DNY59/E+ via Getty Images

What is a patent cliff?

A “patent cliff” is a term used to describe the event of a patent expiration, where the massive amount of a protected drug’s revenue that the company enjoyed for some time, dramatically falls off a cliff. History does not demonstrate many examples of long-term stagnation for large pharmaceutical companies after their blockbuster drugs were no longer patented. Yet.

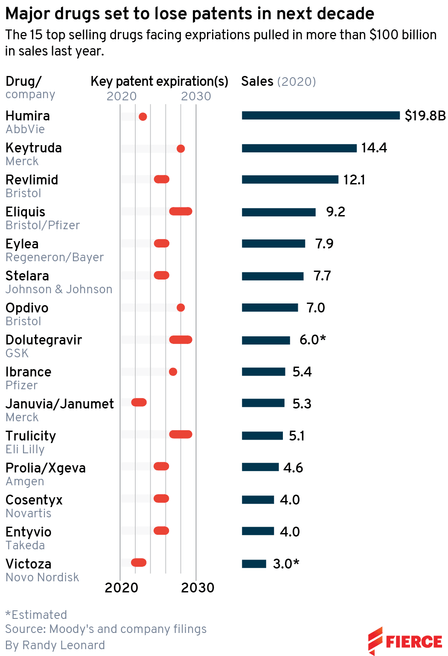

Still, it is important to understand that in this decade, many multi-billion drugs will no longer be cash machines, at least as much as they used to be.

Fierce Pharma

I think the best and only way to get back on track after a patent cliff is to find new blockbuster products that are rapidly growing in demand and have a long patent life. And that is not an easy task. According to Biotechnology Innovation Organization, it takes an average of 10.5 years for a drug to get from Phase 1 to regulatory approval.

So, in this article, I will look at the patent cliff of Bristol Myers Squibb (NYSE:BMY) to see whether it is well-positioned .

Too much to cover?

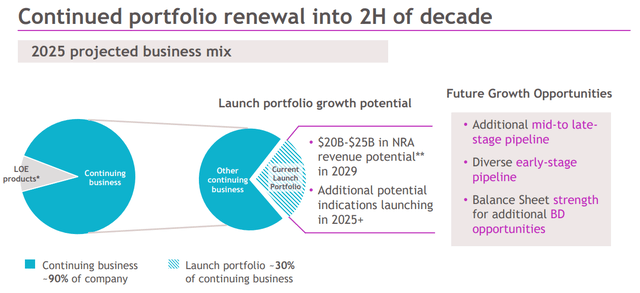

The company says it will only lose 10% of its business due to the LOE of its drugs, which will be offset by a new product portfolio.

However, Revlimid, which accounts for more than 20% of revenue, will lose patent protection in 2024 in the European market, and in 2027 in the US. Eliquis, a blood-thinning drug, loses US patent protection in 2026. Opdivo losses its exclusivity in 2027-2031 depending on the region. The rest will lose protection by 2026. Thus, the company will have to replace six top-selling drugs.

