koto_feja

The major market averages rose for a third day in a row because long-term interest rates fell for a third day in a row after the 10-year Treasury yield peaked last Friday at 4.3%. Investors are growing more confident that the Fed will acknowledge its policies are slowing growth sufficiently enough to rein in inflation, and that it can pause by year end with a more neutral stance and monitor the delayed impact its actions should have on rising prices. That is helping to stabilize interest rates across the curve, but it comes with a cost. We got a glimpse of that cost after the close yesterday with less-than-stellar earnings reports from Microsoft and Alphabet.

Both stocks look to open sharply lower this morning, but it will be how they close today that sets the tone for the remainder of the week. We were reminded that a strong dollar is going to weigh significantly on the results of multinational companies like Mr. Softee, and that slower economic growth means less advertising spending, which adversely impacted Alphabet’s results. These were not surprises, but it is difficult to discern how much of this bad news is already priced into these and other stocks that have yet to report. The important thing to remember is that peaks in the rate of inflation, the U.S. dollar index, and interest rates are either already behind us or will be soon. Those headwinds will eventually become tailwinds, and markets look forward.

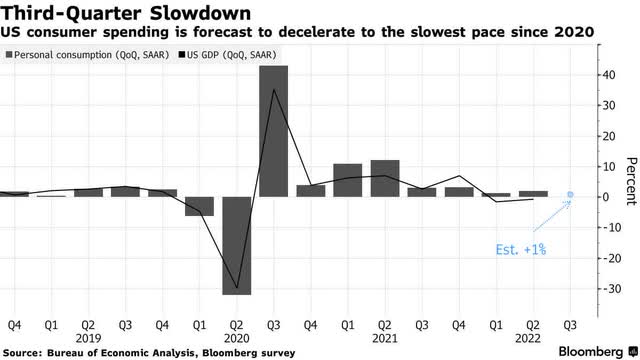

What has baffled those who have a bearish outlook for the U.S. economy is the resiliency of the American consumer, but as I have repeatedly stated, this economic cycle is unique. The greatest beneficiaries of the tsunami of fiscal stimulus dispersed by the government since the pandemic were the bottom 50% of households in terms of income and wealth. This demographic spends the majority of what they earn, and they are not as sensitive to the negative wealth effect caused by market declines because they do not hold a meaningful amount of financial wealth. They have also realized the highest percentage increase in wage growth. This combination has helped keep the rate of consumption just ahead of inflation, resulting in continued real growth for the overall economy. We will see if this has continued in tomorrow’s GDP report for the third quarter.

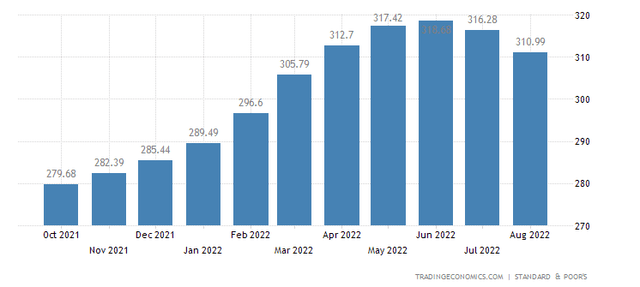

We had more deflationary signs yesterday in home prices and consumer confidence, which should help to convince Fed officials by year end that a pause in additional monetary policy tightening is the prudent course of action. The S&P CoreLogic Case-Shiller 20-city house price index fell 1.3% in August, which is the most since March 2009. That was the second consecutive monthly decline, and all indications are that September and October will show further declines, given that mortgage rates have soared above 7% since.

Granted, home prices were still up 13% year over year in August, but they are slowing at the fastest rate in the history of the index. The peak rate of growth was 21.2% in April, which prompted me to assert last spring that we would see home price declines in 2023, based on the unsustainable rate of increase and easier year-over-year comparisons. That looks to be panning out, and it should result in the largest single component of the inflation indexes flipping from a tailwind to a headwind for overall price increases. The Fed has done its job.

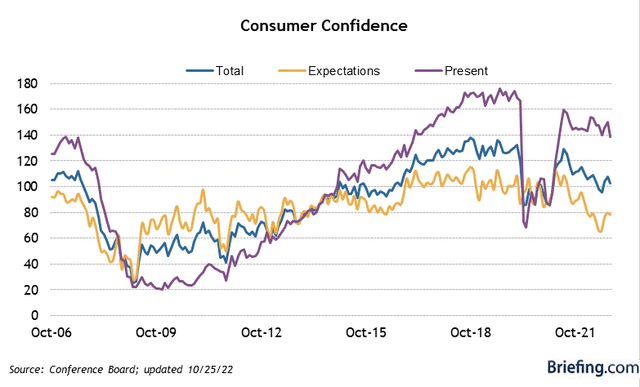

This may be weighing on consumer confidence, which fell below expectations in October, fueled by a sharp decline in the present situations index. Homeowner wealth is far more broadly spread than stock market wealth. Therefore, a decline in home prices may have a greater negative wealth effect than the bear market in stocks.

The restrictive tentacles of Fed policy are spreading throughout the economy, which should lead to a progressively sharper drop in the rate of inflation as we move through the first half of 2023. While this is slowing the rate of economic growth, it should also result in a return to real wage growth that helps keep consumers afloat. Slower growth in combination with a peak Fed funds rate should also weaken the U.S. dollar index, which has adversely impacted the revenues and profits of global companies. Lastly, if the surge in short- and long-term interest rates stalls, and we see some stabilization, if not modest declines, it should also serve to support markets. These headwinds should gradually become tailwinds in 2023.

Be the first to comment