Srinuan Hirunwat/iStock via Getty Images

Investment thesis

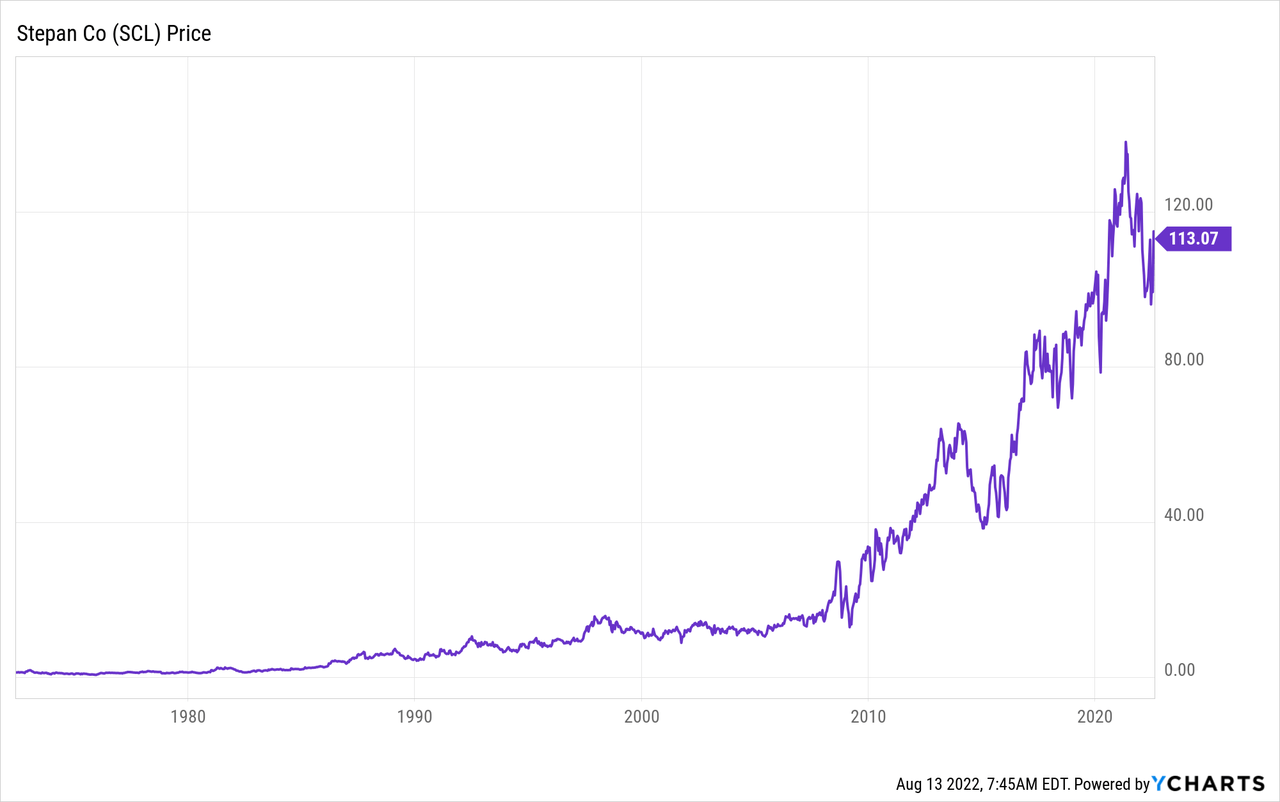

Stepan Company (NYSE:SCL) is a company that you can buy and hold for decades thanks to three main factors. First, the chemical components it manufactures are essential for the manufacturing process of products from third-party manufacturers operating in key markets. Second, their profit margins are relatively high and stable over the years. And thirdly, the management makes very conservative use of cash, which makes it possible to carry out acquisitions and expansions year after year thanks to very low interest on debt and a low dividend cash payout ratio. The company has been operating for 90 years, and everything suggests that it will continue working for many more decades. Still, it’s been hard to find shares at a reasonable price in the last few years, so today I’m going to explain why I believe that the recent headwinds, and the consequent drop in share price, present an opportunity to start a position right now.