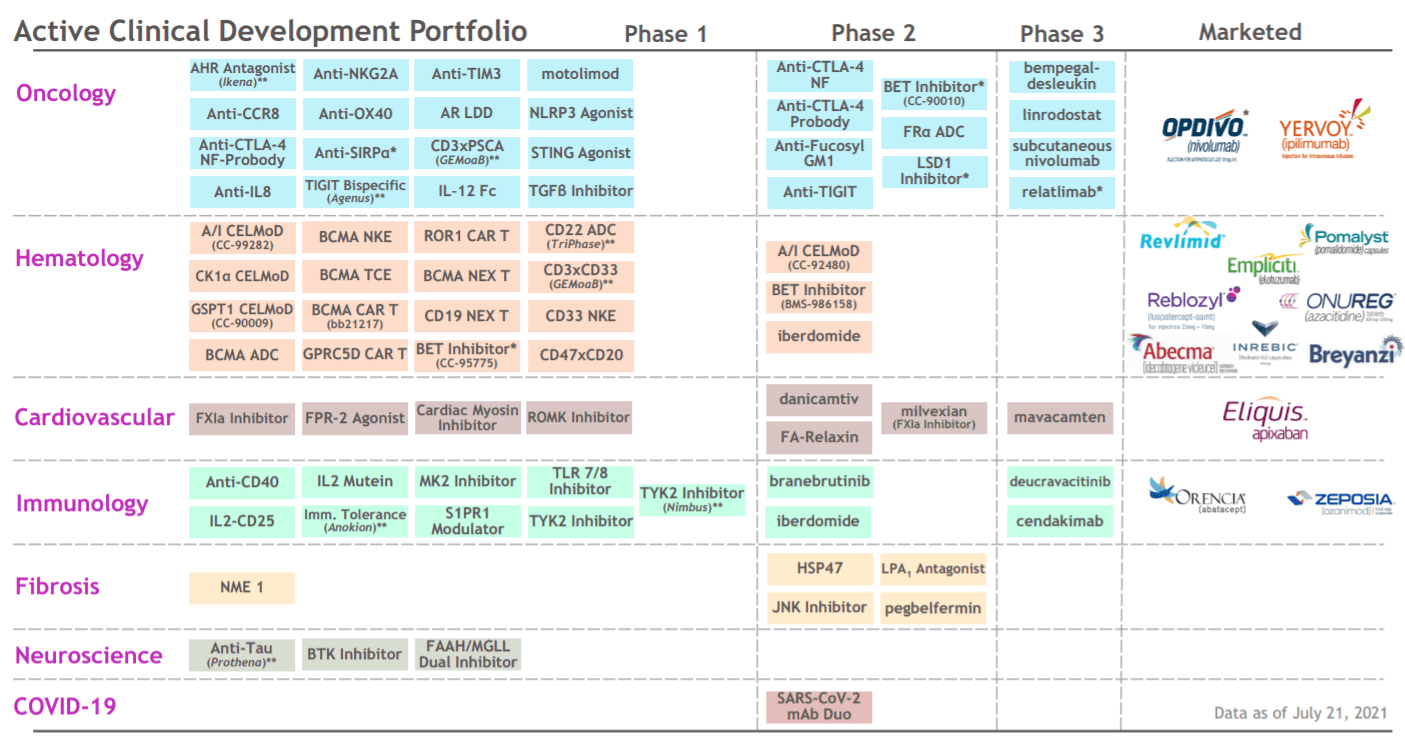

BMY is actively preparing for these huge patent cliffs. With the acquisition of Celgene in 2019 and MyoKardia in 2020, Bristol-Myers has expanded its range significantly. Since then, the number of Phase 1 and 2 assets has doubled to 60+, and the number of Phase 3 assets has doubled to 20+. The company has 10 research platforms, including the creation of antibody-drug conjugates, drugs for cell therapy, epigenetics, gene therapy, protein homeostasis, RNA oligonucleotides, etc.

Bristol Myers Squibb (2021 data)

A very important point is that most of the company’s drugs are designed for the mass market, they cover common diseases, with a multi-billion dollar potential income.

The company’s promising products include Reblozyl for the treatment of adult patients with beta thalassemia and patients with anemia, Inrebic for the treatment of myelofibrosis and polycythemia vera, and Zeposia, which is used for autoimmune diseases. Bristol Myers targets 4 billion for Reblozyl, 400 million for Inrebic and 2 billion for Zeposia.

The company believes that by 2029, its portfolio of new launches could deliver $25 billion or more which would roughly be the equivalent of 54% of the combined sales in 2021.

However, this will not fully cover all the lost profits. In general, the company’s strategy is clear, but BMY will have to work hard to get through these difficulties. The oncology market is projected to grow at a CAGR of 8.2% in the next 8 years and will likely reach $581.25 billion in 2030. With the acquisition of Celgene, the company has every chance of becoming a leader in this area.

Bristol-Myers Squibb also partners with over 20 biopharmaceutical companies. The company concludes or renews new contracts almost every quarter. Among them, BMY partnership with GentiBio to develop next-generation Treg therapies that may offer new treatment options for patients living with inflammatory bowel diseases (‘IBD’). The TAM is estimated at $1.2 billion by 2030. Also last year, an agreement was signed with Agenus, under which the company paid $1.56 billion for the exclusive development and commercialization of the anti-cancer drug AGEN1777. Equally important is the renewal of the agreement with Exscientia, under which BMY will be able to use AI developed by this company to accelerate the discovery of small molecular weight candidates in many therapeutic areas, including in oncology and immunology.

Given the strong pipeline in the oncology field and the size of the hole that needs to be filled, I would rate BMY as a Hold.

