piranka

Thesis highlight

I recommend going long on Hashicorp (NASDAQ:HCP) ($32.28 as of this writing). It offers a product that rides on the secular tailwinds of digital cloud adoption and has a strong go-to-market strategy to support its strategy to capture share in a large TAM. As HCP continues to carry out its growth strategy and adjust its products to ensure continuous market fit, it should continue to capture more share. I expect it to make $1 billion in revenue in FY26, which, based on an 8x forward revenue multiple in FY25, would give it an equity value of $49 per share, which is 50% more than it is worth now.

Company overview

The HCP cloud operating model provides consistent procedures for automating cloud application delivery processes. Its products and services can assist businesses of all sizes and industries in shortening the time it takes to bring a product to market, reducing overhead costs, and increasing control over complex infrastructure installations.

HCP has 4 primary commercial products: Terraform, Vault, Consul, and Nomad (HCP S-1).

- Terraform is an infrastructure provisioning product that allows users to easily set up and manage IT infrastructure.

- Vault is a secret management and data protection product.

- Consul is an application-centric networking automation product.

- Nomad is a scheduler and workload orchestrator that enables organizations to deploy and manage applications.

Investments merits

Industry has several mega secular tailwinds supporting growth

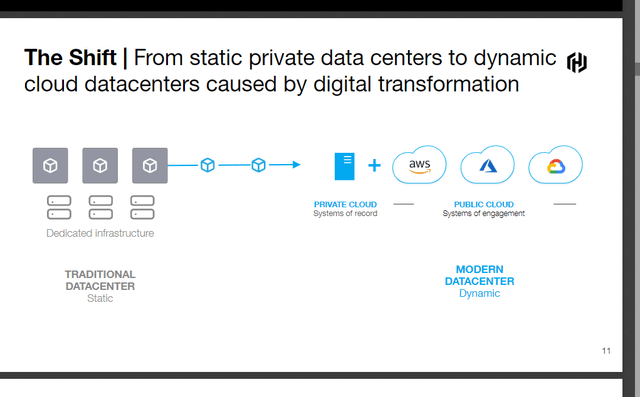

In today’s business climate, where globalization is made possible by the internet, digitizing operations and adopting cloud-based solutions are obvious key initiatives. Indeed, competition and consumers’ expectations of rich experiences across multiple platforms and technologies are prompting businesses to digitize their operations at an accelerated rate. The ability to deliver novel features and services is becoming increasingly important as the value of software rises alongside the digital revolution. As a result, cloud platforms are being built in part to speed up the rollout of new apps, and IT infrastructures are being updated to allow for faster iteration, higher levels of security, and less operational overhead.

In my opinion, the transition to cloud computing is a vital part of modernizing business processes. All over the world, businesses are moving more and more of their operations to the cloud. Numerous cloud service providers, services, and frequent updates are hallmarks of today’s cloud computing environments. That’s very different from the static and uniform on-premises environments of the past. Because these settings are so different, you need new ways to manage them and cutting-edge tools that are built on cloud-native principles.

HSP May’22 Investor Presentation

On top of that, many new companies today are cloud-native from the ground up, while established businesses have traditionally placed less importance on cloud computing. Most large companies use a multi-cloud strategy rather than relying on just one cloud provider, which presents its own unique set of complications and difficulties. According to a recent Gartner survey on cloud adoption, more than seventy-five percent of companies employ a multi-cloud adoption strategy. This is because of a number of factors, such as access to vendor-specific capabilities, optimizing cost across on-premises and public cloud resources, off-site location for backup, M&A activities, etc.

The aforementioned trends are very likely to persist for the foreseeable future; however, there are a number of pressing problems that must be resolved (this is where HCP steps in). The few primary problems are a disjointed set of processes, cloud fragmentation, and inefficient workflows.

- Disjointed set of processes: Taking care of this will save money in the long run by cutting down on things like new hire training and onboarding costs, operational expenses, and security risks and governance headaches.

- Cloud Fragmentation: There is a lack of standardization as a result of businesses’ varied approaches to deployment in both public and private clouds. Businesses need to agree on a single way to run so that all of their locations can work well together.

- Inefficient Workflows: For large-scale application deployments to go off without a hitch, it’s crucial that all parties involved in the process work in tandem. But most businesses define ticket-driven manual workflows for infrastructure management. With this model, developers must submit tickets to a large number of internal groups. This creates a lot of tension between the teams, which raises costs and risks and slows down work.

The HCP platform solves these problems because it offers a universal operating model for all clouds. This lets businesses get the benefits of automation without sacrificing the scalability, reliability, or security of the cloud.

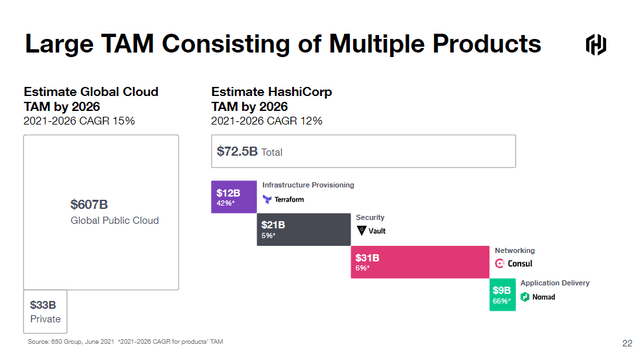

As an investor, it’s important to know the size of the TAM – which is massive. According to IDC, by 2024 the global public cloud services market will be worth $676.1 billion (IDC data from HCP S-1). HCP believes its product offering addresses four separate but related markets: infrastructure, security, networking, and applications. These four markets, which the 650 Group estimates to be worth $41.7 billion in 2021 and $72.5 billion by 2026, include both legacy markets being reconstituted by the cloud transition and new markets created by modern ways of deploying applications and managing infrastructure (TAM data from HCP S-1).