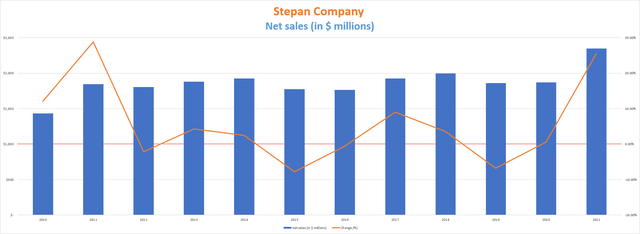

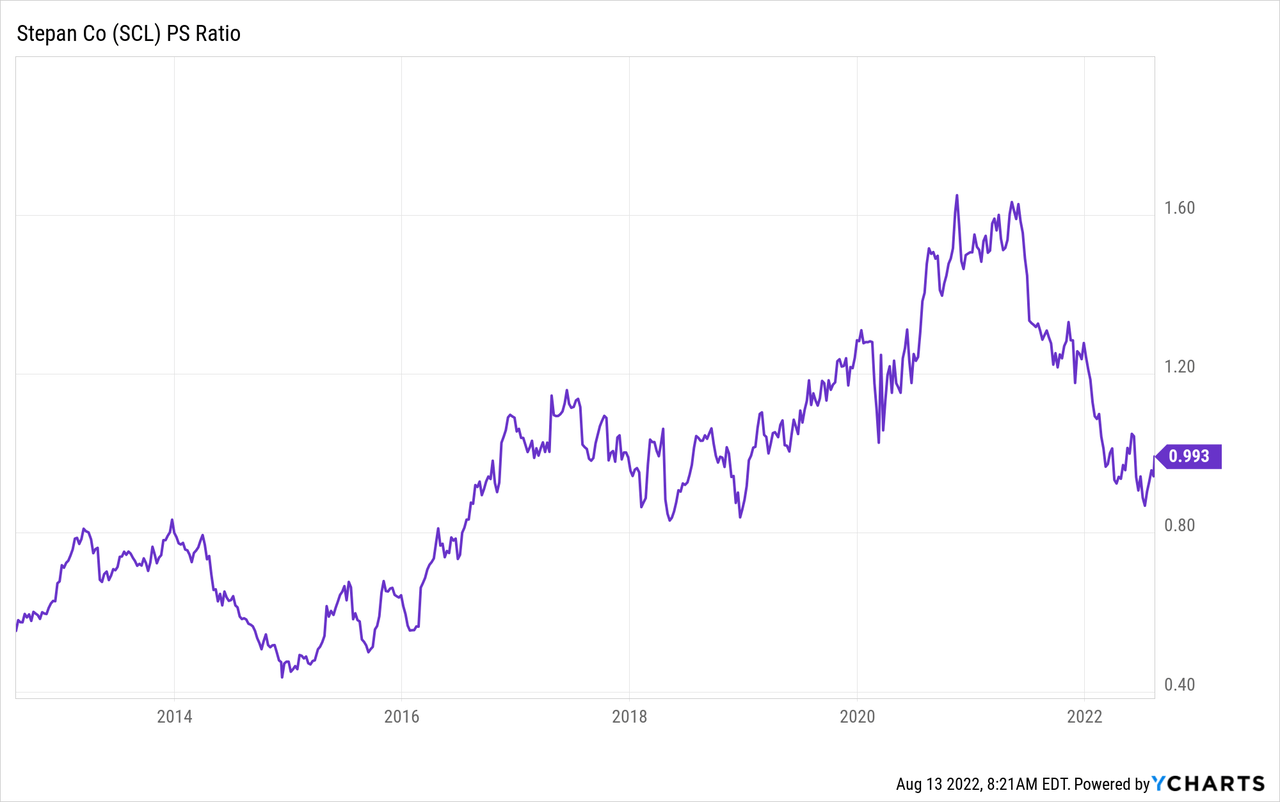

In 2021, net sales increased by 25.47% year over year despite the fact that 2020 was a year with stable sales, and sales are expected to grow again by ~13% in 2022 and stabilize at that level in 2023. But despite the recent increase and high expectations related to sales, the company’s shares are trading at -18% from all-time highs reached in May 2021 due to the fact that margins have been negatively affected as a consequence of the recent inflationary tensions experienced worldwide, as well as supply chain issues and labor shortages. In short, increasing sales but declining margins are the main factors why today we find a PS ratio of 0.993 compared to ~1.6 during late 2020 and early 2021. Nevertheless, the recent increase in debt to expand the company’s operations has also contributed to a higher risk perceived by investors, but the company is profitable enough to deleverage the balance sheet, as it has demonstrated in the past.

However, these two factors (higher debt and lower profit margins) do not represent significant long-term risks due to their temporary nature. Apart from the fact that the company has previously demonstrated its ability to continuously reduce its debt pile, the recent inflationary pressures are the consequence of a series of global events (the coronavirus pandemic crisis and the consequent supply chain issues, rising costs of transportation, raw materials and energy, and labor shortages, and the recent war between Ukraine and Russia) that are affecting every industry in the world in one way or another, so they are not a consequence of any decision taken by the management of the company.

A brief overview of the company

Stepan Company is a manufacturer and marketer of intermediate chemicals for the manufacturing process of products from third-party manufacturers. Its products are essential components for the elaboration of products by companies that operate in key industries, which enables a reliable source of revenue for Stepan. These industries include agriculture, coatings, adhesives, sealants, elastomers, construction, cleaning products for domestic and institutional markets, industrial products, insulation, oilfield, personal care, and phthalic anhydride.