Valuations & Dividends

I compared BMY with Gilead Sciences (GILD), Pfizer (PFE), AbbVie (ABBV) and Merck (MRK) based on 4 forward multiples namely EV/S, EV/EBITDA, P/E, P/S and P/FCF

| AbbVie | BMY | Merck & Co | Gilead | |

| P/E | 10.9 | 9.74 | 13.24 | 10.67 |

| EV/EBITDA | 10.27 | 10.7 | 9 | 8.2 |

| P/S | 4.53 | 4.2 | 3.4 | 3.4 |

| EV/S | 5.6 | 4 | 4.6 | 4.2 |

| P/FCF | 17.2 | 11 | 12 | 9.3 |

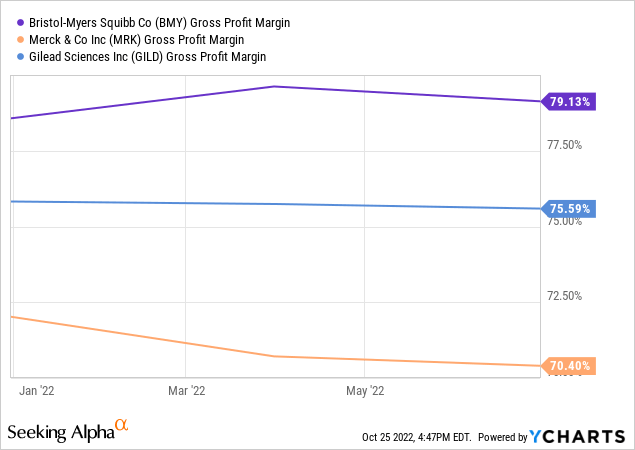

MRK looks a bit cheaper than BMY, but a slight premium makes sense as Bristol Myers’ gross margin is 9 points higher than Merck’s and 3.6 points higher than Gilead’s and will likely grow faster as the integration of recent acquisitions, deleveraging and new product launches will be the key factors in increasing the firm’s efficiency.

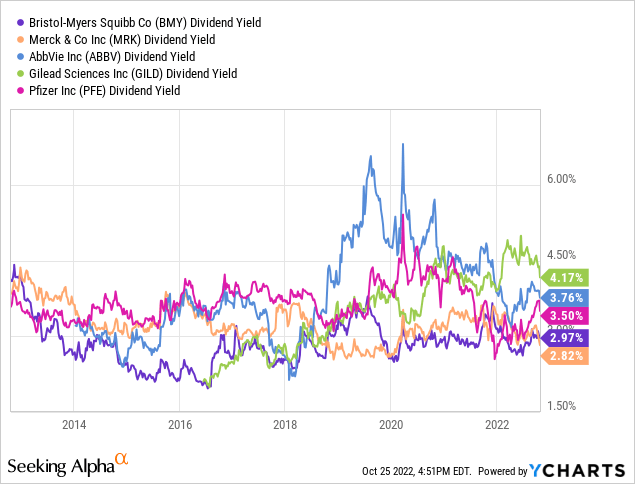

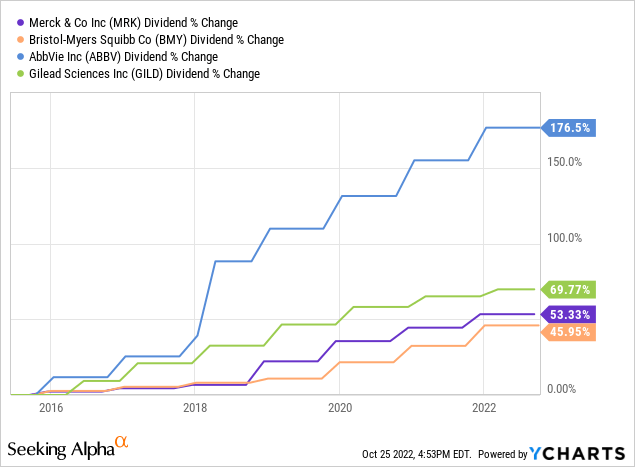

Bristol Myers’ dividend yield and the growth of the dividends are slightly lower than most of its nearest competitors .

However, the company has completed the integration of all recent acquisitions, which will see BMY move towards deleveraging and, therefore, I think an increase of the payments to shareholders and buybacks.

Conclusion

Given the impending cliff of patents this decade, it’s safe to say that only the strongest will hold their ground. Big pharma is all about the strongest. Sure, some will suffer more, some less, but don’t expect the company to fail because of the LOE of the drug.

I like the strategy that Bristol Myers has chosen betting on its enormous pipeline, which will help it to become one of the leaders in the oncology field. With that being said, I still await further news on what steps BMY will take to cover its future patent losses. Thus, I rate it as a Hold.

Be the first to comment