M of revenue in 2022 and $227M the following year. Currently six analysts cover the stock.

One small knock on Vericel is its ownership structure. Insiders own just 0.6% of the company. While CEO Nick Colangelo has more than aptly guided the company to growth since 2013, it would be nice to see insiders more vested in the company financially.

Investment Risks

For a full rundown of investment risks, please see the previous coverage of Vericel here. This section will highlight the risk items most pressing on the stock today.

The competitive landscape is likely the most important risk area for investors to consider. At the moment, VCEL enjoys a very strong position in both its core sports medicine and burn treatment markets. MACI, Epicel, and Nexobrid have all been shown to be safer, more effective options than traditional treatments and approaches. Additionally, MACI and Nexobrid both have some forms of patent protection or exclusivity until late in the current decade. So, from a competitive standpoint, what’s the concern here?

To start with, investors need to understand that a product like MACI is still very up-and-coming in the sports medicine industry. In many cases, microfracture surgery remains the default treatment. While this is a positive because it provides VCEL with a long runway for growth and ability to gain further market share, management will need to continue marketing efforts and educate the medical community on the upside of MACI. Beyond marketing, investors need to consider that there are a variety of new and potential competing solutions currently in the testing phases.

Although these solutions will likely face similar challenges in gaining market acceptance, the world can change quickly, and MACI may have further challengers to its best in class status in the future. Consider the following commentary from the annual report:

There are multiple other cartilage repair technologies currently being studied in clinical and preclinical studies. Hyalofast® is a biodegradable hyaluronic acid-based scaffold used in conjunction with autologous concentrated bone marrow aspirate being developed by Anika Therapeutics, Inc. It is currently being studied in a Phase 3 trial that was initiated in 2015. Agili-C® is a non-cellular biphasic implant derived from aragonite coral which is implanted into the subchondral bone and is being developed by CartiHeal, Inc. It has undergone a Phase 3 trial that initiated in 2018 and has met its primary endpoint. CartiHeal has announced plans to submit a PMA to the FDA’s Center for Devices and Radiological Health (“CDRH”) in late 2021 or early 2022 to seek medical device approval for Agili-C. MACI is the only FDA-approved ACI product on the market in the U.S. We are aware of one other ACI product in development in the U.S. for the treatment of articular cartilage defects of the knee. In 2014, Aesculap Biologics, LLC initiated a Phase 3 trial of NOVOCART® 3D, a biologic-device combination product comprised of autologous chondrocytes seeded on a collagen scaffold. The trial is still enrolling patients. Source: Company Annual Report

While none of the above appear to be immediate challengers, keeping a close watch on developments in this space will be crucial to successfully investing in VCEL.

Further execution risks also remain for VCEL. While MACI and Epicel have seen strong growth to date and demonstrated superior performance vs. currently available alternatives, management will need to spend significant time commercializing the products to take advantage of the market opportunity. These efforts will likely include a fair amount of time and resources spent educating medical and healthcare communities on the benefits of VCEL’s solutions.

Stock-based compensation will be another area to watch closely for further developments. In my view, $34M of stock-based compensation expense last year is too much for a company of VCEL’s size. However, it is nice to see that the company generated strong free cash flow growth in the midst of the spike in stock-based compensation last year. In the long run, continued high levels of stock-based compensation are likely to end up diluting and hurting existing shareholders.

Valuation & Recommendation

Due to the recent lumpiness in VCEL’s earnings, as well as the sales growth profile of the business, valuing the business on a price-to-sales approach is most applicable under current conditions. With a current market capitalization of $1.73 billion, VCEL trades at 11.0x trailing twelve-month sales and roughly 10.0x expected 2022 sales. Historically, the business has traded at the 7-8x sales range throughout 2019 and in the months before COVID. After global re-openings, VCEL’s P/S ratio hit 12x in 2020 and further jumped to almost 20x in 2021, before contracting to its current level.

The bull case for VCEL would be that it maintains a 10.0-11.0x multiple, which I believe is reasonable given the growth profile of the company, quality management, market opportunities, and proprietary & high-performing products. In this scenario, assuming the company hits analyst consensus revenue estimates of $227M in 2023, VCEL’s market capitalization grows to $2.5 billion. This represents 47% upside vs. today’s prices or a 23.5% return annually over the next 2 years.

The bear case for VCEL would likely be that valuations further contract and that the company’s multiple falls to the 7.5x range, more in line with pre–COVID levels. Again, using analyst consensus revenue projections for 2023, in this scenario VCEL maintains its current valuation of $1.7B billion and doesn’t see further upside. This appears to be a reasonable “floor” for the company, barring a major unexpected downturn in sales over the next two years or a significant and prolonged recession.

At its current valuation of $1.7 billion, I’m going to assign VCEL a buy rating. This is based on the growth opportunities ahead, its history of delivering results, quality management, and VCEL’s industry-leading innovative products. In full disclosure, I’ll likely see if this one drops another 10-15% in price before buying, given current market volatility. However, investors with a 3+ year time horizon can feel comfortable buying today, as there’s significant long-term upside in the stock/company and a management team that has a track record of delivering.

Be the first to comment