The company was founded in 1932 and its market cap currently stands at ~$2.5 billion, which means it’s a mid-cap company of considerable size. Insiders own 5.16% of the company’s outstanding shares, and therefore, these are direct beneficiaries of the good behavior of the share price and the positive course of the company’s operations.

The company’s operations are divided into three main segments: Surfactants, Polymers, and Specialty Products. Surfactants are the main cleaning agent in detergents, shampoos, body wash and conditioners, fabric softeners, toothpaste, cosmetics, and other personal care products. Surfactants are also used by third-party manufacturers for agricultural products, emulsion polymers, and oilfield applications. Polymers are used in a variety of applications, including the manufacture of rigid foam for thermal insulation in the construction industry, coatings, adhesives, sealants and elastomers applications, polyester resins, alkyd resins, and plasticizers for applications in construction materials and components of automotive, boating, and other consumer products and internally in the production of polyols. And lastly, the Specialty Products segment manufactures chemicals for food, flavoring, nutritional supplement, and pharmaceutical applications.

As of 2021, the Surfactants segment provided 67% of the company’s total net sales, whereas the Polymers segment provided 30%, and the Specialty Products segment 3%.

Currently, the share price stands at $113.07, which represents an 18.03% decline from all-time highs of $137.95 on May 6, 2021. But this is not the end of the story since, as we will see throughout the article, the PS ratio has plummeted even more reaching levels not seen for five years due to increased net sales while margins have not yet recovered from inflationary pressures. This increase in sales has been possible thanks to the active acquisition policy carried out by the management, which is possible through a conservative use of the cash generated from operations, and increasing base prices of its products to pass on part of the increased production costs to customers.

Recent acquisitions

It is part of the company’s policy to make continuous acquisitions, and that’s the reason for a very low dividend payout ratio. The management prefers to invest the cash generated through operations back to the company rather than paying juicy dividends, and this can be something advantageous for long-term investors, who enjoy increasing dividends.

In March 2020, Stepan acquired Logos Technologies LLC’s NatSurFact business, a rhamnolipid-based line of bio-surfactants derived from renewable sources that are produced via fermentation. Later in the same year, in September 2020, the company acquired Clariant’s (OTCPK:CLZNF) (OTCPK:CLZNY) anionic surfactant business in Mexico, which further expanded the company’s presence in emerging markets.

In January 2021, the company announced the acquisition of INVISTA’s aromatic polyester polyol business and associated assets. With this acquisition, Stepan added two manufacturing facilities, one located in the United States and another in the Netherlands, apart from intellectual property, customer relationships, inventory, and working capital. The acquired business had net sales of approximately $100 million at the time of purchase, so Stepan’s overall sales were boosted by 5%. Later, in February of the same year, the company acquired a fermentation plant located in Louisiana for the manufacturing of next-generation surfactants, that is, bio-surfactants, which are used in agriculture, oilfield, personal care, and household, industrial and institutional cleaning markets.

Despite the recent increase in debt exposure, the management is still open to make further acquisitions if attractive opportunities are found in the market, as stated in the last earnings call conference. Therefore, it should come as no surprise if operations continue to expand in the short to medium term. The balance sheet continues to be very solid and there is still room for it without this entailing an excessive added risk.

Net sales are increasing while the PS ratio is plummeting

Throughout the last decade, sales have remained stable, with a relatively significant increase during 2021 of 25.47% year over year. Furthermore, sales are expected to keep growing from $2.35 billion in 2021 to $2.66 billion in 2022, which represents a 13% increase year over year, and then stabilize at $2.69 billion in 2023. Still, it is very important to note that volumes declined by 1% year over year during the last quarter while prices increased by 32% in the Surfactant segment and by 30% in the polymers segment. This means that the recent increase in sales is mostly related to increased prices.

Stepan Company net sales (10-K filings)

Expectations seem to be reasonable considering trailing twelve months’ sales already stand at $2.64 billion, although these could be exceeded if inflation remains high as Stepan would be forced to keep increasing the price of its products. Furthermore, the company keeps increasing its manufacturing capacity in order to capitalize on new market opportunities. In this sense, the company has recently started to upgrade its Pasadena, Texas, facility in order to increase alkoxylation capabilities, a chemical reaction, by building a new plant, in order to capitalize on the expected growing demand for its Surfactant and Polymer businesses, and it is expected to be operational by the first quarter of 2024, which is later than expected due to labor shortages. The newly built plant is expected to increase the company’s alkoxylation capabilities by 75,000 tons per year, which is very positive for the company’s future as the global alkoxylates market is expected to grow at a CAGR of 4.25% by 2030.

Using 2021 as reference, 55% of the company’s net sales are provided by operations within the United States, 9% from the United Kingdom, 8% from Poland, 8% from France, 6% from Brazil, 5% from Mexico, and 8% from the rest of the world.