HSP May’22 Investor Presentation

Broad ecosystem of users and an integrated portfolio of products

Most companies have already made significant technological investments and have deployed numerous technological platforms. Integrating new technologies into existing systems is essential. HCP works with hundreds of partners to ensure that its solutions are compatible with one another and that the products themselves are built with extensibility in mind. The HCP ecosystem relies heavily on its community of “providers.” Providers of this ilk use APIs to link Terraform items to cloud services, other software, and hardware makers. In order to integrate with HCP, many of these companies develop their own proprietary providers for relevant technologies. Furthermore, users can rest assured that the integrations have been validated because HCP has certification programs for its major products.

In essence, enterprises rely on HCP as a unified dashboard for managing their cloud environments. In a multi-cloud environment, HCP’s integrated product portfolio’s ease of use is crucial. As a result of HCP’s extensive integrations and partnerships, customers have access to the cutting-edge innovations of HCP’s partners and the broader ecosystem through a unified workflow. As of January 2022, HCP’s ecosystem has thousands of technology partners and all of the major cloud service providers.

Strong go-to-market strategy

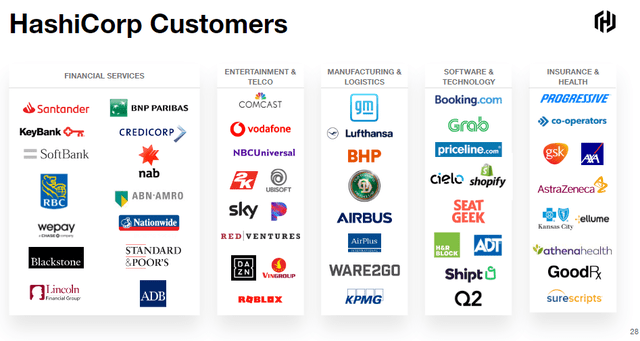

HCP’s open-source methodology and proprietary enterprise tools have generated a steady stream of demand, and the company has a well-thought-out go-to-market strategy in place to meet that demand. HCP’s large, well-known clients aid in direct sales by serving as references for the scalability, performance, and strength of its platform. HCP’s open-source participation and self-service cloud development both speed up the spread of its products and demonstrate how its technology affects a diverse range of clients. As a result, HCP’s direct sales team now has significantly more time and energy to devote to acquiring new commercial clients. Customers can learn about HCP’s offerings through open source or the HCP self-service cloud platform, try them out for free, and eventually become paying customers, creating a virtuous cycle.

HSP May’22 Investor Presentation

Valuation

Price target

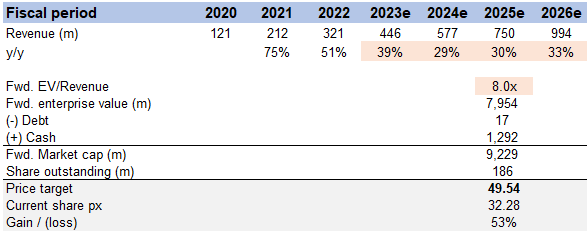

My model suggests a price target of ~$49 or ~50% upside from today’s share price of $32.28. This is on the basis of ~30% revenue growth from FY23 to FY26 and a forward EV/revenue multiple of 8x.

Image created by author using data from HCP’s filings and own estimates

Firstly, I do not expect any model to be able to precisely forecast HCP’s future, especially given the large TAM and new products that HCP can roll out to capture more growth. I believe in HCP’s ability to solve the industry’s pain points with their products and also grow due to the right go-to-market strategy they are employing. For my model, I used consensus’s forecast until 2026, which suggests HCP will continue growing at a high rate of ~30%+ CAGR and generate ~$1 billion in revenue in FY26. As of 2FQ23, HCP is still printing 51% revenue growth. This gives confidence that it could continue to grow at a higher rate moving forward.

Risks

Open-source code is a risk

Since open-source and source-available licenses give third parties a lot of rights, there aren’t many technological barriers to getting into the market.

Valuation is dependent on growth

HCP is not currently profitable and is valued by the market based on a revenue multiple, which is heavily reliant on growth. While the growth strategy is sound, if HCP fails to execute in the short term (i.e., growth slows), the valuation could suffer.

Companies push out heavy CAPEX deployments due to the recession

HCP sells to enterprise customers, who tend to push out any heavy CAPEX during a recession in order to preserve cash on the balance sheet. While the long-term megatrend is unaffected, short-term fluctuations may occur.

Conclusion

To conclude, I believe HCP is worth ~50% more than its value today ($32.28 as of writing). HCP is operating in a very large TAM with very strong secular tailwinds driving growth and adoption. I believe HCP is well positioned with its product offerings and go-to-market strategy to capture this growth, and ultimately be a very profitable company in the long term.

Be the first to comment