The PS ratio currently stands at 0.949. This means that the company is generating $1.05 in sales for each dollar held in shares by investors, annually. This PS ratio is lower than the spike of 1.60 experienced in 2020 and 2021, which opens the window to consider that we are facing a good opportunity as long as the headwinds that keep the price depressed are resolved in the coming quarters and years.

A declining PS ratio is a very important fact to take into account when looking for good opportunities in turbulent markets, but just as important (if not even more so) is the company’s ability to convert net sales into actual cash, and although it is true that margins have suffered as a result of current inflationary pressures, as well as supply chain issues and labor shortages, the company’s margins are fairly stable and healthy, which suggests that the room for maneuver is immense until inflationary tensions are eased.

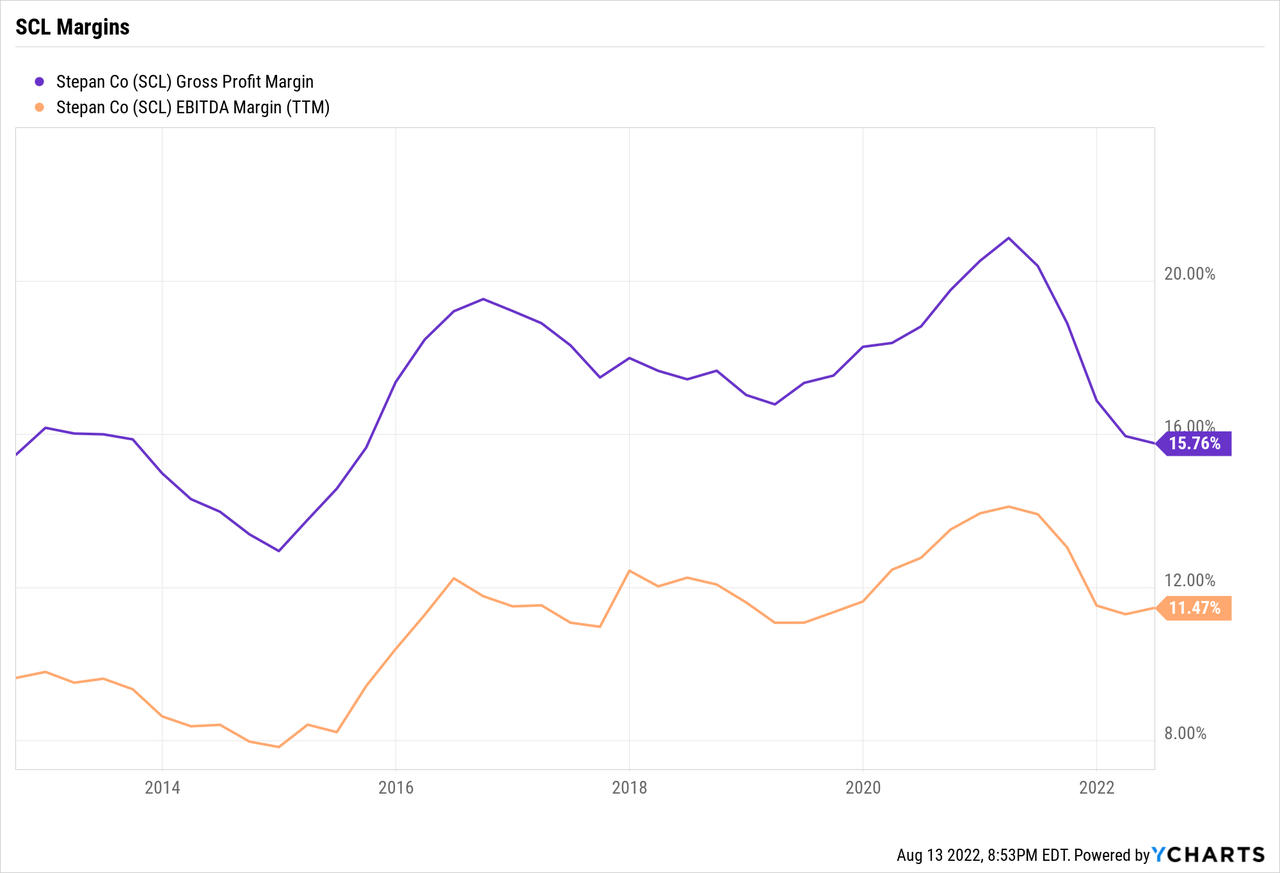

Margins, although temporarily depressed, are very healthy and stable

The company has historically enjoyed very healthy profit margins. In this sense, gross profit margins, which currently stand at 15.76%, usually dance between 15 and 20%, while EBITDA margins, which currently stand at 10.58%, have been slightly above 10% since 2015. In conclusion, margins have suffered a sharp decline in recent months due to inflationary pressures, supply chain issues, and labor shortages worldwide.

However, during the last quarter, there was a great improvement in the company’s margins compared to the trailing twelve months’ margins as gross profit margins stood at 17.51% while EBITDA margins remained relatively stable at 10.47%. Net income of $52.1 million during the second quarter of 2022 was also very positive as it broke the previous record as they increased by 20.32% year over year.

During highly inflationary periods, it is normal for the increase in the production costs of companies to take time before being completely transferred to their customers, so seeing contracted margins in recent quarters is something that was actually to be expected. But thanks to consistently high margins, the company is still able to generate enough cash to keep going, and while it’s still early to conclude that the company is already recovering from current headwinds, we must not forget that it represents a macroeconomic problem affecting the whole industry, and not so much to the nature of Stepan’s specific operations.

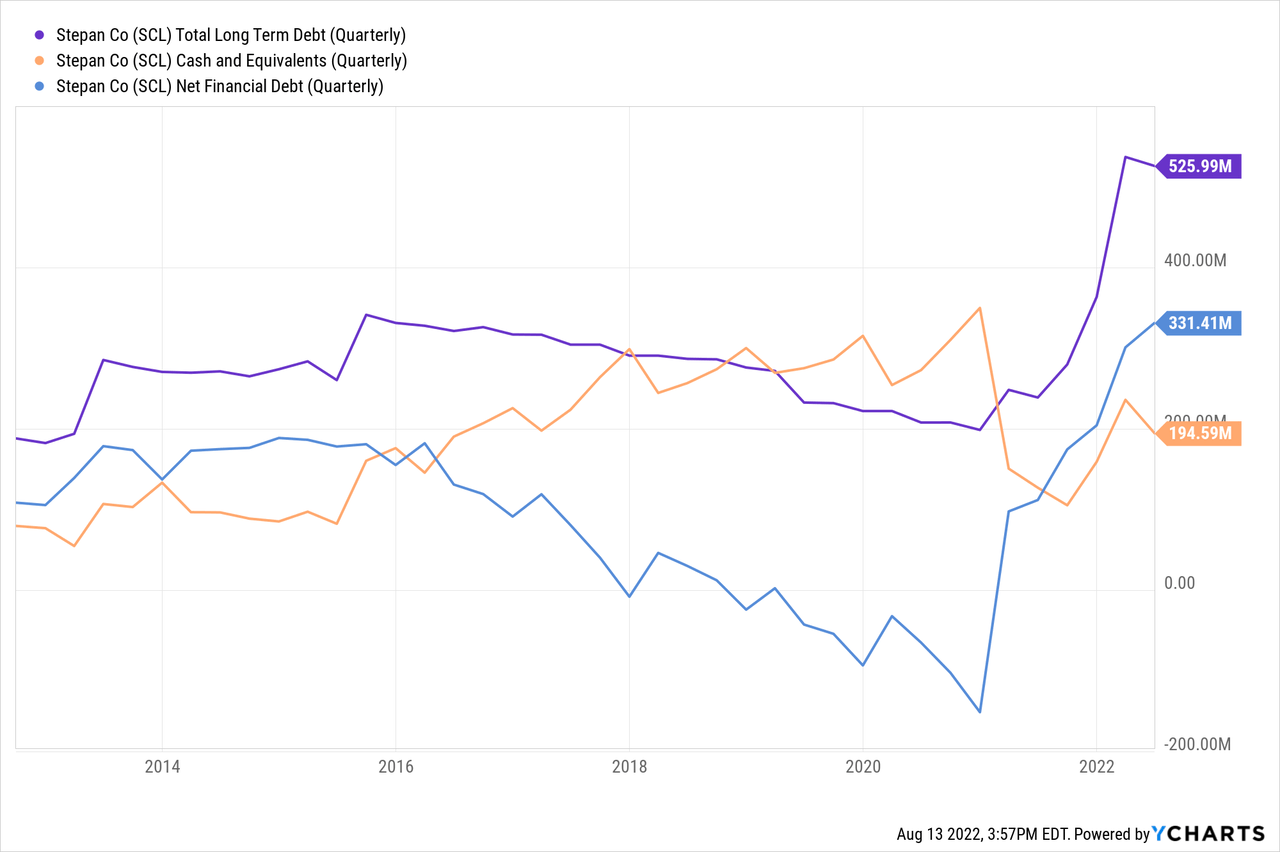

The company is leveraging its balance sheet

Since 2016, Stepan has reduced its debt exposure, and by 2019 it reached negative levels. This means that the company held more cash than debt. But this advantageous position has changed in 2021 after the acquisitions of INVISTA’s aromatic polyester polyol business and the fermentation plant in Louisiana.

But despite the increase in long-term and net debt, the company is still holding $194.59 million of cash on hand, which suggests that it could be willing to continue expanding its operations with a new acquisition soon. During the earnings call conference of the second quarter of 2022, CEO Scott Behrens expressed that he is still interested in continuing to make acquisitions in the near future.

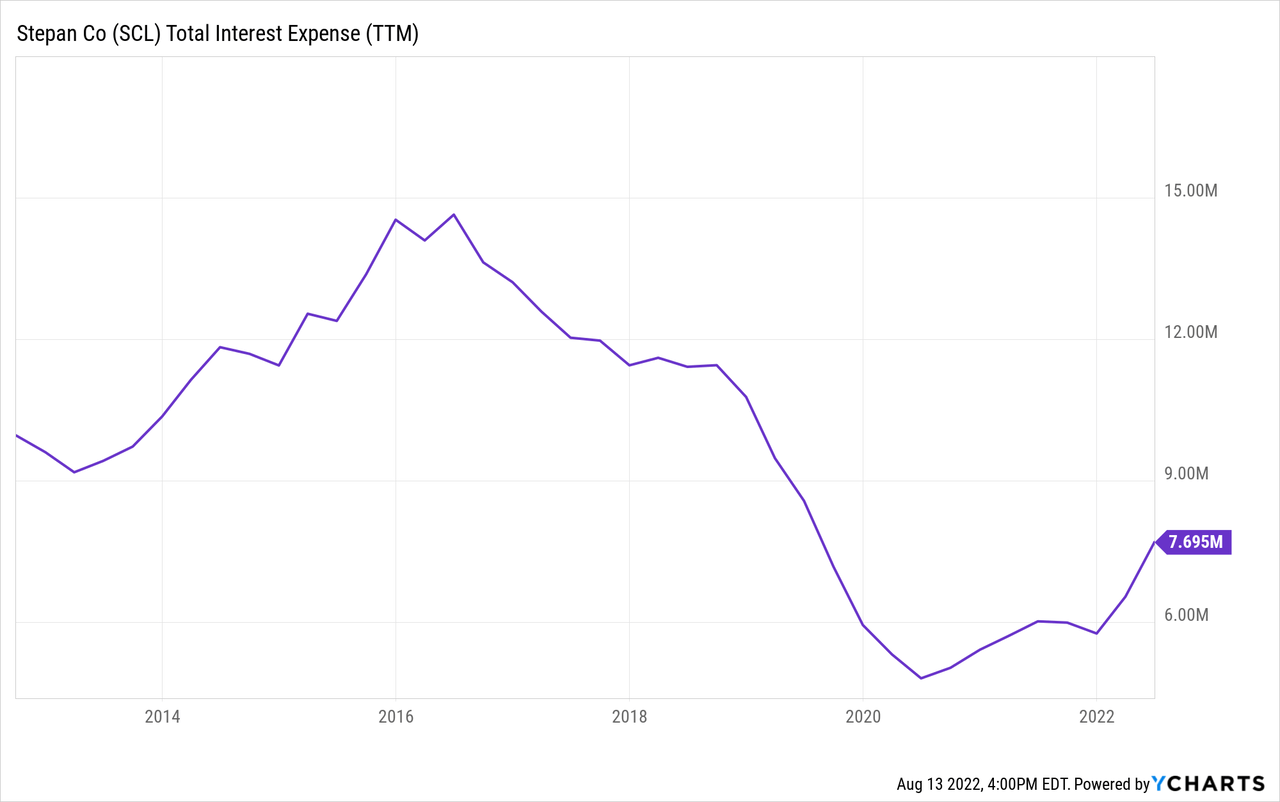

It is also very important to point out that this recent surge in debt has caused interest expenses to reach $7.7 million per year, although this figure represents the average for the last 12 months. Considering that net interest expenses during the last quarter were $2.73 million, we can expect an annual interest expense of slightly more than $10 million from now on.

This recent increase in interest expenses will limit, in the future, the company’s ability to raise the dividend until part of the debt is paid down once the company enters deleveraging mode, a process that seems not to have started yet. In any case, the company has already demonstrated its ability to manage its debt, and a low cash payout ratio leaves more than enough room to do so again.

The dividend is safe as the cash payout ratio is very low

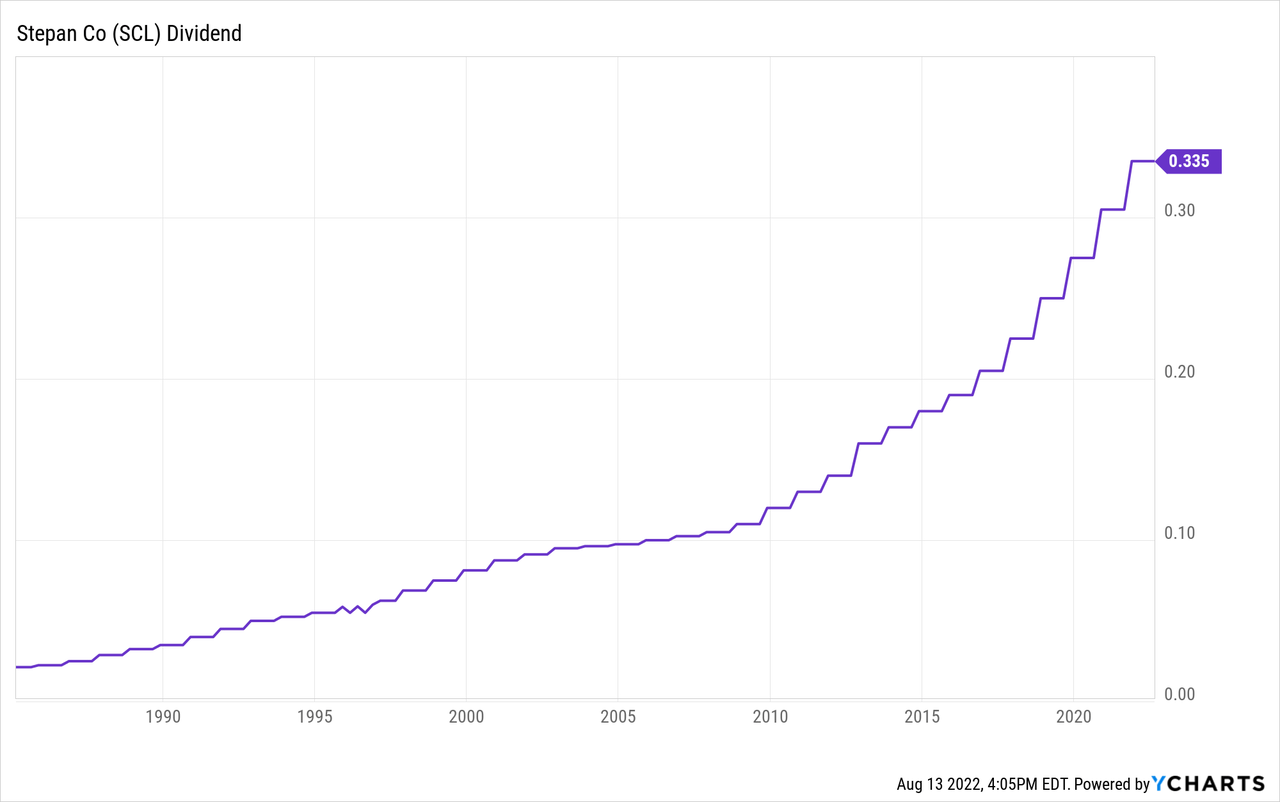

The company has steadily increased its dividend year after year for more than 50 years. Currently, investors holding Stepan’s shares enjoy a quarterly dividend of $0.335 per share, which is low considering the price of the shares because the management prefers to use the cash to continue expanding the company, which will ultimately allow the dividend to continue increasing over the years.

To calculate the economic effort that the company makes each year to pay dividends, in the following table I have calculated what percentage of the cash from operations has been allocated each year for the payment of dividends and interest expenses. In this way, we can determine the company’s ability to cover its dividends with the cash generated from its actual operations.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $150.31 | $81.96 | $183.27 | $212.16 | $198.86 | $171.13 | $218.43 | $235.22 | $72.14 |

| Dividends paid (in millions) | $14.47 | $15.39 | $16.30 | $17.33 | $18.91 | $20.86 | $23.10 | $25.41 | $28.08 |

| Interest expenses (in millions) | $10.36 | $11.44 | $14.53 | $13.21 | $11.44 | $10.77 | $5.93 | $5.41 | $5.75 |

| Cash payout ratio | 16.52% | 32.74% | 16.82% | 14.39% | 15.26% | 18.48% | 13.29% | 13.10% | 46.91% |

The conclusion that we can draw from the calculation is that the company allocates a very small portion of the cash generated through its current operations, and that is why the dividend yield has been historically low. 2021 was a very difficult year as cash from operations was low due to declining margins, but even in such a hostile environment, the company successfully covered the dividend with less than 50% of the cash it generated through operations. Trailing twelve months’ cash from operations of $85.6 million represents a slight improvement from $72.14 million in 2021, but there is still a long way before being able to cover the dividend again with the ease experienced in past years.

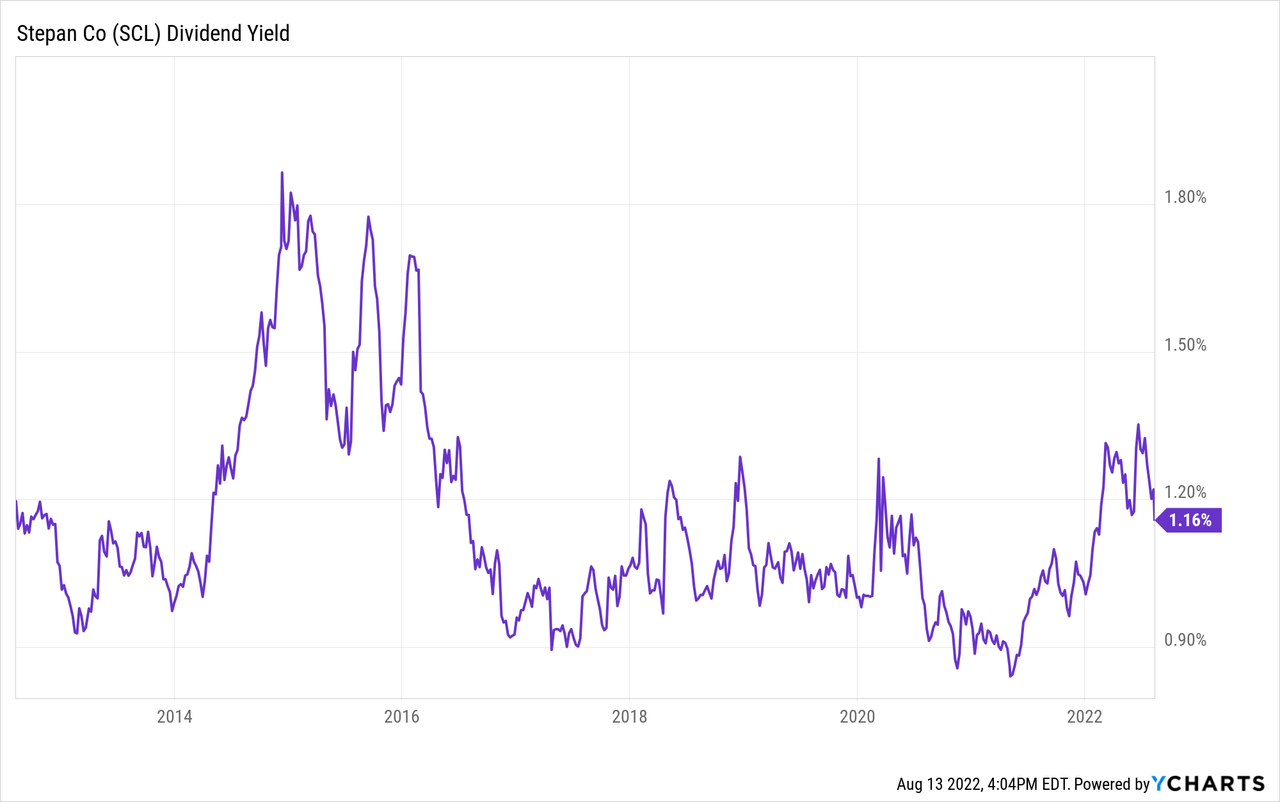

In this sense, investors who purchase Stepan shares today will be rewarded with an initial dividend yield of 1.16%, which is well below inflation and very low, but that is due to the fact that the company continues to expand the business with most of its profits instead of paying juicy dividends. In the long run, investors holding shares of Stepan can expect a growing dividend stream.

Risks worth mentioning

Profit margins have not yet recovered, and the company is not generating as much cash as it used to due to current headwinds despite a very huge increase in the base price of its products. Furthermore, the Pasadena facility’s projected cost increased by 10% due to cost inflation, and its projected start-up has been delayed by two quarters to the first quarter of 2024 due to labor shortages.

Also, in 2020, the company incurred into debt in an effort to expand its operations and thus end the sales stagnation experienced during the last decade. This has significantly raised the debt load on the balance sheet and increased the interest expense the company now faces to just over $10 million annually. The company’s CEO is looking for new opportunities in the market to make another acquisition, and therefore, the debt burden could continue to increase if the cost of said acquisition exceeds the total current cash on hand.

And ultimately, I would like to mention that the materials with which the company operates are of dangerous nature, and any accident, fire, or even natural disaster could severely impact operations in some of the company’s facilities. Also, there are risks of fatalities that could lead to large compensations for the company’s customers or workers.

Conclusion

Despite the recent decline in the price of shares due to increased perceived risk and lower cash generation capacity, Stepan is a company that can be bought and held for years and even decades. Management’s use of cash is very conservative, and the chemical components that the company offers to third-party manufacturers are essential for the manufacturing process of their products. Recent inflationary pressures and the increase in net debt have caused the PS ratio to decline even more sharply than the share price as sales have increased despite the decline in the share price. That increase in net sales is because the company increased the base price of its products by ~30%, so the increase is still not linked to any volume increase.

Once inflationary pressures, labor shortages, and supply chain issues ease, at least partially, the company should be able to continue generating the vast amounts of cash it used to. That is because margins should recover as the cost of goods sold stabilize, but also volumes, which are currently limited by the higher price of their products. In addition, the increase in the price of its products should serve in the long term to dilute the debt as it will represent a lower and lower figure compared to the company’s net sales.

For all the reasons mentioned throughout the article, I believe it is a good time to start a position in Stepan Company. But lastly, I would like investors who decide to join Stepan’s shareholder team to do so by acquiring shares in stages, that is, using dollar cost averaging as the main strategy. Buying additional shares as the price declines in turbulent times is a strategy that greatly reduces the risk of buying at the wrong time.

Be the first to comment